Documents Required for GST Registration for Proprietorship

Overview : GST Registration is crucial for tax compliance of Sole Proprietorship businesses in India. This comprehensive guide on the documents required for GST registration for Proprietorship will help you navigate through the process successfully.

Sole proprietorships are entrepreneurial ventures led by single individuals, navigating the challenges and opportunities of the market. As the backbone of our economic ecosystem, these enterprises play a pivotal role in shaping industries and driving growth. Amidst the various regulatory compliances they have to meet, GST registration emerges as a critical step.

Understanding the nuances of GST registration is paramount, not only for legal compliance but as a strategic maneuver to avail benefits like enhanced market credibility and input Tax Credit. This comprehensive guide sheds light on the intricacies of the GST registration process by unraveling the essential documents required for GST registration for proprietorship.

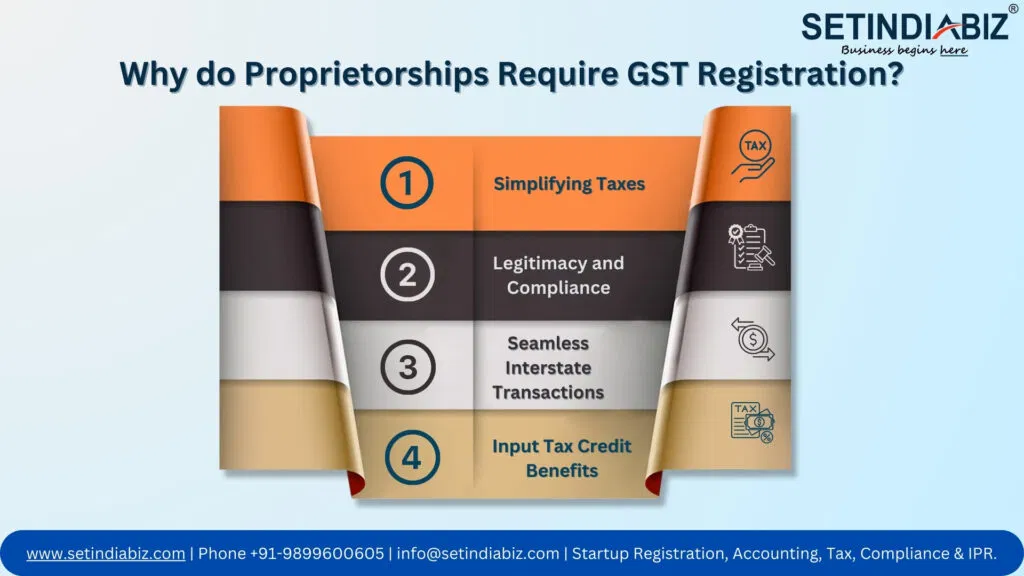

Why do Proprietorships Require GST Registration?

GST or Goods and Services Tax is a unified taxation system that replaced the complex web of indirect tax regimes in India. GST Registration is the process through which businesses officially become part of this taxation framework. It is a mandatory requirement for fulfilling GST compliances like paying taxes and filing GST returns. Among all the businesses GST Registration applies to, Sole Proprietorships have the simplest process and documentation requirements. Here are a few reasons why Sole Proprietorships must acquire GST Registration:

1. Simplifying Taxes:

GST simplifies the tax structure by subsuming various indirect taxes, making it easier for businesses to comply with tax regulations. For a Sole Proprietorship, this means less hassle in dealing with a multitude of taxes and more focus on the core business.

2. Legitimacy and Compliance:

Registering for GST gives legitimacy to a business. It ensures compliance with tax laws and regulations, instilling trust among partners, customers, and financial institutions. This is especially vital for Sole Proprietorships, as they are usually small businesses struggling for credibility in the market.

3. Seamless Interstate Transactions:

GST transforms the taxation of goods and services across state borders. With GST registration, a Sole Proprietorship can engage in interstate transactions seamlessly, expanding its market reach without the burden of multiple state taxes.

4. Input Tax Credit Benefits:

One of the significant advantages of GST registration is the ability to claim Input Tax Credit. This means a Sole Proprietorship can set off the taxes paid on purchases against the taxes collected on sales, reducing the overall tax liability.

