Overview : In a significant move to enhance corporate transparency and validate the physical existence of registered entities, the Ministry of Corporate Affairs (MCA) has introduced mandatory photographic evidence requirements for Annual Return filings. This update, effective from July 14, 2025, impacts explicitly One Person Companies (OPCs) and Small Companies utilising Form MGT-7A. Under the Companies (Management and Administration) Amendment Rules, 2025, the MCA officially substituted the existing Form MGT-7A with a new version that requires the attachment of a geotagged, timestamped photograph of the registered office exterior. This guide provides a definitive overview of the new requirements, the precise legal framework, and the practical steps required for compliance.

What is the Legal Basis for the New MGT-7A Requirements?

The mandate for photographic proof of the registered office of the company is established through the Companies (Management and Administration) Amendment Rules, 2025, officially notified by the MCA via Notification G.S.R. 358(E), dated May 30, 2025. This notification did not introduce a new narrative rule regarding photographs. Instead, it exercised the government’s power to amend the Companies (Management and Administration) Rules, 2014, by formally substituting the existing Form MGT-7A with a new V3 version, effective July 14, 2025.

The requirement stems directly from the structure of this new statutory form. Under Section 92 of the Companies Act, 2013, companies must file returns in the “prescribed form.” When the prescribed form (MGT-7A) is officially updated to include a mandatory attachment field for a photograph, this becomes a direct legal obligation. This mechanism aims to strengthen the enforcement of Section 12 of the Companies Act, 2013 (requiring a verifiable registered office) by integrating photographic evidence and precise location data (latitude and longitude) into the annual compliance process.

Which Companies Must Comply with the Photographic Mandate?

This new compliance requirement is strictly applicable to entities eligible to file the abridged Annual Return using Form MGT-7A. The entities primarily filing MGT-7A are defined under the Companies Act, 2013, as follows:

| One Person Companies (OPCs) | Small Private Limited Companies |

|---|---|

| As defined under Section 2(62) of the Companies Act, 2013, an OPC is a company formed with a single member. All OPCs, regardless of their turnover or capital, must adhere to this new photographic mandate when filing their annual return. | These are defined under Section 2(85) of the Companies Act, 2013. A private company is classified as a ‘Small Company’ if it meets both current thresholds: its paid-up share capital does not exceed Rs. 4 Crores, AND its annual turnover does not exceed Rs. 40 Crores. Companies meeting these criteria must provide the required photographic evidence. |

