Conversion of LLP Into a Private Limited Company

Overview : With the increasing globalization and widespread startup ecosystem worldwide, entrepreneurs felt the need for a corporate form that would be recognized worldwide. Hence, it has increased demand for the conversion of existing LLP into a private limited company. Dive into several essential aspects of conversion of LLP to private limited company, including benefits, process, and documents required for conversion of LLP into private limited company.

The LLP form of business is a new kind of legal entity compared to a Company form of organization. Before the year 2009, there was no LLP in existence, as the LLP Act was enacted in 2009. Thus, there was no question of converting an LLP into a company. Globalization was rising at a high pace, and several entrepreneurs felt the need for a corporate form recognized across the Globe. This has led to a demand for converting existing LLPs into companies

Assessing the need for the conversion of LLP into a company, the Home Ministry of Corporate Affairs issued a notification on 31 May 2016, allowing the conversion of LLP into a Company. These rules are called “The Companies Authorized to Register Amendment Rules, 2016”. Further, Section 366 of the Companies Act 2013 provides provisions for conversion of LLP to a private limited company.

| Benefits of Conversion from LLP to Private Limited Company | |

|---|---|

| Closure of one form of business and constitution of a separate entity is not required. Existing LLP is replaced as a Private Limited company. | In most of the registration and licences amendment is to be done because it is just switching the one form of business with another. The fact of conversion will be mentioned in the certificate of Incorporation of the company. |

| Title/Ownership of all the properties of the LLP vests in the newly converted company without any need for a separate conveyance. | No capital Gain Tax is involved |

The Systematic Approach of LLP Conversion to a Company

The conversion of LLP to a private limited company is possible only when the LLP has filed all its statutory returns and that there is no non-compliance of the LLP Act, Indian Stamp Act, Income Tax Act etc. Certain activities need to be followed while going for conversion of LLP to a private limited company. The key activities which are needed to be performed before the LLP Conversion to the Company are described below:

- Due Diligence of the LLP: This is the most critical step which has to be done prior to any activity to convert LLP into a company. The scope of due diligence should be to ascertain whether the LLP Conversion will succeed or fail. As already mentioned any default with ROC filing or under the Stamp Act shall lead to summary rejection of the application of Conversion of LLP into Private limited company.

- News Paper Publication of the intention to convert an LLP into a private limited company is a statutory notice to the ROC, Creditors, Other Stakeholders and the public at large to raise an objection to such conversion along with the grounds of the objection of conversion of the LLP.

- Prepare a statement of accounts of the LLP to be attested by the auditor of the LLP or where there is no auditor by any practicing CA. The statement of accounts must be latest should be later than 15 days from the date on which the application for LLP Conversion to Private Limited is being filed in form URC-1.

- Certification of Compliance with Stamp Act: You have to obtain a certificate from a practising CA, CS or CMA that the LLP has complied with the applicable provisions of the stamp act.

- A statement of Legal Proceedings: The LLP intending to convert as a company needs to prepare a statement of all the court cases, legal proceedings with any statutory authority with its status.

