Setindiabiz is Trusted By Leading Brands

Overview of Legal Entity Identifier Number (LEI)

| What is a Legal Entity Identifier Number (LEI)? | LEI, or Legal Entity Identifier number, is a unique code assigned to every legally recognised, non-individual entity across the world. It helps in identifying financial transactions conducted by these entities with their domestic and international counterparts. | ||||||||

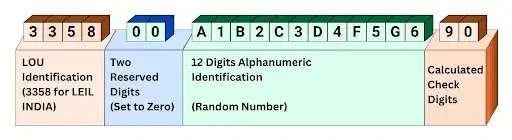

| LEI Structure | The LEI is a 20-character alphanumeric code created using ISO 17442:2012 standard and has the following structure:

|

||||||||

| Why is LEI Required in India? |

|

||||||||

| Who Needs LEI? | Non-individual borrowers and international traders must obtain and use LEI information in single-payment transactions of Rs. 50 Crores and above. This includes NEFT and RTGS transactions as well. Specifically for RTGS transactions, the use of LEI is applicable to customer payments and inter-bank transactions that meet the requirements. 50 crore threshold as well. Individuals and Government Departments/ Ministries are exempted from the requirement to obtain and use LEI. |

Benefits of Legal Entity Identifier

The use of the LEI Number brings immense benefits for a legal entity. It helps in its unique global recognition and provides the means to verify its business transactions. Verifying and tracking business transactions through LEI is not just beneficial for the government and regulatory bodies, but also for the parties involved, as it helps in prior risk assessment and management, thereby helping create a financially sound and secure environment. Let’s elaborate on the benefits of the Legal Entity Identifier Number a little.

Unique Global Identification

LEI serves as a unique identification mark for legal entities globally, ensuring their easy recognition across national and international jurisdictions.

Legitimacy to Financial Transactions

As a uniquely assigned number, LEI makes it easy to verify the origin of financial transactions, thereby offering legitimacy and authenticity to the parties involved.

Compliance

Many jurisdictions across the world, including India, have adopted the concept of LEI and made its use mandatory among legal entities. So, obtaining and using LEI helps an entity remain compliant with law.

Easy Application Process

The process of obtaining an LEI is quite easy and convenient. Entities can apply online through certified Local Operating Units (LOUs) in their home country and get the LEI number without any hassle.

Risk Assessment

The unique LEI number helps track and monitor every financial transaction of a legal entity, thereby giving accurate insights into its financial status and performance.

Flexible to Manage

With consistent tracking of financial transactions through an LEI number, assessing associated risks becomes easy. It helps foresee a financial crisis and prevent the same before time.

Process of LEI Application

The Legal Entity Identifier procedure is quite straightforward and convenient. The applicant entity has to approach the LEIL, which is the LEI issuing Local Operating Unit in India, on its official website. Since documentation is a crucial part of the process, the applicant must begin by assessing what’s required. Once the list of documents is readily available, the applicant can begin the process by creating an account on the website, signing in with the login credentials received, and filing the complete application online. Here are the detailed steps for the process of LEI application:

Step 1: Create an Account on LEIL Website

Visit the official website of the LEIL @ LEIL LEI (ccilindia-lei.co.in) Go to the right hand corner on the Home Page, and click the option “Create an Account”. Fill in the Required Details of the authorised person to create a New User Account. The authorised person would be nominated or appointed for this purpose via a Letter of Authority or General Board Resolution. The details required include full name of the person, email ID and password to create login credentials, full address, and contact number. If the authorised person is different from the person of contact, provide the details of the latter as well. After filling the details, enter the captcha code and proceed.

Step 2: Receive Login Credentials and Sign In

The login credentials will be sent to the registered email address along with the activation link. Click on the link to continue with the signing in process. Next, go back to the Home Page and Click on Login in the right hand corner, just above the “Create Account” option. The login page will open. Enter the registered email address and password provided while creating the account.

Step 3: Access & Fill Out the LEI Application Form

After successful login, go to the LEI Services tab on the menu and click on “Register” from the dropdown. The application form for LEI number will appear on the screen. The requisite details to be filled will be divided in four sections, namely, Company Information requiring information of the legal entity applying for the LEI number, Direct Parent Page requiring information of the lowest level entity preparing consolidated financial statements or the applicant entity, Ultimate Parent Page requiring information of the lowest level entity that is preparing consolidated financial statements or the applicant entity, and ultimately the Payment Page requiring Payment Details of the application form. After filling out the details in each section, click on “Save” to save the information.

