What is GST LUT Form?: Eligibility & Filing Process

Overview : Filing the Letter of Undertaking (GST LUT) Form allows businesses to export goods and services beyond national borders without paying the applicable IGST charges. This is applicable to SEZ suppliers as well. The process of GST LUT Filing can be conveniently completed on the GST website (www.gst.gov.in). For this, the taxpayer can access the online GST RFD 11 form. The form seeks a few details and declarations from the taxpayer. Once the details are fiiled, the authorised signatory can submit the verified, authentic form online with the digital signature or EVC OTP of the authorised signatory. The detailed steps are explained further in the blog.

What is the GST LUT Form?

The primary function of filing a GST Letter of undertaking is to enable export at NIL rate of GST, which is a declaration filed by an exporter or supplier of goods/services to an SEZ developer/unit. It is issued to the jurisdictional Commissioner from where the supply is made in pursuance of Rule 96 A of the CGST Rules, 2017. The declaration assures that the supply will be made in adherence to all GST laws and regulations. A failure to do so shall make the supplier liable to bear the consequences mentioned in rule 96 A. In the absence of GST LUT, the supplier can also provide an export bond of a similar nature with a bank guarantee worth 15% of the bond amount.

Eligibility to File GST LUT / Bond?

To reduce the tax impact of first exporting by applying total gst and then claiming a refund, the exporter can now export at the NIL rate of GST after filing an undertaking in the form of LUT at the gst portal. The exporter or the supplier to the SEZ who has not been prosecuted for an amount exceeding 2.5 crore is eligible to export at the NIL rate of GST by filing LUT on the GST Portal.

Process of Filing GST LUT Form

GST LUT Form can be filed online on the GST website itself. The process is quite simple and straightforward. It includes filing the GST RFD 11 form online with accurate details and declarations. The form is submitted after authentication by the authorised signatory using DSC or EVC. Let’s understand the steps in detail.

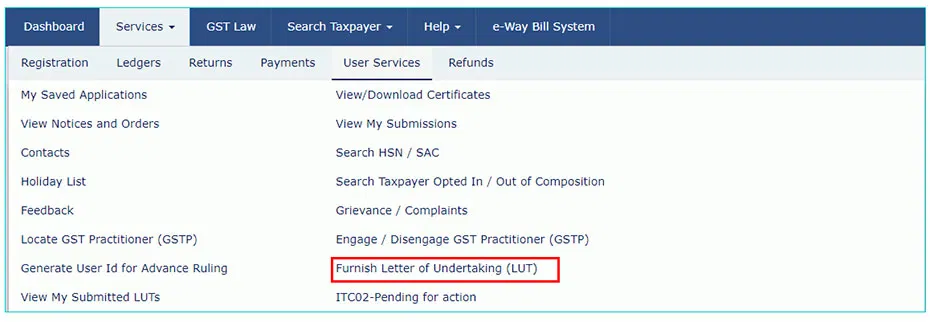

Step 1: Go to the GST LUT Filing Service on the GST Portal

Visit the GST Portal at www.gst.gov. in and navigate to the Home page. Here, use login credentials to sign in to your GST account. On the dashboard displayed, go to Services > User Services > Furnish Letter of Undertaking (LUT) option.

