Key Difference Between LLP and Partnership Firms

Overview : This blog explains the key difference between LLP and Partnership Firms to determine their suitability for your business in terms of ownership, management, liability, and key compliances. Taking insights into LLP vs Partnership Firms is essential for entrepreneurs or business people helping them make informed decisions. Get detailed information on LLP vs Partnership Firms with this simple and easy to understand guide.

Choosing the right business structure must be your first priority when starting a business. The structure you choose determines the legal and financial liabilities of the owners and the ease of doing business in the market. Among the various types of business structures available in India, two of the most popular options are Limited Liability Partnerships (LLP) and Partnership Firms.

While both of these structures allow two or more people to start a business together, they have significant differences in terms of ownership, liability, and key compliances. This blog explores the key differences between LLP and Partnership Firms to help you choose the one that rightly suits your needs.

Partnership Firm is a traditional structure in which two or more individuals come together to run a business and share its profits and liabilities as per mutually agreed terms and conditions. On the other hand, Limited Liability Partnership (LLP) is a newer structure that combines the flexibility of a traditional partnership with limited liability of a company to give a better hybrid structure. Let’s dig a little deeper into the concepts of the two to better evaluate the significant difference between LLP and Partnership Firms.

What is LLP?

An LLP or Limited Liability Partnership is established and registered under the LLP Act of 2008. The registration provides a distinct legal identity to the business and allows it to operate as an entity separate from its partners. The partners agree to share the capital, profits and liabilities of the firm in a predetermined ratio documented inside the LLP Agreement. Moreover, their liabilities are restricted or limited to a fixed amount, usually in correlation with their capital sharing ratio. The key features of LLP mentioned below will help you understand better.

Key Features of LLP

- Governing Law: LLPs are governed by the Limited Liability Partnership Act, 2008. It provides the legal framework for their establishment, incorporation, governance, and dissolution.

- Mandatory Registration: LLPs are required to be mandatorily registered in India. This means operating an unregistered LLP is not only detrimental but also absolutely illegal.

- Separate Legal Identity: As a registered entity, an LLP has a separate legal identity from its partners, which means that it can own assets, enter into contracts, and sue or be sued in its own name. This feature offers flexibility in terms of ownership and management of the business.

- Limited Liability: LLP provides limited liability protection to its partners, which means that the personal assets of partners are not at risk in case of any losses or legal disputes. Each partner’s liability is limited to the amount of their agreed-upon contribution to the LLP.

- Sharing of Profits & Liabilities: LLP is a partnership structure that allows two or more individuals to start a business together and share its profits and losses. The partners have the flexibility to manage the business according to their preferences, unlike in a company where there are strict regulations to follow.

- Number of Partners: LLP must have at least two partners before its establishment, and there is no maximum limit on the number of partners it can add in the due course of business

- Designated Partners: An LLP must have at least two designated partners who shall be responsible for fulfilling the compliance requirements and controlling the overall management of the LLP. One of the designated partners must be a resident of India.

- Minimum Capital Requirement: LLP does not have a minimum capital requirement. The partners can contribute any amount of capital they deem fit.

- Perpetual Existence: Since LLP is the creation of law, it has a perpetual existence, which means that it continues to exist even if one or more partners leave or die. The LLP can be dissolved only through a legal process.

What is a Partnership Firm?

Partnership Firms are traditional forms of Partnership businesses operating in India. These are established on the basis of a Partnership Deed signed between the partners. Registration for Partnership Firms is optional and is done by the State Government where its registered office is located. The existence of a firm is limited to the life of the partners as the Partnership Deed becomes null and void if a partner who has signed on it dies or departs. The key features of Partnership Firms mentioned below will help you understand better.

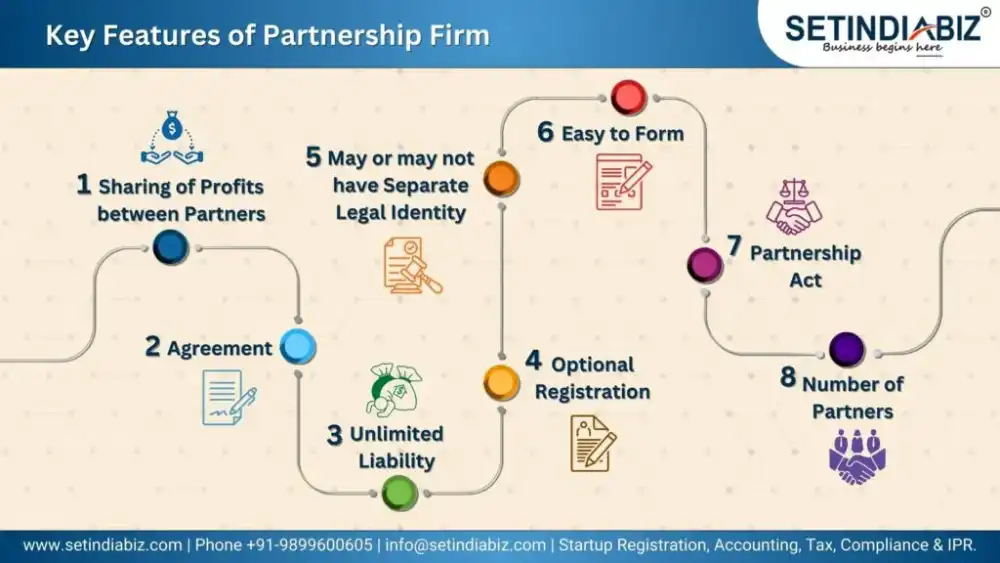

Key Features of Partnership Firm:

