What is the meaning of Wholly Owned Subsidiary Company in India?

Overview : The number of Foreign companies looking to tap into the Indian market has shot up dramatically in recent years due to its growth rate and anticipation of experts on its scope of growth in future. Wholly owned subsidiaries are one of the hottest ways to step into businesses/industries of a foreign country. This simple guide on ‘What is Wholly Owned Subsidiary’ provides you with a comprehensive and clear understanding of all essentials of a wholly owned subsidiary company in India.

India is a fast-growing economy and is anticipated to grow at an even better pace in the years to come. Due to this, the inclination of foreign nationals/corporations toward Indian business sectors has increased. It can simply be determined by comparing the number of foreign companies invested in Indian businesses in the last five years.

The comparison will provide you with clear statistics on how rapidly the interest of foreign investors increased in the Indian industries. As per their intent regarding setting up a company, either a private limited or public company structure can be chosen. Foreign nationals like to opt for a wholly-owned subsidiary in India. Learn about what is the meaning of a wholly owned subsidiary in India and some important aspects including considering factors before setting up and pros and cons of a wholly owned subsidiary.

What is the meaning of Wholly Owned Subsidiary company in India?

A wholly-owned subsidiary is a separate legal entity that is completely (100%) owned and controlled by another company called Parent Company. The purpose of establishing a wholly-owned subsidiary is to diversify the parent company’s business operations and to foray into a new market. There are numerous advantages of a wholly-owned subsidiary including easier management, enhanced brand recognition, instilling trust and henceforth building better relationships with customers and investors.

According to the Companies Act 2013, a company will be referred to as a Wholly Owned Subsidiary when all the shares are owned by another company. In most cases, a wholly-owned subsidiary is located in a country other than that of the parent company’s origin country.

A subsidiary is more likely to have its own executive structure, products, and of course customers. In fact, a subsidiary may be a medium for a parent company to diversify its work portfolio and thus, carry out operations in different geographical areas (i.e. a different country), markets, or even a separate sector.

Examples of Wholly Owned Subsidiary Companies

When it comes to the examples for wholly owned subsidiary in India and overseas, a few well-known examples are listed below;

| Reliance Industrial Management and Holding Limited (RIHL) is a wholly-owned subsidiary of the Reliance Group of Company. | Concorde Motors India Ltd. (CMIL), Tata Motors Insurance Broking and Advisory Services Limited (TMIBASL) are a wholly-owned subsidiary of Tata Motors. | The World Popular Marvel Entertainment, the world-known Superheroes movies producer and EDL Holding Company LLC is a wholly-owned subsidiary of Walt Disney Entertainment. | One of the leading Automobile Brands, Volkswagen Group of America, Inc. including luxurious automotive brands Audi, Bugatti, Lamborghini, Bentley, and Volkswagen, is a wholly-owned subsidiary of Volkswagen AG. |

Key Points to Consider Before Setting up a Wholly Owned Subsidiary

The companies or business people must be completely aware of some fundamental terms related to WOS before setting up a wholly-owned subsidiary in India. Those key terms are described below;

1. Unique Name

The proposed name of the wholly owned subsidiary should be unique and should not be similar to any existing Company or LLP name. In case, a subsidiary wants to have the name of the parent company, all it needs to do is seek an NOC from the parent company for using its name.

2. Directors

Director is an individual who is appointed to the Board of a Company and In general, at least 2 directors are required to register your business as a private limited company and at least 3 directors for registering a public limited company. In a public limited company, at least one of the directors must be an Indian resident. A director is an individual appointed to the Board of a Company who is entrusted with taking care of all day-to-day activities of the company.

3. Share Capital of the Company

Share Capital of the Company is classified into four sections i.e. Authorized Share Capital, Issued Share Capital, Subscribed Share Capital, and Paid-up Share Capital.

Authorized Share capital means such capital that is authorized by the MOA of a company to be the maximum amount of share capital the company can raise.

Issued Share Capital is such capital as the company issues from time to time for subscription.

Subscribed Share Capital is the kind of capital that is subscribed till date by the members of the company.

Paid-up Share Capital is the aggregate amount of money received by the company when it sells shares to the shareholders and investors. In simple words, it is the amount that the investors pay to the company in return for buying shares in the company.

