Remuneration to Partners in LLP – Limited Liability Partnership

Overview : Limited Liability Partnership (LLP) is gaining more popularity among some elite professionals as it offers combined benefits of both a partnership firm and a company such as limited liability and management related flexibility, etc. Like other business structures, LLPs also have a few drawbacks i.e. distribution of remuneration to partners in LLP and a few other factors that play a significant role in determining compensation. Dive into those key factors including maximum remuneration paid to partners LLP with this guide.

LLPs have become a popular business structure among professionals such as lawyers, accountants, and consultants due to the plethora of benefits they offer, such as limited liability protection akin to corporations and flexibility in management akin to Partnership Firms. One of the major challenges faced by LLPs is determining the remuneration to partners and the various factors which can impact its compensation. Understanding the nuances of remuneration is extremely crucial!

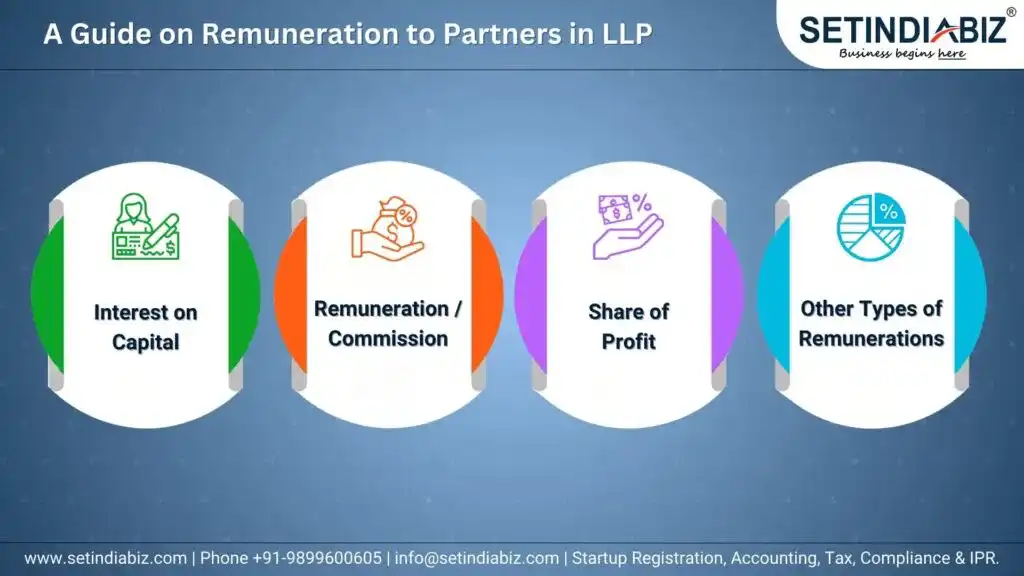

A Guide on Remuneration to Partners in LLP

In an LLP, partners are typically compensated for their contributions to the business in various ways. These can include interest on capital, remuneration or commission, and a share in the profits. Each type of compensation has its own advantages, depending upon the partner’s level of involvement and the financial performance of the LLP. We have discussed all the types of LLP remunerations received by the partners of a Limited Liability Partnership in detail below:

1. Interest on Capital

Interest on capital is a type of remuneration paid to partners based on their capital contribution to the LLP. It is different from profit sharing in that it is not linked to the overall profitability of the business. Partners receive interest on their capital regardless of whether the LLP makes a profit or not.

Interest on capital is typically calculated as a percentage of the capital contribution and is paid out annually or at regular intervals as specified in the LLP agreement. The percentage can be fixed or variable, depending on the LLP’s financial performance. Interest on capital might be a preferred type of remuneration for partners who want a steady income stream from their investment in the LLP. It can also be useful in situations where the LLP is in its early stages and not yet profitable, as it allows partners to earn a return on their investment even in the absence of profits.

The LLP Agreement is a legal document that outlines the terms and conditions of a Limited Liability Partnership, including the interest rate payable to partners on their capital investments. Section 40b of the Income Tax Act regulates the maximum amount of interest and salary that a LLP can pay to a partner.

The interest rate specified in the LLP Agreement must be paid out of earnings, and any amount over 12% per annum is not deductible. The LLP Agreement must also specify the method of calculating compensation for partners, which can only be deducted from taxes if the agreement specifies the compensation amount or the calculation method.

2. Remuneration / Commission

Remuneration or commission is a type of remuneration paid to partners for the professional services they offer to the LLP. It is different from interest on capital and profit sharing in terms that it is neither linked to the partner’s capital contribution nor to the overall profitability of the business. It is wholly dependent on the professional services that the partners offer.

