Overview : GST, or Goods and Services Tax Certificate, is issued to the businesses registered under GST. For such businesses, it is mandatory to display this certification at their place of business. Since we are in the digital age, it’s accessible to download a GST Certificate online; all you need to do is follow the step-by-step process. This article is about how to download a GST Registration Certificate Online from the GST Portal.

Want to download your Goods and Service Tax (GST) registration certificate? Only a registered taxpayer can download his certificate from the GST Portal. This will show you how to do it quickly and easily from the GST portal. Follow these steps for a smooth GST certificate download to get your GST certificate without any hassle.

What is a GST Registration Certificate

A GST registration certificate is a mandatory document for businesses registered under India’s Goods and Services Tax system. This certificate is proof that your business is officially recognized by the tax authorities and is authorized to collect GST. Businesses having turnover above a certain limit are required to obtain a GST registration certificate as a legal requirement.

A GST registration certificate allows businesses to collect tax from customers and claim input tax credits on purchases, reducing overall tax liability. Also, it helps in compliance with GST law and tax law, smooth business operations and enhances credibility with customers and suppliers.

Why GST Registration?

GST registration is compulsory for businesses operating in India as it enables them to comply with Goods and Services Tax (GST) law. The GST registration certificate is proof of registration under GST regime, allows businesses to collect and pay GST, claim input tax credit (ITC) and file GST returns. Moreover GST registration is mandatory for businesses having turnover above a certain limit or those who are required to register under GST. By getting a GST registration certificate, businesses can ensure compliance with tax liability and avoid penalties.

The GST registration certificate legitimizes a business in the eyes of tax authorities and enhances its credibility with customers and suppliers. This means that the business is authorized to collect GST on behalf of the government and pass on the benefit of input tax credit to its customers. This compliance with GST law is necessary for smooth business operations and good standing with tax authorities.

How to Download GST Registration Certificate Online?

Downloading your GST Certificate is easy these days as you can download it online. To download GST certificate online, you need to follow certain easy steps. The steps to download GST Registration Certificate Online are as follows;

1. Login to GST Portal

Log in to your GST account by entering your username, password and captcha on the login page of the GST portal. Ensure your account has valid credentials. Common login issues are connection errors, Java Runtime Environment errors and PAN verification issues. Restart the emSigner server as an administrator to resolve connection errors, install the correct Java version for Java errors and verify PAN details in DSC for PAN issues.

If your Digital Signature Certificate (DSC) is not registered use the ‘Register/Update DSC’ tab on the GST portal. Add the emSigner server’s URL to Firefox’s exception site list to resolve WebSocket visibility issues. Solving these issues will ensure smooth login and access to your GST account.

2. User Services

After logging in, navigate to User Services by following the path Services -User Services view downloadon the GST portal. Here, you will find various options related to your GST registration, including the option to view or download your registration certificate.

3. View/Download Certificate

In User Services, select ‘View/Download Certificate’ to view your GST registration certificate. Download it in PDF by clicking the ‘Download’ button. Ensure your credentials are valid and up-to-date to avoid any issues during download. The downloaded certificate is an important document to be printed and displayed at your business location. It has an e-signature of the approving authority making it a legal document. Following these steps will help you to download and display your GST registration certificate and comply with GST laws.

