Mastering TDS on Salary: A Comprehensive Guide to Section 192 of the Income Tax Act.

In India, Section 192 of the Income Tax Act requires that every employer, while paying salary to its employee, deducts

Important Registrations

Startup India (DPIIT)/GEM

Special Purpose Entity

NGO & Others

Book Keeping & Audits

GST Compliance

Digital Accounting

TDS

HR Policy Document

Labour Law Registrations

Payroll & Labour Law Return

POSH

Post Incorporation

Director Related

Annual Filings

Shares Related

LLP Change

Partner & Capital

LLP Annual Return

Conversion – Company

Conversion – LLP

Winding UP/Restructuring

Other Conversions

FDI Related

Fin-Corp

SEBI

Overseas Investments by Indians

FSSAI & Eating License

Food Business – Others

Drug – Pharmaceuticals

Insecticide & Pest Control

Special Activities

Legal Metrology

Metrology & Hallmarking

Other Certifications

WPC

Telecom Product Certification

BIS Certifications

Trademarks Filing

Design & Copyright

Trademark Post Filing

International Trademark

International Patents

In India, Section 192 of the Income Tax Act requires that every employer, while paying salary to its employee, deducts

The term ‘TDS’ refers to ‘Tax Deduction at source’. It is a mechanism wherein a person responsible to pay a

The Ministry of MSMEs has decided to reduce the turnover limit of businesses to get onboard with the Trade Receivables

The tough times are over for non-resident entities as the Central Board of Direct Taxes (CBDT) has eased taxation norms

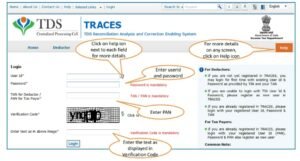

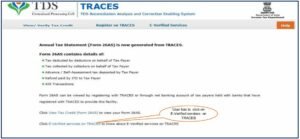

TRACES or TDS Reconciliation Analysis and Correction Enabling System is a web-based platform administered by the Income Tax Department of

TRACES (TDS Reconciliation Analysis and Correction Enabling System) is a web-based platform administered by the Income Tax Department of India.

TRACES (TDS Reconciliation Analysis and Correction Enabling System) is a web-based platform administered by the Income Tax Department of India.

DIR 3 KYC eForm is an essential form that needs to be filed annually by the DIN holders with ‘Approved’

Tan Number is a ten-digit alphanumeric number which is allotted to by NSDL to tax deductors. This is unique number

This comprehensive blog discusses the step-by-step process of online form 26QB correction on the TRACES portal and its e-verification via