Remuneration or commission is typically calculated as a percentage of the LLP’s revenue or profit and is paid out annually or at regular intervals as specified in the LLP agreement. The percentage can be fixed or variable, depending on the LLP’s financial performance.

Remuneration or commission might be a preferred type of LLP remuneration for partners who are actively involved in the day-to-day operations of the LLP and want to be compensated for their time and effort. It can also be useful in situations where partners have different levels of capital contributions and want to ensure that they are compensated fairly based on their contributions to the business.

3. Share of Profit

A share of profit is a type of llp remuneration paid to partners based on their ownership percentage in the LLP. It is different from interest on capital and remuneration/commission in that it is directly linked to the overall profitability of the business. A share of profit is typically calculated as a percentage of the LLP’s net profit and is paid out annually or at regular intervals as specified in the partnership agreement. The percentage can be fixed or variable, depending on the LLP’s financial performance.

A share of profit might be a preferred type of LLP remuneration for partners who want to share in the LLP’s financial success and be compensated based on their ownership stake in the business. It can also be useful in situations where partners have equal capital contributions and want to ensure that they are compensated fairly based on their ownership percentage.

4. Other Types of Remunerations

In addition to interest on capital, remuneration/commission, and share of profit, LLPs may also use other types of llp remuneration for partners such as bonuses. Bonuses are typically paid out to partners based on specific achievements or milestones, such as meeting sales targets or completing a major project. They can be in the form of cash or non-cash incentives, such as gift cards or trips.

Can LLP Give Remuneration To Partners?

Yes, LLPs are allowed to provide remuneration to their partners for their contributions to the business. However, not all partners are eligible to receive remuneration. The LLP agreement is bound to outline the eligibility criteria for partners to receive remuneration, which typically includes factors such as the partner’s capital contribution to the LLP, their role and responsibilities within the partnership, their professional performance, and the financial performance of the LLP.

Partners who have made a higher capital contribution to the LLP may be eligible to receive a larger share of the profits. Similarly, partners who hold leadership roles or contribute significant value to the partnership’s success may be eligible for a larger remuneration package. However, it’s important to note that remuneration in an LLP is not solely based on the partner’s role or capital contribution. The LLP agreement may also take into account factors such as the partner’s experience, skills, and professional performance as well.

In addition, the LLP agreement may also outline the process for determining remuneration. This may include the establishment of a remuneration committee or an independent appraisal process to ensure that remuneration decisions are fair and transparent.

Overall, while LLPs are allowed to provide remuneration to partners, eligibility for remuneration is typically based on a combination of factors, including the partner’s capital contribution, roles and responsibilities, and professional performance. It’s essential for partners to review their LLP agreement carefully to understand how remuneration is determined and what factors may impact their eligibility to receive it.

What is The Rule For Remuneration To Partners?

The rule for LLP remuneration to partners is governed by the Limited Liability Partnership Act of 2008. According to the Act, the LLP can pay remuneration to its partners in the form of LLP salary, bonus, commission, interest, and so on, subject to the provisions mentioned in the LLP agreement to its partners. If no such provisions are mentioned in the Agreement, none of the partners will be entitled to llp remuneration for their involvement in the business or management of the LLP, according to the First Schedule of the LLP Act.

LLP Agreement: The LLP agreement must clearly outline the type of remunerations partners can receive, the basis and method of calculating such remuneration, specifying whether the LLP remuneration to partners is fixed or may vary conditionally, and finally, the maximum remuneration that partners can receive in an LLP. You must note that LLP remuneration to partners cannot be paid in the breach of the LLP Agreement.

Consent of all Partners and Designated Partners: Furthermore, the Act requires that remuneration to partners must be approved by all the other partners and designated partners of the LLP. The designated partners are partners responsible for managing the affairs of the LLP and authorized to make decisions related to the LLP’s day to day operations, and internal management.

Taxation & Remuneration: The LLP remuneration paid to the partners is treated as a business expense of the LLP, and it is deductible from the taxable income of the LLP, subject to certain conditions. We will discuss these conditions later in this blog. However, the partners are required to pay tax on the remuneration received under Section 28 of the Income Tax Act, as it is treated as their income earned from the LLP.

TDS Deductions: Partners must pay tax on any remuneration received from the LLP, and the LLP must deduct tax at source on the remuneration paid to partners, as per Section 194 A of Income Tax Act, 1961. The current rate of TDS on partners remuneration in LLP paid is 10% if the total amount of such remuneration paid or likely to be paid during the financial year exceeds Rs. 5,000. However, if the recipient does not provide his or her PAN during the deduction, the TDS rate applicable on partners remuneration would be as high as 20%.

