Overview : Capital plays a vital role in incorporation of a company as well as ensuring its smooth operations. Authorised capital and Paid up capital are two significant forms of capital in a company. This blog covers the key difference between authorised capital and paid up capital that will help you know about authorised capital vs paid up capital: meaning, purpose and role in the net worth of a company precisely.

Authorised Capital is the maximum capital a Company can receive as decided by its shareholders. On the other hand, paid up capital is the actual capital a company receives in exchange for the shares it has sold. Both these capitals have their unique purpose in a company’s business operations.

Moreover, irrespective of size, type, and nature of business activity, every company must have the limits of authorised and paid up capital fixed before their incorporation. Let’s understand the meaning, purpose and key difference between authorised capital and paid up capital now.

What is Authorised Capital?

Authorised capital, sometimes referred to as registered capital or nominal capital, is the maximum amount of capital a company can obtain to ensure its smooth operations. This sum is determined during the incorporation process of the company by its shareholders, and is mentioned in the Memorandum of Association.

Since it is the maximum capital limit, a company cannot exceed this limit while issuing or selling. In other words, a company is not allowed to issue/sell shares worth more than this amount. However, the authorised capital can be raised in the future by passing a resolution to that effect in the general meeting of shareholders.

Let’s dive into the importance of authorised capital with the help of an example. Assume, a company has an authorised capital worth Rs.20 lakhs. In that case, it is permitted to issue and sell shares up to Rs.20 lakhs only. If it wishes to sell shares worth more than this amount, it will first have to raise the authorised capital through a resolution at the general meeting. Besides limiting the shares sold by a company, authorised capital also determines the ROC fees for company registration and other compliances fees for companies.

What is Paid Up Capital?

Paid Up Capital, also known as net worth, is the actual amount a company receives from its shareholders in exchange of shares they’ve bought. Paid Up capital may be equal to or less that the subscribed capital which is the worth of shares a company has sold.

The paid up capital can be less than the subscribed capital if the shareholders fail to deposit the entire amount of their respective share capital to the company at once. This leaves them in dues towards the company which have to be paid later. Note that this due amount determines the individual liabilities of each shareholder in a company.

Additionally, the paid up capital cannot exceed a company’s subscribed and authorised capital under any circumstance.

Let’s understand the importance of paid up capital more better with a quick example. Suppose, a company has an authorised capital of Rs.20 lakhs. From the above explanation on authorised capital, it is already understood that the company will not be able to sell shares worth more than this amount. Now, suppose the company is able to sell Rs.10 lakhs worth of shares. This becomes its subscribed capital. Paid up capital is that part of subscribed capital which is paid in real time.

So, suppose the shareholders are collectively able to pay Rs.5 lakhs to the company, keeping the other 5 lakhs due for later. So, Rs.5 lakhs paid to the company becomes its paid up capital, and the due amount which is also Rs.5 lakhs becomes the collective liability all shareholders have towards the company. Besides, determining the liability of shareholders, paid up capital is also used to conduct the day-to-day activities of the company.

Note : There is no minimum and maximum limits of authorised and paid up capital prescribed to start a company in India. The authorised capital is decided at the will of the shareholders. As far as paid up capital is concerned, it depends on the amount deposited by the shareholders. If they fail to deposit any amount, the company will get incorporated with Nil. paid up capital.

While starting a company at Nil. Paid Up capital is not forbidden, a company cannot remain without paid up capital beyond 60 days from the date of its incorporation. In fact, if a company operates with Nil. paid up capital for a year after incorporation, the ROC may strike it off and close the company altogether.

Top 5 Key Differences Between Authorised Capital and Paid Up Capital

Now, let’s dive into what is authorised capital and paid up capital! The authorised capital and paid up capital of a company have distinct purposes. While authorised capital is considered as the target capital or fund that the company wants to raise for its business, it is the paid up capital that is actually used for conducting the day-to-day business activities.

The table provided below highlights the key differences between authorised capital and paid up capital based on multiple parameters including meaning, purpose, and also its role in the net worth. It will provide a clearer picture and understanding of paid up capital vs authorised capital in a company.

| Parameters | Authorized Capital | Paid-up Capital |

|---|---|---|

| Definition | Authorised Capital is the maximum worth of shares a company can issue. | Paid-up Capital is the actual worth of shares a company receives. |

| Documentation | Authorised capital is mentioned in the Memorandum of Association of a company | Paid Up capital is mentioned in the Balance Sheet of the Company |

| Role in the Net Worth | The net worth of a company is not determined by its authorised capital. | The paid up capital is the net worth of the company. |

| Minimum value for Setting Up a Company | No minimum value prescribed under law. Authorised capital is decided at the will of shareholders. | No minimum value prescribed under law. Companies can be set up at Nil. paid up capital as well. |

| Restriction in selling shares | A company is not permitted to issue shares worth more than its authorised capital. | The paid-up capital places no limits on the sale of shares by the company. |

What is the Minimum Capital Required to Register a Company?

