All About DPT 3 Filing in India: Purpose, Process & Documents

Overview : Discover everything you need to know about DPT 3 filing in India. From its origin to legal provisions, eligibility criteria and filing process, this guide covers it all. Learn about DPT 3 applicability, due date, and late fees to ensure timely compliance. The exact DPT 3 due due late fees has been mentioned in the blog. With a focus on transparency, regulatory compliance, and protecting the interests of depositors, this blog serves as an indispensable resource for corporate entities and stakeholders navigating the complexities of DPT 3 compliance in India.

When it comes to corporate governance, meeting compliance requirements play a vital role in fostering transparency and upholding the trust of stakeholders. Among these critical requirements, is the filing of Form DPT 3 which caters to the depositors of a company. DPT 3 is an annual return of deposits filed to the Registrar of Companies to intimate the authority of all the deposit and non-deposit receipts a company has accumulated in a financial year. In this blog, we will discuss the filing of these returns in detail, with special emphasis on the purpose, due date, eligibility, process, and fee for submitting DPT 3 form.

The significance of DPT 3 filing cannot be overstated. It goes beyond mere paperwork; rather, it holds the key to promoting financial integrity and safeguarding the interests of depositors. By providing a comprehensive record of deposits received by companies throughout a financial year, DPT 3 empowers regulatory authorities to closely monitor corporate financial health, effectively mitigating potential risks and malpractices. Moreover, DPT 3 filing extends its reach into clarifying financial dealings, allowing companies to distinguish between deposits and other transactions.

What is DPT 3 Form?

DPT 3 means a Form introduced by the Ministry of Corporate Affairs to file a company’s return on deposits it has accepted in a financial year. The purpose of this filing is to intimate the Registrar of Companies of all of the company’s deposits and outstanding receipts in a financial year in order to maintain transparency, protect the interests of depositors, and monitor the financial activities of companies. When a company accepts deposits from its members, directors, or third parties there is a risk associated with it, So, filing DPT 3 helps regulatory authorities track the financial health of companies and ensure compliance with the Companies Act, mitigating the risk of fraudulent practices or mismanagement of deposited funds.

How and When Did DPT 3 Originate?

Rule 16 of the Companies (Deposits and Acceptance) Rules, 2014 already established DPT 3 as an annual form for filing Return on Deposits accepted by applicable companies in a financial year. An amendment to these Rules in 2019 clarified that the applicable companies for this purpose includes all companies registered under the Companies Act, except Government Companies. Moreover, a provision was added in Rule 16A(3) which made it mandatory for all Companies other than Government Companies incorporated in India to file a one-time return of their deposits in Form DPT 3 encompassing all financial years from 2014-15 to 2018-19. From FY 2019-2020 onwards, the annual Filing of DPT 3 was to be continued as per Rule 16.

Legal Provisions for DPT 3 Filing:

- Section 73(2), Companies Act: The legal foundation for DPT 3 filing lies in the Companies Act, 2013. Specifically, Section 73(2) of the Act provides the framework for acceptance of deposits by companies, in accordance with the relevant rules issued by the Ministry of Corporate Affairs in consultation with the Reserve Bank of India.

- Section 16, Companies (Acceptance and Deposits) Rules: Rule 16 of the Companies (Acceptance and Deposits) Rules states that every company to which these rules apply, shall on or before the 30th day of June, of every year, file with the Registrar, a return in Form DPT 3 along with the fee as provided in Companies (Registration Offices and Fees) Rules, 2014 and furnish the information contained therein as on the 31st day of March of that year duly audited by the auditor of the company in Form DPT 3.

- Section 16A, Companies (Acceptance and Deposits) Rules: Company (Acceptance of Deposits) Amendment Rules, 2020 introduced amendments to the original rules and added new provisions in Rule 16A. The new amendments addressed various aspects of DPT 3 filing.

- One-Time Filing Requirement: The 2020 amendment introduced a one-time filing requirement for outstanding deposits of companies up to the date of the amendment for all financial years since 2014-15. This new provision was added through Clause 3 of Rule 16A.

