Navigating the Procedure of Share Transfer to a Non-Resident in a Private Limited Company

Overview :Share transfer to a non-resident in a private limited company has become so common these days due to the increasing impact of globalization. Unlike share transfer to a resident, the process to share transfer to a non-resident involves extensive processes including various legal, legal, compliance and other regulatory requirements. Taking an insight into the share transfer procedure can ensure a faster and smoother transaction in a private limited company.

As many businesses are joining the transnational shift or globalization, the share transfer to non-resident or foreign investors in private limited companies has become increasingly common. However, this process is not as easy as it seems! It involves various legal, regulatory, and procedural steps to ensure compliance as well as a smooth & hassle-free transfer. In this blog, we’ll dive deeper into the procedure of share transfer to a non-resident in a private limited company, highlighting the key steps involved and considerations to keep in mind.

Understanding Share Transfer in a Private Limited Company

In a company, shares refer to the unit of ownership interests, and transferring shares means selling or transferring ownership rights from one party (transferor) to another (the transferee). Share transfer to a resident or non-resident in a private limited company can take place as per the clauses in the Articles of Association (AOA), applicable laws, and regulatory requirements. However, transferring shares to a non-resident involves following relatively more compliances and legal requirements.

Key Parties involved in Share Transfer to a Non-Resident

In private limited companies, the share transfer procedure to a non-resident involves several parties associated with the company. Without the involvement of certain parties, no share transfer can take place effectively. Listed below are the parties that must be primarily involved in this pivotal procedure of share transfer;

- Transferor: The existing shareholder who wants to sell or transfer their shares in the private company to a non-resident.

- Transferee (Non-Resident): A non-resident individual or entity who wants to acquire the shares that are open to sell. This party may be required to comply with several regulatory requirements and present documents to facilitate the share transfer.

- Board of Directors: They play a crucial role in approving the share transfer. They review the transaction and authorize it through a board resolution.

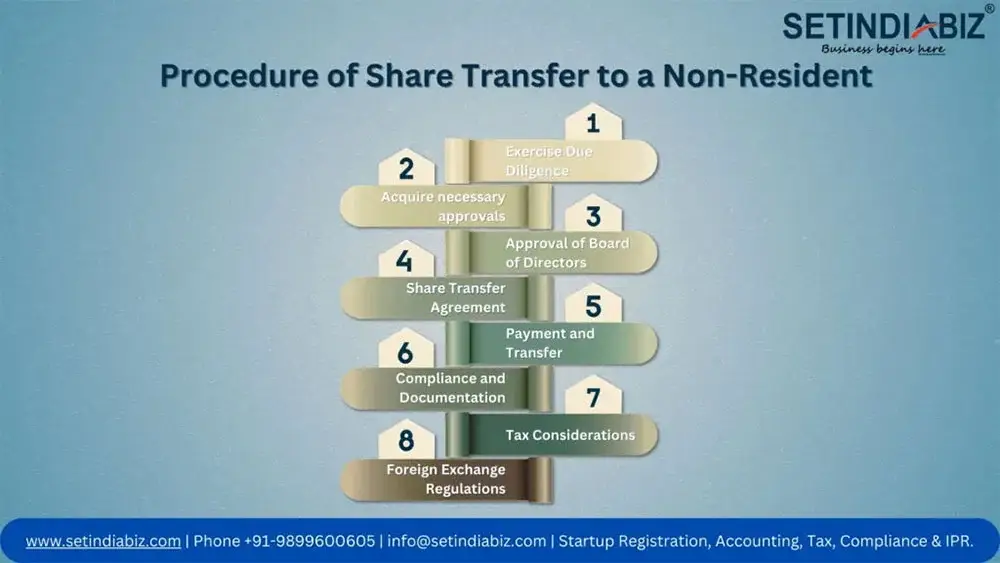

Procedure of Share Transfer to a Non-Resident

Since share transfer to a foreign entity differs from share transfer to a resident, the transfer procedure also varies. As compared to share transfer to a resident, it requires more compliances and regulations to follow. However, practicing certain steps can ensure a seamless transfer. The procedure to share transfer to a non-resident in a pvt ltd company involves the below-listed steps;

- Exercise Due Diligence: It’s always advisable for the transferor as well as the foreign transferee to examine the company’s financial situation, management, legal compliance, and any restrictions on share transfer or vice versa. It helps both parties to determine potential issues or liabilities (loans or debts) associated with the shares.

- Acquire necessary approvals: Before commencing the share transfer process, it’s essential to meet regulatory requirements and seek approvals from the concerned authorities or regulatory authorities. In many jurisdictions, foreign investment regulations govern share transfers to non-residents and therefore, obtaining approvals from such authorities may be a prerequisite. One such essential document is FC-TRS (Foreign Currency Transfer of Shares) which is regulated by the RBI. It is the governing body that is responsible for handling the transfer of shares between residents and non-residents in India. In order to facilitate and enhance the ease of doing business in India, the government took steps to enable the filing of Form FC-TRS through FIRMS (Foreign Investment Report and Management System) which is an online application introduced in the year 2018 by RBI.

- Approval of Board of Directors: In a private limited company, share transfer can’t be initiated until the board of directors approves it. A board resolution authorizing the transfer should be passed, documenting the approval of the transaction.

- Share Transfer Agreement: After obtaining approval from the board and agreeing on the share transfer, both parties must execute a share transfer agreement. This agreement outlines the delineating details of the transaction including the number of shares, price, payment terms, representations, and warranties.

- Payment and Transfer: The non-resident transferee must release the pre-agreed payment for the shares to the transferor. Upon receipt of payment, the transferor transfers the shares to the foreign transferee by endorsing the share certificates and updating the share register of the company.

- Compliance and Documentation: Ensure compliance with all the necessary legal and regulatory requirements pertaining to share transfer to a foreigner. It may include filing necessary documents with regulatory authorities, updating the company’s records, and adhering to any reporting authorities/departments.

- Tax Considerations: Both parties must consider tax implications related to their transaction of share transfer. Tax laws related to capital gains, and foreign investment may apply in such transactions.

- Foreign Exchange Regulations: It’s essential to adhere to the foreign exchange regulations governing the repatriation of funds related to the share transfer. Complying with currency conversion regulations, reporting requirements, and any restrictions on repatriation is necessary.

Conclusion

Share transfer to a non-resident in a private limited company involves following several regulatory compliances, documentation, and a systematic process. By following the aforementioned share transfer procedure including due diligence, and obtaining required approvals, the primary parties (transferor & transferee) can ensure a smooth share transfer process.

FAQ's

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.