India has emerged as a hub for startups in recent years, with a rapidly growing ecosystem that supports innovation and entrepreneurship. To encourage and promote startup culture in India, the government has introduced several measures, including tax benefits, subsidies, and incentives. One such tax benefit available to startups is the tax exemption under Section 80IAC of the Income Tax Act. In this blog post, we will discuss the eligibility criteria and the process to obtain tax exemption under Section 80IAC.

What is a Startup?

Before we dive into the eligibility criteria and the process to obtain tax exemption, it is important to understand what a startup is. According to the Department for Promotion of Industry and Internal Trade (DPIIT), a startup is an entity that has been incorporated not more than ten years ago and is working towards innovation, development, deployment, or commercialization of new products, processes or services driven by technology or intellectual property.

What is Startup

- Eligible Entity: Only following business types are eligible.

- Incorporated not more than 10 years ago

- Turnover should be less than 100 Crores

- Startup Business Must be

- Innovative

- Improve existing products, services, and processes

- Have the potential to generate employment/ create wealth.

- Not formed by splitting up or reconstruction of an existing business

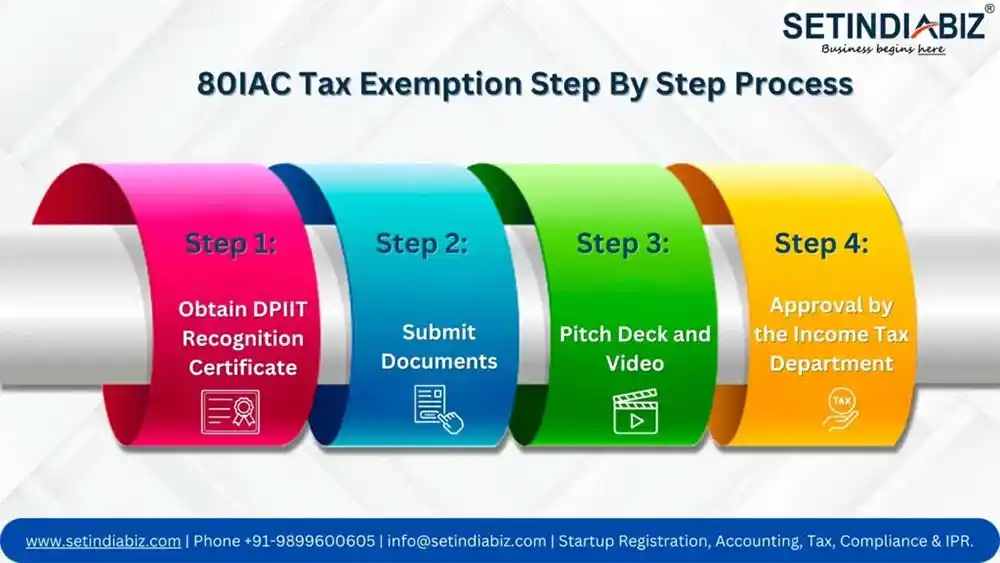

Process to Obtain Tax Exemption under Section 80IAC

To avail of the tax benefit under Section 80IAC, the startup needs to obtain tax exemption every year. The approval for tax exemption is discretionary and based on the concept, its innovativeness, and scalability. The potential of growth and employment generation is one of the major criteria, hence you should include these aspects in your pitch deck and video.

Here are the Steps to Obtain Tax Exemption Under Section 80IAC:

Step 1: Obtain DPIIT Recognition Certificate

To avail of the tax benefit, the startup must first obtain the DPIIT recognition certificate . The startup needs to apply to the DPIIT and submit the necessary documents and information. The DPIIT will evaluate the application and issue the recognition certificate if the startup meets the eligibility criteria.

Step 2: Submit Documents

Once the startup has obtained the DPIIT recognition certificate, it needs to submit the following documents to the Income Tax Department:

- MOA Attested by Authorised Signatory/Directors

- Board Resolution

- Audited Financial Statements of the past 3 years (if available)

- ITR Copy Duly Certified by CA

- Pitch Deck

- Video

Step 3: Pitch Deck and Video

The pitch deck and video are an essential part of the process to obtain tax exemption under Section 80IAC. The pitch deck should include details about the startup, the product or service, the market, the competition, and the potential for growth and employment generation. The video should provide a brief overview of the startup, the product or service, and the team.

Step 4: Approval by the Income Tax Department

The approval for tax exemption is subject to the satisfaction of the Income Tax Department. The department will evaluate the startup’s application, documents, and pitch deck and video and decide whether to grant tax exemption or not.

Conclusion

Tax exemption under Section 80IAC is a significant benefit for startups in India, as it can help them reduce their tax liability and reinvest the savings into their business. However, it is important to note that the approval for tax exemption is discretionary and based on the evaluation of the startup’s concept, innovativeness, scalability, and potential for growth and employment generation. Therefore, it is crucial for startups to put together a compelling pitch deck and video that highlights their strengths and potential.

At SetIndiaBiz, we understand the importance of tax exemption for startups and offer an all-inclusive package to help startups obtain DPIIT recognition and tax exemption under Section 80IAC. Our team of experts can guide you through the process and ensure that you submit all the necessary documents and information in a timely manner. We strive to complete the process within the committed timeline and request your cooperation in arranging the information and documents necessary for getting the DPIIT recognition.