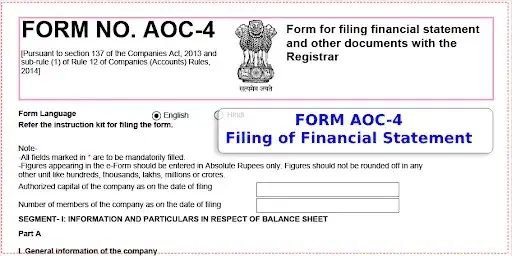

Overview of Form AOC-4 filing to the ROC | |

|---|---|

| Purpose | To report the audited financial statement of the company |

| Legal Provisions | Section 137 of the Companies Act provides for mandatory filing of AOC-4. |

| Nature of Filing | Mandatory for every company after adoption of the financial statements in AGM |

| Due Date | Within 30 days of the conclusion of the AGM |

| ROC Filing Fee | ROC filing fee is based on the Capital of the company and is in the range of ₹200/- to ₹600/- |

| Delayed Filing | Delayed filing is allowed with an additional fee of ₹100/- for each day of delay. |

Legal Provisions for Filing AOC-4 Form

Under Section 137(1) of the Companies Act 2013, every Indian incorporated company is required to file its financial statements that also include the consolidated financial statement, if applicable, in an AOC-4 Form with the Registrar of the company. The said financial statements are first presented in the AGM before the shareholders for their adoption, and once the financial statements are adopted in the AGM.

Simply put, the books of accounts need to be finalised, which will cause the preparation of the company’s financial statement as per Schedule III of the Companies Act, 2023, for the relevant financial year. The financial statement then has to be audited by the company’s statutory auditor. The auditor, a practising chartered accountant, then reviews the same and issues an Audit Report stating whether the same reflects the true and fair view of the financial position of the company or not. The audited financial statement is then presented to the shareholders along with the directors’ report for its adoption in the company’s Annual General Meeting (AGM). After the conclusion of the AGM, the form AOC-4 is filed with the ROC.

Flow of the AOC-4 Form

Finalise Books of Account

Financial Statement Preparation

Statutory Audit by Practicing CA

Adoption of the Financial Statements in AGM

Filing of AOC-4 form to the ROC.

Applicability and Various Types of AOC-4 Form

The filing of AOC-4 is for the particular purpose of filing the audited financial statements of an eligible company to the ROC as required under section 137(1) of the Companies Act. Based on company type or reporting obligation, AOC-4 is of different types. The Following are different types of AOC-4 Forms that are filed in India before the ROC.

Standard Form AOC-4

The Ministry of Corporate Affairs has prescribed a standard form, AOC-4, for filing the company's financial statements. The standard form applies to all cases except those involving XBRL, CFS, or NBFC.

Form AOC-4 XBRL

The companies that are listed on the stock exchange or have paid up capital of INR 5 Crores (INR 50 Million) or if the turnover is more than 100 Crore (10 Million) are under a statutory obligation to file the AOC-4 in XBRL Format, also known as form AOC-4 XBRL, selecting Ind AS Taxonomy.

Form AOC-4 CFS

Companies required to file consolidated financial statements and other related documents are required to file Form AOC-4 CFS with the registrar of companies as per Section 129(3) of the Companies Act 2013.

Form AOC-4 NBFC (Ind AS)

This is an extended version of the AOC-4 Form for NBFCs, which allows the NBFCs to file the consolidated financial statements and all other accompanying documents following the Indian Accounting Standards (Ind AS) with the Registrar of Companies.

The information/attachments of Form AOC-4

Form AOC-4 is a digital form where the company furnishes the financial information and attaches a scan of the prescribed documents. The company’s directors then digitally sign the e-form before filing it with the MCA. In the table below, we have summarised some of the required information and the list of documents that are filed as attachments.

| Information to be furnished | List of documents |

|

|

The annual filing of the AOC-4 Form is a vital part of corporate compliance, also ensuring that the registered companies are filing their financial statements on an accurate time period. The subtlety associated with this Form AOC-4, the applicability and the penalties associated with it is very crucial for businesses to maintain transparency and other legal obligations. So, as the final deadline to file Form AOC-4 approaches it is highly mandated that the professionals of the company must stay vigilant and file the required forms within the prescribed time limits by the government.

