What is Web Based Director KYC, Its Applicability and Process?

Overview : DIR-3 KYC Web service form was introduced by the Ministry of Corporate Affairs (MCA) to allow individuals holding DIN with ‘Approved’ status, to validate their existing annual KYC credentials. Taking an insight into the essentials of DIR3 Web KYC, including applicability, process, etc., can help file the annual KYC of directors easily. The blog provides you with a better know-how of the essentials of director KYC Web Form or dir 3 web KYC.

DIR 3 KYC web form is an online form introduced to allow DIN Holders to verify their KYC details under Rule 12A of the Companies Act (Appointment & Qualification of Directors) Rules, 2014. An individual who has obtained a DIN before 31st March of a financial year is required to submit this form on or before the due date of each financial year. It helps them in verifying and confirming their existing KYC details in the MCA21 database.

In simple words, this online KYC form allows a DIN holder to verify his pre-submitted KYC information only; not any kind of update in the database. It was especially introduced to those directors whose KYC information has remained unchanged from its last annual KYC filing.

On the other hand, those DIN holders whose KYC details have changed from their last submission can use DIR 3 KYC form to update their KYC details submitted to ROC. This bifurcation of KYC forms was a part of the government’s move towards reducing entrepreneurs’ compliance burden.

Applicability of Web based director kyc or DIR 3 KYC Web

The main purpose of Form DIR 3 KYC Web is to simplify process of verification of kyc for directors. Submitting this form is mandatory for those directors who have got a DIN on or before the end of the financial year. This form can be accessed and submitted through the MCA’s portal. This form helps MCA to have accurate and latest information of directors in their records which can be accessed by the general public as well.

Key Check Points for filing DIR 3 KYC Web Form

DIN holders who want to file director KYC Web form, should consider various points for successfully submitting this form. Some of those main checkpoints are listed below;

- Please go through necessary instructions and guidelines carefully before filing this KYC web-service form.

- Register your business on the MCA portal.

- Ensure that you have a valid Mobile Number & Email Address against your DIN and they must not be linked with any other DIN.

- Hold a valid DIN whose status is ‘Approved’, ‘Disqualified’ or ‘Deactivated’ due to non-filing of DIR 3 KYC web form. If DIN status is deactivated, you are allowed to submit a web-service form only in case of ‘Non-filing of KYC in DIR 3 KYC.

- Make sure that you have filed DIR 3 KYC eForm at least once against your DIN in any of the last financial year.

- Don’t forget to verify OTP entered for the mobile number and email ID.

- No fee is applicable to filing DIR 3 KYC web form if you file it before 30th September of the next financial year of obtaining DIN.

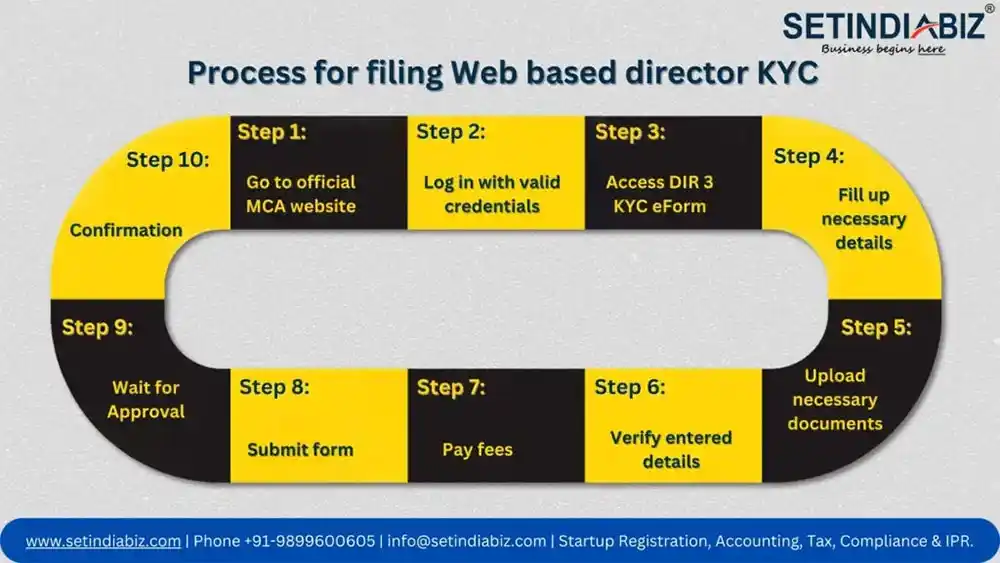

Process for filing Web based director KYC

Following a specific process of filing web based director kyc is necessary to verify director details. The process is divided into some steps so that the directors can easily complete their annual compliance of director kyc verification. The process of web based director kyc filing can be completed by following the below steps;

Step 1. Go to official MCA website: The first step to filing a web based kyc form is to go to the official website of the Ministry of Corporate Affairs (MCA).

Step 2. Log in with valid credentials: Log in to the MCA portal using your login credentials that you have created for filing director e kyc. However, new users have to first sign up to the portal by entering the asked details.

Step 3. Access DIR 3 KYC eForm: Once you are logged in to the portal, search for DIR 3 KYC form under ‘Filings’ section on this portal.

Step 4. Fill up necessary details: Fill in the details as required by the system. This may include basic information such as director identification number (DIN), PAN, Address, Email ID and contact number.

Step 5. Upload necessary documents: Upload the required supportive documents that may be proof of identity, proof of address, PAN Card, and so on. Upload clearly visible documents.

Step 6. Verify entered details: Review closely each information you will enter in the web kyc form. After getting assured, move further to submit the form.

Step 7. Pay fees: Make payment fee if applicable in the form. It may vary from one to another as per their past compliance and other regulations.

Step 8. Submit form: After checking entered details and paying required fees, submit the duly filled form with necessary attachment. On successful submission of the form, an acknowledgement receipt will be sent to your email.

Step 9. Wait for Approval: The MCA will process your submitted form to check and verify the information you have entered. If your provided information and documents are found to be correct, your director kyc web form will be approved.

Step 10. Confirmation: If your dir kyc web form is approved, you will receive confirmation for the same. Collect and keep the copy of the acknowledgement safely for future records.

It’s essential to stay updated with any changes or notifications from the MCA or relevant authorities regarding the filing process or requirements for the DIR-3 KYC e-Form. Additionally, consulting with a legal or financial expert may provide further guidance specific to your situation.

Conclusion

Director KYC is an essential annual compliance that each individual with DIN status ‘approved’ needs to file. Another form, dir 3 KYC Web based allows directors to verify their kyc information who have already filed their director kyc in any previous financial year and no updates in their KYC details have taken place since then.

FAQ's

1.Who may need to submit an DIR-3 KYC eForm?

2.Who is needed to file KYC through the DIR-3 KYC web-service?

3.Is it obligatory to enter a unique mobile number and email ID while filing form DIR-3 KYC?

4.Do I need to file form DIR 3 KYC if I am a disqualified director?

5.What is the deadline to submit Form DIR-3 KYC?

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.