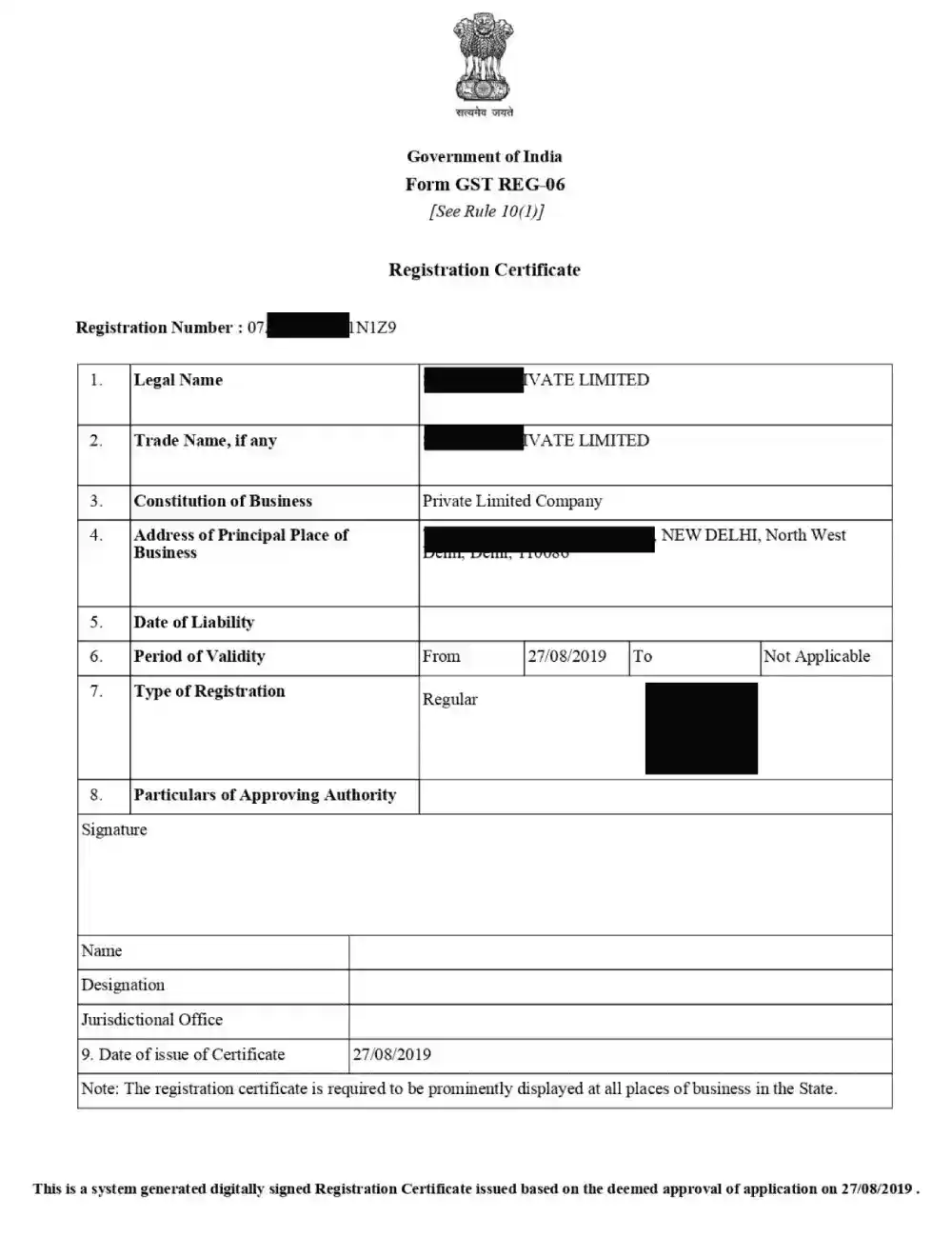

The downloaded GST Registration Certificate will be shown in the format given below;

Key Details on GST Registration Certificate

The GST registration certificate has many details which are essential for your business. Some of the key details that this certificate comprise of are as below;

- GSTIN

- Legal name of the business

- Date of registration

- Type of business structure (e.g., sole proprietorship or partnership)Annexure-A of the GST certificate has additional places of business and trade name along with GSTIN and legal name. Annexure-B has details of proprietors or partners of the business including their names and designations.

Know these details to ensure all your business information is updated and easily accessible when needed. Consult an experienced professional to get your GST registration done completely.

GST Registration Certificate for Exporters

Exporters need a GST registration certificate that shows their business is registered for the export of goods and services. This is mandatory for exporters as they can claim refund of tax paid on inputs. The GST registration certificate for exporters should clearly show export registration and exporters can claim refund of tax paid on inputs.

Businesses need to register on the GST portal and upload the required documents including proof of export to get a GST registration certificate for the exporter. This ensures the exporter is recognized under the GST regime and can get tax refund making their business more cost effective and competitive in the global market.

Validity and Expiry of GST Certificate

Validity of GST registration certificate depends on the type of taxpayer. For normal taxpayers GST registration is valid indefinitely unless cancelled or revoked. For casual and non-resident taxpayer GST registration is valid for 90 days. The casual taxable persons can renew their GST certificate before the initial validity period gets over. It is essential to keep track of the expiry date and renew the certificate on time to avoid any business disruption. Knowing the validity and renewal process will ensure that your business is GST-compliant.

Time Limit to Download GST Certificate

There is no time limit to download a GST certificate from the GST portal. Taxpayers can download a GST certificate at any time from the GST portal and the certificate is valid for a specific period. However it is to be noted that the GST registration certificate needs to be renewed periodically, and taxpayers should ensure their certificate is up-to-date to avoid penalty or fine.

Display of GST Certificate

Displaying a GST certificate at your business location is both a legal requirement and a mark of credibility and compliance. Registered businesses are legally liable to display their GST registration certificate at each business location. Failure to display the certificate can lead to a penalty even if not mentioned in GST law. Display the GST certificate and GSTIN so that customers can ask for valid tax invoices and customers and suppliers can trust you. Print and display the downloaded GST certificate at your business location.

Conclusion

In summary, downloading a GST certificate online is easy in this digital era. Follow the steps mentioned above and you can download your registration certificate and your business will be GST compliant. Displaying the certificate at your business location is not only a legal requirement but also enhances credibility of your business among customers and suppliers. Know the key details of the GST registration certificate, validity and expiry of certificate and amendment process is very important for GST compliance. Stay updated with GST laws to use your GST Number smoothly and avoid penalties.