How to Opt Out of New Income Tax Regime For the FY 2024-25: Complete Guide on Form 10-IEA Filing

Overview : Looking to switch from the new to the old tax regime for business income in FY 2024-25? Form 10-IEA is your essential tool. With the new tax regime becoming the default option under Section 115BAC, entrepreneurs and professionals must understand how to opt out of the new tax regime for FY 2024-25 to continue claiming valuable deductions. This comprehensive guide covers the Form 10-IEA filing deadline for the FY 2024-25, eligibility criteria, and step-by-step filing process to help you make an informed tax planning decision.

Understanding Form 10-IEA: Legal Framework and Purpose

Rule 21AHA of the Income Tax Rules, 1962, prescribes Form 10-IEA as notified by the Income Tax (Fifth Amendment) Rules, 2023. Taxpayers file this declaration to exercise the option of opting out of the default new tax regime under sub-section (6) of section 115BAC of the Income Tax Act, 1961, thereby choosing to be taxed under the regular (old) tax provisions.

The new tax regime, while offering reduced tax rates, eliminates access to popular deductions, including those under Section 80C (investments), Section 80D (medical insurance), and House Rent Allowance (HRA) exemptions. For many Indian businesses and professionals with substantial eligible expenses, the old regime often provides better tax efficiency despite higher slab rates.

Practical Example:

Consider Priya, a freelance digital marketing consultant earning ₹12 lakh annually. She invests ₹1.5 lakh in ELSS funds, pays ₹25,000 as medical insurance premium, and claims ₹2 lakh as HRA. Under the old regime, her tax savings from deductions could outweigh the benefits of lower slab rates in the new regime, making Form 10-IEA filing beneficial for her situation.

Quick Comparison: Key Differences Between Tax Regimes

| Aspect | Old Regime | New Regime |

|---|---|---|

| Tax Rates | Higher slab rates | Reduced slab rates |

| Deductions | Section 80C, 80D, 80E etc | Most deductions are not allowed |

| HRA Exemption | Available | Not available |

| Standard Deduction | ₹50,000 for salaried | ₹50,000 for salaried |

| Best For | High deduction claimers | Low deduction users |

Note: Tax benefit varies based on individual income and eligible deductions. Consult a tax professional for personalised analysis.

File Form 10-IEA to Switch from the New to Old Tax Regime? 🎯

Now that we understand the legal framework, let’s examine who exactly needs to file this form. According to the Income Tax Department’s guidelines, Form 10-IEA filing is mandatory for Individuals and Hindu Undivided Families (HUFs) who have income under the head “Profits and Gains of Business or Profession” as defined under Section 28 of the Income Tax Act, 1961.

This includes:

- Entrepreneurs running proprietary businesses

- Professional consultants (CAs, lawyers, doctors)

- Freelancers and independent contractors

- Partnership firm partners (individual capacity)

- Those filing ITR-3 or ITR-4 returns

Important Note: Salaried employees without business income (filing ITR-1 or ITR-2) are not required to file Form 10-IEA. They can exercise their right to choose a regime annually while filing their income tax return.

🔑 Key Takeaways:

- Form 10-IEA is mandatory only for business/professional income earners

- Applies to proprietors, consultants, freelancers filing ITR-3 or ITR-4

- Salaried employees can choose a regime annually in their ITR

- Even small business income makes Form 10-IEA filing necessary

Form 10-IEA Filing Deadline FY 2024-25: Critical Dates You Must Know ⏰

Having established eligibility, let’s focus on the most crucial aspect – timing your Form 10-IEA submission correctly. The due date for filing Form 10-IEA must be on or before the due date for filing the Income Tax Return (ITR) under section 139(1). As per CBDT Circular No. 06/2025, the dates are as follows:

Due Dates for FY 2024-25 (AY 2025-26):

| No | Taxpayer Category | Form 10-IEA & ITR Due Date |

|---|---|---|

| 1 | Non-audit cases | September 15, 2025 |

| 2 | Audit cases | October 31, 2025 |

Warning: Missing the Form 10-IEA deadline results in automatic taxation under the new regime for that financial year, forfeiting all deductions and exemptions available under the old regime.

Step-by-Step Guide: How to File Form 10-IEA Online 💻

Now that you are aware of the deadlines, let’s walk through the complete filing process to ensure a successful submission.

