Post Incorporation Compliances for a Private Limited Company

Overview : MSME Registration offers the much needed financial support to Sole Proprietorships. During their initial stages of business development, MSME registration helps them secure credit at low interests from banks and financial institutions, on government-backed guarantees. Also, registered MSMEs have low operational costs due to additional subsidies, tax benefits, and rebates on IPR protection.

The process of MSME Registration for Sole Proprietorship can conveniently be completed on the Udyam Portal. The Proprietor simply needs to file an online application, and submit basic documents. Once the application is filed, MSME Certificate of Sole Proprietorship gets issued within a week and can be downloaded or printed from the portal itself. Let’s discuss the detailed process for better understanding.

Is a Sole Proprietorship Eligible for MSME Registration?

All businesses, including Sole Proprietorships, are eligible for MSME Registration provided they meet the threshold requirements. The threshold requirements are based on investment in plant, machinery and equipment as well as the annual turnover of the business in the relevant financial year. Their overall limits must not exceed Rs.50 crores and Rs.250 crores respectively.

For detailed classification, refer to the table below.

| MSME Classification | Turnover Limits | Investment Limits |

|---|---|---|

| Micro Enterprises | Up to Rs.5 crores | Up to Rs.1 crore |

| Small Enterprises | Up to Rs.50 crores | Up to Rs.5 crores |

| Medium Enterprises | Up to Rs.250 crores | Up to Rs. 10 crores |

What are the Prerequisites for MSME Registration of Sole Proprietorship?

MSME Registration of Sole Proprietorship is done on the online Udyam Portal. To register on the portal, a valid mobile number and email ID of the Proprietor will be needed. The mobile number must be linked to the proprietor’s Adhar for OTP authentication. Also, the proprietor’s PAN will be required during the registration process since the Proprietorship firm does not have a distinct legal identity and cannot apply for a business PAN. Besides, if the Proprietorship is an eligible GST payer, GST identification number (GSTIN) is also a must-have.

Documents Required for MSME Registration of Sole Proprietorship

MSME Registration of a Sole Proprietorship can be done with minimal documents, since the applicant and the stakeholder is just a single person. The required documents include:

- Proprietor’s PAN

- Proprietor’s Aadhar

- Firm’s GST Registration Certificate to verify the GSTIN, if applicable

- Classification of Business Activity using NIC Code

Process of MSME Registration for Sole Proprietorship

MSME Registration for Sole Proprietorship is a simplified online process conducted on the Udyam Portal. It involves creating an account using Aadhar and name of the proprietor. Once registered, login credentials are sent to the proprietor’s email address, after which he can begin the application filing process. Here are the steps to be followed.

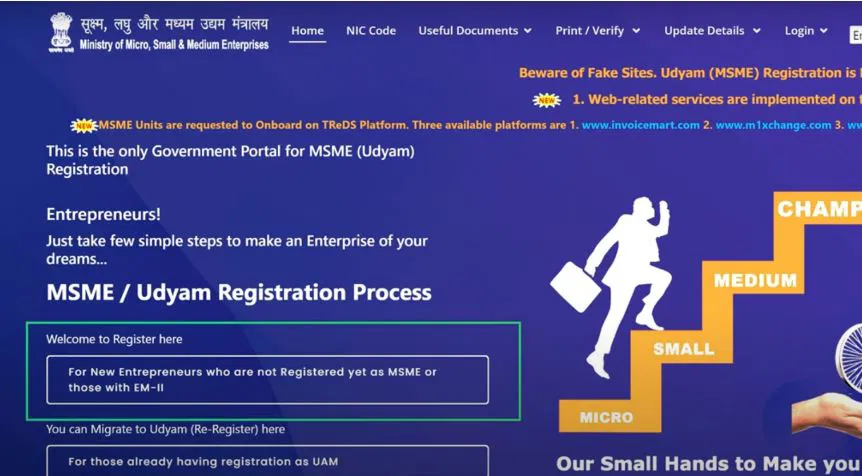

Go to the Udyam Portal udyamregistration.gov.in/Government-India/Ministry-MSME-registration.htm

Select the “New MSME Registration”.

