Post Incorporation Compliances for a Private Limited Company

Overview: This comprehensive guide on ‘Post Incorporation Compliances for Companies’ sheds light on their legal requirements, due dates, and consequences of non-compliance. Delving into the intricacies of each of these compliances for a private limited company after incorporation separately can provide actionable insights into maintaining the legal and operational robustness of your company. Altogether, the guide covers 15 key post-compliance issues after the incorporation of a company.

Ensuring compliance with regulatory requirements is paramount for the smooth functioning and sustainable growth of any company. Post incorporation compliances for a private limited company, in particular, refer to the set of legal obligations that a company must fulfil after its formation or incorporation. These obligations encompass a wide range of activities, from appointing directors and filing statutory documents to obtaining necessary licenses and adhering to labour laws.

Compliance with these requirements is essential as it not only ensures the company operates within the bounds of the law but also fosters trust among stakeholders, mitigates legal risks, and lays the foundation for long-term success. In this blog, we delve into the significance of post-incorporation compliance for private limited companies, shedding light on its key components and implications for businesses.

What are the Post-Incorporation Compliances of a Company?

Post incorporation compliances for private limited companies encompass a series of legal obligations that a company must adhere to following its formation or incorporation. The obligations include appointing directors & key managerial personnel, opening bank accounts, obtaining necessary licenses & permits, conducting initial board meetings, issuing share certificates, appointing auditors, filing statutory documents, ensuring compliance with labour laws, registering for taxes, and maintaining statutory registers, among others.

Fulfilling these requirements involves meticulous attention to detail, timely submission of documents, adherence to prescribed procedures, and compliance with applicable laws and regulations. Failure to meet these compliances can expose the company to legal penalties, financial liabilities, reputational damage, and operational disruptions. Hence, a thorough understanding and diligent execution of compliance are essential for ensuring the legal and operational integrity of the company.

Mandatory Post-Incorporation Compliances, Their Due Dates & Purpose

Meeting post-incorporation compliance for a private limited company is crucial for any company to establish a strong legal footing and operate within the framework of regulatory requirements, including the Companies Act. Having a detailed understanding of those post-incorporation compliances is as crucial as those of primary private limited company compliances.

Let’s delve into the key post-incorporation compliances, their corresponding due dates, and their underlying purposes in depth. By understanding these crucial aspects, you can proactively manage your company’s requirements and obligations with ease, thereby mitigating potential risks associated with non-compliance.

Post Incorporation Compliance for a Private Limited Company

Among several post-incorporation compliance requirements, there are 15 compliances that must be followed in order to ensure compliance. Having a detailed understanding of these compliances can help private limited companies stay compliant and focus on business growth. Refer to the table below for the complete list of compliances, followed by their detailed explanations further.

| Within 30 days from Incorporation | Within 60 days from Incorporation | Within 180 days from Incorporation |

|

Collect Entire Subscribed Capital Issue Share Certificates and Pay Stamp Duty |

|

- Organise the First Board Meeting: Organising the first board meeting marks the commencement of formal corporate governance. Typically, the first board meeting must be held within 30 days of incorporation or within such timeframe as specified by the company’s articles of association. This meeting serves as a platform for directors to convene, establish corporate policies, approve initial transactions, and lay the groundwork for the company’s operations.

Failure to convene the first board meeting within the stipulated time frame can lead to legal repercussions, including potential fines, and may hinder the company’s ability to carry out essential business activities in a legally compliant manner. Therefore, it’s essential to organise the first board meeting. - First Auditor Appointment: The appointment of the first auditor ensures the company’s financial affairs are scrutinised by a professional auditor. As per regulatory requirements, the first auditor must be appointed within 30 days of incorporation. This appointment is essential to validate the accuracy and integrity of the company’s financial records, providing stakeholders with confidence in its financial reporting.

