Documents Required For GST Registration of Company

Overview : This comprehensive blog discusses everything you need to know about GST registration documents and essential paperwork required by companies. Thorough knowledge of these documents helps companies navigate the GST registration process seamlessly, reducing the overall chances of departmental objections. For a clearer understanding of their significance, we have discussed their purposes and formats at great length. Additionally, we have also attempted to give you insights into the GST Registration process, eligibility, and benefits for a clearer understanding.

GST registration documents majorly encompass the identification documents of directors, the incorporation documents of the company, documents of the registered office address, and other essential paperwork like the Board Resolution approving the decision to take GST Registration at the company’s end. These documents play a pivotal role in establishing the legal identity, structure, and operational framework of the company within the GST framework. Additionally, they ensure compliance with tax regulations and facilitate seamless interaction with tax authorities. By meticulously gathering and submitting these documents, companies not only fulfill their legal obligations but also set a solid foundation for their operations in the GST regime. Let’s dig into further details.

What is GST Registration?

GST Registration is a legal process by which eligible businesses register under the GST Act, 2016. This registration is required to ensure GST payment and timely GST compliance by businesses involved in the sale of goods and services within India. The eligibility for GST registration is determined by the annual turnover registered during the previous financial year. We have discussed the turnover threshold limits further in the blog.

After acquiring GST Registration, businesses receive a unique GSTIN or GST identification number using which they can perform all compliance tasks at their helm. GSTIN is also used by GST authorities to monitor the compliance status of businesses and examine their eligibility for the same. Besides, GSTIN is used to avail benefits like Input Tax Credit and deductions permitted under the GST Act. Here’s a closer look at other benefits businesses receive after acquiring GSTIN.

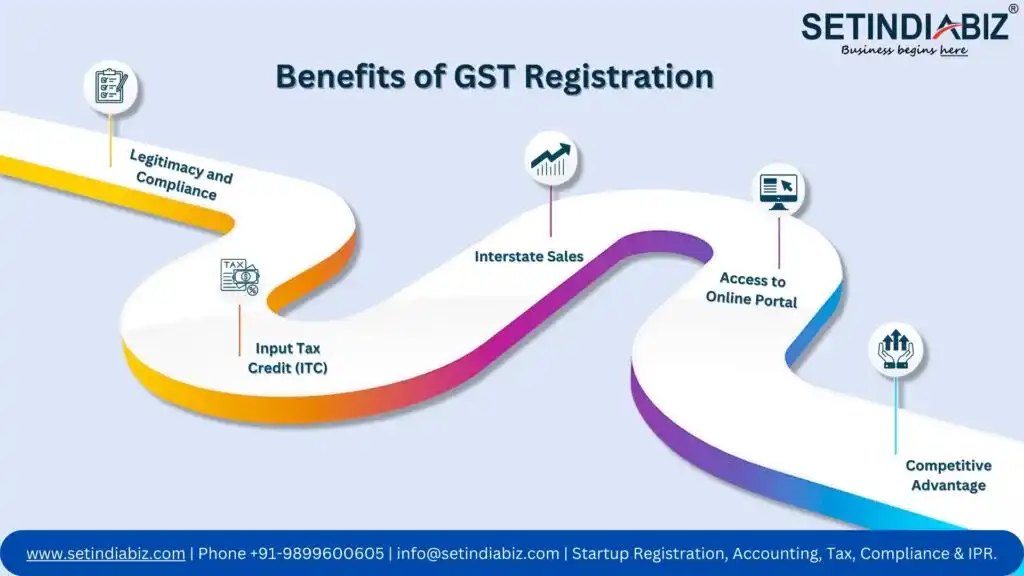

Benefits of GST Registration

- Legitimacy and Compliance: GST registration lends legitimacy to a business’s operations, ensuring compliance with tax laws and regulations. It establishes transparency and credibility in the eyes of customers, suppliers, and financial institutions.

- Input Tax Credit (ITC): Registered businesses can claim input tax credit on GST paid on their purchases of goods and services used for furtherance of business activities. This helps in reducing the overall tax liability and promotes cost efficiency.

- Interstate Sales: GST registration is necessary for businesses engaged in interstate sales or supply of goods and services. It facilitates seamless trade across state borders by eliminating the cascading effect of taxes and simplifying compliance procedures.

- Access to Online Portal: Registered businesses gain access to the GST online portal, enabling them to file tax returns, make payments, and manage compliance requirements electronically. This promotes ease of doing business and reduces paperwork.

- Competitive Advantage: GST registration enhances a business’s competitive edge by enabling it to participate in the formal economy. It opens up opportunities for collaboration, expansion, and access to government contracts and incentives.