Features of One Person Company

Understanding the features that define an OPC is not merely a legal necessity but a strategic imperative for entrepreneurs. These features, ranging from limited liability protection to its distinct legal identity, form the foundation of what makes an OPC a nuanced and advantageous choice. Let’s unveil these significant features one by one, so that you have a clear understanding before you make the informed choice to opt for OPC as your business structure.

- Sharing of Profits between Partners: A Partnership Firm is a type of business structure in which two or more individuals come together to establish a business with the aim of earning profits. They share the profits and losses of the business in a pre-fixed, predetermined, mutually agreed upon ratio. The profit sharing ratio is mentioned in the Partnership Agreement signed by all the partners.

- Agreement: A Partnership Firm is governed by a partnership agreement drafted and signed by all partners of the firm. The agreement outlines all the terms and conditions agreed between partners, for instance, the rights, duties, and responsibilities of the partners, as well as the profit-sharing ratio and the duration of the partnership.

- Unlimited Liability: The partners in a Partnership Firm have unlimited liability, which means that their personal assets are at risk in case of any losses or legal disputes. Each partner is personally liable for paying-off the debts and other obligations of the Partnership Firm.

- Optional Registration: Unlike an LLP for which registration is mandatorily required, for a Partnership registration is optional. This means that you can operate both registered and unregistered Partnership firms in India.

- May or may not have Separate Legal Identity: Unlike an LLP which is a creation of law, a Partnership Firm is constituted on the basis of a Partnership Agreement. So, a Partnership Firm does not have a separate legal identity, that is it cannot acquire property, sign contracts, or sue and get sued in its own name.

- Easy to Form: A Partnership Firm is relatively easier to form and does not require the fulfillment of many legal compliances. It can be formed by simply drafting a partnership deed and registering it with the relevant authority.

- Partnership Act: Partnership Firms are governed by the Indian Partnership Act of 1932, which provides the legal framework for their establishment, governance, and dissolution.

- Number of Partners: A Partnership Firm must have at least two partners before its establishment. However, after establishment it can add as many as 20 partners in the due course of business.

What Is The Difference Between LLP and Partnership Firms?

Now that we have a clear understanding of the two structures, LLP vs Partnership Firms, let’s delve deeper into LLP vs Partnership Firms. While Partnership Firms are more traditional business structures, they have certain flaws which makes them difficult to operate. This is why LLP was introduced more recently by the Government with new features of a Limited Company.

These features made LLP one of the most popular choices among entrepreneurs owing to its ease and simplicity of operations. There were other significant differences between LLP and Partnership Firms which added to the LLPs popularity and preference.

10 Key Differences Between LLP and Partnership Firms

The table below mentions 10 key differences between LLP and Partnership Firms. These differences are based on several parameters like ownership, management, governing statute, requirement for registration, liability and most importantly duration of existence. Referring to this table of difference will help you choose the partnership structure most suitable for your business needs.

| Parameter | LLP | Partnership Firm |

|---|---|---|

| Governing Statute | LLP Act, 2008 | Partnership Act 1932 |

| Need for Registration | Mandatory | Optional |

| Registering Authority | Registrar of Companies (Central Government) | Registrar of Firms (State Government) |

| Separate Legal Identity | Yes | No |

| Liability of Partners | Limited Liability | Unlimited Liability |

| Agreement | LLP Agreement only defines the rights & duties of partners. | Partnership Agreement is the basis of the constitution of a Partnership Firm. |

| Compliance Requirements | Fulfilled by Designated Partners | Fulfilled by Partners |

| Number of Designated Partners |

| No Designated Partners are appointed |

| Number of Partners |

|

|

| Perpetual Existence | Continues to exist for an indefinite Period. Existence is not affected by the death or departure of one or more partners. | Gets dissolved and ceases to exist on the death or departure of any one of the partners |

Conclusion

Understanding LLP vs Partnership Firms can help make an informed decision about which business structure to choose. While Partnership Firms have been popular for decades, LLPs offer several advantages, i.e. limited liability protection and perpetual existence. Choosing the right business structure depends on various factors, and entrepreneurs should carefully weigh the pros and cons of LLP vs Partnership Firms before making a decision.

FAQ's

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.