Non-compliance with this requirement may result in penalties, legal liabilities, and may impede the company’s ability to operate smoothly, as it could affect its eligibility for certain contracts, loans, or regulatory approvals. This is why it’s become more important to appoint the first auditor of the company. - File INC-22: Filing Form INC-22 is mandated by the Companies Act, 2013, in India. This form pertains to intimation about the change of the company’s registered office address to the ROC within 30 days of incorporation or the change of registered office. Make sure to file it within its prescribed due date.

Failure to file Form INC-22 within the specified timeframe can result in legal consequences, including fines and penalties imposed by regulatory authorities. Moreover, non-compliance may also lead to the company being considered inactive or dormant, affecting its ability to enter into contracts, access banking facilities, or maintain its legal status, thereby disrupting its operations and reputation. - Shops & Establishment Registration: Securing Shops and Establishment Registration is a crucial post-incorporation labour law compliance requirement for businesses operating through physical establishments. This registration is typically mandated by the state governments and must be obtained within 30 days of incorporation. It serves to regulate the working conditions, employee rights, and safety standards within commercial establishments.

Non-compliance with this requirement can lead to legal repercussions, including fines, closure orders, or even legal action against the company. Additionally, failure to obtain this registration may jeopardise the company’s ability to conduct business legally, impacting its reputation and hindering its growth prospects. - Professional Tax Registration, If Applicable: Professional Tax Registration is a mandatory compliance obligation for businesses employing professionals or skilled workers in certain states of India. This registration must be obtained within 30 days of company incorporation. PT Registration enables professionals to pay Professional Tax, a state-level tax levied on the income earned by individuals engaged in various professions, trades, or employment.

Non-compliance with this requirement may result in penalties, fines, and legal consequences imposed by the state tax authorities. Moreover, failure to obtain Professional Tax Registration could lead to the company being considered non-compliant with tax regulations, potentially impacting its ability to operate legally and attracting further scrutiny from regulatory authorities. - Opening the Company’s Bank Account: Opening a bank account is a fundamental compliance after company incorporation, facilitating financial transactions and business operations. Typically, companies are required to open a bank account in the name of the business entity within a reasonable timeframe after incorporation, usually within a few weeks to a month. This bank account serves as a repository for company funds, enabling transactions such as receipt of payments, payment of expenses, and payroll processing.

Non-compliance with this requirement can impede the company’s ability to carry out financial transactions effectively, hindering its operational efficiency and potentially leading to missed business opportunities. Additionally, failure to open a bank account may result in difficulties in managing company finances and compliance with tax regulations, exposing the company to financial risks and regulatory penalties. - Collect the Entire Subscribed Capital: Collecting the entire subscribed capital in a timely manner ensures adequate capitalisation for business operations. Subscribed capital refers to the portion of a company’s shares that shareholders have committed to purchasing. The due date for collecting the entire subscribed capital is 60 days from the company’s incorporation. Failing to collect the entire subscribed capital within the specified time frame can result in legal consequences, i.e. breach of contract or violation of corporate governance principles.

Additionally, insufficient capitalisation may hinder the company’s ability to meet financial obligations, pursue growth opportunities, and maintain credibility with investors and stakeholders, potentially impeding its long-term success and viability. If this non-compliance remains for a longer period, the company may even be deemed inactive and closed by the ROC. - Issue Share Certificates and Pay Stamp Duty: Stamp duty is a tax levied by the government on stamping various documents, including share certificates, to make them legally valid. Share certificates are official documents that confirm the ownership of shares by shareholders in a company. Typically, share certificates must be issued to shareholders within 60 days of incorporation, and after being stamped at the local stamp office.

Additionally, stamp duty must be paid on these stamps according to the applicable rates set by the respective state government. Non-compliance with this requirement may render the share transactions legally invalid and may expose the company and its directors to penalties, fines, and legal liabilities.

Moreover, failure to issue share certificates and pay stamp duty can undermine investor confidence, affect the company’s ability to raise capital, and lead to disputes over ownership rights, potentially damaging the company’s reputation and financial stability. - File INC-20A: Filing Form INC-20A is also mandated by the Companies Act, 2013. This form signifies the declaration of the company’s business commencement, confirming that it has obtained the necessary subscribed capital and has initiated its operations. The due date for filing INC-20A is within 180 days from the date of incorporation.