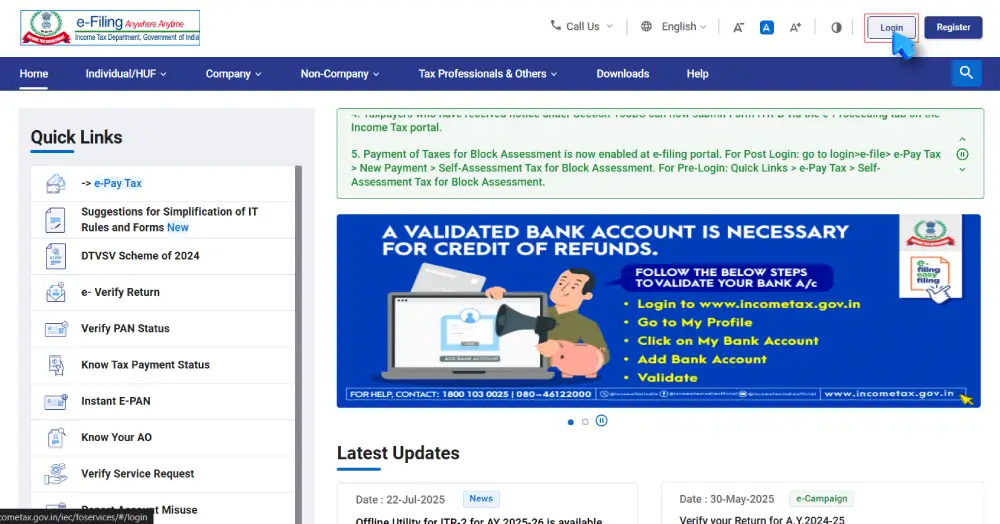

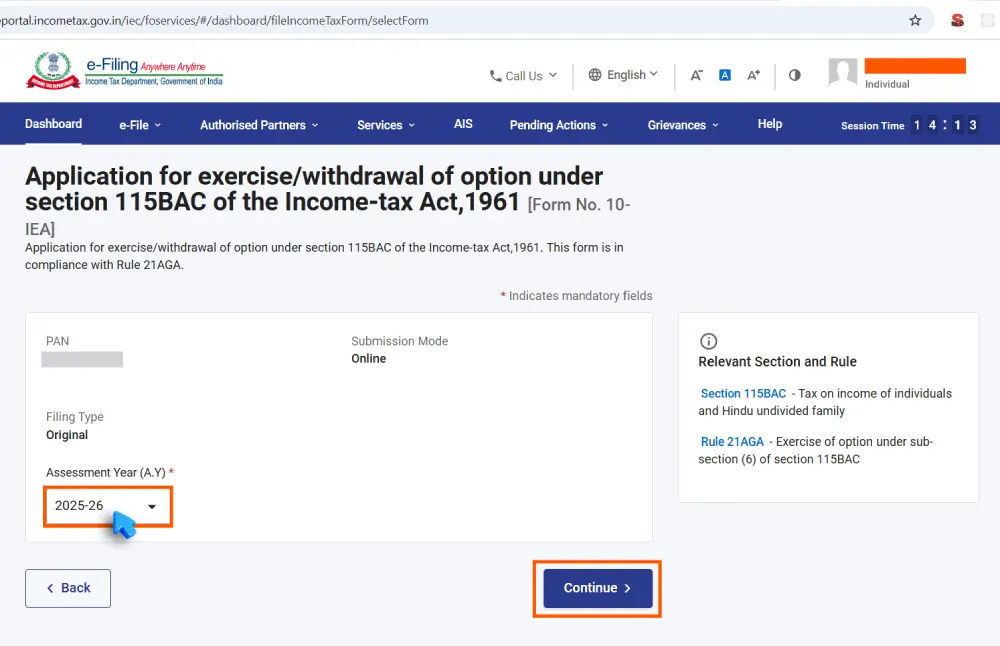

Step 1: Portal Access

- Log in to the official Income Tax e-filing portal (www.incometax.gov.in)

