Fee for filing the Director KYC (DIR3-KYC) and Penalty for Late Filing

Overview : Any director holding a ‘Director Identification Number’ or DIN with the status ‘approved’, must file a KYC form every financial year before the due date. It helps the Ministry of Corporate Affairs (MCA) to maintain & update data of every director having a DIN, in their records. If form DIR-3 KYC is filed within the due date (30th September) of the respective financial year, no government fee is payable. The blog unveils charges for Director KYC (DIR-3 KYC) and Penalty for late filing of director KYC form.

What is DIR 3 KYC?

DIN is an abbreviation of Directors Identification Number which is a type of unique number allotted to individuals who are proposed to be directors or already a director in a business. DIN number is essential not only to incorporate a company but also to maintain the director’s status in the company.

So, Form DIR 3 KYC was introduced with the intent to keep the DIN and its associated details updated regularly. Filing DIR KYC is a single-time process carried out annually, enabling directors to intimate their details to regulatory authorities like the ROC, and keep them updated on any done or undone changes.

Director Kyc Registration Fee/Charges & Penalty

In general, no government fee is payable for filing the DIR-3 KYC form within the due date of filing. However, if the directors fail to file the e-Form DIR 3 KYC within 30 September, the MCA will mark their DIN as ‘Deactivated’ on the MCA21 portal, demonstrating the reason ‘Non-Filing of DIR-3 KYC’.

In such cases, the directors whose DINs have been deactivated and want to file their KYC after the prescribed date, have to pay director KYC fees or charges of Rs. 5000 for late filing.

Purpose of Filing DIR-3 KYC

The government keeps the data of every DIN holder in their records. In order to ensure that the data in the records of the government is updated and correct, e-Form DIR-3 KYC was introduced and every director holding a DIN has to file each financial year. With updated records, the MCA can deactivate DINs that are not in use and their updated data is also not available.

For the directors who have failed to file their DIR-3 KYC for the previous financial year, their DIN status is updated with a remark of ‘Deactivated due to Non-Filing of DIR-3 KYC’. Such directors also have to file this KYC Form along with a penalty of Rs. 5,000 to reactivate their DIN.

Who has to file e-Form DIR-3 KYC?

The Ministry of Corporate Affairs (MCA) recently stated that a director holding a DIN by or on March 31, 2018, with ‘Approved’ status, must submit his/her KYC information to it. It is also a mandatory process for the directors whose DIN has been marked ‘disqualified’.

After FY 2019-20, every director who has been allotted DIN on or before the end of the financial year with its DIN status ‘Approved’, is needed to file form DIR-3 KYC before 30th September of the next financial year. For instance, for the financial year 2022-23, the directors who have been allotted a DIN or DPIN (Director Partner Identification Number) by 31st March 2023 or already have a DIN, need to file their e-Form DIR-3 KYC before 30th September 2023.

There are two ways of filing an e-Form DIR-3 KYC that are described below;

1. E-form DIR-3 KYC

The directors who are filing e-Form DIR KYC for the first time post allotment of their DIN or whose credentials need to be updated must file their Director KYC through filing the E-form DIR-3 KYC.

2. Web-based DIR-3 KYC

Any director who has already filed the Director KYC e-Form in any of the previous financial years and no changes incurred in their KYC credentials are needed to file Web-based DIR-3 KYC. They can simply file this e-Form by logging into the MCA portal followed by navigating to the ‘MCA Services’ tab then ‘Company e-Filing’ ‘DIN Related Filings’ and clicking on ‘Form DIR-3 KYC Web’.

In this form, the directors are needed to provide their DIN number, Mobile Number as well as Email address. An OTP will be sent via Mobile Number and Email, fill out the OTP and click on the ‘Next’ button.

Checklist for DIR-3 KYC Form Filing

Before initiating director KYC form filing, make sure to fulfill certain requirements. Complying with such requirements makes the director KYC filing process hassle-free, and quick. Here is a quick checklist points for filing dir-3 KYC form;

- Each director must have a separate Mobile number and Email address which will be verified by OTPs.

- Digital Signature of the Directors as DSC is required while filing e-Form.

- The director has to ensure that correct and right information is given in the e-form and it must also be certified by a practicing Chartered Accountant (CA), Company Secretary (CS), or Cost Accountant.

Documents Required for Director KYC Filing

In order to duly file the Director KYC form, the applicant must have a set of documents required for Director KYC. If documentation requirements are left unfilled, filing Director KYC can’t be completed. If one fails to file a director KYC e-Form, he may have to face penalties. In order to file the DIR-3 KYC Form, the documents required are listed below;

- Details of Nationality

- Details of Citizenship such as Gender, Date of Birth, etc.