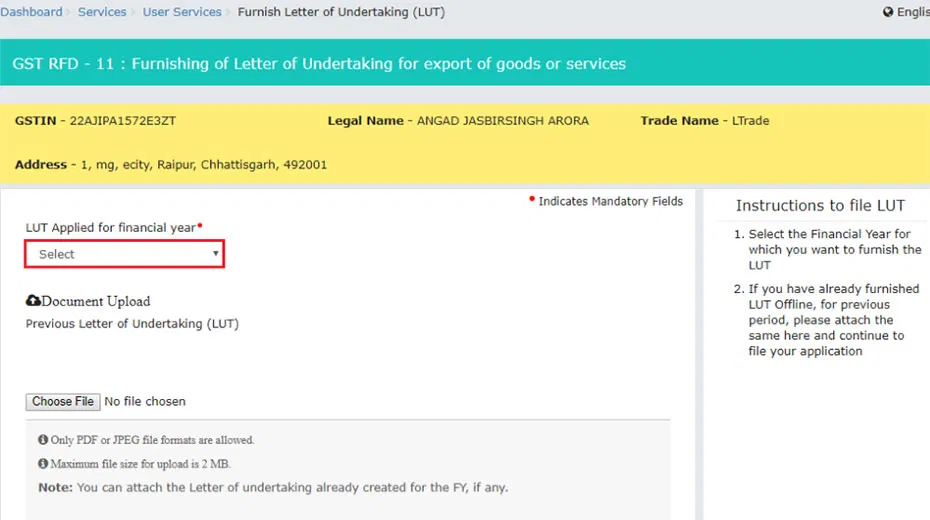

Step 2: Fill Out the GST LUT Form

Form GST RFD-11 will appear on the screen. Select the financial year for which LUT is applied. Further, if any LUT Form has been filed previously, the same must be uploaded in the “Choose File” option. The file format must be PDF or JPEG only. Besides, the file size cannot exceed more than 2 MB.

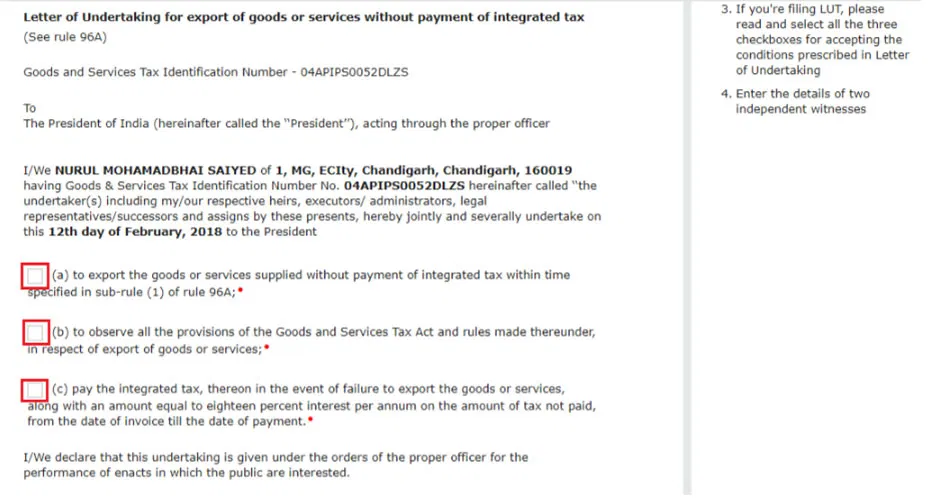

Step 3: Check the Declaration Boxes

GST LUT Form can be submitted after agreeing to three crucial declarations. The first one confirms that the export or supply to SEZ is being made without IGST payment. The second declaration confirms that the supply is being made in adherence to GST laws and regulations. Finally, the third and last declaration confirms the consequences of failing to export or supply goods / services within time, after the submission of the LUT or export bond.