- Annual Filing of DPT 3: Another significant clarification made by the 2020 amendment was the requirement for companies to file Form DPT 3 on an annual basis for all companies other than Government Companies. This ensures that the RoC has up-to-date information about the deposits accepted by the company every year.

What is the Purpose of DPT 3 Filing?

Filing DPT 3 promotes transparency in financial transactions, and it holds companies accountable for their deposit-related activities. The disclosed information in Form DPT 3 is accessible to the public and other stakeholders, fostering trust and confidence in the company’s financial operations.

- Intimation of Deposits Received by the Company: One of the primary purposes of filing DPT 3 is to provide an intimation of the deposits received by the company during a financial year. This intimation ensures that the Registrar of Companies has a comprehensive record of the deposits collected by the company throughout the year, thus promoting transparency and regulatory oversight.

- Intimation of Receipts Not Considered as Deposits: In addition to recording the deposits received, Rule 16 of the Companies (Acceptance and Deposits) Rule specifies that Form DPT 3 will also be used to intimate the receipts that are not considered as deposits by the company, such as outstanding loans received in a financial year. By providing this intimation, the company intimates its wholesome financial activities and transactions carried out in a year, ensuring accuracy and compliance with the law.

Who is Eligible for Filing DPT 3?

Not all Companies established and operating in India are required to file DPT 3. The Companies Act and the Companies (Acceptance and Deposits) Rules specifies clear and distinct eligibility requirements for filing the Return on Deposits in DPT 3. Moreover, these statutes also exempt certain organizations and transactions from DPT-3 applicability as discussed below.

DPT 3 Applicability for Companies

All Companies other than Government Companies are required to file their annual returns on deposits and outstanding receipts not considered deposits, in Form DPT 3. Given below is the list of companies for which DPT 3 applicability has been prescribed:

Note that Public Limited Companies are also required to intimate any deposits it receives from the general public. This is not applicable to Private Limited Companies and OPCs as they are forbidden from receiving deposits from the general public.

Companies Exempted from DPT 3 Applicability

Now that you are aware of the types of companies eligible for filing DPT 3 annually, let us discuss the companies for which DPT-3 applicability has been exempted. These organizations include:

- A Government Company

- A Non-Banking Financial Company

- A Housing Finance Company registered by the National Housing Bank

Non-Eligible Transactions

While Filing DPT 3, a company does not have to report all its deposit or receipt related transactions. Here is a complete list of transactions which need not be reported in form DPT 3 while a company is filing its annual return on deposits.

- Receipts from Central Government, State Government, any organisation under the Central/State/Local Government or formed under a statute or an act of law

- Receipts from Foreign Governments or non-government organizations/platforms

- Receipts from International Financial Institutions like banks and non-banking financial institutions

- Receipts from Banking Companies or Co-operative Banks

- Receipts from Public Financial Institutions, Insurance Companies, and Scheduled Banks

- Receipts from Commercial Papers or other notified security instruments

- Receipts from another Company

- Receipts in exchange to subscription to securities

- Receipt from a person who, at the time of the receipt of the amount, was a director of the company or a relative of the director of the Private company

- Receipts against the issue of bonds or debentures except those that are fully convertible

- Non-interest bearing security deposits received from employees not exceeding his annual salary

- Any non-interest bearing amount received and held in trust

- Receipt brought by Promoters by way of Unsecured Loans

- Receipts from a Nidhi Company

How to File DPT 3? Complete Process and Documents

Form DPT 3 is a web-based form and can be filed online on the MCA Website. The filing process involves several steps which must be navigated successfully from beginning to the end. We have discussed below the complete process and documents required for DPT 3 filling for your clear and comprehensive understanding. However, if you face any trouble or need professional supervision, you can contact our experts anytime.

