LLP Accounting – Section 34 of the Limited Liability Partnership Act requires that every LLP shall maintain and keep the accounting records which are sufficient to show and explain the transactions of an LLP and which disclose with reasonable accuracy the financial position of the LLP. Such a book of accounts needs to be prepared on the accrual basis or the cash basis and according to the double-entry accounting system.

The following are the records that should be maintained at the registered office of the LLP:

- Entries from day to day of all sums of money received and expended by the LLP, and the matters in respect of which the receipt and expenditure take place;

- Records of the assets and liabilities;

- Statement of inventories;

- Statement of work-in-progress;

- Statement of finished goods;

- Statement of cost of goods sold; and

- Other details which the partner may decide.

The financial year of an LLP starts from the date of its incorporation in case of a newly incorporated LLP, and in other cases, it starts on 01st April and ends on 31st March every year. At the end of the financial year, the designated partners are required to prepare an annual financial statement, and they need to certify it to be true. The books of account of the LLP are required to be kept and maintained at the registered office of the LLP for a period of 8 years.

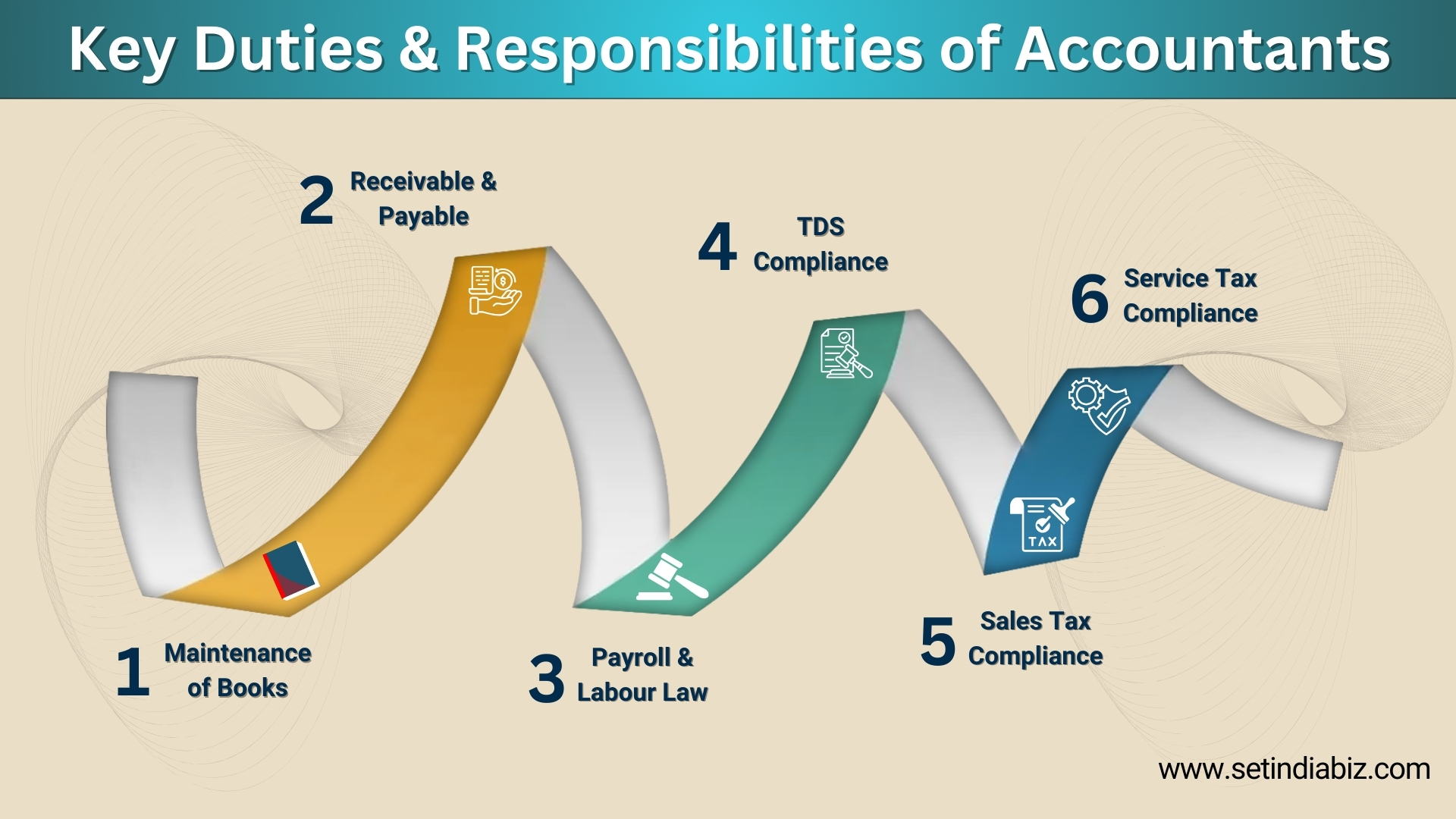

Accountants Responsibility

Maintenance of Books

The most important role that an account must play is to ensure that the books of accounts are properly maintained and updated.

Receivable & Payable

The payables must be paid within the due date to avoid interest and loss of reputation; the receivables must be taken care of by way of reminders.

Payroll & Labour Law

Employee’s salary needs to be paid within time after statutory deductions like Professional Tax, TDS, PF and ESIC contribution.

TDS Compliance

While making payments to vendors, employees, contractors, rent, professional payments, etc, TDS must be deducted at applicable rates.

Sales Tax Compliance

Correct computation/working of VAT payable after taking input tax in credit and filing of a timely return is an important responsibility of an accountant.

Service Tax Compliance

Every month, the service tax needs to be paid after taking proper deduction of available service tax credit. The return must be filed within the due date.

Details and Documents Required for Filing GSTR-3B

To file GSTR-3B in India, taxpayers are required to provide certain details and furnish relevant documents related to their sales, purchases, and input tax credit (ITC) for the month. The table below contains the details and documents required for filing GSTR-3B.

Conclusion

To sum up, LLPs shall maintain sufficient accounting records reflecting their accurate financial position. Certain records that must be maintained at the registered office of the LLP are described in this post. Hopefully, the blog will have clarified all your doubts related to maintaining accounting records in an LLP.