- Permanent Account Number (PAN)

- Passport, in case a DIN holder has a foreign nationality

- Proof of Identity i.e. Voter’s Identity Card, Aadhaar Card, Driving License, Passport

- Proof of Address

- Personal Mobile Number & Email ID

- Digital Signature Certificate (DSC)

- A Declaration signed by the applicant and must also be attested by any practicing CA, CS, or Cost Accountant

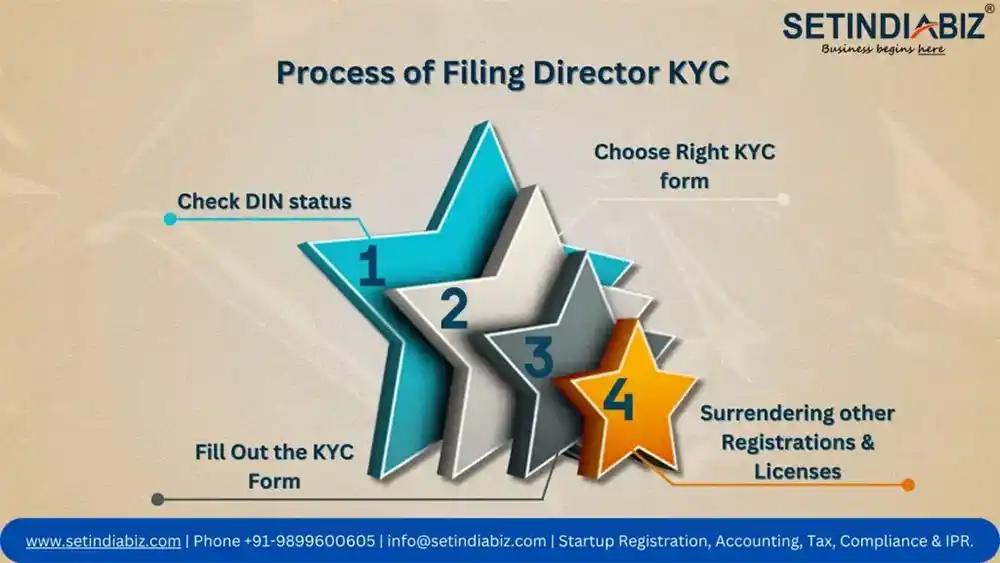

Process of Filing Director KYC

The director kyc filing process has several steps that you need to follow. Follow each step of the DIR KYC process strictly to file this annual form properly which includes;

1. Check DIN status

The DIR KYC form filing process starts with checking the DIN status first. For that, you need to visit the MCA’s official website and check the DIN Section under Services. By this, you can determine whether your DIN is in active or deactivated mode. After that, you are all set to move to the further steps.

2. Choose Right KYC form

In the DIR-3 KYC Section of the MCA’s portal, there are two e-forms for KYC; one is DIR-3 KYC and the other is DIR-3 KYC (Web-based) Form. Depending upon the type of filing (New or Existing), the relevant form must be filed. Directors having DIN and filing KYC for the first time must opt for e-Form DIR-3 KYC.

On the other hand, the directors who have already filed KYC in any of the financial years and no alterations in their credentials took place since then, must file a DIR-3 e-Form Web-based form. A web-based form has pre-filled details that you only need to verify and submit the form.

3. Fill Out the KYC Form

The directors filing e-form for KYC for the first time have to fill out the correct form with the right details including Name, Address, Nationality, Gender, Birth Date, PAN Number, Identity Proof (Aadhaar Card/DL/Voter ID/Passport) Number, and other required details. Post submission, click each detail at least once and click on ‘Send OTP’ to receive verification codes on your given mobile and email address.

4. Surrendering other Registrations & Licenses

The director KYC e-Form must be signed digitally by the applicant. And don’t forget to get this form verified by a practicing CA or CS. Once done, submit the form.

Post-Submission Process

Upon successful submission of the DIR 3 kyc form, wait for MCA’s approval. In general, the processing of DIR-3 KYC verification may take a few hours to 24. However, it may take some time to get DIR-3 KYC approval depending upon a few conditions such as withdrawal in verification status, etc. The post-submission process of DIR-3 KYC includes;

- SRN Generation : On successful submission of the Director KYC Form, an SRN will be generated for the applicant. This SRN will help in making any future correspondence with the MCA.

- Final Approval : If the MCA finds all the information given in the DIR-3 e-form true & correct during the form verification process, it will send an email to your email id with the approval of the receipt of the form on the Email ID of the applicant. Once you receive an approval mail, your e-Form DIR-3 KYC has been completed.

Conclusion

Director KYC registration is a must-follow annual compliance that each director who has a DIN and its status is ‘Approved’ has to file every financial year. If they don’t file this online form before the specified date, they may have to face director KYC penalty or late filing fees. Learn more about various aspects of director kyc including registration fee/cost, late KYC penalty charges, and other essential aspects by going through the above blog post.

FAQ’s

Do I need to give a unique mobile number and email ID in DIR-3 KYC form?

What details should be filled in the director KYC form?

- Name of Applicant (as per PAN),

- Father Name of Applicant,

- Date of Birth,

- PAN Number (mandatory for Indian residents),

- Personal Mobile Number & Email Address,

- Present/Permanent Address, etc.