What is GSTR-1?: GST Returns, Eligibility, Due Date & Documents

Overview: This informative blog is a comprehensive guide on GSTR-1, a crucial GST return filed under the GST Act of 2017. The topics covered include eligibility, exemptions, monthly and quarterly filing options, and the importance of accurate and timely filing. Our purpose in this blog is to inform you about what GSTR 1 is, the documents required for GSTR 1, the due date and the potential penalties of delayed filing of GSTR 1 Form in India.

Goods and Services Tax (GST) was introduced in India in 2017 as a comprehensive indirect tax to replace various other indirect taxes and streamline the overall tax regime. Besides the payment of taxes, businesses are also required to file various tax returns to comply with the provisions of the GST Act. Filing GST returns accurately and timely is crucial for businesses to claim their input tax credit as well. So, in this blog, we will guide you through essential aspects of GSTR-1, including GSTR-1 Turnover limit, Applicability, Documents Issued and the process of filing GST returns in India, and take an in-depth look at GSTR-1, one of the most important returns under the GST tax regime.

GST Returns Filing under the GST Act

The GST Act has provided for two different schemes under which a GST-registered business can pay GST. These are the Regular GST Scheme and the GST Composition Scheme. Under the GST Regular Scheme, GST is liable to be paid by individuals and businesses if their annual turnover exceeds the threshold limit of Rs . 20 lakhs (Rs . 10 lakhs for special category states). However, there are certain exemptions and exceptions to this rule. The following categories of businesses are exempt from GST payment under the GST Regular Scheme:

- Businesses whose annual turnover does not exceed the threshold limit of Rs 20 lakhs (Rs . 10 lakhs for special category states).

- Businesses engaged in the supply of exempted goods and services, such as education, healthcare, and religious services.

- Businesses that fall under the reverse charge mechanism, where the recipient of the goods or services is liable to pay GST instead of the supplier.

In addition to these exemptions, businesses enrolled under the GST composition scheme cannot pay GST under the Regular Scheme. The GST Composition Scheme provides the benefits of extremely low GST rates to small businesses with low turnover. Under this scheme, businesses with an annual turnover equal to or less than Rs . 1.5 crores can pay taxes at rates ranging from 1% to 6%, with relatively simpler compliance procedures.

However, a major drawback of the scheme is that businesses will not be eligible to claim the input tax credits on their purchases, and will not be able to supply their goods and services beyond the territorial boundaries of their states. It is important to note here that businesses registered under the GST Act and liable to pay GST under any of the above schemes shall be required to file regular GST returns on such payment for such period as may be prescribed.

What is GSTR-1?