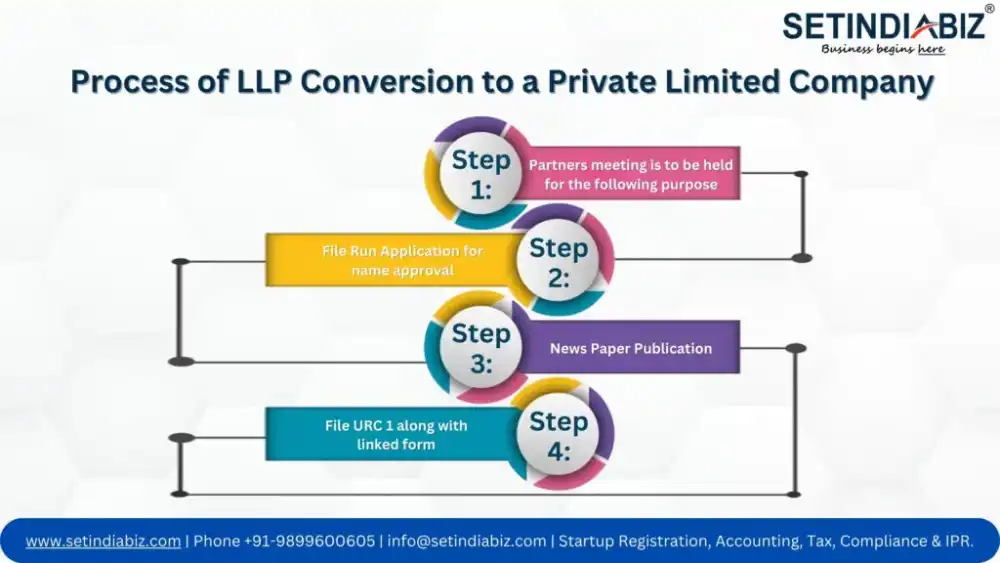

Process of LLP Conversion to a Private Limited Company

For the conversion of LLP to private limited company, several steps need to be followed. The step by step process of conversion of LLP to private limited company goes as below:

Step:1 Partners meeting is to be held for the following purpose

- To register the existing LLP under section 366 of Companies Act 2013

- Choose the way for conversion- There are various ways of converting an LLP into a private limited company, for example by way of slump sale, selling assets of the LLP at their respective value, etc Given the alternates available, the manner in which an LLP shall be converted as a company depends on the specific case.

- Authorize one or more partners to sign all the documents, affidavits, papers, deeds etc and to take all the steps incidental and ancillary to the said conversion of LLP in a company

Step 2: File Run Application for name approval

The run is the name of the application for seeking name approval of the proposed resulting company after the conversion of the LLP. In the case of LLP generally, only the last word(s) are changed. Ie. In place of LLP, the words Private Limited is added.

Step 3: News Paper Publication

Twenty-one days before making the application for conversion in form URC1 publish a newspaper advertisement in the prescribed form URC2, seeking objections, in a newspaper in English and in any vernacular language, circulating in the district in which the LLP is situated.

Step 4: File URC 1 along with linked form

- E-form INC- 33 (For MOA)

- E-Form INC-34 (For AOA)

- INC-9- Specimen Signature of directors

- DIR-2 – Consent to act as Director

- The KYC of the directors and all the attachment as required in normal Incorporation of Company

- News Paper Publication Proof

- Further, where the LLP has more than seven partners MOA & AOA is to be filed in physical form.

Documents required for conversion of LLP into a private limited company limited by shares

A certain set of documents must be arranged and provided in order to get your LLP converted into a private limited company successfully. The essential documents that one will need to undergo the process of conversion of LLP to a company are listed down:

- Copy of certificate of registration of the LLP

- Consent of the majority of members is mandatory to be attached in case the company is limited by shares or Unlimited company

- No objection certificate from the concerned Registrar of Companies (LLP)

- Details of members/partners along with the details of shares held by them, if any.

- Declaration of two or more directors verifying the particulars of all members/ partners.

- An affidavit from all the members/partners for dissolution of the entity if dissolution is chosen as a model of conversion

- Copy of the LLP Agreement

- Copy of Newspaper advertisement.

- Certificate from a CA/CS/CWA certifying the compliance with all the provisions of the Stamp Act, to the extent applicable.

- Undertaking by the proposed directors for compliance with requirements of the Indian Stamp Act, 1899

- A copy of the latest Income Tax Return of the firm

- No objection certificate/Consent given by secured creditors is mandatory to be attached in case of any secured debt outstanding as on the date of application.

- Statement of accounts of the existing entity prepared not be older than 15 days preceding the date of application duly certified by the auditor, if applicable.

- INC-9- Specimen Signature of directors

- DIR-2 – Consent to act as Director

Conclusion

Amidst the rising demand for a corporate entity that will be accepted globally, the concept of conversion of LLP into private limited company was introduced. Addressing the need, the Home Ministry of Corporate Affairs allowed the conversion of LLP into a Company by issuing a notification in 2016. The above blog elucidates crucial aspects of conversion of LLP to a private limited company.

FAQ's

1.How to convert an LLP into a private limited company?

2.How long does it take for conversion of LLP to a private limited company?

3.What are the tax implications of Conversion LLP to private limited Company?

4.Is an LLP better than a Private Limited Company?

5.What is the turnover limit for an LLP?

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.