What is the Cost of Company Registration in India?

Understanding the overall cost of Company Registration is quite essential for starting a Company in India. We are here to discover the various elements which add up to this cost including Government fees, professional charges and fees for essential prerequisites like DIN & DSC. At the end we will also suggest a few tips to reduce this cost drastically!

Startups established as companies in India are required to get a mandatory registration under the Companies Act. However, most startup-owners lack the legal know-how of the company registration procedure and cost, thus being compelled to seek professional consultation for the same. The added charges of consultation, along with the government fees for company registration, results in a huge amount being paid by startup companies to get incorporated as a legal entity.

In order to reduce the burden of expenses for Startups, the Indian Ministry of Corporate Affairs has introduced the provision of Zero Filing Fee for Company Incorporation, provided the company has an authorised capital not exceeding Rs.15 lakhs. This has resulted in a drastic reduction of the overall company registration cost for Startups, helping them save, invest and grow freely during the initial stages.

What are the Factors Influencing Company Registration Cost in India?

- Type of Company: The type of company you choose to register plays a significant role in determining its registration fees. Each type of company, such as a private limited company, public limited company, or one-person company, has specific requirements and compliance obligations for incorporation. For instance, a private limited company may have a higher registration fees compared to a one-person company due to additional statutory requirements, such as, appointment of additional directors, admitting additional shareholders, drafting additional documents, and so on.

- Stage of Company Incorporation: The stage of incorporation at which your company is can also impact the overall cost of registration. Pre-registration costs include name reservation, drafting the Memorandum of Association and Articles of Association, and acquiring other necessary documents like DIN and DSC of promoters. Once this stage is surpassed, we have costs of filing the application and submitting the documents to the ROC. Even after registration, post-registration costs like obtaining, PAN, TAN, and various other tax and labour law registrations are incurred.

- State of Incorporation: The state in which you choose to incorporate your company can affect the registration fees and overall cost as well. Different states in India have different fee structures, stamp duty charges, and compliance costs applicable . So, it is important to consider the state-specific requirements while estimating the overall cost of company registration for your startup.

- Requirement for Professional Services: Engaging legal and professional services is crucial for a smooth company registration process. The professional fees charged by lawyers, chartered accountants, or company secretaries for incorporating your company can vary based on their expertise and experience, as well as the complexity of the process. It is advisable to research and compare the fees charged by different professionals to ensure you are offered quality services at a reasonable cost.

- Additional Requirements: Besides the primary costs involved like the registration fee and professional charges, there may be additional expenses like fees for DIN, name reservation, digital signature certificates, notary stamp, stamp duty, and other incidental charges. For instance, obtaining digital signature certificates (DSC) of promoters are required for authenticating the Company Registration form. Similarly, all directors of the company are required to pay the fees to obtain their DIN before company incorporation.

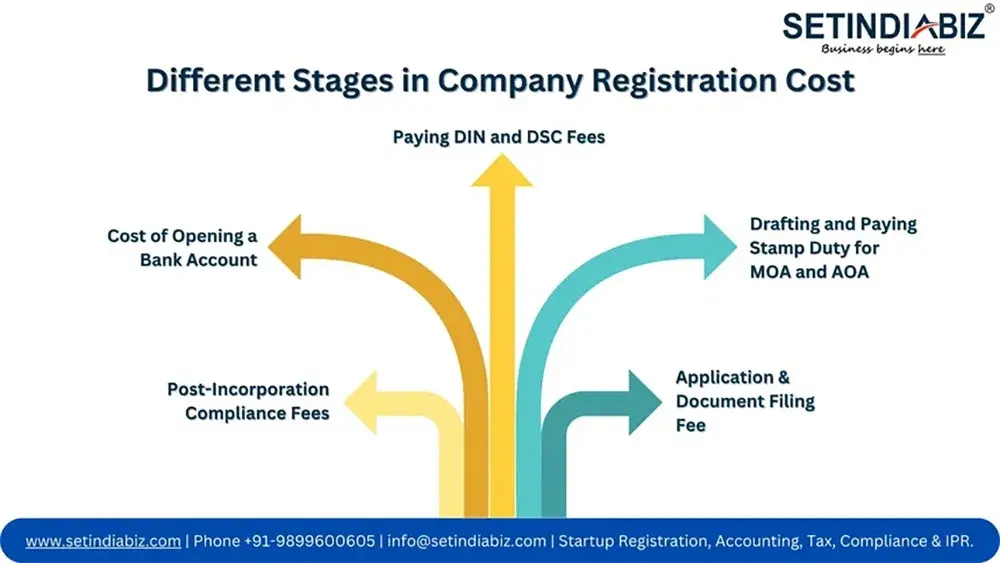

What are the Different Stages in Company Registration Cost?