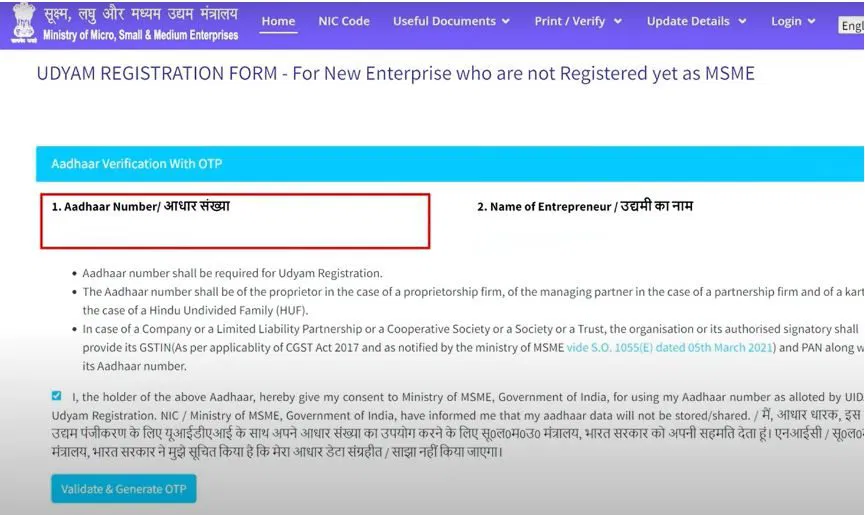

Register on the Website with Adhar and name of the Proprietor. Verify the Adhar using OTP.

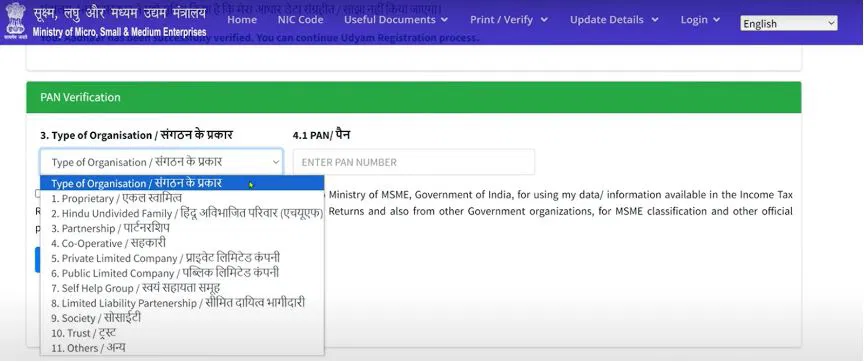

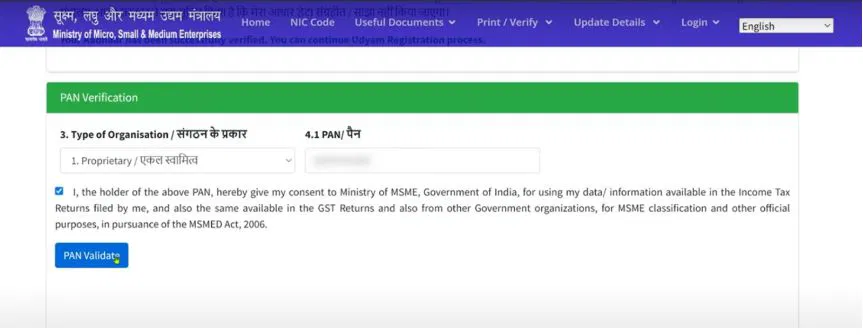

Select the Type of Organisation as “Proprietary”.

Enter and Validate the Proprietor’s PAN

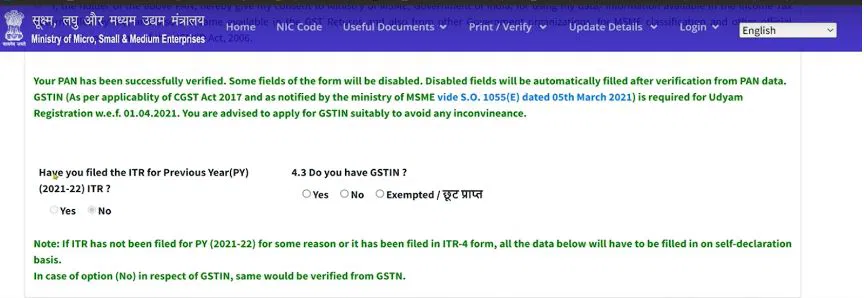

In the next step, select the ITR filing status of the Proprietor. Also confirm the availability of GSTIN.

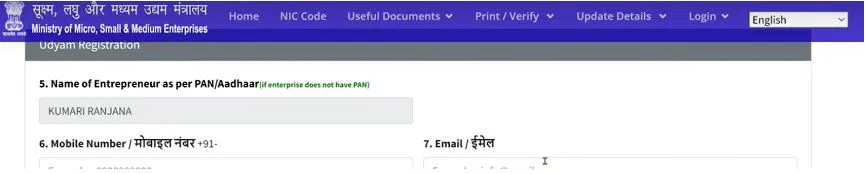

Enter the mobile number and email of the proprietor.

