Convert Private Limited into One Person Company

Overview : The conversion of a private limited into One Person Company (OPC) is allowed as per the Companies Act, 2013, which provides a mechanism to convert one class of company into another.

Section 18 of the Act, explicitly provides for the conversion of an already registered private limited company with effect from 1-4-2014. Therefore, a private limited company can be converted into the one person company by following the procedures prescribed under the Act and the rules, however subject to following conditions.

- That the paid-up capital of the company is less than Rs. 50 Lacs

- That the annual turnover of the company must be less than Rs. 2 crores during the past three consecutive financial years. In case the company is new and have not completed three years, then the turnover shall be reckoned from the date of its incorporation.

- That the shareholder of the resulting OPC shall be only one Natural Individual having Indian nationality.

- That the shareholder of the OPC must be a resident person, a person becomes a resident if he stays for 180 days in India during immediately preceding one calendar year.

- The shareholder of the Resulting OPC must not have incorporated any other OPC, or he is not a nominee of any other OPC.

- A minor cannot be a member or nominee of an OPC

AThe conversion of the private limited company into OPC shall not affect the liabilities, and contractual obligations entered, by the company before conversion & such debts, liabilities, obligations shall be enforceable in law as if no such conversion has taken place and the resulting OPC shall be liable for them.

Checklist Before Proceeding With The Conversion

| S.No. | Check List Item |

|---|---|

| 1. | That the company have properly maintained its book of account and the Balance Sheet and Proft& Loss A/c is prepared and audited |

| 2. | Company have filed all ROC Returns |

| 3. | Company have paid requisite stamp on issue of share certificate and that the share certificates are duly franked or endorsed with the payment of stamp duty |

| 4. | The company have paid all TDS deducted and filed appropriate TDS Returns |

| 5. | The company have paid Vat and Service Tax or GST and filed appropriate returns for all periods before commencing the conversion |

| 6. | That the company is maintaining proper record of minutes of the meeting of its board and shareholders and keep updated registers at its registered office. |

| 7. | That company has obtained registration under shops of establishment act of relevant state, where they maintain offices, shops, warehouse, etc. |

| 8. | That the company has obtained and complied with the provisions of the professional tax, if applicable in the state where the registered office of the company is situated and the states in which it has employees. |

| 9. | That the company has obtained registration under PF in case, the number of employees is more than 20 and with ESIC if the number of employees is more than 10 and that it is filing monthly returns and paying dues as required under PF and ESIC. |

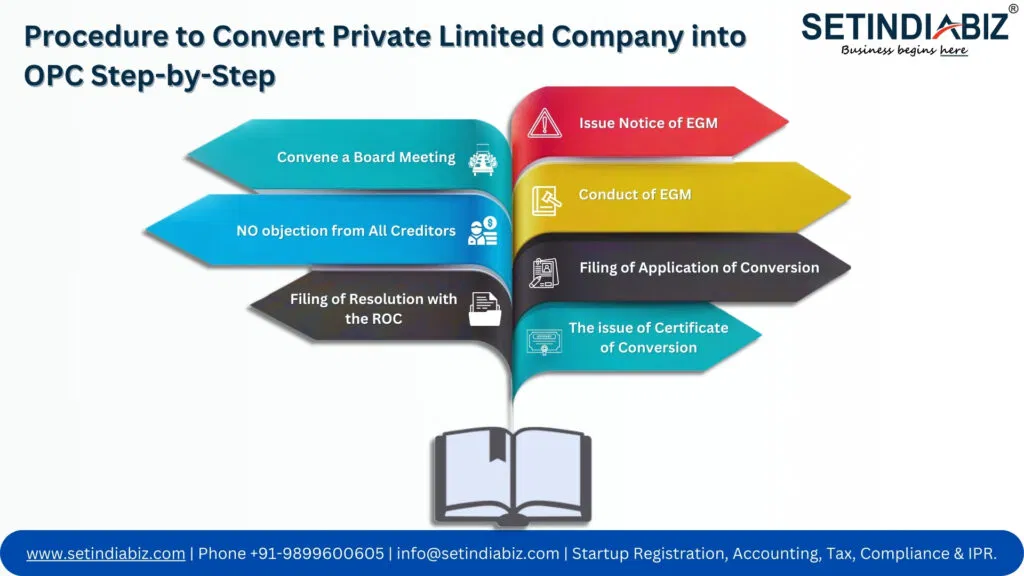

Procedure to Convert Private Limited Company into OPC Step-by-Step

- Convene a Board Meeting: The directors of the company must meet and take a decision on conversion and fix a date for calling the meeting of the shareholders (Extra Ordinary General Meeting). Notice to the shareholders need to be drafted along with draft resolution, to be passed as special resolution to be adopted by the shareholder concerning the conversion of private limited to OPC.

- Issue Notice of EGM: The notice of the EGM is required to be issued to all the members, directors and auditors of the company. The date of issue of notice must be 21 days before the date of EGM. Along with the notice, the agenda, draft resolution to be passed as a special resolution and an explanatory statement shall be enclosed.

- NO objection from All Creditors: Before the date of EGM, the consent in the form of a No Objection Certificate from of all the creditors of the company is necessary to be obtained. A copy of the consent of the creditors is to be placed before the EGM.

- Conduct of EGM: The EGM must be conducted as per the notice, on the designated date, time and place. The EGM shall pass the special resolution concerning the conversion & also approval of altered MOA & AOA (A resolution is said to SPECIAL RESOLUTION if it is adopted by 75% of the members present and eligible to vote)

- Filing of Resolution with the ROC: As per companies Act, 2013 all the resolution passed as a special resolution by the members must be filed with the ROC in Form No MGT-14, along with prescribed attachments within 30 days from its date of passing. After approval of the MGT-14, the ROC takes the resolution on its record.

- Filing of Application of Conversion: After completion of steps mentioned above application for conversion is filed in Form – INC-6 with following attachments

- A declaration in the form of an affidavit by all the directors that all members and creditors of the company have given consent to conversion of company into an OPC, and that the paid-up capital of the company is less than 50 lacs and that the turnover is less than two crores

- Affidavits from the members confirming the paid-up capital being less than 50 lacs and the average turnover are less than two crores in the past three consecutive financial years.

- A certificate from a practicing Chartered Accountant to confirm that the paid-up capital of the company is less than 50 lac and that the turnover is less than two crores.

- The latest audited profit and loss account and balance sheet of the company

- No objection / Consent of all the creditors

- List of members and directors of the company

- Copy of Board Resolution and the special resolution passed at the EGM, along with its notices, agenda and explanatory statement

- Altered copy of MOA and AOA, incorporating relevant clauses necessary for OPC.

- The issue of Certificate of Conversion: On receipt of the application for conversion, the Registrar of Companies having jurisdiction scrutinize the application and if found complete and proper approves the form and issues a certificate of Private Limited Company into One Person Company.

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.