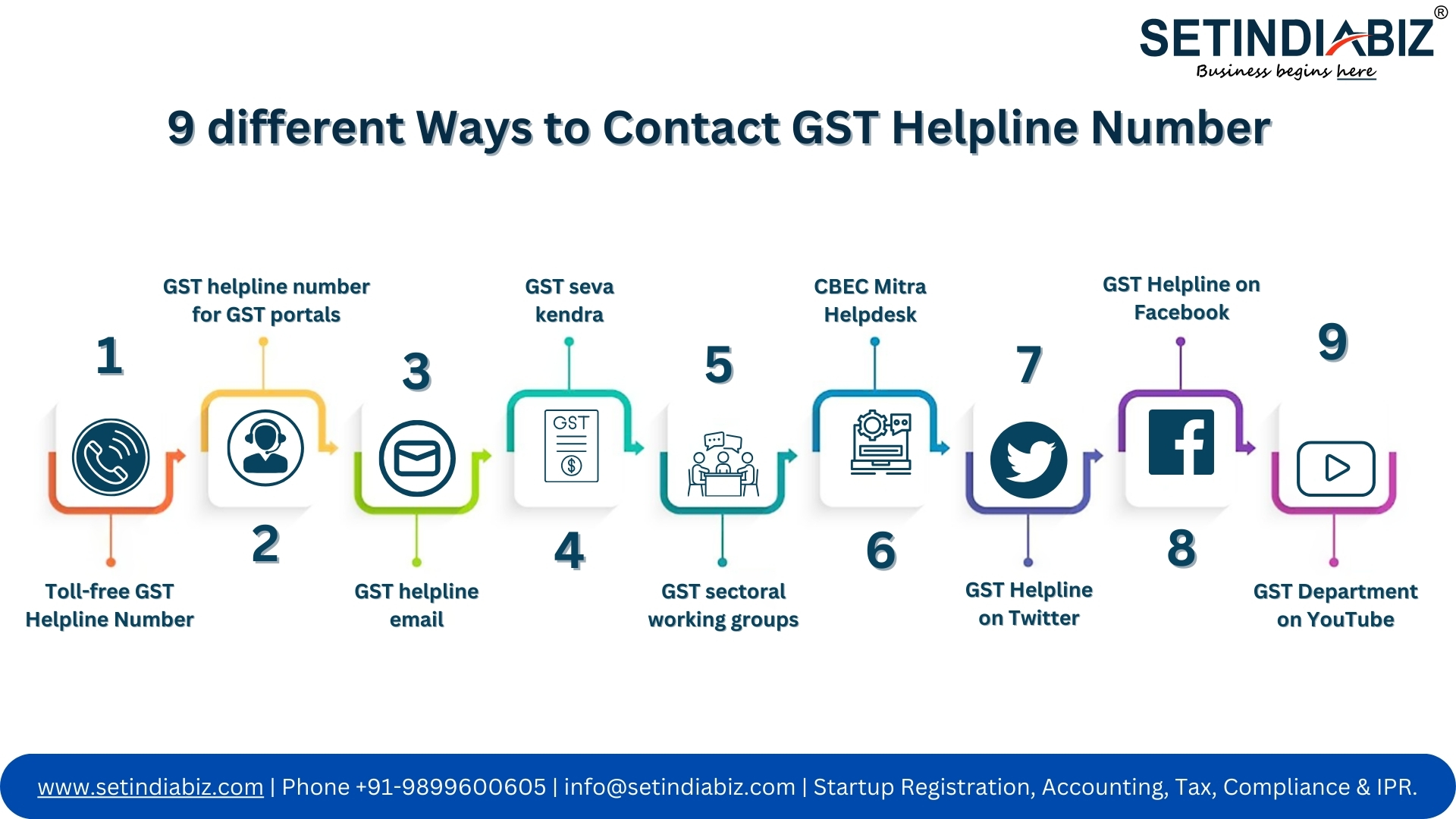

Read 9 different Ways to Contact GST Helpline Number

Overview: Struggling to comprehend GST Regulations? This blog explains how to utilise various GST helpline numbers to effectively deal with major GST-related grievances. Whether you’re a business owner grappling with GST laws or an individual seeking clarity on GST procedures, this blog equips you with the necessary resources and support to streamline your tax-related queries and ensure smoother operations. The ultimate goal is to make your GST compliance journey hassle-free.

GST, or goods and services tax, is levied on the sale of products and services in India. It was introduced in 2016 to implement the idea of “One Nation One Tax”. The tax replaces several other indirect taxes under the Central and State Governments, like VAT, Sales Tax, Services Tax, etc, thereby making things more simplistic and convenient for business entities. After the introduction of GST, businesses involved in the sale of goods and services are liable to pay a single tax, i.e. the Goods and Services tax only. This has not only reduced the burden of tax payment, but also the burden of compliance like filing tax returns for businesses in India.

However, the streamlining of taxes under GST has not resolved all the problems for entrepreneurs in India, as their lack of knowledge and inexperience about the legalities involved has given rise to new grievances that need to be addressed. Considering the urgency and seriousness of the problem, the Indian Government has introduced several GST helpline numbers to guide entrepreneurs at every single step of GST payment and filing of GST returns in India. This article informs readers about all such GST helplines and their respective utilities in the most comprehensive manner.