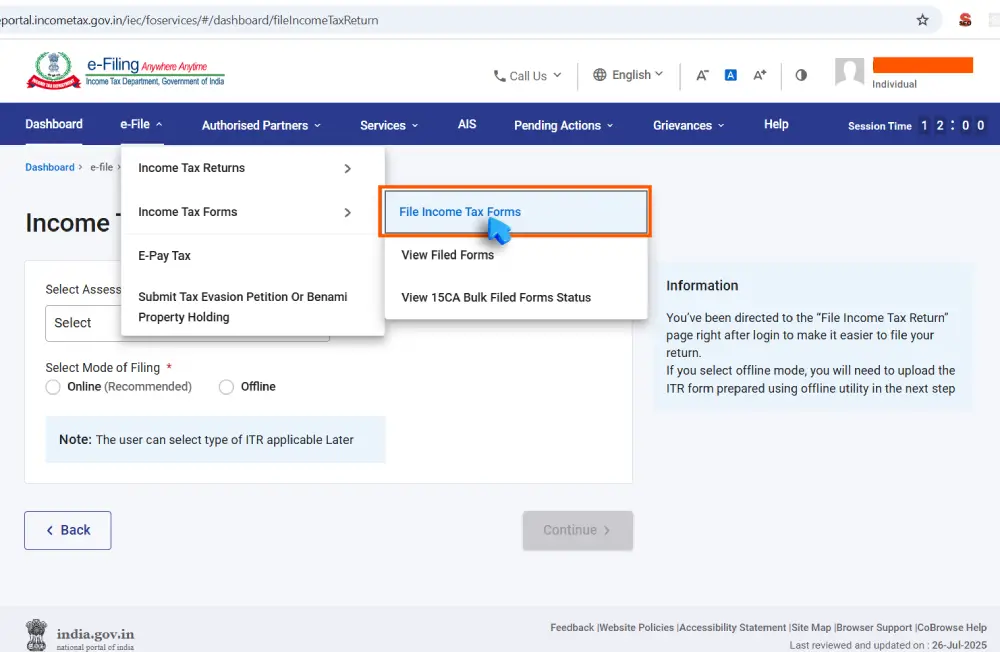

- Navigate to e-File → Income Tax Forms → File Income Tax Forms

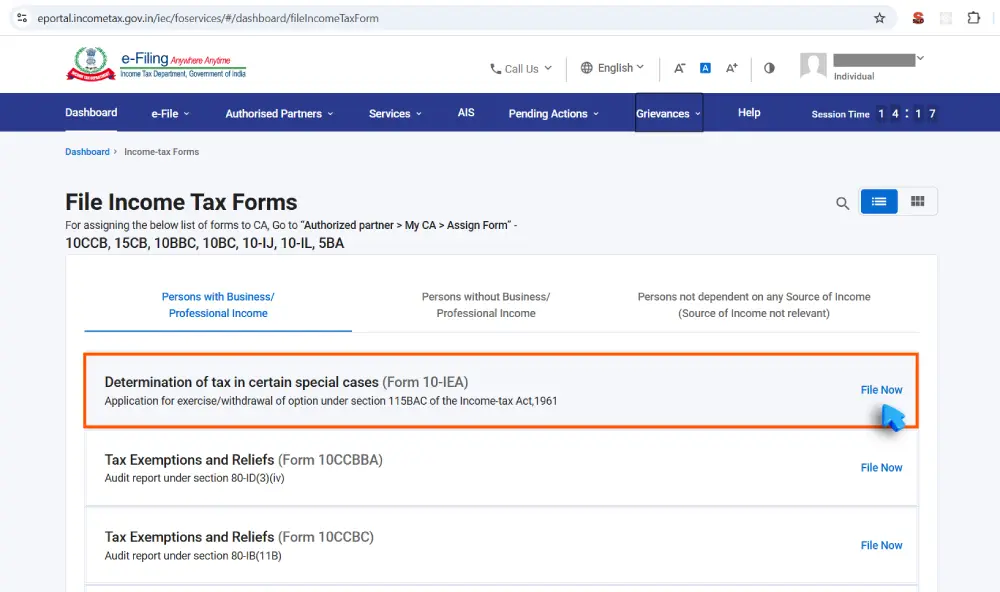

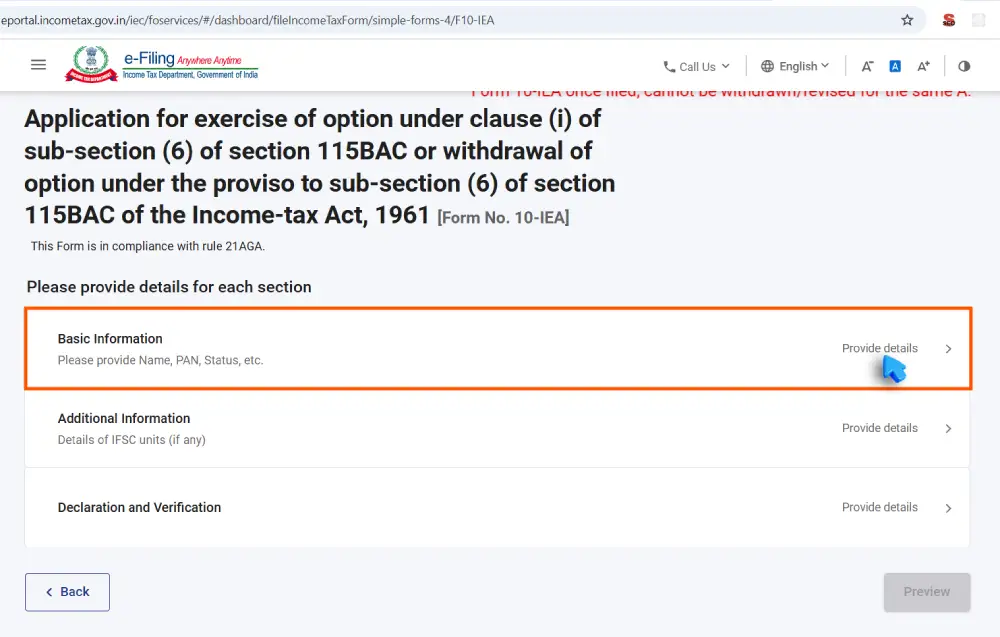

Step 2: Form Selection

- Search and select “Form 10-IEA”

- Choose Assessment Year: 2025-26 (for FY 2024-25)