Eligibility of Sole Proprietorships for GST Registration

GST registration is a crucial step, but not every Sole Proprietorship is required to go through this process. The eligibility conditions vary based on the annual turnover of the business. Besides, certain types of sole proprietorship businesses must take GST Registration, regardless of their turnover limits. Here’s a complete breakdown of these eligibility criteria for your clear and comprehensive understanding:

- Turnover Limits: Sole proprietorship businesses may be merchandise or services-based. According to the nature of their business activities, different threshold limits have been prescribed. GST Registration is mandatory if a merchandise or goods-based proprietorship exceeds Rs.40 lakhs of annual turnover. However, this threshold limit is Rs.20 lakhs for service-based businesses. For businesses operating in hilly areas, be it goods or service-based, this threshold limit has been conveniently reduced to Rs.10 lakhs.

- Mandatory GST Registration: GST Registration will be mandatory for a few specific Proprietorship businesses, due to the nature of their business activity. These include:

- E-commerce operators/ aggregators

- Businesses selling on e-commerce platforms

- Casual Taxpayers

- Business non-residents in India

- Importers & Exporters

- Taxpayers under GST Reverse Charge Mechanism

- Taxpayers registered under the older tax regime

- Businesses engaged in Inter-state supplies of goods & services

- Service Providers providing information & online databases services (OIDAR

- Voluntary Registration: For Sole Proprietorships operating below mandatory turnover thresholds, voluntary GST registration is a strategic option. This choice, while not mandatory, allows businesses to access benefits such as input tax credits. Beyond compliance, it enhances market presence and strategically positions the business for operational flexibility and potential growth.

- Composition Scheme: The Composition Scheme is a simplified tax avenue for Sole Proprietorships with an annual turnover up to Rs.1.5 crores. Businesses opting for this scheme benefit from a reduced flat tax rate, limited compliance requirements, and a streamlined invoicing process. While it offers operational ease, participants forgo the option of claiming Input Tax Credit on purchases, and the scheme is limited to intra-state transactions. Opting in involves a straightforward application process, providing eligible businesses with a simplified tax structure within the GST framework.

Documents Required for GST Registration for Proprietorship?

The table below mentions all the new GST Registration documents for Proprietorship. Further, the significance of each of these documents has been explained below.

| GST Registration Documents for Proprietorships | |

|---|---|

| 1. | PAN Card of the Proprietor |

| 2. | Aadhaar Card of the Proprietor |

| 3. | Photograph of the Proprietor |

| 4. | Proof of Business Registration |

| 5. | Address Proof for Place of Business |

| 6. | Bank Account Details |

| 7. | Digital Signature |

PAN Card of the Proprietor

A scanned copy of the proprietor’s PAN card is a fundamental requirement among the new GST registration documents for proprietorships. The PAN card serves as a unique identifier for tax-related transactions, ensuring accurate and secure documentation. It is a crucial element in establishing the proprietor’s identity within the GST framework, aligning with the broader taxation ecosystem in the country.

Aadhaar Card of the Proprietor

Providing a scanned copy of the proprietor’s Aadhaar card is essential for identity verification during the GST registration process. The Aadhaar card acts as a key document for confirming the proprietor’s identity, enhancing the overall security and authenticity of the registration procedure. This step aligns with the government’s emphasis on Aadhaar-based authentication for various financial and regulatory transactions.

Photograph of the Proprietor

Recent passport-sized photographs of the proprietor are a visual confirmation of identity on the GST application. This requirement adds an additional layer of verification, ensuring that the person initiating the registration corresponds with the provided identification documents. The photographs contribute to the overall integrity and reliability of the GST registration process.

Address Proof for Place of Business

The documents required for GST registration for Proprietorship vary depending on the address situation. If the applicant proprietor owns the premises, proof such as the most recent Property Tax Receipt, Municipal Khata, or Electricity Bill is needed. If the premises are owned by another person, supporting documents along with a consent letter are required. In the case of rented or leased premises, a valid Rent/Lease Agreement and documents proving lessor’s ownership are necessary.

If the address is owned by a different company or LLP, documents supporting ownership and a Board Resolution/Consent are needed. For Virtual/Shared Office spaces, additional documents include a valid Rental/Lease Agreement, proof of lessor’s ownership, and a consent letter. Special Economic Zone addresses require government-issued certificates. Accurate submission of these documents ensures a smooth GST registration process, aligning with specific address verification criteria based on the proprietorship’s circumstances.

Bank Account Details

Submission of bank account details, including a canceled cheque or bank statement, is crucial for facilitating seamless transactions and refunds under GST. This document ensures that the financial aspects of the business are correctly linked to the GST system, streamlining all the monetary processes. Providing accurate bank account details contributes to the efficiency and reliability of the overall process of GST registration for Proprietorship.