Types of GST Helpline Numbers

Utilising the GST Helpline number is paramount for businesses and individuals navigating the complexities of GST in India. These helplines offer invaluable assistance, from clarifying tax procedures to resolving grievances swiftly. To leverage these resources effectively, simply dial the toll-free number provided by the Indian Government or visit the official GST portal. Additionally, reaching out via email or interacting with experts at GST Seva Kendras ensures personalised guidance. Embracing these helpline channels empowers taxpayers to navigate GST intricacies with confidence, ensuring compliance and smooth operations.

GST Helpline Toll-Free Number

The Indian Government and the GST council have provided a toll-free number for the taxpayers to share their queries and grievances related to GST payment, GST returns, late filing fees, penalties, etc. The toll-free number is 1800-1200-232. Besides queries and grievances, taxpayers can also register their complaints regarding GST payment, settlement, and compliance on this number. The toll-free number is valid across all Indian states and is available in 6 different vernacular languages. Also, the number is active 24×7 with experts available for guidance whenever their advice and assistance are sought. The option to give suggestions and feedback is also there to improve the quality of information.

GST Helpline Number for GST Portals

There is another option for taxpayers to register their complaints and questions related to GST by visiting the official website and logging into the GST portal or by simply clicking here. By dialling this helpline number, you can seek information about GST registration in India.

GST Helpline Email

Apart from these helpline numbers, there is also an option to send emails to the helpline in order to register your queries and complaints related to the GST. The official email address for the purpose is cbecmitra.helpdesk@icegate.gov.in. There is an entire support team at the other end to help taxpayers with all their grievances regarding GST payments, returns, and registrations. Drop a message on this registered email address and within 24 hours, you shall be responded to by an executive expert who shall address and resolve your query.

GST Seva Kendra

To seek guidance and assistance regarding GST, taxpayers can also visit dedicated seva kendras and interact with executive experts directly. An in-person interaction is undoubtedly a more effective means of communication for aggrieved taxpayers in India. The Indian Government has set up many seva kendras across India for the convenience of taxpayers. These centres house entire support teams who assist and educate taxpayers about every little detail regarding GST in India. These executive experts are well-informed and experienced about all legalities and technicalities regarding GST in India.

GST Sectoral Working Groups

The GST Council of India has set up several sectoral working groups to ensure the smooth implementation of the GST Act in India. These working groups are also responsible for resolving queries and grievances of taxpayers regarding GST. Such groups are composed of an experienced team of senior government officials who have served either under the Central or the State Governments. The list of all such authorised officials is provided to the local public, along with all their professional details and information. Taxpayers who have queries, grievances and other related issues can directly contact these officials and get their problems solved.

CBEC Mitra Helpdesk

The CBEC Mitra Helpdesk is designed to resolve all the compliance-related issues with the CBEC/ACES application. In the case of any issues or problems, a user can reach out to the CBEC helpdesk by using their contact details and getting their queries solved. Right from taxpayers to tax officials, all can connect on the details mentioned below about GST-related issues.

- GST Contact Email ID: info@gstn.org.in

- GSTN Help Desk Call Number (For taxpayers): 0124-4688999

- GSTN Help Desk Email ID: helpdesk@gst.gov.in

- Helpline Number for Tax Officials: 0124-4479900

- GST Help Desk Number: 011-49111200

GST Helpline on Twitter

The GST Council has introduced its presence on several social media sites, including Twitter, in order to serve the needs of the taxpaying entities. The aggrieved taxpayers can visit the official handle of the GST Helpline on Twitter and post or tweet their queries, grievances, complaints, and other GST-related concerns immediately, after which authorised experts shall respond to the tweet with the purpose of resolving the issues of the aggrieved party. This method of grievance redressal is extremely simple, easy, quick, and effective for the aggrieved parties and the GST executives alike.

GST Helpline on Facebook

The GST helpline is also available on Facebook, where taxpayers can get all the information related to GST. All they’re required to do is visit the official page of GST Helpline on Facebook and directly message all their queries, grievances, complaints, and other GST-related concerns. Even this method of grievance redressal is extremely simple, easy, quick, and effective for the aggrieved parties and the GST executives alike.

GST Department on YouTube

There is also an official YouTube channel where you can find lots of informative tutorials and video content on GST. This is convenient for people as they can simply watch videos on their smartphones and get their issues and dilemmas resolved. Informative content can also be viewed on the GST Helpline Application, which people can easily install and operate on their smartphones and other smart devices.

Conclusion

All of these helplines are especially created to solve all types of queries and concerns of GST taxpayers in India. Besides, at SetIndiaBiz, we specialise in offering valuable support for GST registration and further assistance on GST returns. We have a team of experienced professionals who provide guidance and assistance on concerns related to GST in the most efficient and professional manner possible. Our services can be availed of from anywhere in India through our regional branches in New Delhi, Noida, Mumbai, Bengaluru, Pune, and Kolkata. We ensure that our services are of high quality and are available to you at the most affordable prices. To avail our services related to GST, you may visit our website, contact us, or drop your query here for GST registration and here for the filing of GST returns.