Non-compliance with this requirement can result in severe consequences, including fines and potential legal actions against the company and its officers. Additionally, failure to file INC-20A may lead to the company being categorised as inactive, impacting its ability to conduct business, open bank accounts, or enter into contracts, thereby resulting in its closure by the ROC.

Other Optional Post-Incorporation Compliances of a Company

In addition to the mandatory post-incorporation obligations, there are several other optional but highly relevant obligations that companies may consider undertaking to enhance their operational efficiency, legal protection, and growth prospects. These include registrations such as GST Registration, MSME Registration, Startup India Recognition, Industry-Specific License, IPR/Trademark Registration, and Disclosing Director’s Interests.

While not legally obligatory, these compliances play a significant role in fostering transparency, credibility, and competitiveness in the business environment. Let’s delve into each of these registrations and explore their relevance for companies in order to ensure compliance.

- GST Registration: GST registration is essential for businesses involved in the supply of goods or services. It ensures compliance with the Goods and Services Tax (GST) regime, facilitates seamless input tax credit, and enhances credibility among customers and suppliers.

Any business with an annual turnover exceeding the prescribed threshold limit of INR 40 lakhs (INR 20 lakhs for service providers) is required to register under GST. Voluntary registration is also available for businesses below the threshold limit to avail of the benefits and simplify compliance. - MSME Registration: MSME registration provides micro, small, and medium enterprises with various benefits, including access to credit, subsidies, and government schemes. It enhances visibility, competitiveness, and growth prospects in the market.

Businesses engaged in manufacturing or providing services falling within the prescribed investment and turnover limits are eligible for MSME registration. These limits vary based on the nature of the enterprise (micro, small, or medium). However, the maximum upward limit for investment in plant and machinery is Rs. 50 crores, whereas the turnover was Rs . 250 crores in the previous financial year. - Startup India Recognition: Startup India recognition offers startups access to incentives, tax benefits, and networking opportunities. It boosts investor confidence, fosters innovation, and facilitates collaboration with government agencies and other startups. Startups meeting the criteria defined by the DPIIT, such as being incorporated as a private limited company, having a turnover below the Rs. 100 crores, and being less than ten years old, are eligible for Startup India recognition.

- Industry-Specific License: Industry-specific licenses are essential for companies operating in regulated sectors such as pharmaceuticals, food processing, and manufacturing. Compliance with industry regulations ensures legal compliance, consumer safety, and industry standards.

Companies operating in industries subject to specific regulations, standards, or licensing requirements must obtain industry-specific licenses to operate legally. The eligibility criteria vary based on the nature of the industry and its regulatory framework. - IPR/Trademark Registration: Intellectual Property Rights (IPR) and trademark registration safeguard a company’s unique ideas, inventions, and brand identity. They protect against infringement, enhance market exclusivity, and strengthen brand reputation and market positioning.

Any individual or business entity that owns intellectual property assets or proposes to own one in the future, such as inventions, designs, trademarks, or copyrights, is eligible to apply for IPR or trademark registration. Registration is recommended for businesses seeking legal protection and exclusivity for their intellectual property assets. - Disclosure of Interest by Directors: Section 184 of the Companies Act requires every director to disclose his concern or interest, whether directly or indirectly, in a contract or arrangement, or proposed contract or arrangement, in the first meeting of a board of directors of the company and thereafter in the first board meeting to be held in every financial year.

Any change in the interest of the director is to be intimated to the Board of Directors within 30 days of such change. Any non-disclosure shall make any such contract or arrangement voidable at the option of the company. Such disclosure is to be made in the prescribed form MBP-1. In the case of public limited companies, such disclosure needs to be filed with the ROC in the prescribed Form MGT-14.

