TRACES: Form 26QC Correction using DSC/ AO Approval

Overview : TRACES (TDS Reconciliation Analysis and Correction Enabling System) is a web-based platform administered by the Income Tax Department of India. Its primary purpose is to provide various TDS and TCS related services to tax deductors, tax collectors, and taxpayers alike. A few of these services include online correction of TDS statements, viewing status of TDS payment challan, downloading consolidated files of TDS statements, downloading justification reports pointing out errors in TDS statements, and the viewing of annual tax credit statements.

In this article, we shall be discussing in detail the purpose, conditions, and stepwise procedure for making corrections in TDS return statements for tax levied and deducted on property rentals, by submitting online correction requests on TRACES, and also learn the process by which the statuses of such requests can be tracked on TRACES itself.

What is Form 26 QC?

Taxes that are levied by the Government on various types of incomes earned can be deducted and collected at the source of income itself. This is termed as TDS or Tax Deduction at Source, and TCS or Tax Collection at Source.

In this context, Section 194 IB of the Income Tax Act prescribes tax deduction and collection on the income earned from renting or leasing property. According to this section, if a property has been rented to an individual or a Hindu Undivided Family for a rental charge exceeding Rs.50,000 per month, the landlord or the lessor of such property, who is earning income from the rent payment, will have to pay 5% of the total rent received, as income tax to the Government. This amount will be deducted as TDS by the tenant, and paid to the government on behalf of the landlord / lessor.

Also, the statement of returns of such TDS payment must be filed in form 26 QC to the Income Tax Department within 30 days from the end of the month in which the tax was deducted. However, if the tenant has paid the rental charge of the entire financial year at once, form 26 QC will have to be filed within 30 days from the end of such financial year. Similarly, if the tenant is vacating the property, or the rent agreement has expired or terminated, the tenant can file form 26 QC within 30 days from the date on which the property is being vacated or the rent agreement has expired / terminated.

What details can be corrected in form 26 QC?

The provision for online corrections in form 26 QC on TRACES was introduced in Financial year 2017-18. Using this facility, you can correct or update any detail mentioned in the application. A list of such details that can be corrected has been mentioned below.

- Details of the tenant (Name, address, and PAN)

- PAN details of the landlord / lessor (Name, address, and PAN)

- Date of rent payment received

- Date of TDS deducted

- Amount paid as TDS

- Details of the Property let out (Type of property and its address)

- Rental charges to be paid every month

- Rental charges paid in the previous month

What are the conditions to make corrections in form 26 QC?

The correction request for form 26 QC can only be filed by the tenant who is paying the rent of the property. However, for changing or updating certain details like the date and amount of rent received, PAN of the landlord, or PAN of the tenant, and the amount of TDS deducted, the approval of the landlord will be required. To submit the correction request you are required to fulfil the following prerequisite conditions:

- Your correction request can only be submitted if form 26 QC has been processed.

- Your request needs to be verified before submission for which 3 different options are available, through DSC, by obtaining the approval of the jurisdictional Assessing Officer, or by internet banking.

- If the DSC of the tenant is registered on TRACES, and the landlord is known, the tenant can opt for any of the above mentioned options.

- However, if the DSC of the tenant is not registered on TRACES, and the landlord is also unknown, the tenant has no choice but to opt for approval of the Assessing Officer.

- If the Digital Signature is not registered but the landlord is known, the tenant can either opt for verification through internet banking, or obtaining the approval of the Assessing Officer.

- If details related to the property (its address and name), tenant’s address, and the landlord’s address are to be corrected, the same can be verified or auto approved by the DSC of the tenant and landlord, irrespective of whether their DSCs are registered or unregistered.

- If the DSC of the tenant is not registered, and the correction request has been filed for details like the rent amount, date of payment of rent amount, and the date and amount of tax deduction, the request will be verified with the Assessing Officer’s approval only.

How to make corrections in Form 26 QC?

Form 26QB correction requests can be filed only after certain requirements are met. These include the possession of necessary documents like DSC, their registration on the TRACES portal, and knowledge of crucial details regarding the buyer, seller, and assessing officer. The list below will give you complete clarity. Note that unless these requirements are met, filing TDS 26QB correction requests may be detrimental.