Eligibility for Companies to Obtain GST Registration

Companies operating in India need to fulfill certain eligibility criteria to obtain GST registration. The eligibility criteria depend on various factors such as the turnover of the company, its nature of operations, and the type of goods or services supplied. Whether a company is carrying out its activities within a state, outside the state, in multiple states, or outside the country, these criteria apply uniformly across the spectrum. However, note that GST registration is location-specific. This indicates that companies carrying out their activities at multiple locations must obtain distinct GST Registrations for every functional place of business. Let’s dig deeper into eligibility requirements for GST Registration in the list below.

- Threshold Turnover: The most common eligibility criterion is the turnover threshold of the company. As per the GST Act, businesses with an aggregate turnover exceeding the Rs.40 lakhs limit must register for GST. This limit remains Rs.20 lakhs for service-based companies, and Rs.10 lakhs for companies located in North-Eastern and hilly states.

- Mandatory Requirements: An exception to the above criteria is a list of companies involved in specific business activities for which GST Registration is mandatory. This mandate extends regardless of their turnover limits. Simply put, certain companies must obtain GST registration whether or not their turnover limits exceed the prescribed threshold. A list of such businesses is given below.

- Companies involved in interstate commerce

- Export-Import companies

- Casual Taxable entities

- Companies on which Reverse Charge Mechanism applies

- E-commerce companies

- E-commerce aggregators

- NRI companies

- Companies providing OIDAR services

- Voluntary Registration: Voluntary registration under the Goods and Services Tax (GST) regime allows businesses to register for GST even if their turnover falls below the prescribed threshold limit. Opting for voluntary registration provides several advantages to businesses, including the ability to avail of input tax credit on their purchases, thereby reducing their overall tax liability. Moreover, voluntary registration enhances a company’s market presence by signaling its commitment to compliance and legitimacy in the eyes of customers, suppliers, and partners. It also enables businesses to participate in interstate trade seamlessly, without the hindrance of compliance barriers.

Identification Documents of Directors/Authorized Signatory

PAN card, Aadhar card, and address proof of directors or authorized signatories are the most basic documents required for GST Registration. The PAN card serves as a director’s evidence of income tax compliance. On the other hand, Aadhar cards provide for their primary proof of identity. Directors need to submit their personal address proof documents as well, which include recent utility bills in their names. This will be required to validate the residential addresses of these individuals by the government authorities. These documents collectively authenticate the identity and residential details of directors or authorized signatories, ensuring compliance and accuracy during the GST registration process.

Colored Photographs of Directors/Authorized Signatory

Recent colored photographs of directors or authorized signatories are essential for identification and authentication purposes during GST registration. They serve to visually confirm the identity of individuals involved in the registration process, enhancing security and accuracy. Their formats for GST registration should be in passport size with a clear image of the face, preferably taken against a plain white background.

Company’s PAN

A company’s PAN is also one of the mandatory documents required for GST registration, serving as its unique identification as a taxable entity. It helps in identifying the company’s tax compliance status and monitoring its financial status. The PAN card should be issued in the name of the company, displaying its legal name as registered with the Ministry of Corporate Affairs (MCA), and must be duly issued by the Income Tax Department.

Company’s Bank Details

Submission of the company’s bank details is necessary during GST registration for processing future refunds, facilitating electronic transactions, and linking bank accounts for tax-related purposes. These details typically include a bank statement or canceled cheque displaying the company’s name, address, and account number. Ensuring accurate bank details helps in smooth processing of transactions and compliance with banking regulations.

Certificate of Incorporation

The Certificate of Incorporation is a foundational document issued by the Ministry of Corporate Affairs (MCA) that confirms its formal incorporation under the Companies Act. This official certificate contains essential details such as the company’s name, registration number, date of incorporation, and registered office address. It serves as proof of the company’s legal existence and is necessary to validate the company’s legal status during the GST registration process.

Memorandum and Articles of Association of the Company

MOA and AOA are essential documents required for GST registration of companies. The MOA outlines the company’s objectives, its scope of operations, and the relationship of the company with its shareholders. On the other hand, the AOA contains rules and regulations governing the internal management and administration of a company. Both documents provide crucial insights into the company’s structure, powers, and governance framework, ensuring transparency and compliance with legal requirements. During the GST registration process, companies are required to submit copies of their MOA and AOA to establish their legal identity and operational framework. They must be drafted in the prescribed formats for GST registration, signed by all shareholders, and duly stamped to ensure validation.

Letter of Authorization for Authorized Signatory

This letter formally authorizes the designated director to represent the company for GST-related matters. It outlines the scope of authority granted to the authorized director and specifies his responsibilities regarding further GST compliances. The letter of authorization is issued by the company’s management or board of directors and is duly signed by its shareholders. It is drafted on the company’s letterhead and stamped with its seal. Their specified formats for GST Registration must be followed while drafting to ensure authenticity and legal adherence.