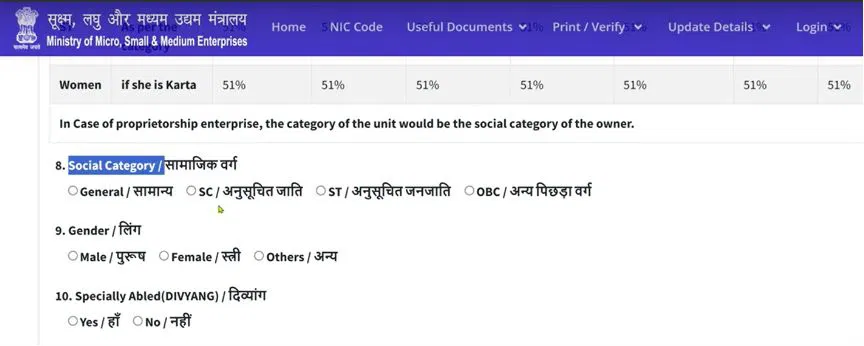

Enter the Social Category of the Proprietor and confirm other details like gender and specially-abled status.

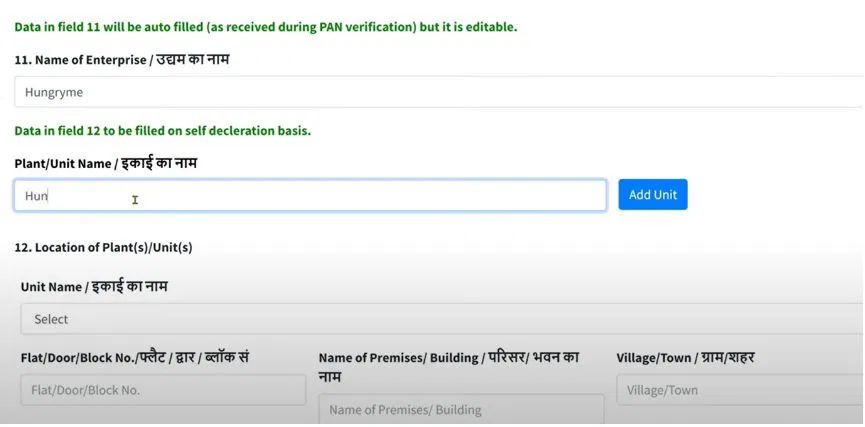

Next, enter the firm’s name, along with the name and address of its manufacturing plant. Add as many plants as the firm operates..

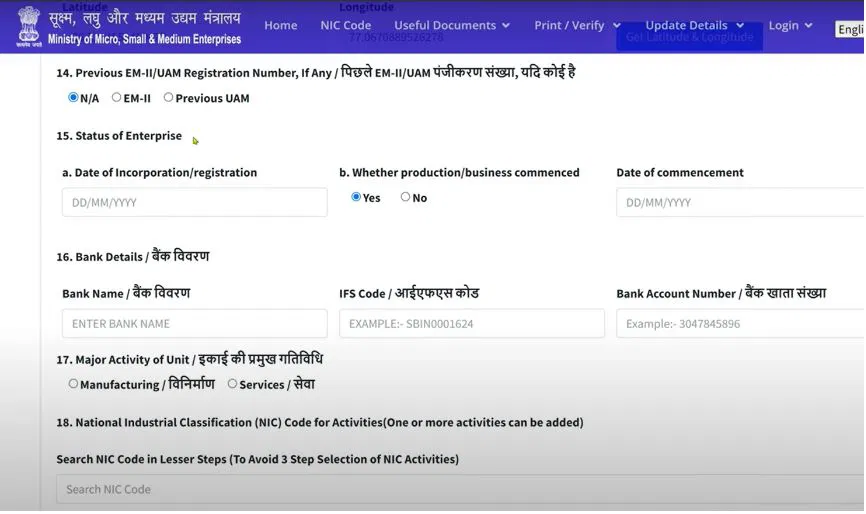

Enter the details of business commencement, bank account, and business activity as per the NIC Code Classification. Since the proprietorship firm is not formally incorporated or registered, enter the date of starting the business in the incorporation / registration date field.

Enter the number of male employees, female employees, and other category employees working in the firm.

Self-declare the turnover and investment details.

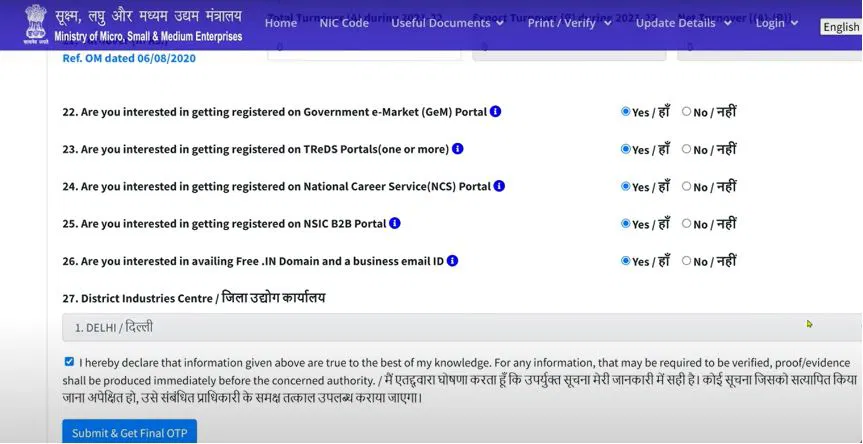

Confirm the last few details and then agree to the given declaration. Validate using OTP.

