Company ITR Filing – Due Date , Process & Charges

Overview: Company ITR Filing is one of the essential annual compliances that companies must fulfill. When it comes to ITR Filing, it is always advisable to file company ITR within due date or last date as it not only ensures tax-compliance but also prevents a company from getting unnecessary burden of additional business ITR filing charges or penalties that can be levied for non-filing or late filing of ITR. The blog provides you with a better understanding of Company ITR filing last date, charges and also the process of e-Filing.

Company Income Tax Return (ITR) filing is an essential annual exercise that ensures fulfilling compliance requirements, record keeping, seeking tax benefits and thus building or enhancing goodwill of the company. In India, each company should file ITR Returns irrespective of whether they make profit or loss. Even the companies that are in dormant state and have not conducted business operations in a year are also required to file returns.

There are 7 different forms available for filing ITR, however their applicability varies as per various factors such as the type of company structure, amount of income earned during the financial year, and a few more. Apart from these conditions, businesses can also file ITR returns for companies before the due date in case of loss so that to carry it forward to the next assessment year.

Which ITR Form should a company file?

As mentioned above, selecting the type of ITR Form primarily depends on the type of company structure under which it is registered. The applicability of different ITR Forms for company is described below;

- Form ITR-4: This form is applicable on those firms except LLPs which are having a total income of up to Rs. 50 lakhs during previous financial year. Their income is calculated under Sections 44AD, 44ADA, and 44AE.

- Form ITR-5: This ITR Form is applicable on LLPs and partnerships; not Form ITR-7.

- Form ITR-6: This form can be used by those companies which are not claiming exemption under Section 11, to file their Income Tax return.

- Form ITR 7: This form is applicable on the companies that are obliged to file their ITR from Sections 139 (4A), 139(4B), and 139 (4D) only. Moreover, this ITR form applies to the Firms and Trusts as well.

Business/Company ITR filing Due Date

Similar to individual taxpayers, companies/businesses must keep in mind the company itr filing due date. Rather, it’s even more crucial for the companies/businesses to remember the deadline for filing their income tax returns. The businesses must ensure to file their ITR on or before due dates as it will help them avoid the unnecessary burden of incurring business ITR filing charges like late ITR filing penalty, and other additional charges specified under Section 234A and 234F.

The below table consisting of ‘Due dates for different businesses/companies or taxpayers category’ can give you a better understanding of individual and company ITR filing due dates.

| Taxpayer Category | Due Date for Tax Filing |

|---|---|

| Businesses (Requiring Audit & include Private Limited Companies, OPCs, LLPs, and firms) | 31 October 2024 |

| Businesses (Not Requiring Audit & including Private Limited Companies, OPCs, LLPs & Firms) | 31 July 2024 |

| Individual/HUF/AOP/BOI | 31 July 2024 |

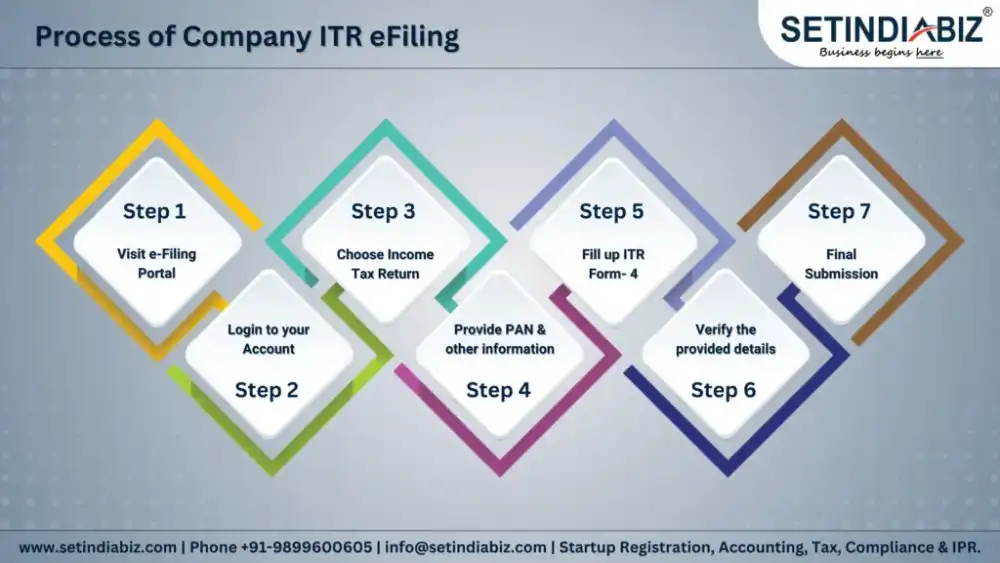

Process of Company ITR eFiling

For business/company ITR e-filing, it is required to file Form ITR-4 Sugam online. Follow the step-by-step company process described below;

Step 1: Visit e-Filing Portal

Browse the official website of Income tax efiling on your smartphone or laptop via https://www.incometax.gov.in/iec/foportal to file ITR-4.

Step 2: Login to your Account

Once you visit the eFiling Portal, the next step is to Log in to your account by entering your PAN details, password, and also the captcha that is displayed on your screen.

Step 3: Choose Income Tax Return

When you browse ‘e-File’ Menu, search ‘Income Tax Return’ option and Select it.

Step 4: Provide PAN & other information

On the page, you will need to provide PAN details. Moreover, choose the right assessment year, ITR Form number, the type of filing ‘Original/Revised Return’ and then click on ‘Prepare & Submit Online’ option and click on Continue.

Step 5: Fill up ITR Form- 4

First, read the instructions carefully before filling up the ITR-4 Form. Then fill the information as instructed and also keep clicking on the ‘Save Draft’ button from time to time to save the details.

Step 6: Verify the provided details

Select a verification option as per your preference and then select the ‘Preview and Submit’ button. Now, recheck the information you have provided in the form and verify them too.

Step 7: Final Submission

After checking the form details carefully, submit the ITR Form.

Upon online verification of your company returns by the Income Tax Department, you can see your ITR file status on your e-Filing Account.

Company/Business ITR Filing Charges & Penalty

As we all know, Company ITR filing is a necessary annual task, failing which can attract various consequences in the form of penalty or charges for late ITR filing. Some of the consequences of non-filing of ITR of a company by due date are described below;

- Penalty: In case of non-compliance, the company may have to face penalties or fines. According to Section 234F of the IT Act, a fine of Rs. 10,000 will be levied in case of non-filing of company tax returns.

- Disqualifying Directors: Failing to file company ITR, the directors of the company shall be disqualified from directorship and cannot be appointed as a director in any company for up to 5 years.

- Interest: Along with the penalty, the company may also have to pay interest on the unpaid tax amount. Additionally, the interest for delay in ITR filing can be charged under Section 234A of the Income Tax Act 1961.

- Losing Eligibility for Government Contracts: If a company fails to file ITR, it may be disqualified from bidding for contracts issued by the government or availing government facilities like subsidies, etc.

- Prosecution: In a few severe cases of non-compliance to ITR, a company may also be prosecuted and have to deal with imprisonment of up to 7 years and/or fines.

Apart from the aforementioned, a few other penalties may be levied on companies that are found to be non-compliant to ITR filing or failed to file their ITR. Therefore, it is always advisable to file your business ITR return before the due date.