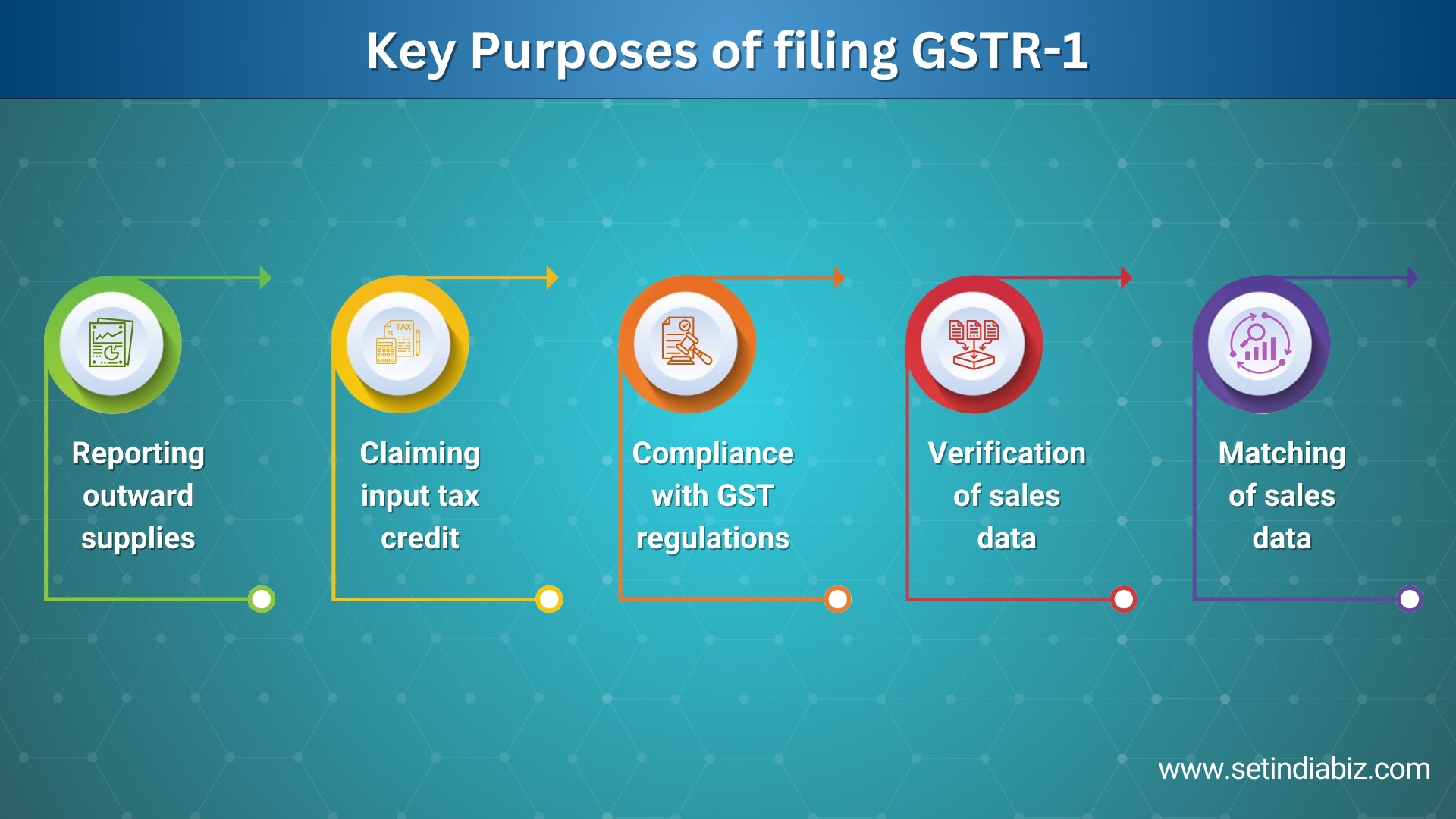

GSTR-1 is a monthly or quarterly return filed by registered taxpayers under the Goods and Services Tax (GST) system in India. It contains details of outward supplies, i.e., details of all the sales made by a registered taxpayer to other businesses or end consumers. Filing GST Returns in GSTR-1 is a mandatory compliance for businesses eligible under GST. The key purposes of filing GSTR-1 are as follows:

- Reporting outward supplies: GSTR-1 contains details of all the outward supplies made by a registered taxpayer in a particular tax period. This information helps the tax authorities to track and verify the sales made by the taxpayer and ensure that the correct amount of GST is being paid.

- Claiming input tax credit: The information provided in GSTR-1 is used by the recipient of goods or services to claim the input tax credit. The recipient can claim input tax credit only if the details of the supplies made by the supplier are properly reported in GSTR-1.

- Compliance with GST regulations: GSTR-1 is a mandatory return that must be filed by all registered taxpayers. Non-filing of GSTR-1 can result in penalties and legal issues. Therefore, filing GSTR-1 helps businesses to comply with GST regulations and avoid any issues.

- Verification of sales data: GSTR-1 data is used by the tax authorities to verify the sales data reported by a registered taxpayer. If there is any discrepancy between the sales data reported in GSTR-1 and the actual sales made by the taxpayer, the tax authorities may conduct an audit and take necessary actions.

- Matching of sales data: The sales data reported in GSTR-1 is matched with the sales data reported by the recipient in their GSTR-2A/2B returns. This helps in identifying any discrepancies or errors in the reporting of sales data and ensures that the correct amount of GST is being paid.

GSTR-1 Eligibility & Exemptions

GST Returns filed in GSTR-1 can be of two types, viz, monthly returns and quarterly returns under the QRMP (Quarterly Return Monthly Payment) Scheme. The eligibility for filing each of these types of returns is different in multiple aspects. Let’s discuss each of them one by one.

Monthly Returns in GSTR-1 Eligibility

All businesses are eligible to file monthly returns in Form GSTR-1. However, it is optional for businesses with an annual turnover up to Rs . 5 crores, while mandatory for businesses with an annual turnover exceeding Rs . 5 crores, in the previous financial year. GST returns in GSTR-1 have to be filed once every month or 12 times in a financial year to the concerned tax authorities. It must contain all the necessary details and documents required to calculate the net amount of tax payable. Such details would include the aggregate turnover, outward and inward supplies supported by invoices, revised invoices, debit notes, credit notes, and delivery challans. You can only file the monthly returns after you have obtained GST registration under the GST Act.

Quarterly Returns in GSTR-1 Eligibility

Filing GSTR-1 under the Quarterly Returns, Monthly payment, or QRMP scheme can be opted for by businesses whose annual turnovers in the previous financial years are less than or equal to Rs . 5 crores. Such businesses ought to be small, and the scheme rightly reduces their cost of filing GST returns. Businesses that have opted for the QRMP scheme must file GST returns four times or once in each quarter of a financial year.