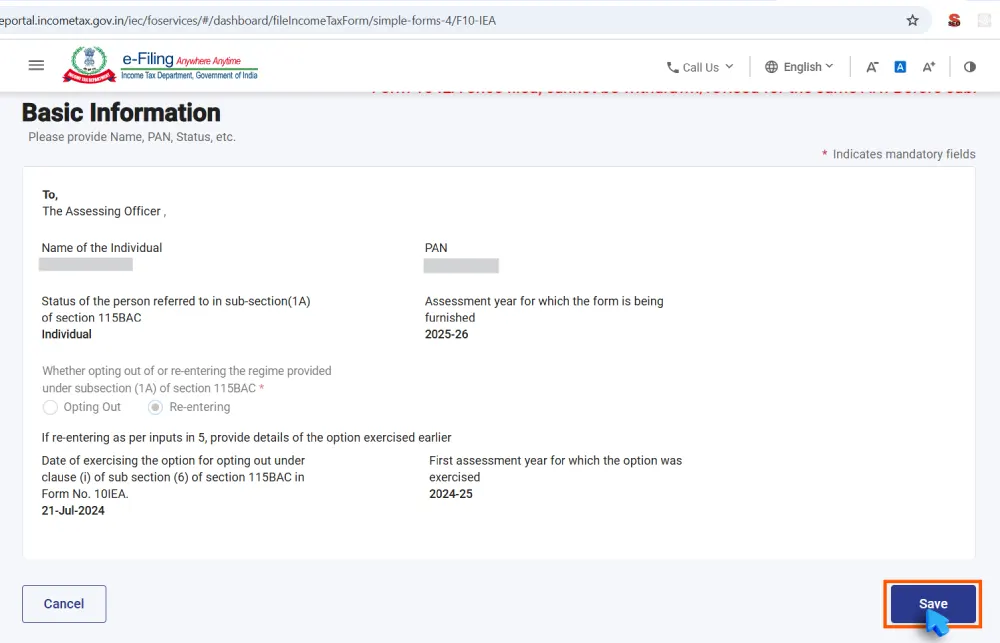

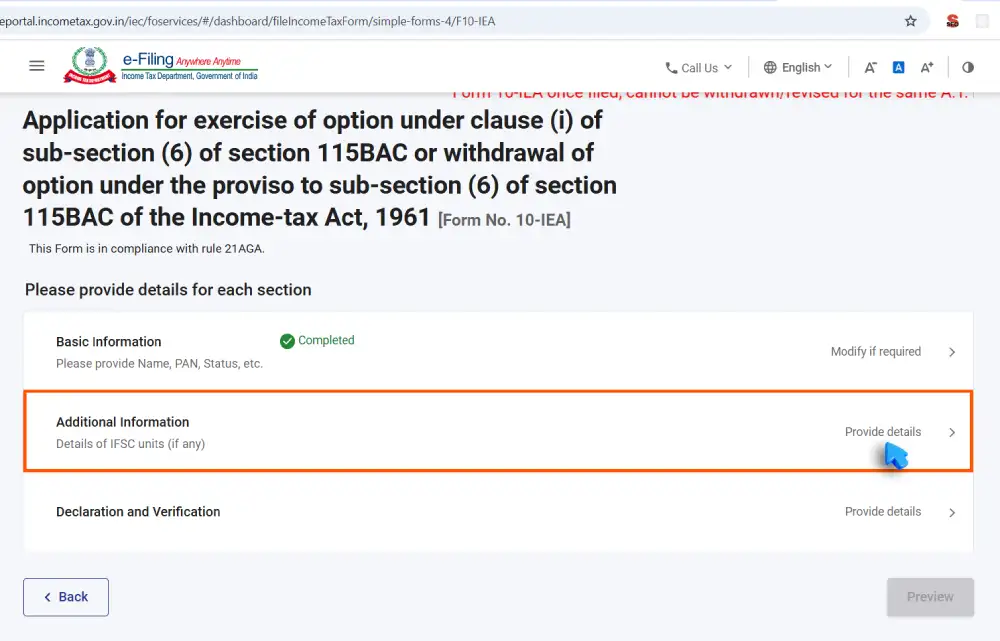

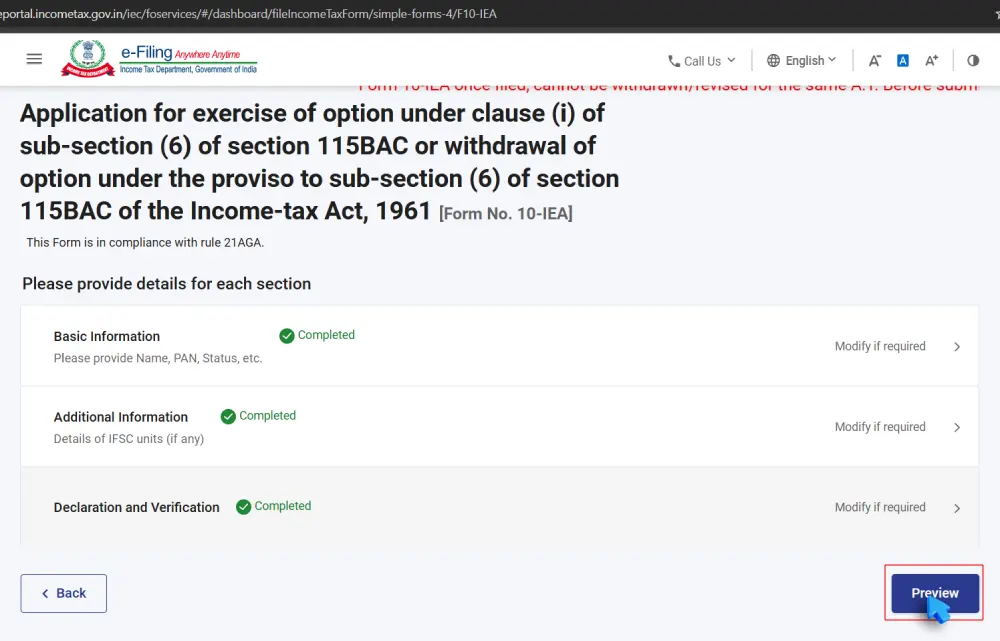

Step 3: Form Completion

- Part A: Basic information (auto-populated from PAN database)