The Ministry of Corporate Affairs (MCA) has exempted private limited companies through the Companies (Amendment) Act, 2015 by removing the minimum requirement for authorized and paid up capital. The funding of the company, as of now, should be sufficient to support its business operations, especially, in the initial stages of its operations.

It should also be noted that a company can only obtain finance for its operations through the equity investment received from its shareholders. The basis of determining a company’s capital rests on its business activities and scale of operations. It is advisable to create a small budget for prospective business activities aside, and then determine the appropriate capital requirements for your company.

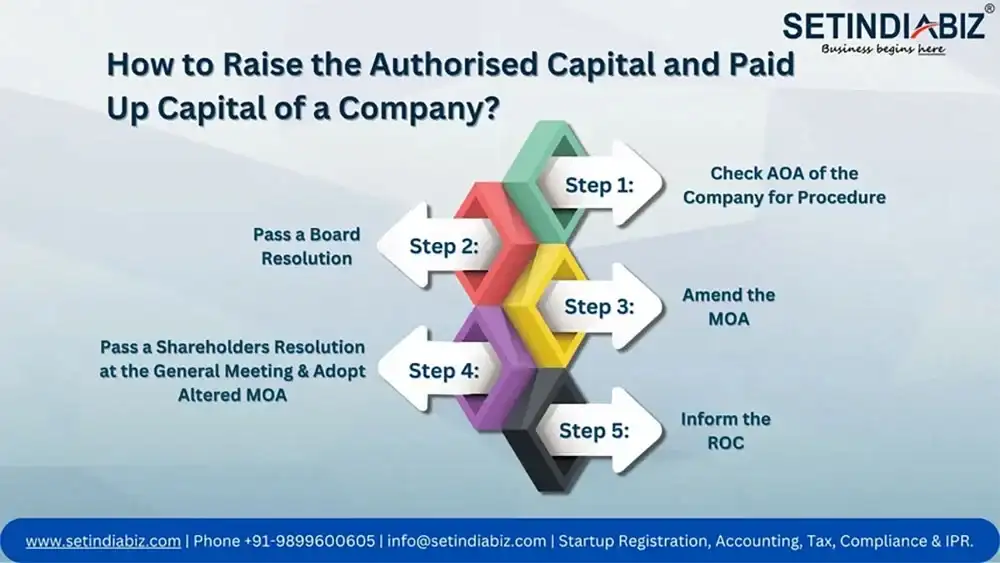

How to Raise the Authorised Capital and Paid Up Capital of a Company?

The authorized capital and paid up capital of a company can be raised with the purpose to expand or upscale its investment limits. The raised capital will allow the company to issue more shares to new and existing shareholders. Raising authorised capital would mean that the company is permitted to issue and sell more shares, on the other hand, raising paid up capital would indicate that the company has already sold more shares than its current worth.

However, raising both these capital limits requires the approval of the shareholders and also an intimation to the Registrar of Companies (RoC) in the prescribed forms. Here’s a detailed process of doing so.

Step 1: Check AOA of the Company for Procedure

The procedure for raising Authorized capital and Paid Up capital must be mentioned in the AOA (Articles of Association) of the company. If not mentioned, the AOA must be amended in order to make the inclusion of the procedure.

Step 2: Pass a Board Resolution

After making sure that the AOA consists of the procedure for raising the company’s capital limits, a Board of Directors’ meeting must be held. In this meeting, the directors would pass two resolutions. The first resolution consists of approving the decision to raise the capital of the company. The second one would be for approving the date, time, and venue for holding the Shareholders general meeting.

Step 3: Amend the MOA

Before the Shareholders meeting, the company’s MOA (Memorandum of Association) needs to be amended to mention the new capital limits.

Step 4: Pass a Shareholders Resolution at the General Meeting & Adopt Altered MOA

The final step is to organise the EGM (Extraordinary General Meeting) of shareholders. In this meeting the shareholders will approve the new capital limits through an ordinary resolution and adopt the amended MOA. After the shareholders approve the new capital limits, the change of authorized capital and paid up capital will be confirmed.

Step 5: Inform the ROC

The new capital limits and amended MOA have to be intimated to the ROC (Registrar of Companies). For intimating change of paid up capital, form PAS-3 is submitted. For intimating change of authorised capital, form SH-7 is filed. The documents submitted with these applications mainly include the notice of EGM, shareholders resolution in MGT-14, new shareholders’ list, amended MOA, and valuation report of the newly allotted shares.

Conclusion

Understanding the differences between paid up capital and authorised capital plays a crucial role in determining the company’s financial status, investor perception, and regulatory obligations. Hopefully, the blog would have provided better insights into the difference between authorized capital and paid up capital, helping both investors and entrepreneurs make informed decisions, aligning with their strategic objectives. Eventually, it can ensure a solid foundation for sustainable business growth.