Remuneration to Partners in LLP – Limited Liability Partnership

Limited Liability Partnership (LLP) is gaining more popularity among some elite professionals as it offers combined benefits of both a

Important Registrations

Startup India (DPIIT)/GEM

Special Purpose Entity

NGO & Others

Book Keeping & Audits

GST Compliance

Digital Accounting

TDS

HR Policy Document

Labour Law Registrations

Payroll & Labour Law Return

POSH

Post Incorporation

Director Related

Annual Filings

Shares Related

LLP Change

Partner & Capital

LLP Annual Return

Conversion – Company

Conversion – LLP

Winding UP/Restructuring

Other Conversions

FDI Related

Fin-Corp

SEBI

Overseas Investments by Indians

FSSAI & Eating License

Food Business – Others

Drug – Pharmaceuticals

Insecticide & Pest Control

Special Activities

Legal Metrology

Metrology & Hallmarking

Other Certifications

WPC

Telecom Product Certification

BIS Certifications

Trademarks Filing

Design & Copyright

Trademark Post Filing

International Trademark

International Patents

Limited Liability Partnership (LLP) is gaining more popularity among some elite professionals as it offers combined benefits of both a

NEW DELHI: In line with Prime Minister Narendra Modi’s recent message to the tax department, the government has sought to

Taxation in India can often be complex, especially when it comes to understanding what TDS and TCS actually mean. Both

The month of July is approaching and so is the time for filing your income tax return. The aforementioned statement is

Penalty and prosecution for non filers of income tax returns With an exponential increase observed in the number of non-filers

Tax payments, return filings, and other tax compliances are extremely exhaustive, time, and cost consuming processes, especially for entrepreneurs who

Future and Options are stock derivatives that enable a future sale and purchase of commodities and securities in the stock

Section 285BA of the Income tax Act,1961 introduces the concept of filing of SFT form 61A by certain authorities carrying

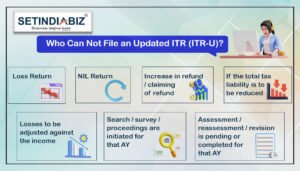

This blog provides comprehensive information on the newly introduced provision of filing Updated Income Tax Returns (ITR-U) under Section 139(8A)

An organization is referred to as a partnership firm when multiple owners operate it under one legal name. According to