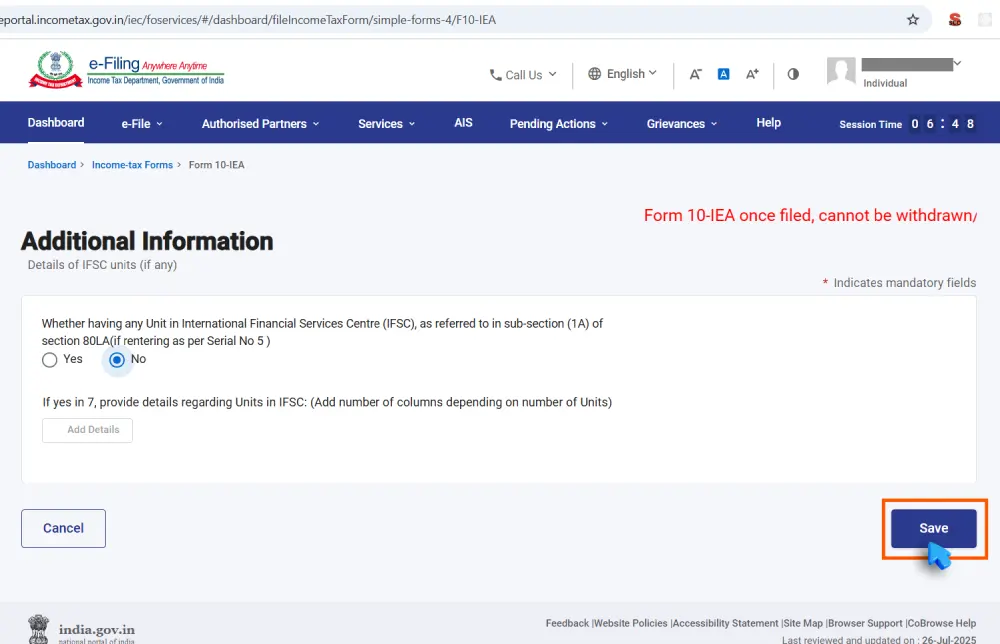

- Part B: Additional information for International Financial Services Centre (IFSC) units (if applicable)