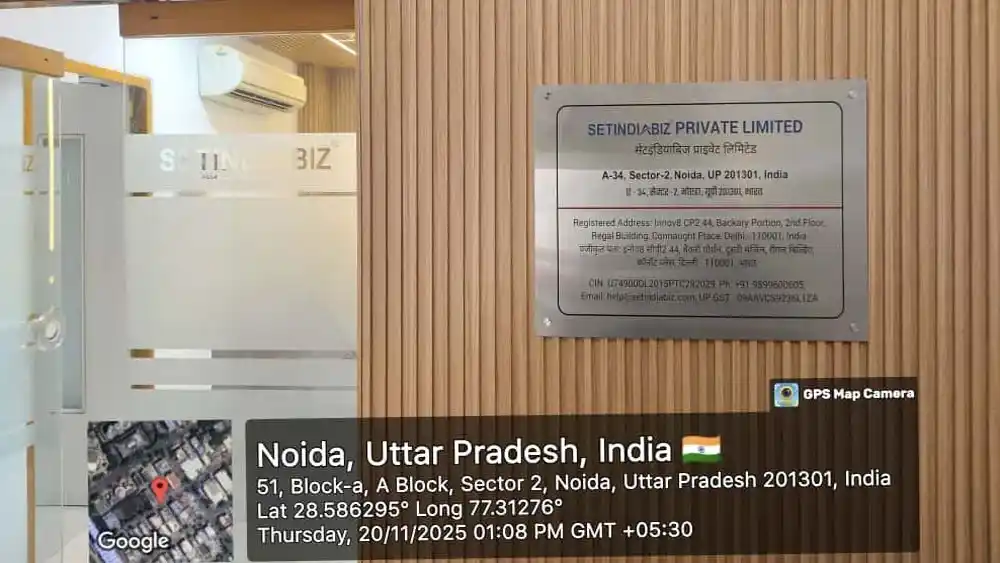

The Required Photograph: External View of the Registered Office

The substituted Form MGT-7A requires the attachment of one specific photograph. Crucially, this is not a simple image; it must be embedded with metadata to ensure authenticity. It must be geotagged (containing latitude and longitude coordinates) and timestamped (showing the exact date and time of capture). The official requirement, as stipulated in the attachment section of the substituted Form MGT-7A (pursuant to Notification G.S.R. 358(E)), is a “Photograph of the registered office of the Company showing external building and name prominently visible.” This image serves to validate the physical address recorded with the MCA.

- Complete Name of the Company

- Full Registered Address

- CIN

- Phone

- Website (If available)

The photograph must clearly display the Company Name Board, ensuring compliance with Section 12(3)(a) of the Companies Act, 2013. This section mandates that every company must paint or affix its name and the address of its registered office in a conspicuous position. The signboard should also display the Corporate Identification Number (CIN). The geotagging embedded in the photo must align precisely with the registered address coordinates provided in the form.

Practical Compliance Checklist for Companies

With an effective date of July 14, 2025, and applicable to filings for the Financial Year 2024-25 onwards, OPCs and Small Companies must prepare proactively. This ensures the registered office is accurately represented and compliant before the filing deadline.

| Checklist for the Registered Office Photo for MGT7A | ||

|---|---|---|

| 1 | Verify Signage Compliance | Ensure that a compliant signboard displaying the company’s full name, address, and CIN is clearly visible on the exterior of the registered office, as required by Section 12(3)(a). |

| 2 | Check Address Accuracy | Confirm that the address on the signboard matches the official address registered with the MCA |

| 3 | Enable Geotagging and Timestamping | Use a GPS-enabled smartphone or camera. Ensure location services are activated in the camera settings before taking the picture so that the coordinates (latitude and longitude) and time are embedded in the image metadata. |

| 4 | Capture the Accurate Image | Take a clear photograph of the exterior, ensuring the building structure and the signboard are clearly legible and unobstructed |

| 5 | File Size Limits | Ensure the image file size does not exceed the MCA V3 portal’s limits for MGT-7A attachments (typically 2MB) |

Clarification: Is an Internal Photo or Director’s Presence Required?

It is critical to note that, for the Form MGT-7A amendment, the official MCA notification and the new form layout do not mandate an internal photograph of the office premises, nor do they require a director to be present in the picture. While previous compliance measures (such as Form INC-22A ACTIVE) required a director’s photo, this specific update for the annual return only requires the external view with the compliant signboard.

What are the Consequences of Non-Compliance?

Failing to comply with the requirements of the prescribed statutory form is a serious matter. Filing the Annual Return is a statutory obligation under Section 92 of the Companies Act, 2013. If an OPC or Small Company fails to attach the required photograph, or if the picture lacks the necessary geotags or does not clearly show the required signage, the filing will be deemed incomplete by the Registrar of Companies (RoC).

An incomplete annual return is treated as if it were never filed. As per Section 92(5) of the Companies Act, 2013, this results in automatic penalties (additional filing fees) for the company and potential penalties for every officer in default, which accrue daily until the compliance is met. Furthermore, this requirement directly verifies compliance with Section 12. Continuous failure to maintain a compliant registered office and signboard can result in severe action under Section 12(8), including the RoC initiating the striking off of the company’s name from the register.

Conclusion

The introduction of Form MGT-7A under the Companies (Management and Administration) Amendment Rules, 2025, represents a key improvement in India’s digital compliance framework. By requiring geotagged photographic evidence, the Ministry of Corporate Affairs (MCA) is enhancing transparency and accountability while combating shell companies. One Person Companies and Small Companies must ensure their registered offices and signage comply with these requirements, effective July 14, 2025, to maintain good standing and avoid penalties.