Stepwise Process of Filing the AOC-4 Form

Step - 1 : Preparation of Documents

The first step towards filing the AOC-4 is to prepare the necessary information and draft documents that need the directors’ signatures. Preparation begins immediately after the company’s statutory audit is completed. Following is the list of documents that need to be prepared or arranged for the purpose of filing Form AOC-4.

- Notice of AGM with Explanatory Statement

- Financial Statements that include Balance Sheet, Profit and Loss Account, Cash Flow Statement and Notes to Accounts.

- Statutory Auditor’s Report

- Board Report ( Director’s Report).

Step-2 : Preparation of AOC-4 Form & Filing

Access the Ministry of Corporate Affairs (MCA) portal at www.mca.gov.in, and download applicable AOC-4 Form such as Non-XBRL or XBRL, depending on whether you are filing in XBRL format or not. Fill in all required details in Form AOC-4 accurately. This includes information about the company, financial year, financial statement date, and other relevant particulars. When all the information is filled in the AOC-4 form, attach the scan of applicable documents in the prescribed attachment section, one by one, keeping in mind the file size of the attachments. After all the documents are attached, the director’s DSC must digitally sign the AOC-4 form.

Step-3 : Submit Form AOC-4 & Pay ROC Fee

After completing the form and attaching all necessary documents, submit Form AOC-4 on the MCA portal. Pay the requisite filing fees online through the MCA portal. The fees depend on the company’s authorised capital. After submission, an acknowledgement (SRN – Service Request Number) will be generated. Keep this acknowledgement for future reference.

Step-4 : Approval of Form AOC-4 by the ROC

The approval of the AOC-4 is done by the Registrar of Companies in STP (Straight-to-process) mode. Retain a copy of the filed Form AOC-4, acknowledgement, and all related documents in the company’s records.

ROC Fees for filing AOC-4

The filing fee for Form AOC-4 is based on the authorised capital of the company. The ROC Fee is payable after the form is filed and SRN is generated. The same can be paid online; the mca portal accepts all modes of online payment.

| No | Authorised Capital | ROC Fee Payable |

|---|---|---|

| 1 | A company having no share capital | Rs. 200/- |

| 2. | Less than Rs. 1,00,000/- | Rs. 200/- |

| 3. | Rs. 1,00,000/- to 4,99,999/- | Rs. 300/- |

| 4. | Rs. 5,00,000/- to 24,99,999/- | Rs. 400/- |

| 5. | Rs. 25,00,000/- to 99,99,999/- | Rs. 500/- |

| 6. | 100,00,000 or More | Rs. 600/- |

Late Filing of AOC-4: Companies should endeavour to file Form AOC-4 within its due date. However, if you miss filing Form AOC-4 within its due date, an additional fee of Rs 100 per day for every day of delay will be charged.

Penalty for Non-Compliance AOC-4

Non-filing of the AOC-4 form is a severe non-compliance and is punishable under the Companies Act, 2013, wherein the Company and the key managerial personnel (KMP), are penalised. Following is the table of penalties that may be imposed for the non-filing of Form AOC-4

| No | Defaulting Party | Penalty |

|---|---|---|

| 1 | Company |

|

| 2. | Managing Director/Chief Financial Officer (CFO) |

|

| 3. | Other directors who is responsible for compliance in the absence of the MD/CFO |

|

| 4. | All directors (in the absence of a specifically assigned director) |

|

The Ministry of Corporate Affairs (MCA) views the non-filing of the company's financial statements as an attachment in the prescribed Form AOC-4; therefore, the company must follow the regulatory requirements by the due date.