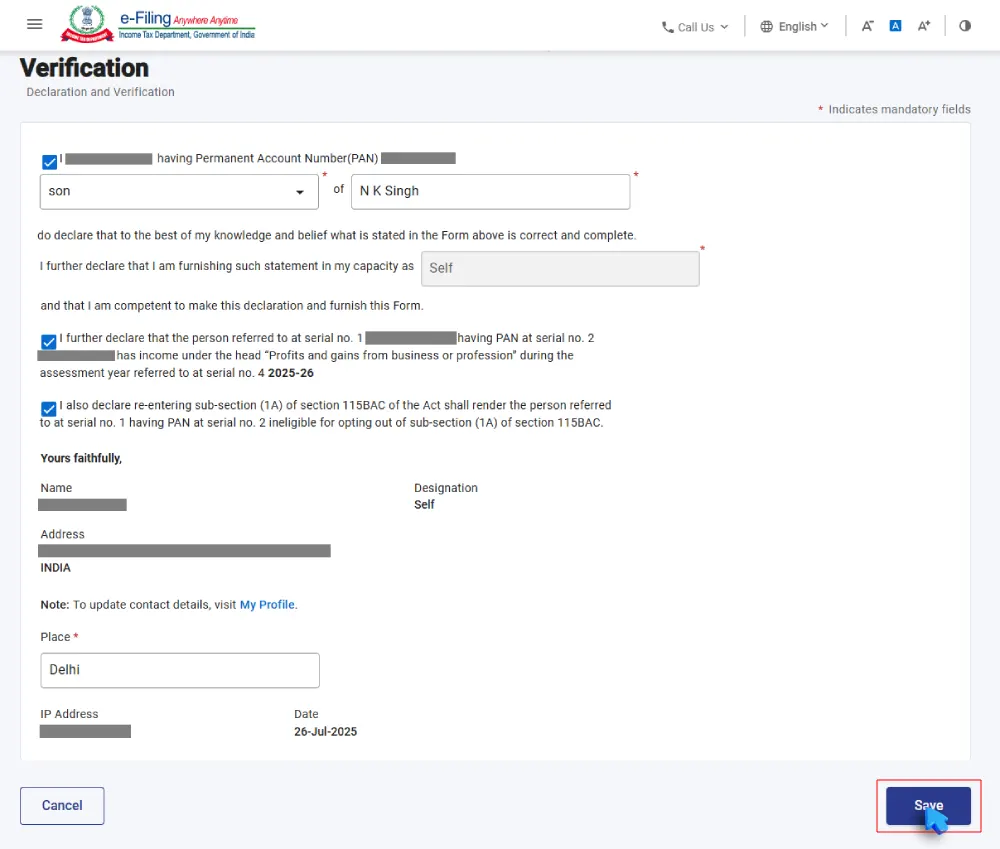

- Part C: Verification and declaration

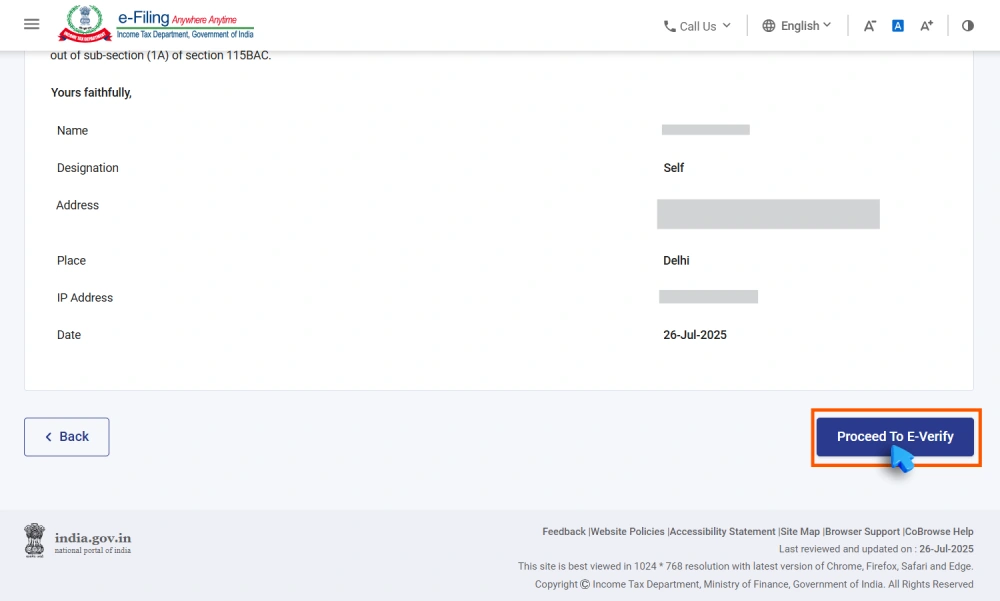

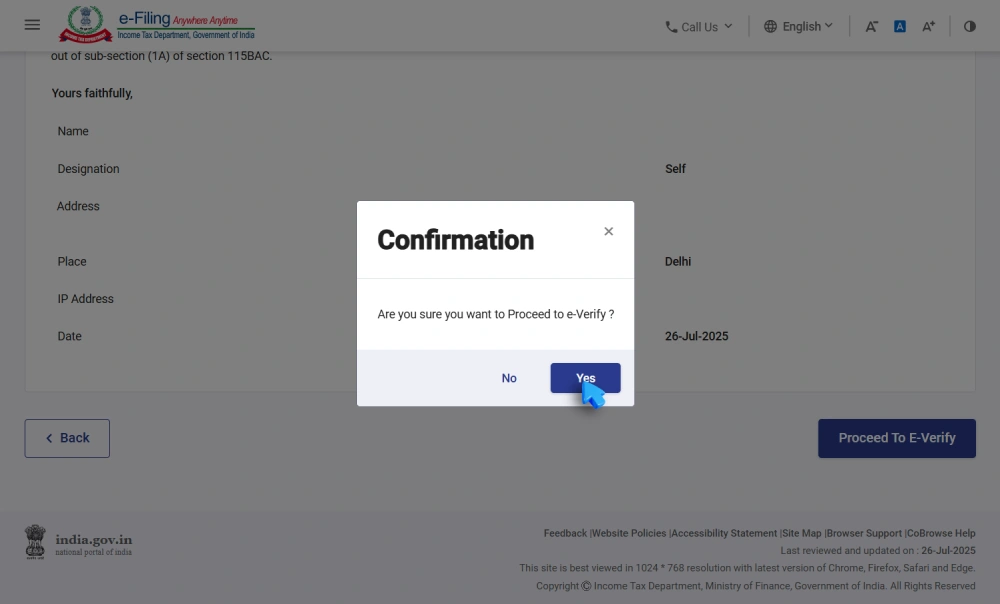

Step 4: Verification and Submission

- Review all entries carefully

- Choose e-verification method (Aadhaar OTP/DSC/EVC)

- Submit and download the acknowledgement

Conclusion

Form 10-IEA provides Indian entrepreneurs and professionals a crucial opportunity to optimise their tax strategy for FY 2024-25. Given the lifetime limitation on switching for business income holders, this decision requires careful consideration of your investment patterns and financial goals. Don’t wait—review your eligibility today and file Form 10-IEA before September 15, 2025 (for non-audit cases) to preserve access to valuable deductions under the traditional tax regime. The choice you make now will impact your tax planning for years to come.