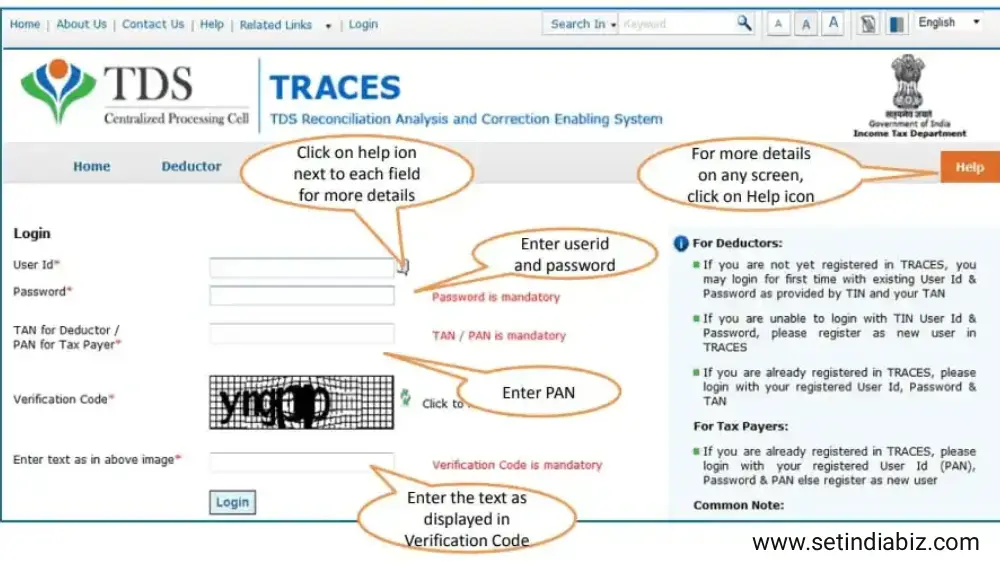

- Login to TRACES portal: To Login into your TRACES account you are required to enter your registered User Id, Password, and PAN number.

- Navigate to Request for Correction: Now in order to access and fill the correction form you will have to go to Statements / Forms then go to ‘Request for Correction’.

- Select the Form Type: Then Select Form 26QC from the dropdown, and then go to “Online Correction” to submit the Correction Request.

- Review the Checklist: Before processing, you must review the checklist and then click on ‘Proceed’. This checklist mentions the same conditions that we have discussed in the previous section.

- Fill the appropriate details: Now, fill in the Financial Year, the Acknowledgement Number received when Form 26 QC was filed, and then click on the ‘Request for Correction’ tab next to it.

- Submission of the Request:After all this, the Success page will appear on the screen and you will see that a ‘Request Number’ has been generated. You can track the status of the correction request using this number under the tab ‘Statements / Forms’.

- Navigate to Track Correction Request: Go to Statements / Forms > Track Correction Request

- Verify the status of Correction Request: Enter the Request Number or Request Date. Then Click on ‘View Request’. A list of requests pertaining to the search criteria will appear. Select the relevant row and if the status is ‘Available’, you can start the correction.

- Enter Challan details:Enter Challan Identification Number and other details of any challan paid while filing Form 26QC. Click on ‘Proceed’

- Edit the details: Details as per Form 26QC filed will appear on the screen. Click on ‘Edit’ for correcting the details.

- If your DSC is not registered on TRACES or if you don’t have e-verification (internet banking), you will require the approval of the jurisdictional Assessing Officer. For this purpose, you will have to approach the AO with the following documents:

- Hard copy of acknowledgement of correction of Form 26 QC

- PAN card of the tenant

- ID proof of the tenant

- Copy of the Rent Agreement

- Proof of payment of TDS

- Save & Submit the corrections: Make the necessary corrections. Click on ‘Save’. Click on ‘Submit Correction Statement’ once you have finished with all the corrections.

- Confirmation message: Confirmation Screen will appear. The updated details will be highlighted in yellow colour. You should review the updated details once again and then finally click on the ‘Confirm the Details’ option.

- Submit correction request: Profile details will appear as updated on the portal. Click on “Submit Request” to Submit Correction Request by choosing the appropriate option, if provided.

- Option 1: Validate Correction Request using AO Approval – Click on AO Approval. Click on ‘Submit Request’. A pop-up will appear to track correction status. Click on ‘Continue’. The AO Details will be available once the ‘Correction Status’ changes to ‘Pending for AO Approval’.

- Option 2: Validate Correction Request using DSC – Click on DSC. Click on the option ‘DSC’. Click on ‘Proceed’. Then choose DSC i.e. Digital Signature Certificate of the Authorised Person. Click on ‘Sign’. To use DSC on TRACES, it is mandatory that you download and install WebSocket emSigner.

Different Statuses of Correction Request Made in Form 26 QC

To check the status of the correction request you have to click on the statements or forms then Track Correction Request. Let’s see the different types of status that is reflected on the website.

- Pending for PAN Approval – Is shown when the Correction Statement is submitted for approval of the tenant or landlord of the property.

- Pending for AO Approval – When the Correction Statement is pending for approval from the Assessing Officer, this appears as its status Users can check AO details in the column ‘Assessing Officer Details’.

- Submitted to ITD – Appears if the Correction Statement has been approved by AO, tenant or landlord and has now been submitted to the Income Tax Department.

- Processed – When the Correction Statement is processed by TDS CPC, “Processed” appears as the status.

- Cancelled – If the Correction Statement is cancelled by Tenant, then “cancelled” appears as the status.

- Rejected – Appears when the Correction Statement is rejected by Tenant, Landlord, AO or TDS-CPC.

Conclusion

We hope that this blog has been helpful for you to understand the Form 26QC Correction using AO approval or DSC, and hope that you can now file your TDS return statements more efficiently, easily, and in a hassle free manner.

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.