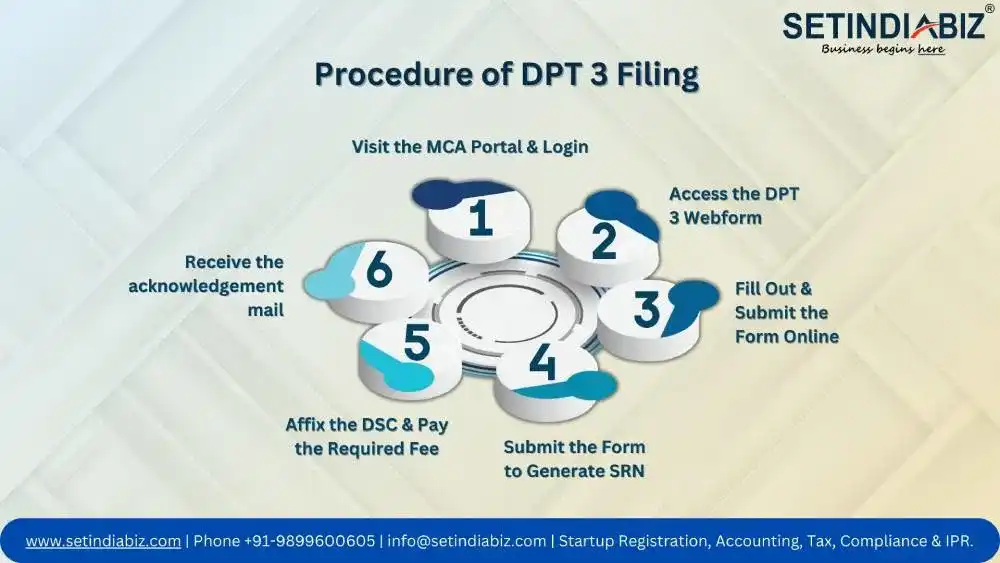

Procedure of DPT 3 Filing:

- Visit the MCA Portal & Login: The first step in the filing process is to visit the MCA website. MCA website is the official one-stop solution for all the e-filing and other services which the Ministry of Corporate Affairs provides, including the filing of form DPT 3. So, after opening the website you need to login to your account and if you do not have one, you can create it using it by registering as a Business User.

- Access the DPT 3 Webform: Once you are logged into your account, go to the main menu and under the MCA Services Section, click on the “e-filing services”. In the dropdown that further appears, you can go to the “Deposit Related Filings” and then Access the DPT 3 Webform. The process of filing this form is completely online from the beginning to the end.

- Fill Out & Submit the Form Online: The Form DPT 3 which you access on the MCA website is a webform, so you fill the required details online, attach the required documents digitally and verify the form by attaching the applicant’s Digital Signature. Here are the details sought in the application:

- Company’s details: Name, Registered Address, CIN, Official Email Address, type of company structure (Private/Public), and its business activity.

- Net-Worth Details: Paid Up Share Capital, Free Reserves, accumulated loss, net worth as per the latest audited balance sheet, and maximum limit of deposits

- Deposits Related Details: Existing deposits in the current financial year, deposits received in the previous financial year (Secured & Unsecured), Repaid Deposits, Outstanding Deposits in the previous financial year, Particulars of Liquid Assets, Particulars Deposit Insurance, and the Particulars of charge.

- Necessary Attachments: To support the details provided in the Form, you need to attach certain necessary documents in their digital formats. We have provided a complete list of these documents in the further sections.

- Submit the Form to Generate SRN: Once you have completed the form, filled out all the details and attached all the necessary documents, you can proceed with its submission on the website, after which a Service Request Number or SRN will be generated. This SRN can be used to track the form’s status until all the formalities are completed.

- Affix the DSC & Pay the Required Fee: Once the application is submitted and the SRN is generated, you can complete the filing process by authenticating the form with the applicant’s DSC, and paying the required application fee. The application fee for DPT 3 depends on the nominal or paid up capital of the Company, and increases with its increase. We have provided the complete fee structure for DPT 3 filing in the further sections.

- Receive the acknowledgement mail: You will receive an acknowledgement for completing the filing process on your registered e-mail address. This will confirm that your filing is done and the return of deposits for the concerned financial year has been received by the Registrar of Companies.