Such returns shall be filed in GSTR 1 and contain all the necessary details and documents required to calculate the net amount of tax payable. These would include the aggregate turnover, outward and inward supplies supported by invoices, revised invoices, debit notes, credit notes, and delivery challans. You can only file the quarterly returns after you have obtained GST Registration under the GST Act. However, there are certain categories of taxpayers who are exempted from filing GSTR-1 in India. They are:

- Composition Scheme taxpayers: Businesses registered under the Composition Scheme are not required to file GSTR-1. They need to file GSTR-4 on a quarterly basis instead.

- Non-resident taxable persons: Non-resident taxable persons who do not have a permanent establishment in India are not required to file GSTR-1. They need to file GSTR-5 instead.

- Input service distributors: Input service distributors are not required to file GSTR-1 as they do not make any outward supplies. They are required to file GSTR-6 instead.

- Suppliers of online information and database access or retrieval services (OIDAR): Suppliers of OIDAR services who are located outside India and are registered under GST in India are not required to file GSTR-1. They need to file GSTR-5A instead.

- Taxpayers liable to deduct tax at source (TDS): Taxpayers who are required to deduct tax at source under GST are not required to file GSTR-1. They need to file GSTR-7 instead.

Details & Documents required for GSTR-1 Filing

Accurate and timely filing of GSTR-1 is crucial for compliance with the GST laws in India. However, such a filing cannot be possible without the availability of certain documents, which are crucial for calculating the tax liability of the taxpayer and ensuring the accuracy of the details provided to the tax authorities. A detailed list of such documents is mentioned in the table below.

| Documents for GSTR-1 | Key Purpose |

|---|---|

| Invoices | These are commercial documents issued by the supplier to the recipient for the supply of goods or services. They contain details such as the name and address of the supplier and recipient, the description and quantity of the goods or services supplied, and the tax charged. Invoices are required to report details of all outward supplies made during the tax period. |

| Debit Notes | These are issued when there is an increase in the value of the supply or tax charged. Debit notes are required to report such changes made to invoices already issued. |

| Credit Notes | These are issued when there is a decrease in the value of the supply or tax charged. Credit notes are required to report such changes made to invoices already issued. |

| Export invoices | These are issued for the supply of goods or services to recipients located outside India. Export invoices are required to report details of all exports made during the tax period. |

| Shipping bills | These are documents issued by the exporter to customs authorities at the port of export. They contain details of the goods to be exported. Shipping bills are required to report details of all exports made during the tax period. |

| Bill of entry | These are documents filed by the importer with customs authorities at the port of entry. They contain details of the goods to be imported. A Bill of entry is required to report details of all imports made during the tax period. |

What is the Due Date of GSTR-1 Filing?

If you ask about ‘What is the Due Date of GSTR-1’, the simple answer is that the GSTR-1 due date depends on the monthly or quarterly GST Returns filing. If it’s a monthly return, GSTR-1 for every month is filed on the 11th day of the next month. However, if GSTR-1 is filed quarterly, it shall be filed on the 13th day of the month following the end of the quarter. Not filing the GST Returns in GSTR-1 will have adverse consequences, which we have discussed in detail further. For timely assistance, consult our tax experts now!

