Step by Step Process on How to file ITR Online on Tax Portal

Overview : Filing ITR online is essential for you especially if your total annual income exceeds the tax exemption bracket. A taxpayer needs to file their income tax returns every year. Even if an individual whose total income doesn’t fall under the taxable bracket can file ITR online to carry forward their losses, claim refunds, etc. Filing Income tax returns online helps access loans, attract VISA or reap such other benefits easily. Delve into the step by step process of how to file ITR online step by step.

An Income tax return is a form using which a taxpayer can declare his income, expenses, tax deductions, investments, etc. According to the Income Tax Act 1961, it’s mandatory for a taxpayer to file an income tax return under several conditions. Even if one doesn’t fall under the taxable income bracket can file income tax return due to a number of reasons including carrying forward losses, claiming income tax refund, leveraging grant of VISA, loan from banking institutions, etc.

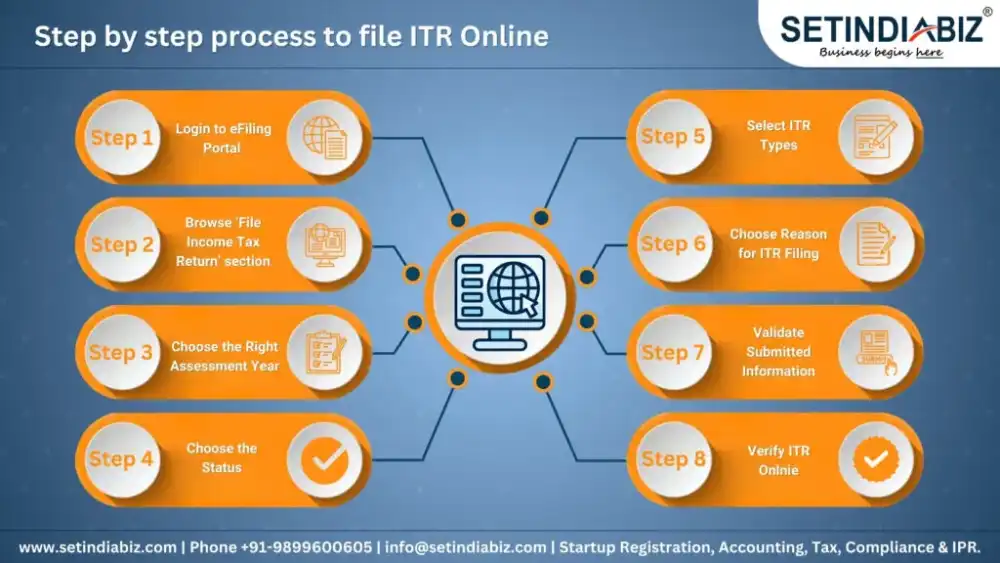

Step-by-step Process of Filing ITR Online

As mentioned above, filing ITR is one of the essential annual returns that taxpayers must file each financial year. Filing ITR returns within the due date is always advisable. It not only helps you fulfill your tax responsibilities but also keep late filing penalties at bay. Learning the process of how to file itr online step by step for filing Income Tax online or ITR Online filing steps can help stay compliant to ITR with no time/location restriction.

Step 1: Login to eFiling Portal

Go to the official Income Tax Portal online and after that click on ‘Login’. On the further page, you are required to submit your PAN credentials in the User ID section. On entering PAN details correctly, check the security message in the tickbox. Enter your password and then click on ‘Continue’.

Step 2: Browse ‘File Income Tax Return’ section

After logging in on ITR Portal, click on e-File tab and then you will see ‘Income Tax Returns’ in the dropdown menu. In the same section, you get the option ‘File Income Tax Return’.

Step 3: Choose the Right Assessment Year

The next step is to select ‘Assessment Year’ as ‘AY 2024-25’ for filing ITR for FY 2023-24. If you want to file ITR for FY 2022-23, select ‘AY 2023-24’. After that, select your preferred mode of Filing which is Online.

Step 4: Choose the Status

Now, you need to choose your application filing status i.e. Individuals, HUF, or even Others.

Step 5: Select ITR Types

In order to proceed further in the online ITR Filing process, select ITR type. In this step, the taxpayer must be sure about which ITR form he needs to file for ITR returns. As there are a total 7 ITR forms available allowing different categories of taxpayers to file their income tax returns. Form ITR 1 to 4 is designed for filing ITR by individuals and HUFs. Depending upon the sources of income, different ITR Forms may be required to file for ITR. Consult a CS or financial advisor to determine which ITR Form you need to file.

Step 6: Choose Reason for ITR Filing

- In this step, you are required to mark your reason for filing returns. Select the right option as per your situation if;

- Your Taxable income exceeds basic exemption limit

- You fall under any specific condition due to which filing ITR is mandatory for you.

- You have any Other reason for filing ITR.

Step 7: Validate Submitted Information

In this step, a taxpayer needs to carefully validate his/her pre-filled details including PAN, Aadhaar, Name, Date of birth, Contact information, etc. Make sure to provide your bank details if not provided yet and also validate them too.

Before proceeding further, disclose all relevant income, exemptions and also deduction details. However, most of the information of taxpayer’s is pre-filled as per the data provided by your employer, bank, or any such other entity. Make sure that the provided information is true and authentic. Confirm your returns summary, validate those details, and also pay outstanding tax if any.Step 8: Verify ITR Onlnie

The final step of ITR filing online is to verify your returns within the time limit which is typically 30 days (or a month). Don’t forget to verify your return as it is considered equivalent to not filing your return. There are various methods to e-verify your returns such as by Aadhaar OTP verification, electronic verification code (EVC), Net banking, or even by submitting a physical copy of ITR-V to Income Tax Department Head office, Bengaluru.

This step-by-step process of file income tax return online helps you file your returns in a hassle-free manner.

Benefits of filing ITR Online

Online Income Tax Return filing has revolutionized the way of filing Income tax returns, making it a more convenient, faster and thus hassle-free process. There are numerous benefits of steps for filing income tax return online; some major benefits are described below;

- eFiling ITR allows the taxpayer to maintain records of all his financial activities effectively with the Income Tax Department.

- Due to facilitating upload of necessary documents for ITR filing, it helps create a database of your financial transactions that the taxpayer can access in just a few clicks. Manual returns filing has no facility that enables taxpayers to access their previous financial transactions. Therefore, e-filing helps taxpayers to easily get into a business deal with any other organization by providing their past financial transactions that may need to be verified by that organization.

- If a taxpayer uploads the necessary documentation for online ITR filing a couple of months before the deadline, he will be able to efile his ITR quickly with lesser congestion and doesn’t need to face any sort of issue due to congestion of server nearby deadline.

- Due to the tedious offline or manual process of ITR filing, many taxpayers fail to file it which may lead to penalties and fines. However, the simplified efiling process enables a taxpayer to file his ITR easily thus saves your time as well as hard-earned money.

- Online income tax filing enables taxpayers to file their returns easily within the due date for the respective year. E-filing of returns under income-tax gives taxpayers an edge as they are more likely to receive refunds faster than offline or manual mode of ITR filing.

Conclusion

Filing ITR online helps taxpayers report their income and assets to the IT department. With the introduction of efiling portal, itr return filing online enables taxpayers to file their returns without getting detangled into cumbersome process of manual ITR filing. The post has provided you with important information about the step by step process on how to fill ITR Online on the ITR portal.

FAQ's

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.