Copy of Board Resolution

A resolution passed by the company’s Board of Directors approves the decision to apply for GST registration and authorizes an official applicant for the purpose. The resolution should be duly signed and stamped by the directors, specifying the authorised signatory’s name. This document demonstrates the company’s commitment to compliance and formalizes its intent to register under the GST regime. Given below is a sample format to be followed while drafting it.

Board Resolution Formats or GST Registration

CERTIFIED TRUE COPY OF THE RESOLUTION PASSED AT THE MEETING OF THE BOARD OF DIRECTORS OF _____________________________________ PRIVATE LIMITED AT THE REGISTERED ADDRESS AT ____________________________, INDIA ON _______ OF ___________ 2017 AT 11 A.M. RESOLVED THAT the consent of the Board of Directors is accorded for registration under Goods and Services Tax at GST portal under the applicable provisions of the Central Goods and Services Tax Act, 2017; The Integrated Goods and Services Tax Act, 2017 And The Union Territory Goods and Services Tax Act, 2017. And the rules made thereunder. FURTHER RESOLVED THAT ___________________________, director of the company be and is hereby authorized to represent before the GST department and its competent authority and to sign and submit the application(s), authority letter, disclosures and other related documents required to be filed in connection with the above-mentioned GST registration on behalf of the company. He is further authorised to engage any lawyer or GST Practitioner for compliance with the terms decided by him.

Registered Office Address Proof

Registered Office address proof of the company provides the documentary evidence of its physical location. Documents such as rent agreements, property tax receipts, or utility bills (electricity, water, gas) in the name of the company confirm the address and duration of occupancy. These documents establish the legal status of the registered office and are essential for verifying the company’s place of business during GST registration.

NOC (No Objection Certificate) from the Premises Owner

An NOC from the premises owner confirms his consent for establishing the company’s registered office at the concerned location. It is a formal document issued by the premises owner, not object to the company’s use of the premises for business purposes. The NOC should be duly signed and stamped by the premises owner to avoid disputes between the lessor and the lessee at later stages.

Rent Agreement/Property Tax Receipt

Rent agreements or property tax receipts serve as evidence of the company’s occupancy at the registered office address. These documents validate the legal status of the premises and confirm the company’s right to operate from the registered office location. Official rent agreements or property tax receipts issued by the relevant authority should contain details such as the address, duration of occupancy, and signatures of parties involved. Besides, it must be drafted in the prescribed format and stamped by the concerned authority to ensure validity.

How to Obtain GST Registration?

Obtaining GST registration involves a systematic process mandated by the Goods and Services Tax (GST) Act. The registration process is primarily completed online on the GST portal maintained by the Goods and Services Tax Network (GSTN). To begin with, businesses need to visit the GST portal and navigate to the “Registration” section. Here, they fill out the GST registration application form (Form GST REG-01) with accurate details such as business name, address, PAN, directors’ details, bank account information, and other required information.

Subsequently, they upload necessary documents, including PAN card, Aadhar card, address proof, bank statements, certificates of incorporation, and other relevant documents as per the business structure. Following submission, a verification process is initiated by the GST authorities, involving scrutiny of the submitted documents and additional verification checks. Upon successful verification, the GST authorities issue a unique Goods and Services Tax Identification Number (GSTIN) to the applicant, which serves as a unique identifier for the registered business entity. The process, though convenient, can be intricate. So, our legal experts are here to help you navigate through the process easily.

Conclusion

Obtaining GST registration is not just a legal requirement but a crucial step for businesses to establish their legitimacy, comply with tax regulations, and unlock various benefits offered under the GST regime. By ensuring timely registration and submitting all the essential GST registration documents, businesses can streamline their operations, avail input tax credits, expand market presence, and participate in interstate trade seamlessly. At Setindiabiz, we recognize the importance of GST registration documents for businesses and are committed to providing expert assistance throughout the registration process.

FAQ’s

What is a Small Company under the Companies Act 2013?

What distinguishes a Private Company from a Public Company?

Can I voluntarily register for GST even if my turnover is below the threshold limit?

What are the documents required for GST registration?

The documents required for GST registration include:

Documents of Directors

- PAN Card

- Aadhar Card

- Coloured Photograph

- Address Proof

Documents of the Company

- MOA & AOA

- Business PAN

- Business Bank Account Details

- Certificate of Incorporation

- Letter of Authorisation of Authorised Signatory

- Copy of Board Resolution

Documents of Registered Office

- Registered Address Proof

- NOC from the Premises Owner

- Rent Agreement/Property Tax Receipt