Registering a company involves several stages, each with its own set of requirements and associated costs. Let’s walk through the different stages of company incorporation and highlight the points where costs are typically incurred:

- Paying DIN and DSC Fees: The first step is to obtain a Director Identification Number (DIN) for all the proposed directors of the company. This is done by filing an application with the Ministry of Corporate Affairs (MCA). Additionally, a Digital Signature Certificate (DSC) is required for online filing of documents. If you’re at this stage, you need to spend the prescribed amounts fees in acquiring DIN and DSC from the respective authorities.

- Drafting and Paying Stamp Duty for MOA and AOA: The next stage involves drafting the Memorandum of Association (MOA) and Articles of Association (AOA), which are essential documents defining the company’s objectives, rules, and regulations. Once drafted, the documents have to be stamped by a public notary for which stamp duty charges and notary fees applicable in the state will have to be paid. .

- Application & Document Filing Fee: After the MOA and AOA are prepared, the next step is to file an application for company incorporation with the Registrar of Companies (RoC). Along with the application, certain documents need to be attached in their digital formats. At this stage, the application fees for Company Registration will have to be paid, which will be based on Authorised capital of the company.

- Post-Incorporation Compliance Fees: After the company is registered, certain post-incorporation compliance requirements need to be fulfilled. This includes obtaining a Permanent Account Number (PAN), Tax Deduction and Collection Account Number (TAN), and Goods and Services Tax (GST) registration, if applicable. If you use the integrated SPICe Plus Form for incorporation, you can fulfil most of these compliances free of cost (only company registration cost will be applicable).

- Cost of Opening a Bank Account: Finally, the company needs to open a bank account in its name. While this stage does not incur any government cost, it is worth noting that there may be charges associated with opening and maintaining the bank account, such as minimum balance requirements or transaction fees.

What is the Overall Cost of Company Registration in India?

Understanding the overall cost of company registration is crucial for entrepreneurs planning to register their companies. We will explore the basic components associated with the overall cost, viz the fees for obtaining Director Identification Numbers (DIN), Digital Signature Certificates (DSC), company name approval, stamp duty charges on essential documents like MOA and AOA, ROC fees for Registration and finally, the cost of post-registration compliance. By gaining insight into these specific cost components, entrepreneurs can better prepare their budgets and make informed decisions throughout the registration process.

Overall Cost & Government Fees for Getting DSC:

The first cost component is the Digital Signature of the Promoters. The application for incorporation of the company is filed online on the MCA portal, which is signed electronically by the DSC of the promoters. Hence the promoters must have valid digital signatures with them. The cost of making a digital signature for the proposed shareholder and director varies from vendor to vendor. Each vendor charges a different fees for different classes of Digital Signatures, ranging somewhere between Rs.1500 to Rs.2000. At Setindiabiz, we have preferred rates for our customers.

Overall Cost & Government Fees for Director Identification Number (DIN):

Obtaining a Director Identification Number (DIN) is a crucial step in the company registration process. The cost for obtaining a DIN typically involves a fixed fee of Rs. 500 per application. This fee remains constant regardless of the authorised capital or other factors. It is essential to ensure that all proposed directors obtain their DINs before proceeding with the registration process.

Company Name Approval and Reservation Fees by ROC:

Another cost component in the company registration process is the approval of the company name through SPICe Plus. To ensure uniqueness and compliance with naming guidelines, an application for name approval needs to be filed with the Registrar of Companies (RoC). The cost for company name approval involves a fixed fee of Rs. 1,000. It is advisable to choose a unique and appropriate name that aligns with the regulatory requirements to avoid any additional costs due to name rejection or resubmission.

Company Registration Application Fees based on Authorised Capital:

Application Fees for filing the Company Registration Form and Documents is the main cost component for Company Registration. Companies with capital of up to Rs.15 lakhs, have a 100% exemption on the application fees. However, companies having authorised capital greater than Rs.15 lakhs, have to pay a fixed fee of Rs.500 for Registration. We advise you to use the ROC fee calculator available on the MCA Portal for calculating the exact government fees for Company Registration.

State-Specific Stamp Duty on Company Incorporation Documents and Forms:

The State Governments where the companies are incorporated levy state-specific stamp duty on certain documents that are created at the time of incorporation. The state governments impose stamp duty on the following three documents.

- MOA

- AOA

- Spice Form

Every state government has passed their own stamp act imposing different rates of stamp duty, which may be a flat rate or may be based on the authorised capital of the company. Hence while incorporating a company, you must check the stamp duty on MOA, AOA, and Spice Form.