Documents Required for DPT 3 Filing:

- Auditor’s Certificate verifying the Audited Financial Statements ad particulars of DPT 3 form

- Copy of the Deposit Insurance Contract

- Copy of the Trust Deed, if the Particulars of Charge has been provided in the form

- Copy of Instrument Creating Charge

- List of Depositors, their details, and their respective amounts deposited

What is the DPT 3 Filing Fees?

The government fee for filing DPT 3 depends on the Paid up share capital of the Company. The table below shows the different capital slabs for which a different fee has to be paid. As the capital increases the filing fee to be paid for DPT 3 also increases. However, if the company does not have a paid up share capital, the fee for filing Form DPT 3 is fixed at Rs.200.

| Paid Up Share Capital of the Company (in INR) | Filing Fee (in INR) |

|---|---|

| Up To 1,00,000 | 200 |

| 1,00,000 to 4,99,999 | 300 |

| 5,00,000 to 24,99,999 | 400 |

| 25,00,000 to 99,99,999 | 500 |

| 1,00,00,000 and above | 600 |

DPT 3 Due Date and Late Fees

The annual DPT 3 form has to be filed on or before 30th June every financial year reporting the deposits and receipts of the previous financial year. However, if this due date is missed, DPT 3 due date late fees will be imposed. The table below breaks the late fees for you.

| Duration of Delay | DPT 3 Due Date Late Fees |

|---|---|

| Up to 30 days | Twice the Normal Fee |

| 30 to 60 Days | Four Times Normal Fee |

| 60 to 90 Days | Six Times Normal Fee |

| 90 to 180 Days | Ten Times Normal Fee |

| Above 180 Days | Twelve Times Normal Fee |

Conclusion

With companies filing Form DPT 3 annually, they ensure financial responsibility and openness. This mandatory filing ensures that deposits received and receipts not considered as deposits are duly recorded, enabling regulatory authorities to monitor corporate financial health. By embracing this compliance requirement, companies reinforce their commitment to safeguarding the interests of depositors and promoting transparency in financial transactions. DPT 3 stands as a beacon of trust between companies and depositors, guiding corporations towards a more accountable and resilient future, where integrity and transparency form the bedrock of corporate governance.

FAQ's

DPT 3 filing is a mandatory ROC compliance requirement under the Companies Act, 2013. In essence, DPT 3 applicability extends to all companies, except Government companies. It involves submitting Form DPT 3 which is the form for Return on Deposits accepted by a company in a financial year.

Form DPT 3 requires companies to provide comprehensive details regarding the deposits they have accepted during a financial year. It includes information such as the total amount of outstanding deposits, the nature of deposits, interest rates, terms and conditions, and the maturity date of each deposit. Additionally, the form also seeks information about any receipts that are not considered as deposits by the company.

Companies must submit Form DPT 3 to the RoC within 90 days from the end of each financial year, that is on or before 30th June every year for the previous financial year. Delayed Filing will result in the imposition of DPT 3 due date late fees.

The primary purpose of DPT 3 filing is to ensure transparency and protect the interests of depositors. By mandating companies to submit this return, the government aims to monitor the financial activities of companies and ensure compliance with the provisions of the Companies Act. It also helps regulatory authorities in identifying potential risks associated with deposit-taking activities and taking timely actions if any irregularities are found.

You may file the form later with DPT 3 due date late fees which may go up to 12 times the normal fee based on the number of days of delay.

If a company fails to file Form DPT-3, non-compliance can attract penalties under the Companies Act, including fines (₹1,000–₹1 crore) and prosecution of directors/officers.

No, all non-government companies (including startups) must file the DPT-3, unless exempt under Rule 16A (e.g., NBFCs).

Yes, a company can revise Form DPT-3 even after its submission, but only when the filing window for the financial year (before June 30) is open. However, late revisions may attract additional fees.

No, receipts from other companies are exempt (listed under 'Non-Eligible Transactions').

If the loan is from a director/relative in a private company, it's exempt (Rule 2(1)(c)(viii) of the Deposit Rules).

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.