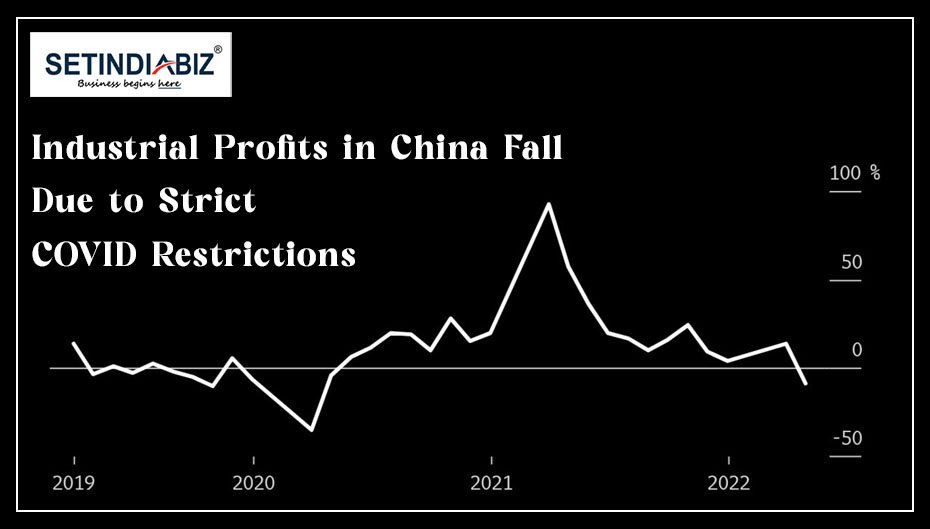

In China, industrial firm profits are rapidly declining from January to August due to COVID regulations, which have curtailed domestic demand, resulting in an economic decline.

The Impact of COVID-19 on China’s Economy

The Impact of COVID-19 on the Global Economy: A Report

Industrial profits decreased 2.1% year on year in the first eight months of 2022, following a 1.1% fall in January-July, according to National Bureau of Statistics (NBS) statistics issued on Tuesday.

The administration did not release separate numbers for August or July.

The Chinese economy surprised observers in August, with faster-than-expected growth in manufacturing output and retail sales, but a housing crisis and COVID lockdowns impacted on the future.

Jones Lang Lasalle’s chief economist, Bruce Pang, stated:

“The economic recovery is facing more uncertainties, as the momentum was disturbed by a variety of unexpected and external factors such as extreme hot weather, regional power restrictions and COVID flare-ups.”

Profits decreased in 25 of 41 major industrial sectors between January and August. Due to lower commodity prices, profit growth in the mining industry fell to 88.1% year on year in January-August, down from 105.3% in the first seven months.

Profits in the manufacturing sector fell 13.4% in the first eight months, following a 12.6% dip in January-July.

Senior NBS statistician Zhu Hong stated in a separate statement that:

“China will accelerate the implementation of policies to expand demand, and promote a sustainable and stable recovery of the industrial economy.”

What Exactly is China's Current Zero-COVID Policy?

Analysts perceive China’s present zero-COVID policy as a key economic barrier, and they see little likelihood of Beijing relaxing its zero-COVID policy before the Communist Party Congress in October.

“Weaker exports and property markets mean that the remaining source of growth support is consumption, in our view. To unleash that, a shift in China’s COVID management approach is needed,” in a research note, Morgan Stanley stated. “We expect policymakers to take important steps in the coming months that would allow reopening from spring 2023.”

COVID restrictions were implemented in places ranging from Shenzhen to Chengdu and Dalian in late August, with the goal of preventing further pandemics.

China’s industrial revenue grew 4.2% year on year in August, following a 3.8% increase in July.

Industrial business liabilities increased 10.0% year on year in August, somewhat slower than the 10.5% increase in July.

One bright light in the otherwise distorted picture was the automobile industry, which benefited from lower purchase taxes and saw earnings more than double in August.

Profits in the energy sectors increased 1.58 times year on year in August, thanks to increasing demand for energy as a result of the hot weather.

Drought restricted hydropower generation in China’s southwestern Sichuan province and Chongqing area in August, while locals increased electricity demand during severe heat waves.

In late August, China’s cabinet proposed further stimulus measures to strengthen the country’s struggling economy, including a 300 billion yuan increase in the cap on policy financing tools.

Data on industrial profits represent significant firms with yearly sales from their main operations surpassing 20 million yuan.