GST State Code List and Jurisdiction

Overview : This article will walk the user through the GST state code and how to find their jurisdictional office. It describes the need to ascertain jurisdiction based on the place of business and PIN codes. This article’s key discussion points are the centralised GST registration process, the structure of the GST Identification Number-GSTIN, and a list of state codes. This article will explain State and Central jurisdictions, along with methods to locate them online, assisting a business in effectively working through the compliance requirements of GST.

Managing a business requires a good understanding of GST. For compliance with the obligations cast under GST law, one must be able to find the GST office/officer that has jurisdiction under the GST laws on your business. You can find the appropriate GST Jurisdictional Office based on the location of the principal place of business, PIN codes, and regional classification. In this blog, we will explain the easiest method to find the jurisdictional office under GST.

Who Approves GST Registration (Central or State Govt)?

GST registration is an online and centralised process handled by the Central Government. Ordinarily, the GST Registration is approved by the State GST office, which has jurisdiction over the principal place of business. However, in some instances, the central office of the GST processes the GST Registration. Learn more about our GST Registration services.

What does GST Registration Number (GSTN) Contain?

The Goods and Services Tax Identification Number (GSTIN) is a 15-digit number issued to every registered taxpayer under the GST. To register for GST, an online application must be submitted through the GSTN common portal at www.gst.gov.in. GST registration is based on the Permanent Account Number (PAN), with the first two digits representing the state. We have provided a complete list of states and their corresponding codes in this blog. Following the state code, ten digits represent the taxpayer’s PAN. The thirteenth digit indicates the number of GST registrations associated with a particular PAN, the fourteen digit is reserved for future use, and the last one is known as the checksum digit, which is used to detect any error at the time of GST Registration.

What is a GST State Code?

The GST State code is fixed for every state or union territory and is the first two digits of the GST registration number. In other words, when you have a party’s GST number, it is very easy to find the state where that party has its principal place of business. Below is the list of state codes for the purpose of GST Registration.

| State Code | State Name | State Code | State Name |

|---|---|---|---|

| 01 | Jammu and Kashmir | 20 | Jharkhand |

| 02 | Himachal Pradesh | 21 | Odisha |

| 03 | Punjab | 22 | Chhattisgarh |

| 04 | Chandigarh | 23 | Madhya Pradesh |

| 05 | Uttarakhand | 24 | Gujarat 2 |

| 06 | Haryana | 26 | Dadra & Nagar Haveli and Daman and Diu |

| 07 | Delhi | 27 | Maharashtra |

| 08 | Rajasthan | 28 | Andhra Pradesh (before bifurcation) |

| 09 | Uttar Pradesh | 29 | Karnataka |

| 10 | Bihar | 30 | Goa |

| 11 | Sikkim | 31 | Lakshadweep |

| 12 | Arunachal Pradesh | 32 | Kerala |

| 13 | Nagaland | 33 | Tamil Nadu |

| 14 | Manipur | 34 | Puducherry |

| 15 | Mizoram | 35 | Andaman and Nicobar Islands |

| 16 | Tripura | 36 | Telangana |

| 17 | Meghalaya | 37 | Andhra Pradesh |

| 18 | Assam 1 | 38 | Ladakh |

| 19 | West Bengal |

Understanding GST Jurisdiction & Its Types

Under the Goods and Services Tax (GST) regime, there are two distinct jurisdictions for administering GST, i.e. State and Central. The State jurisdiction is an administrative office that handles matters related to CGST and SGST/UTGST, while the Central jurisdiction oversees the implementation of IGST. The “jurisdictional officer” is frequently used in the GST proceedings, particularly in areas like exports and input tax credits. In this blog, we have explained the ways to find the state and central jurisdiction.

How to Find State GST Jurisdiction (Administrative Office)

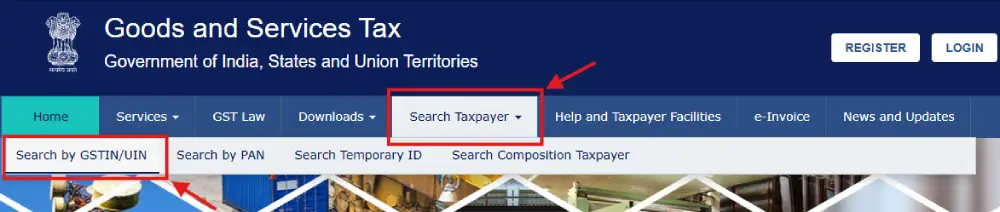

The easiest method of finding the State GST jurisdiction (Administrative Office) for a registered taxpayer is to search the GST portal at www.gst.gov.in under “Search Taxpayer”, where you can search by PAN or GST Number. When you open the details, you will find the State jurisdictional office and the central jurisdiction. For GST Registration, finding the jurisdiction is a little tricky. You should go to the state government GST portal and find the jurisdiction based on the primary location from where the business would operate.

