Overview of Form Annual Return of the Company in MGT-7 | |

|---|---|

| Purpose | To file the annual return of the company after the AGM. |

| Legal Provisions | Section 92 of the Companies Act mandates the filing of an Annual Return. |

| Nature of Filing | It is mandatory for every company after the Conclusion of the AGM. |

| Due Date | Within 60 days of the conclusion of the AGM. |

| ROC Filing Fee | ROC filing fee is based on the Capital of the company and is in the range of ₹200/- to ₹600/- |

| Delayed Filing | Delayed filing is allowed with an additional fee of ₹100/- for each day of delay. |

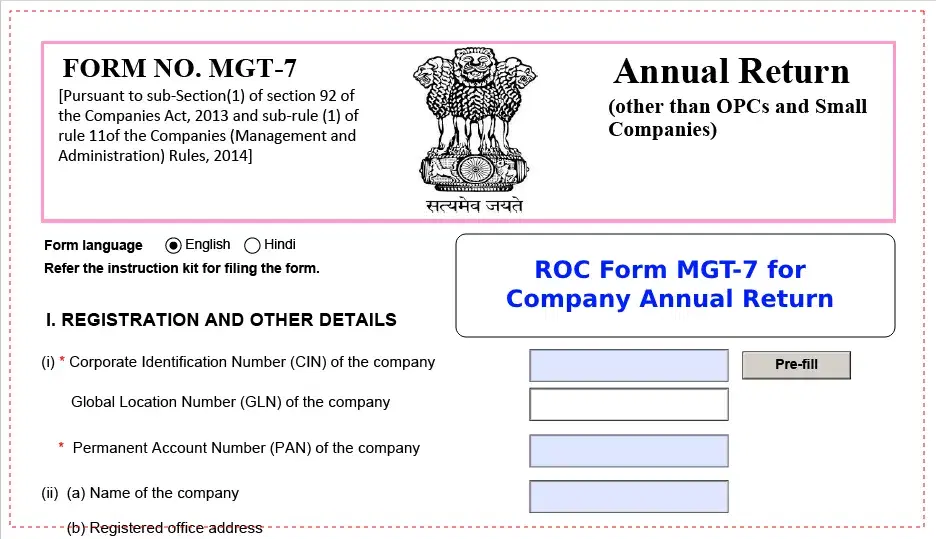

The filing of Annual Returns by companies is the cumulative responsibility of the Board of Directors. Key information about the company and material changes that took place in the company during the previous year are filed with the Registrar of Companies (ROC) in the prescribed form MGT-7 on the MCA portal. This process ensures transparency, accountability, and compliance with the legal provisions laid down under the Companies Act 2013.

Applicability of MGT-7 or MGT-7A

The MGT-7 form is the prescribed form in which the Annual Return of the companies are filed with the Registrar of Companies (ROC). Before 2021, there was only one standard Form MGT-7 requiring comprehensive disclosure by the companies. However, for OPC and Small companies, the Ministry of Corporate Affairs (MCA) in India introduced a simplified Form MGT-7A through the Companies (Management and Administration) Amendment Rules, 2021.

| No | Feature | MGT-7 | MGT-7A |

|---|---|---|---|

| 1 | Applicability | All companies except One Person Companies OPCs and small companies | OPCs and small companies |

| 2 | Scope of Disclosure | Comprehensive (financial statements, shareholding, remuneration, etc.) | Limited (basic company details, director info, board meeting details) |

| 3 | Compliance Burden | Higher | Lower |

| 4 | Introduced | Original annual return form | Introduced in 2021 for simplified compliance for small companies |

Documents & Information to be Furnished in MGT-7

The MGT 7 form is filed to provide comprehensive information to the Registrar of Companies for the preceding financial year. The following is an indicative list of information/documents that companies file with the MGT-7.

- Basic information about the company

- Share Capital and Ownership

- Details of Directors and Key Managerial Personnel (KMP)

- Details of Board Meetings and Resolutions

- Details of penalties or punishments imposed

- List of Shareholders or Debenture Holders

Stepwise Process of Filing the MGT-7 Form

Step - 1 : Preparation of Documents

The first step towards filing the annual return in Form MGT-7 is to gather all the required information and verify the same with the company's statutory registers and records. As the list of shareholders or debenture holders is a mandatory attachment, it should be prepared on the letterhead of the company as of 31st March of the previous financial year.

Step - 2 : Preparation of MGT-7 Form on the MCA Portal

Access the Ministry of Corporate Affairs (MCA) portal at www.mca.gov.in, download the applicable form MGT-7 or MGT-7A and fill in the information that is prescribed. When all the applicable information is filled in the MGT-7 form, attach the scan of the Shareholding of the company as of 31st March of the previous year. After all the documents are attached, the director’s DSC must digitally sign the AOC-4 form.

Step - 3 : Submit Form Annual Return (MGT-7) & Pay ROC Fee

After completing the MGT-7 Form and attaching all necessary documents, submit it on the MCA portal. Pay the requisite filing fees online through the MCA portal. Filing fees depend on the company’s authorised capital. After submission, an acknowledgement (SRN – Service Request Number) will be generated. Keep this acknowledgement for future reference.

Step - 4 : Approval of Form MGT-7 by the ROC

The annual return filed with the Registrar of Companies is processed in STP (Straight-to-process) mode. Retain a copy of the filed Form MGT-7, its acknowledgement, and all related documents in the company’s records.

ROC Fee for MGT-7 Filing

The fee for filing MGT-7 is calculated as per the Authorised Capital (nominal share capital) of the company. The table below provides the table of ROC Fee against the specific authorised capital of the company.

| No | Authorised Capital | ROC Fee Payable |

|---|---|---|

| 1 | A company having no share capital | Rs. 200/- |

| 2. | Less than Rs. 1,00,000/- | Rs. 200/- |

| 3. | Rs. 1,00,000/- to 4,99,999/- | Rs. 300/- |

| 4. | Rs. 5,00,000/- to 24,99,999/- | Rs. 400/- |

| 5. | Rs. 25,00,000/- to 99,99,999/- | Rs. 500/- |

| 6. | 100,00,000 or More | Rs. 600/- |

Late Filing of MGT-7: Companies should endeavor to file their annual returns within its due date. However, if you miss filing Form MGT-7 within its due date, an additional fee of Rs 100 per day for every day of delay will be charged.