Professional Fees of Company Registration Consultant:

Having understood three cost components such as the cost associated with the DSC, the fee of company incorporation levied by the ROC and the respective stamp duty by the state government where the company shall have their registered office, lets us understand the fee that a consultant charges to help you incorporate a company.

The fee charged by the consultant will vary on a case to case basis. In contrast, traditional professional firms charge a hefty amount to assist in the incorporation of companies in India. Online service providers like Setindiabiz have revolutionised the way companies are incorporated and offer their services at a very reasonable fee.

Post Registration Compliance Costs:

After the company is registered, certain post-registration compliance requirements need to be fulfilled. The cost of these compliance may vary depending on the state where the company is registered. Each state has its own set of compliance requirements and associated fees. It is crucial to review the specific compliance requirements of the state and allocate budget accordingly. The compliance costs may include Goods and Services Tax (GST) registration fees, professional tax registration fees, Shops Act Registration fees, and fees for other state-specific registrations or licenses.

Company Registration fees in India

| S.No. | Cost Component | Government Fees |

|---|---|---|

| 1. | Director Identification Number (DIN) | Rs. 500 per director |

| 2. | Digital Signature Certificate (DSC) | Rs. 1,500 – Rs. 2,000 per DSC |

| 3. | Company Name Approval | Rs. 1,000 fixed fee |

| 4. | Stamp Duty on Memorandum of Association (MOA) | State-specific rates |

| 5. | Stamp Duty on Articles of Association (AOA) | State-specific rates |

| 6. | Stamp Duty on Spice Form | State-specific rates |

| 7. | Registrar of Companies (ROC) Fee | Rs. 500 (Authorised capital > Rs. 15 lakhs) |

| 8. | Post Registration Compliance | State-specific fees |

Note : The exact cost of stamp duty is state-specific and depends on the authorized capital, while the cost of post-registration compliance may vary based on the requirements of each state. It is recommended to check the respective state’s stamp duty rates and compliance fees for accurate cost information.

Company Registration Cost

- Director DIN

- Company Name Approval

- Filing Incorporation Forms

- Company PAN & TAN

- Digital Signature

- Drafting MoA & AoA

- Certificate of Incorporation

- 100% Online Process

Tips & Strategies to Reduce the Overall Cost of Company Registration in India

Registering a company involves a lot of cost components which increases the overall cost to a great extent. However, there are several ways to optimise and minimise these costs. Consider the following tips and strategies to reduce your company registration cost in India:

- Research and Compare Professional Fees: Take the time to research and compare the fees charged by different professionals, such as lawyers, chartered accountants, or company secretaries. Look for experienced professionals who offer competitive rates without compromising on quality. Request fee quotes and evaluate the services offered before finalizing your choice.

- Optimize Authorized Capital and Number of Directors: Carefully consider the authorized capital and the number of directors for your company. Higher authorized capital and a larger number of directors may increase registration costs. Analyze your business needs and rightsizing these aspects can help reduce expenses without affecting your operations.

- Leverage Technology for Cost-effective Solutions: Utilize technology to streamline the registration process and reduce costs. Online registration platforms and tools can simplify document preparation, filing, and compliance, reducing the need for extensive professional assistance. Explore government portals and online services for cost-effective solutions.

- Utilize Government Schemes and Incentives: Stay updated with government schemes and incentives that may provide financial support or waivers for company registration. Governments at various levels often introduce initiatives to encourage entrepreneurship. Explore these opportunities and take advantage of any applicable schemes to reduce costs.

- Seek Guidance from Professionals: Engage professionals who specialize in company registration to ensure a smooth process while minimizing expenses. They can guide you through the necessary steps, assist with document preparation, and ensure compliance with the legal requirements. Their expertise can help you navigate complexities efficiently and reduce the risk of costly errors or delays.

Conclusion

Navigating the cost of company registration in India requires careful consideration and strategic decision-making. By understanding the factors influencing registration costs and implementing cost-saving strategies, entrepreneurs can optimize their expenses while ensuring compliance. Thorough research, seeking professional guidance, and staying updated with regulations are essential. With informed decisions and effective cost management, entrepreneurs can embark on their business journey with financial prudence and confidence.

FAQ's

1.What are the typical professional fees for company registration in India?

2.What is the cost of obtaining a Digital Signature Certificate (DSC) for company registration?

3.How much does it cost to reserve a company name during the registration process?

4.What are the stamp duty charges for the MOA and AOA?

5.How much is the Registrar of Companies (RoC) fee for company registration?

6. Are there any post-registration compliance costs after company incorporation?

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.