Overview: DIR 3 KYC eForm is an essential form that needs to be filed annually by the DIN holders with the ‘Approved’ mark. It is a kind of annual Know Your Customer (KYC) process in which a director with DIN has to submit their personal information through this form. In this blog, get to know about a stepwise process to file the Director KYC in India and complete this annual compliance requirement smoothly.

A director of a company must be aware of all their compliance responsibilities. Complying with those compliances keeps you going and protects you from any sort of legal risks, including penalties, prosecution, etc. The Director KYC Form is one of such compliance requirements that should be followed every financial year. It is a mandatory compliance process for directors who have an ‘Approved’ DIN. The blog post helps you learn about DIR-3 KYC eForm filing, their stepwise procedure, benefits, etc.

Director KYC form filing is a compliance requirement for the directors that must be filed every year. Initiated by the Ministry of Corporate Affairs (MCA), it is useful in collecting and maintaining updated information of directors in their records. In short, the DIR KYC online form is a useful tool for the Registrar of Companies (ROC) that is beneficial in managing the personal information of the directors in registers, which eventually contributes to building transparency across the business realm.

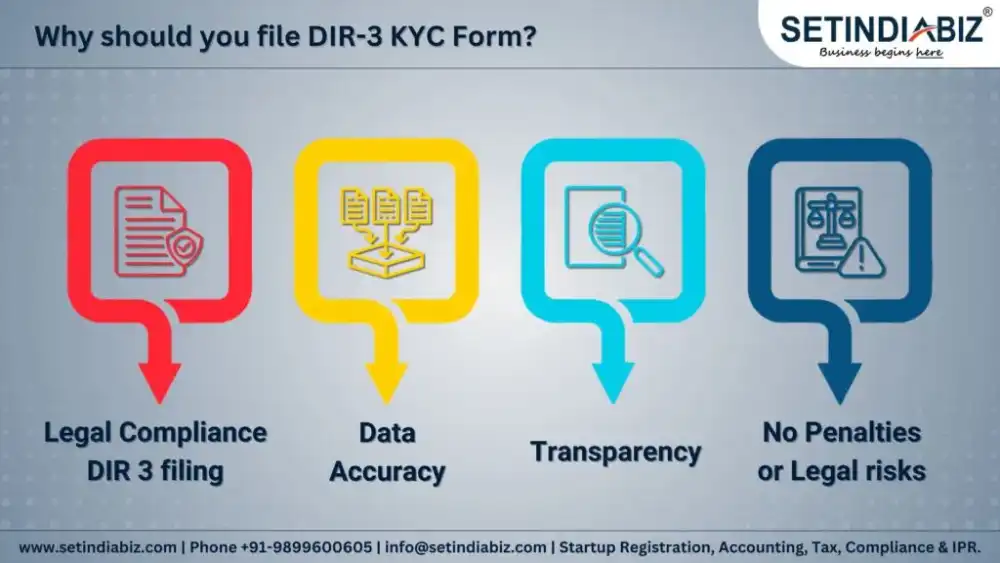

Why should you file the DIR-3 KYC Form?

- Legal Compliance – DIR 3 filing is obligatory for the directors of any company (s) in India so that they can fulfil the MCA as well as the Companies Act 2013 regulations.

- Data Accuracy – The process enables MCA to have fully correct and up-to-date KYC information of company directors in their register. This exercise may minimise cases of misuse of DINs as well.

- Transparency– Filing the DIR KYC form creates transparency across the corporate world and builds trust among stakeholders and customers.

- No Penalties or Legal Risks– If an applicant doesn’t file the director’s KYC within the due date, they might have to face fines or other legal penalties.

Stepwise Process to file Form DIR-3 KYC

The director KYC is a kind of compliance that is a one-time process in each financial year. It is important to file it on or before the due date of the coming financial year. Filing DIR 3 KYC can be a complicated task if a specific process is not followed. By properly following the steps mentioned below, you can file the DIR 3 KYC Form.