4. Subscriber

A subscriber is an individual who has agreed to subscribe to the share capital of the company and on its registration, whose name is entered as a member in the Register of Members. At least 2 subscribers are required to incorporate a private limited company and at least 7 subscribers are required for the incorporation of a Public Limited Company. Subscribers can be an Indian resident or a foreigner. There is no restriction on a subscriber of a private limited company to be appointed as a director in the same company or vice-versa.

5. Registered Office

Every company in India must have a registered office address to carry out each formal communication by receiving, sending, and acknowledging notices addressed to it. The Registered office address of the company must belong to a valid location in India.

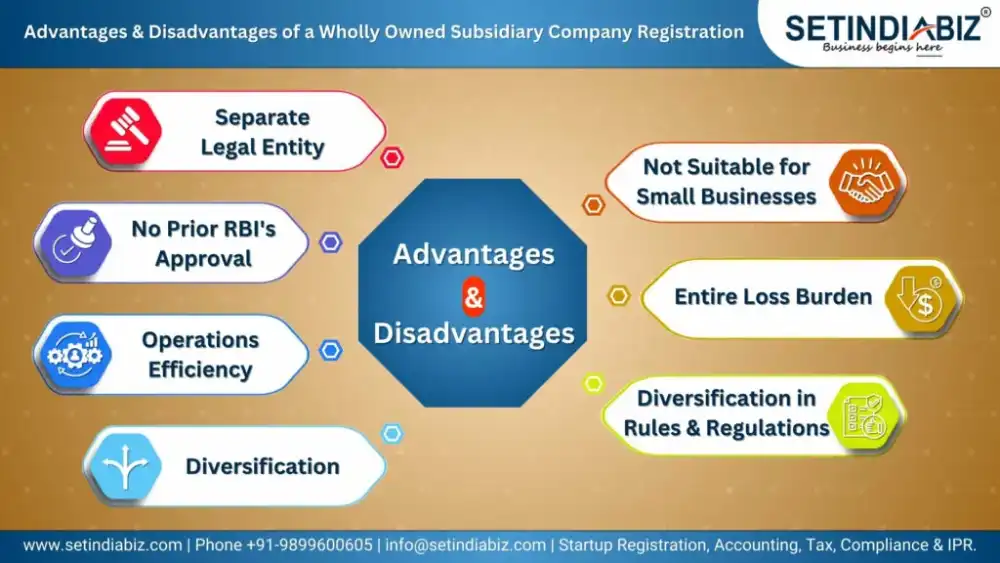

Advantages & Disadvantages of a Wholly Owned Subsidiary Company Registration

Some advantages of wholly owned Subsidiary registration go as;

Some advantages of a Subsidiary Company Registration go as;

1. Separate Legal Entity

In a wholly-owned company structure in India, the company and its members have separate legal identities. Moreover, a subsidiary has to handle all its operations on its own, separate from its parent company.

2. No Prior RBI's Approval

No prior RBI approval is required for incorporating a wholly owned subsidiary if the subsidiary company is related to the sectors where 100% FDI is allowed under the automatic route.

3. Operations Efficiency

It may enable a parent organization to achieve operational efficiency by splitting a larger company into smaller, more easily manageable subsidiary companies.

4. Diversification

Subsidiary companies have ample opportunities to expand their business i.e. adding more investors to business ventures, possible joint ventures to invest in the company, and acquisition of any business in the coming time, etc.

Some of the disadvantages of establishing a wholly-owned subsidiary are as follows;

Some of the disadvantages of establishing a wholly-owned subsidiary are as follows;

1. Not Suitable for Small Businesses

The parent company has to invest 100% of its equity in foreign subsidiaries to wholly own it. Small and medium-sized companies have financial restrictions due to which owning a wholly-owned subsidiary can create a troublesome situation and even may interrupt their existing business operations, putting them in a situation where they won’t be able to revive their business.

2. Entire Loss Burden

As the parent firm owns 100 percent of the foreign company, it has to suffer the entire loss of its Indian wholly-owned subsidiary.

3. Diversification in Rules & Regulations

Since every country has its own specific rules and regulations related to setting up and conducting business. In the absence of familiarity with a foreign country’s rules and regulations dedicated to conducting businesses, it can be quite challenging to manage a wholly-owned foreign subsidiary.

Conclusion

Setting up a wholly-owned subsidiary in India has its own pros and cons. However, gaining a thorough knowledge of different aspects of a wholly owned subsidiary can help corporations make the most of it and minimize the disadvantages of this subsidiary. Hopefully, the blog clarifies what is a wholly-owned subsidiary and why it has become a popular business structure in India!

FAQ's

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.