Digital Signature

A digital signature certificate (DSC) issued by authorized agencies is a requisite for the authorized signatory to sign the GST application electronically. In the case of a Proprietorship, the proprietor itself is the authorised signatory. This feature enhances the security and authenticity of the registration process, aligning with modern digital practices. The digital signature enables a secure and tamper-proof method of verifying the identity of the individual responsible for the GST registration.

| Points to Remember! | |

|---|---|

| 1. | For commercial purposes, the Rent / Lease Agreement should be in the name of the Proprietor. |

| 2. | The rental agreement in the name of the partners / designated partners is not acceptable as proof of address. |

| 3. | If the rent/lease agreement is not available, an affidavit to that effect, along with any document in support of the possession of the premises, such as a copy of the Electricity Bill, will be accepted for GST Registration. |

| 4. | The hourly rate/weekly usage of co-working space will not be accepted for GST registration. |

| 5. | If the address on the ownership document (Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill) is insufficient, additional documents such as Aadhaar Card / Driving License / Passport / Voter ID in the name of the Owner with the complete address of the premises should be provided. |

What is the GST Registration Process of Proprietorship?

The procedure for GST registration of a Proprietorship is a crucial step towards legal compliance and seamless business operations within the Goods and Services Tax framework. This process involves a series of steps that ensure accurate documentation and verification, facilitating the proprietorship’s inclusion into the GST system. A brief discussion of these steps below will guide you through.

Step 1- Visit the GST Portal:

Initiate the process by visiting the official GST portal, where the registration application is filed and processed.

Step 2- Register on the portal:

Furnish the proprietor’s PAN and UID details, essential for identity verification and linkage with tax-related transactions. These details are essential to register on the portal.

Step 3- Fill out the GST Registration Form (REG-01):

Complete the GST registration form with accurate details regarding the business structure, turnover, and other relevant information.

Step 4- Upload Required Documents:

Upload the necessary documents, including PAN card, Aadhaar card, business registration proof, address proof, and other specified documents depending on the nature of the business.

Step 5- Submit Digital Signature (if applicable):

If opting for digital signature submission, upload the digital signature certificate to sign the application electronically.

Step 6- Verification & ARN Generation:

Validate the application through a one-time password (OTP) sent to the registered mobile number and email address. Upon successful submission and payment of GST Registration fees, an Application Reference Number (ARN) is generated, providing a unique identifier for tracking the status of the application.

Step 7- Examination of the Application:

The application undergoes scrutiny by the GST officer, who verifies the submitted documents and information. The GST officer may either approve the application, leading to the issuance of the GSTIN (GST Identification Number), or seek additional information through queries that need prompt resolution.

Step 8- Receipt of GST Number:

Upon approval, the proprietor receives the GSTIN or GST Number electronically, confirming the successful registration of the Sole Proprietorship under the GST regime.

Conclusion

GST registration for Proprietorship is a crucial process that necessitates careful consideration of eligibility and strategic choices. The guide emphasizes the importance of key documents, including PAN, Aadhaar, and business proofs, which serve as the foundation for a successful application. These documents not only fulfill legal obligations but also underscore the proprietorship’s commitment to transparency and compliance. Navigating this process conscientiously ensures a seamless integration into the GST framework, offering growth opportunities and operational efficiency for Sole Proprietorships in the dynamic realm of taxation.

FAQ's

To initiate the GST registration process for a proprietorship, essential documents include PAN and Aadhaar details, business registration proofs, and address validations. These documents form the core requirements of a successful GST registration for proprietorships.

GST registration for proprietorships becomes mandatory when the aggregate turnover exceeds the prescribed threshold limits. Understanding the eligibility criteria and the strategic choice to voluntarily register can influence compliance decisions for businesses. Refer to the detailed guide for insights into the threshold limits and voluntary registration options.

Yes, the Composition Scheme offers a simplified tax structure for eligible proprietorships with an annual aggregate turnover up to Rs. 1.5 crores. While navigating the GST registration process for proprietorships, businesses have the option to choose the Composition Scheme, as highlighted in the comprehensive guide.

After submitting the GST registration application for a proprietorship, applicants can track the status using the Application Reference Number (ARN) generated during the process. The guide outlines the steps involved in the application process and provides insights into the verification and approval stages.

The documents required for GST registration for proprietorships, detailed in the guide, serve as critical components in the application process. PAN and Aadhaar details, business registration proofs, and address validations are not only mandatory for legal compliance but also signify the proprietorship’s commitment to transparency and adherence to regulatory standards. Understanding the significance of these documents is integral to a successful GST registration journey.

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.