How to find Central GST Jurisdiction (Other Office)

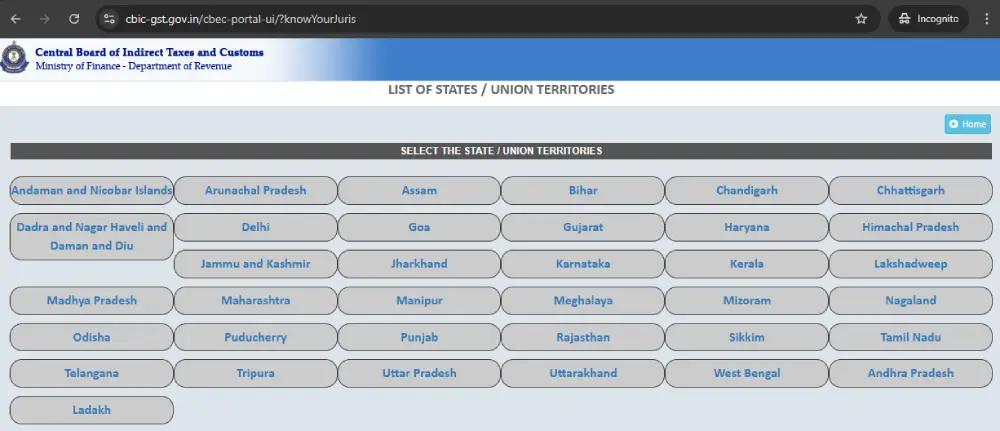

Finding the Central GST jurisdiction is easy and can be done by visiting the CBIC website at https://cbic-gst.gov.in. On the portal, the option to find jurisdiction is under the “Services” tab, and thereafter, select “Know Your Jurisdiction.” the direct link to find GST jurisdiction is at https://cbic-gst.gov.in/cbec-portal-ui/?knowYourJuris The screenshot that appears after you click on the option “Know Your Jurisdiction” is as under

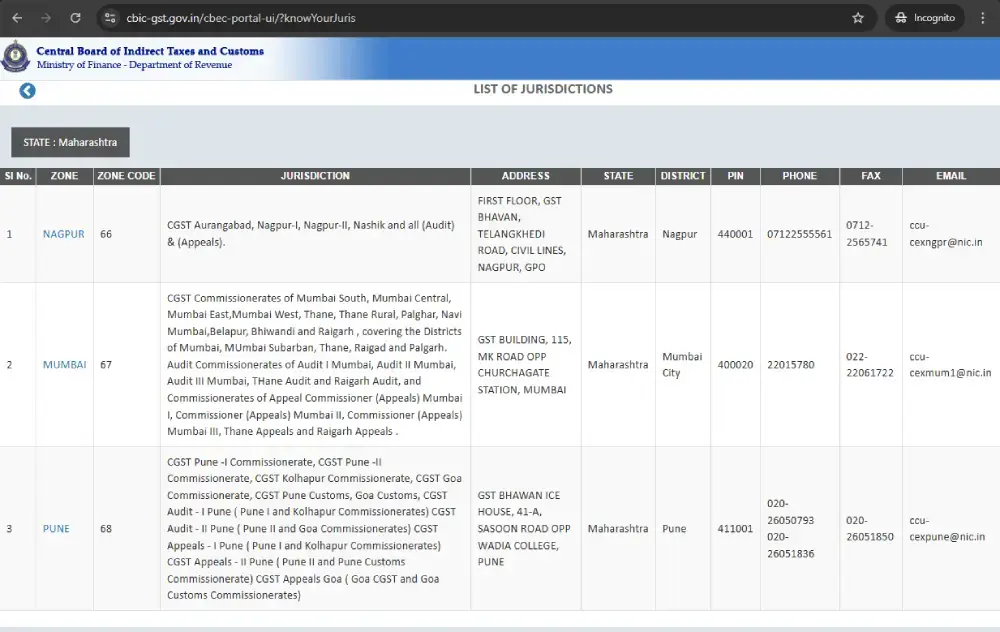

When you click any state from the list of states available on you will be taken to the list of the Zonal Offices of the GST having jurisdiction over your business. Zone Offices are a level above Commissionerates in the CBIC’s organizational structure. Each zone comprises several commissionerates. The Zonal Offices of GST oversee commissionerates under their jurisdiction in terms of properly implementing GST laws. When you click the Zone offices, it shows the commissionerate offices falling within the jurisdiction of the Zone Offices. For example, when you click on Maharashtra, the following zonal offices shall be shown.

Conclusion

In conclusion, understanding the GST state codes and jurisdiction is based on the principal place of business. This article attempted to explain the meaning and significance of the GST state code and the method of finding the correct GST Jurisdiction. You can avail of our services for GST Registration & Compliance.