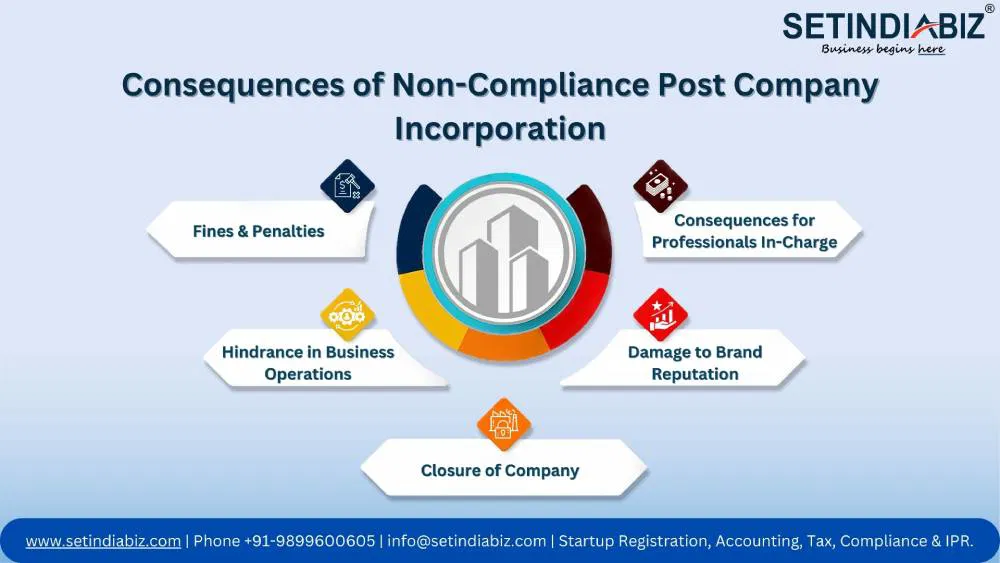

Consequences of Non-Compliance of Post Company Incorporation

In the realm of corporate governance, non-compliance with post-incorporation obligations can have far-reaching consequences, impacting the legal standing, operational continuity, and reputation of a company. Failure to meet these obligations not only exposes the company to penalties and legal liabilities but also poses significant risks to its sustainability and growth prospects. Let’s explore some of the grave consequences that companies may face due to non-compliance post-incorporation:

- Fines & Penalties: Non-compliance with post-incorporation requirements can lead to the imposition of fines, penalties, and interest charges by regulatory authorities. These financial sanctions can strain the company’s resources and impede its financial health.

- Hindrance in Business Operations: Non-compliance may result in the inability to obtain necessary licenses, permits, or approvals, hindering the company’s ability to conduct business operations smoothly. This can lead to delays, disruptions, and loss of revenue opportunities.

- Closure of Company: Persistent non-compliance or serious violations of regulatory requirements may ultimately lead to the closure or dissolution of the company by regulatory authorities. This can result in the loss of investments, jobs, and assets.

- Damage to Brand Reputation: Non-compliance tarnishes the company’s reputation and erodes trust among stakeholders, including customers, investors, and partners. Negative publicity surrounding compliance failures can undermine brand loyalty and market credibility, impacting long-term growth.

- Consequences for Professionals In-Charge: Directors, officers, and professionals responsible for ensuring compliance may face personal liability, legal action, or disqualification from holding directorial positions for failing to fulfil their duties. This can have serious career and financial implications for individuals involved.

These consequences underscore the critical importance of prioritising post-incorporation compliance and implementing robust systems and processes to ensure adherence to regulatory requirements. By proactively managing compliance obligations, companies can safeguard their legal standing, protect their reputation, and foster a culture of integrity and accountability within the organisation.

Conclusion

Post-Incorporation Compliances are not merely a legal obligation but a crucial aspect of corporate governance that underpins the integrity, credibility, and sustainability of a company. By adhering to mandatory requirements and proactively considering optional compliances, businesses can navigate regulatory complexities, mitigate risks, and foster a culture of transparency. Also, it instils confidence among stakeholders, propelling companies towards long-term success and growth in this competitive business landscape.