Within a week, the MSME Certificate of the Sole Proprietorship will be issued by the MSME Department.

How to Download the MSME Certificate?

The MSME Certificate can be downloaded from the Udyam Portal itself. Simply complete the following steps.

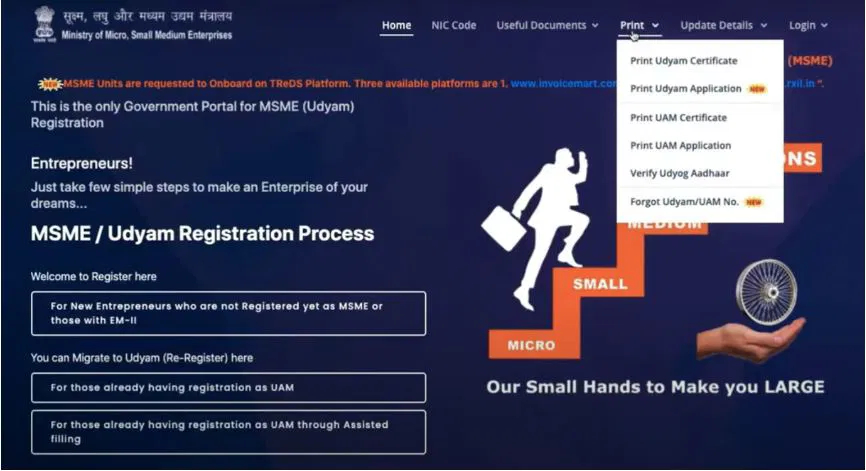

Go to the Udyam Portal and Click on the “Print” option. From the dropdown, click on “Print Udyam Certificate”.

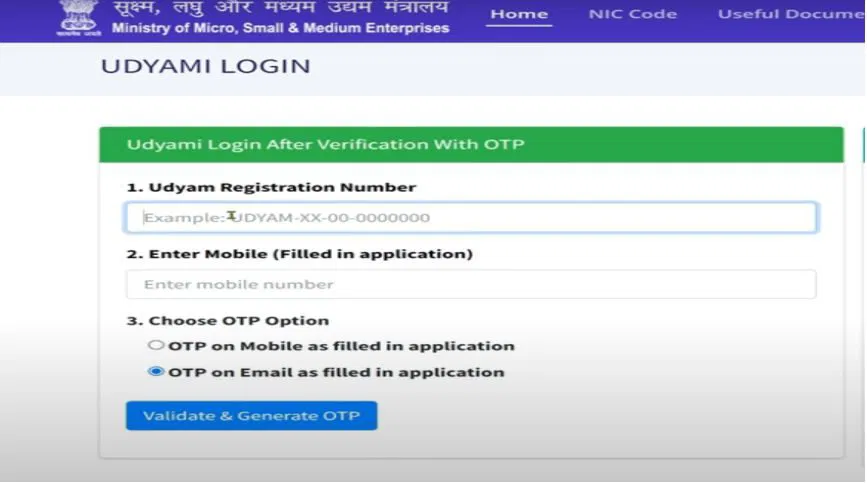

Enter the Udyam Registration Number and the Mobile Number to generate OTP. Get OTP on the registered email or mobile number.

Finally, click on the “Print Certificate” option and download or print the MSME Certificate.

Conclusion

Although registering a Sole Proprietorship firm as MSME is a simple process, it might seem intricate for proprietors who lack the legal know-how of doing so. It is always advisable to approach a professional service provider like ourselves for this purpose. At Setindiabiz, we have served sole proprietary firms for several years in completing the MSME Registration process efficiently. You can approach our advisors for free detailed consultation.

FAQ's

1.How long does it take to get an MSME Registration Certificate of Sole Proprietorship?

2.What is the cost of an MSME Registration Certificate for Sole Proprietorship?

3.What is the validity of a Sole Proprietorship MSME Certificate?

4.How can I verify the MSME Registration status of my Proprietorship Firm?

5.Can I surrender the MSME Certificate of my Sole Proprietorship?

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.

Related Articles :

- MSME Registration of a Wholly-Owned Subsidiary

- Can a Partnership Firm Undertake Udyam Registration?

- MSME Registration for LLP

- MSME Registration of Partnership Firm

- MSME New Definition & Revised Limits

- What are the Benefit of MSME Registration in India?

- Trademark Registration fee for Startups and MSMEs in India