Secondly, Section 15 of the Income Tax Act, 1961 states that, any salary, bonus, commission or remuneration, by whatever name called, due to or, received by a partner of a firm from the firm shall not be regarded as “Salary”. So, Section 192 of the Income Tax Act will not be applicable for the purpose.

Under What Conditions is Remuneration Paid to The Partners Under Income Tax Act?

Under the Act of Income Tax remuneration to partners can be paid and deductions can be claimed by the LLP, only if:

- the remuneration is being paid to a working partner

- the payment of remuneration does not breach any provisions of the LLP Agreement

- the amount of remuneration paid or to be paid is within the limits prescribed under the Income Tax Act. The Income Tax Act prescribes a maximum limit of 90% of book profit or Rs.1,50,000, whichever is more, for the first 3 lakhs of book profit or loss, and for the balance, an amount worth 60% of book profit or loss, in a particular financial year. We will understand this better with an example in the next section.

- if the remuneration paid is an interest on capital contribution of the partner, and does not exceed an amount greater than 12% of the contribution, and

- the remuneration is not a share of the profit of the LLP, as tax on share of profit is completely exempted for the LLP under Section 10(2A) of the Income Tax Act.

How to Calculate Income Tax Deductible on Remuneration to Partners With Example?

As already mentioned before, the Income Tax Act prescribes a maximum remuneration to partners in LLP for claiming deductions. This limit is calculated on the basis of book profit of the LLP in a financial year.

To be precise, it is 30% of the book profit or Rs.1,50,000, whichever is more, for the first 3 lakhs, added to 60% of the book profit for the balance. Let us understand this with the help of a few examples!

Illustration 1:

Let us suppose that the Book Profit of the LLP for financial year 2020-21 is Rs. 8 lakhs. So, to calculate the limit to claim a deduction on the remuneration paid to the partners in the same financial year, we will have to first find out what is 90% of 3 lakhs.

- 90% of Rs.3 Lakhs = Rs 2,70,000

- Clearly, this amount is more than Rs.1,50,000.

- So, for the first Rs.3 Lakhs, the limit of Rs.2,70,000 will be considered.

- But the Book Profit is 8 Lakhs.

- So, for the balance Rs.5 Lakhs of book profit, we will find its 60%.

- 60% of Rs.5 Lakhs = Rs.3,00,000

- Lastly, we will sum up the two, to get the maximum limit to claim deduction.

- Rs.2,70,000 + Rs.3,00,000 = Rs.5,70,000

This means that the concerned LLP can claim deduction for the remuneration it has paid to the partners, only if the amount of such remuneration is up to Rs.5,70,000. No deduction can be claimed by the LLP, under the Income Tax Act, for any amount beyond this.

Illustration 2:

This time let us suppose that the book profit is Rs.2 Lakhs for the financial year 2021-22. So, to calculate the limit to claim a deduction on the remuneration paid to the partners in the same financial year, we will have to first find out what is 90% of 2 lakhs.

- 90% of Rs.2 Lakhs = Rs 1,80,000

- Clearly, this amount is greater than Rs.1,50,000.

- And since, there is no balance left, as the amount does not exceed Rs. 3 Lakhs, the maximum limit to claim deduction will be Rs, 1,80,000 only.

This means that the concerned LLP can claim deduction for the remuneration it has paid to the partners, only if the amount of such remuneration is up to Rs.1,80,000. No deduction can be claimed by the LLP, under the Income Tax Act, for any amount beyond this.

Illustration 3:

Now, let us suppose that the book profit is Rs.50,000 for the financial year 2022-23. So, to calculate the limit to claim a deduction on the remuneration paid to the partners in the same financial year, we will have to first find out what is 90% of 50,000.

- 90% of Rs.50,000 = Rs 45,000

- Clearly, this amount is less than Rs.1,50,000.

- So, the maximum limit to claim deduction will be Rs.1,50,000, according to the rules of calculation we had discussed above.

This means that the concerned LLP can claim deduction for the remuneration it has paid to the partners, only if the amount of such remuneration is up to Rs.1,50,000. No deduction can be claimed by the LLP, under the Income Tax Act, for any amount beyond this.

Note: In case the LLP is having Zero Profit or Loss in a particular financial year then the partner remuneration as per Income Tax Act cannot exceed Rs. 1,50,000.

Conclusion

In conclusion, LLP remuneration to partners is an important aspect that needs to be considered while setting up an LLP or formulating an LLP agreement. While partners are entitled to a share in the profits of the LLP, there are legal provisions that govern the payment of other kinds of remuneration to partners in LLP. It is advisable for LLPs to seek professional advice and ensure that their LLP remuneration to partners policies are in line with the applicable laws and regulations.

FAQ's

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.