Penalty For Late Filing of GSTR-1

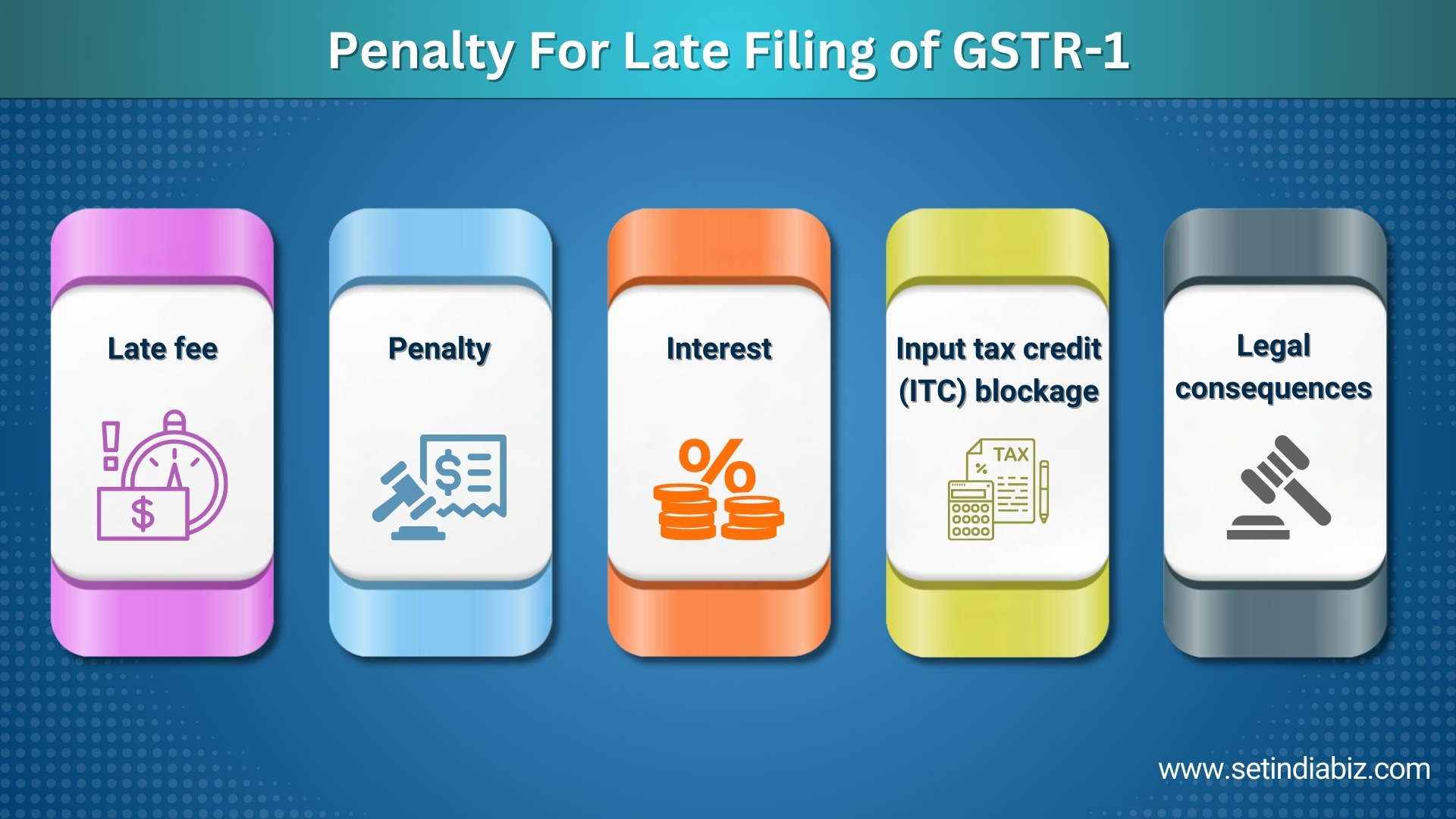

Timely and accurate filing of GSTR-1 is not only a legal requirement but also a key aspect of GST compliance, as non-filing or delay in filing can have various consequences for the registered taxpayer. In this context, taxpayers need to understand the consequences of non-filing or delay in filing of GSTR-1, and take necessary steps to ensure compliance with the GST laws. Non-filing of GSTR-1 or delay in filing can have various adverse consequences, which are explained in detail below.

- Late fee: Registered taxpayers who fail to file GSTR-1 within the due date will be liable to pay a late fee of Rs. 50 per day (Rs. 20 for taxpayers with nil liability) for each day of delay, subject to a maximum of Rs. 5,000 per return.

- Penalty: Non-filing of GSTR-1 can attract a penalty of Rs. 10,000 or 10% of the tax due, whichever is higher. This penalty may be imposed by the tax authorities after due notice and opportunity of being heard.

- Interest: If the tax liability for the tax period is not paid within the due date, interest at the rate of 18% per annum will be levied on the outstanding amount from the due date till the date of payment.

- Input tax credit (ITC) blockage: Non-filing of GSTR-1 or delay in filing can lead to blockage of ITC. Registered taxpayers are required to file GSTR-1 to claim ITC on the goods and services received from their suppliers. If GSTR-1 is not filed within the due date, the recipients may not be able to claim ITC on their purchases, leading to blockage of ITC.

- Legal consequences: Non-filing of GSTR-1 or delay in filing can also have legal consequences. The tax authorities may initiate proceedings against the defaulting taxpayers, which can include issuing show-cause notices, conducting audits, and even prosecuting in some cases.

Conclusion

In conclusion, GSTR-1 is a GST return filed by all businesses registered in India. It is an important return for businesses as it provides the government with information on the outward sales made by the businesses. It contains all details of outward supplies made during a particular tax period. Filing GSTR-1 accurately and timely is essential to ensure compliance with the GST laws and avoid unnecessary penalties and additional filing fees. We hope that this blog has provided you with useful information about the turnover limit, GSTR 1 applicability, documents issued, due date for filing GSTR-1, eligibility criteria, and consequences of not filing this return. If you have any questions or feedback, please feel free to comment below.