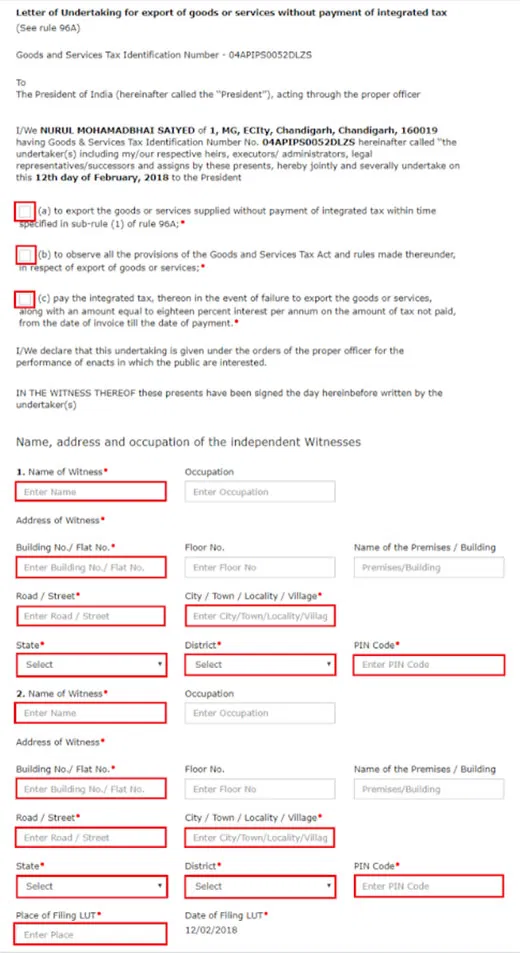

Step 4: Add Details of Witnesses

Next, add the names and full addresses of two independent witnesses in the form. Also, add their occupation. The witnesses provide backing to the LUT bond of the taxpayer.

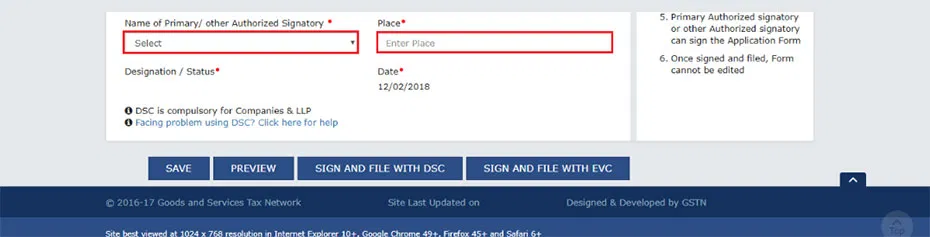

Step 5: Details of the Authorised Signatory

The last step is adding the authorised signatory’s name. An authorised Signatory is appointed or nominated by the business to sign the GST LUT Form. In case of a company, the authorised director can act as the signatory, whereas in case of a partnership firm or LLP, the managing or designated partner can perform this role.

Step 6: Final Authentication of GST LUT Form with DSC or EVC:

The authorised signatory must authenticate the GST LUT form using DSC or EVC. DSC or Digital signature can be uploaded as a file to the form, whereas EVC generates OTP to the registered mobile number and e-mail address of the authorised signatory. The OTP must be furnished in this case for the authentication to complete.

Step 7: Submit and Download Acknowledgement

Once the authentication is completed, the form can be submitted on the portal. After submission, a success message will be displayed and an ARN shall be generated for further reference. The ARN will also be sent to the taxpayer’s registered mobile number and e-mail address. Further, there’s an option to download the acknowledgement receipt after submission as well.

Advantages of Filing GST LUT Form

Filing GST LUT Form comes with several benefits and improved performance of a business entity. The tax savings done through it reduces hefty burden and allows the business to grow freely across borders. Besides, the convenient process of GST LUT filing helps taxpayers avail its benefits easily, if applicable. Here are a few advantages discussed in detail:

- Zero Tax Liability: Filing GST LUT form allows exporters and suppliers of SEZ developers / units to avoid paying IGST on their supplies.

- Improved Liquidity: Avoiding IGST payment helps improve liquidity and cash flow of the business.

- Reduced Compliance: GST LUT bond eliminates the need to claim refunds separately, thus, reduces GST compliance.

- Competitive Pricing for Supplies: Saving taxes through GST LUT bond allows suppliers to reduce their prices of supplies and exports.

- Faster Clearances: Filing GST LUT bond quickens export clearances and allows exporters to expedite shipping to international clients.

Conclusions

GST LUT Filing encourages businesses to grow exports and SEZ supplies, without bearing the heavy tax burden that comes with it. The taxes paid as IGST on these supplies are completely waived off provided the supplier has filed the GST LUT form and has delivered the supplies within time. A failure to do so will not only render the GST LUT bond null and void but impose additional tax and interest on the taxpayers.

FAQ's

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.