Step 4: Upload Documents

Upload all the requisite documents from the list downloaded in the earlier step. The letter of authority and audited financial statements are compulsory for every applicant regardless of the entity structure. An Auditor’s Certificate may be required in case the applicant is also submitting consolidated financial statements. The requirement for other documents may differ for different legal structures. If the applicant is unable to upload the documents, it can be submitted by email ( lei@ccil.india.co.in ) or posted to the registered office of LEIL.

Step 5: Verification of Online Form, Documents and Payment

After receiving the documents (soft or hard copy) and payment, LEIL will verify the same. The process begins 1-2 working days after the submission of the application and documents. Additional documents may be sought at this stage. Also, if any discrepancies are found in the form, LEIL may suggest changes which will have to be made in the prescribed time frame.

Step 6: LEI Issuance

After successful payment and document verification, LEI number is issued. An email containing the LEI number is sent to the legal entity. A digitally signed invoice will be provided to the legal entity through e-mail after the issuance of LEI number.

Documents Required for LEI

The list of Documents for the LEI registration application depends on the type of entity obtaining it. The exact list can be found on the official website of LEIL. However, there are certain documents that are common for all entities. These common documents have to be submitted mandatorily in order to file the LEI application successfully.

Audited Financial Statement

Letter of Authority

Shareholding Pattern

Auditor Certificate

MOA & AOA/LLP Agreement

GST Certificate

PAN

LEI Renewal and Validity

Usually, the validity of LEI extends to one year from the date of first issuance or last renewal. However, the applicant can also opt for multi-contract years and extend the validity of the LEI up to 5 years. In either case, a LEI renewal application has to be filed with the documents discussed above before the expiry date. If the application for renewal gets delayed, an additional fee of Rs . 250 will be charged per month until the renewal procedure is initiated.

- Validity: 1 Year or As Per the Multi-Year Contract

- Renewal Fees: Same as Application Fees; Refer to the table below (link).

- Late Fees: Rs . 250/- per month till the renewal application is submitted.

Legal Entity Identifier Fees for Application & Renewal

The Legal Entity Identifier (LEI) fees depend on the duration for which it is contracted. The applicant can opt for a single-year issuance or may extend the same up to 5 years. The rule applies both in the case of first issuance, as well as renewal of the expired LEI. Let’s understand the cost breakup for LEI application and renewal.

Government Fee Table (Effective 1st July 2024)

| No | Validity | New Registration (Inclusive of GST) | Renewals (Inclusive of GST) |

|---|---|---|---|

| 1. | Single Year | ₹ 4,130/- | ₹ 3,304/- |

| 2. | Two Years | ₹ 7,257/- | ₹ 6,431/- |

| 3. | Three Years | ₹ 10,207/- | ₹ 9,381/- |

| 4. | Four Years | ₹ 13,039/- | ₹ 12,213/- |

| 5. | Five Years | ₹ 15,694/- | ₹ 14,868/- |

Frequently Asked Questions

The LEI number is a globally recognised codification system for legal entities, where a unique 20-digit alphanumeric code is assigned to such entities for consistently monitoring their domestic and international transactions.

LEI numbers are issued by the Global Legal Entity Identifier Foundation (GLEIF) through their Local Operating Units situated in every country. In India, the Legal Entity Identifier India Ltd. (LEIL) is tasked with this responsibility.

Usually, the LEI number remains valid for 1 year. However, during the time of renewal, the applicant can seek multiple years of validity (up to 4 years) by paying additional fees.

Yes. LEI renewal application and documents must be submitted before the expiration date. If the same gets delayed, a fee of Rs. 250 will be charged every month until the application gets filed.

In India, the LEI number has been made mandatory for every non-individual legal entity. However, individuals and government ministries/departments are exempt from its requirement.

A legal entity can obtain only one LEI number, which can be used for its unique identification globally.

Yes. The branch office of a foreign legal entity can obtain an LEI in India as long as it operates in the country.

Yes, LEI is used in all national and international transactions of non-individual legal entities. Note that at least one party to the transaction must be a non-individual legal entity. LEI is not required for transactions where both parties are individuals.

The requirement of documents for LEI application includes the letter of authority or a copy of the General Board Resolution, audited financial statements, and any other constitutional or incorporation documents applicable to the specific legal entity. Besides, if the entity is held by another corporation, the consolidated audited financial statements prepared by the holding company, along with an auditor’s certificate, shall be necessary.

After all the documents and applications are filed, the LEIL takes 1-2 working days for their verification. LEI gets issues soon after the verification process is completed. We help you file the application for LEI in a single day.