Step 1: Visit the official website of the MCA

Visiting MCA’s official website to download KYC is the first step towards filing this annual KYC form.

Step 2: Fill in DIN details

Fill the details of the DIN whose status is ‘Approved’ in this KYC form.

Step 3: Provide Required KYC Information

Name & other basic information: The applicant must fill in his basic details, i.e. ‘First & Last Name’, and also his/her Father’s ‘First & Last Name’. Keep some points in mind when starting KYC information filing, those include;

Enter Director’s Name as per PAN: Enter a valid address in the form, as it will be authenticated with the PAN details. Note that no Acronyms, Single letters, or Short forms are allowed in the form.

Address: The applicant must provide their permanent resident address and also attach proof of their permanent address. In case the current & residential addresses are not common, it’s necessary to provide the current residential address of the applicant.

Age Declaration: Enter a valid date of birth (DOB) in the prescribed manner, which is DD/MM/YYYY format. Age declaration is a mandatory factor, as an individual below the age of 18 years is not qualified to file this form.

Nationality : As we all know, nationality is one of the most crucial aspects for individuals looking to become a director in a company or who are proposed to be a director in any company. While filing the KYC Form in India, a director must also declare their nationality. The Directors with foreign nationality must declare their nationality as per their passport.

Step 4: PAN Verification

Verification of Permanent Account Number (PAN) is a crucial part of DIR KYC. In this step, you need to provide your PAN details. After that, verify the same information by clicking on the ‘Verify Income-Tax PAN’ button. Furthermore, the submitted information is checked & verified by the authorised department. It is important to note that the submitted PAN details through DIR 3 KYC must be similar to the PAN information linked to the Digital Signature Certificate (DSC) to verify them.

Step 5: Update Your Contact Details and Verify through OTP

When a director fills out his basic contact details, he should verify them as well through an OTP by simply clicking on the ‘Generate OTP’ button. Different OTPs are sent for mobile numbers and email addresses. It should be kept in mind that an OTP will be sent to the mobile number & email address not more than 10 times/day and twice in 30 minutes against a form.

Step 6: Verify director’s KYC e-form

Before finally submitting the KYC form, an applicant needs to cross-check that the form is duly filled out and verified. The form must also have the digital signature of a CA/CS or Cost Accountant who is presently in practice. Finally, submit the form by clicking on the ‘Submit’ button.

Director KYC filing is not a mere compliance, so filing it before its deadline is crucial. Filing the KYC form within the due date of the respective financial year can protect you from risks of late filing. File your director KYC Form easily by following the stepwise process mentioned above!

Documents for Director KYC Form

There are several documents that company directors must have while going for the director KYC form filing in India. It’s important to keep those documents handy before initiating the KYC Form filing. The documents required for the director KYC form filing must be properly attested before uploading. Those documents include;

- Photograph: Latest passport-size colour photograph with the front face of the director or Partner of LLP in JPEG Format.

- PAN Card Scanned Copy of PAN Card for Indian Residents

- Proof of Resident

- Voter ID Card,

- Driving License

- Any Utility bill, i.e. Electricity/Telephone, etc. (Not more than 2 months old)

- Mobile Number: A Mobile Number is required for verifying OTP.

- Email ID: An Email ID is needed to send a verification OTP.

- A scanned copy of a Passport must be submitted by Foreign Nationals. In case an Indian Applicant has a passport, it’s mandatory to file it.

Note: The applicant must attest to other attachments using their digital signature.

Conclusion

Follow the steps given below to submit Form 26QC for correction on TRACES using the net banking or e-verification method.

Step 1: Log in to your Internet banking account

Director KYC is an annual compliance procedure that a DIN holder has to file using Form DIR-3 KYC. This form helps the government maintain up-to-date information on the directors who hold directorial positions in any Indian organisation (s).If one follows the stepwise process of filing the Director KYC as described, they can get their DIR KYC filed properly.