KYC of Company

KYC of Company : With effect from 25th February, every company incorporated prior to 31st December 2017 is under an obligation to file Form No INC-22A, which is necessary for the purpose of marking the company as Active – Compliant (Active Company Tagging and Identities and Verification)

The Ministry of Corporate Affairs, through its notification dated 21st February 2019 has made amendments in The Companies (Incorporation) Rules, 2014 which shall be effective from 25th February 2019. Through this amendment, the MCA has introduced a new rule “25A” and also introduced a new form “Form No. INC-22A” and titled it as Active Company Tagging Identities and Verification” The amendment as explained above requires every company registered on or before 31st December 2017 to file the eform which apart from other details also requires photographs of the registered office of the company to be attached as an annexure. The eform shall be digitally signed and to be further certified by a practicing professional in whole-time practice such as CA, CS or CMA.

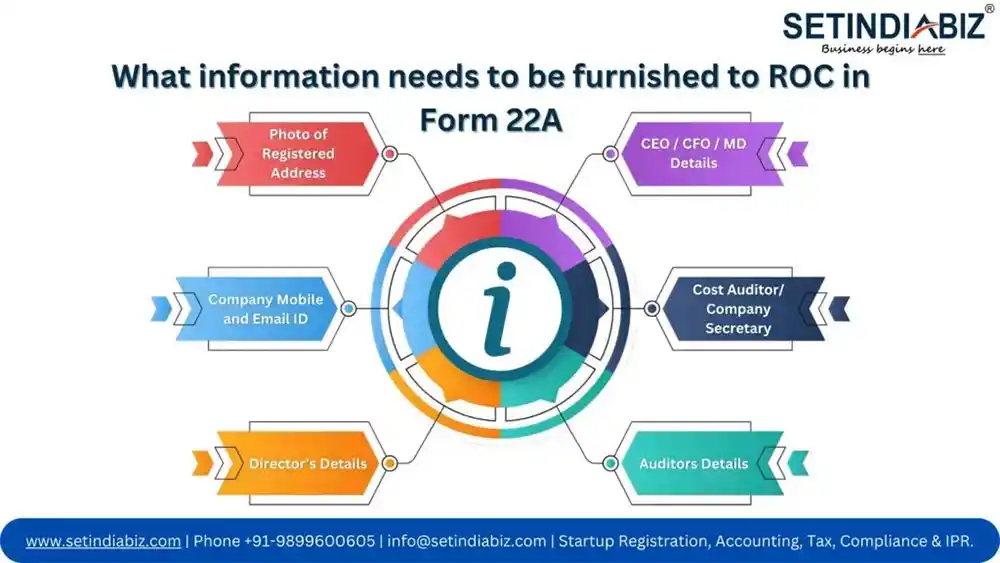

What information needs to be furnished to ROC in Form 22A

Photo of Registered Address

Well, form INC-22A requires only one attachment, that is the photograph of the premises where the registered office of the company is situated. One photo must be taken from outside the premises whereas another photo shall be taken from inside the office.

Company Mobile and Email ID

A Company shall have to provide one official mobile number and email id of the company, which shall be further verified by way of an OTP confirmation. In case you have multiple companies then you need to provide different mobile and email address in the Form INC-22A.

Director’s Details

The company has to file details of all the directors of the company. However, in case there is any director which is disqualified or for any reason, the DIN of any director is deactivated, then the Form INC-22A cannot be filed.

Auditors Details

The company has to furnish complete details of auditor/auditors in case of more than one auditor of the company. Apart from the basic details of the auditor, the period of accounts for which appointed is important to disclose on Form INC-22A.

Cost Auditor/ Company Secretary

In case the company is required to appoint a cost auditor or a company secretary as may be applicable, the details of such cost auditor or the company secretary need to be filed in the Active Form INC-22A. In the case of the cost auditor, the period for which the appointment is made needs to be disclosed.

CEO / CFO / MD Details

Finally, the details of the Managing Director (MD) or Chief Executive Officer (CEO) or Manager or Whole-time Director of the company are submitted for all such persons. The name, designation and Din number shall be filed in the Form INC-22A. In case of a person not having DIN, the PAN Number shall be intimated.

Form No INC-22A (Active Form) Process

Due Diligence of Company

We strongly advise that you conduct thorough due diligence and check if everything related to corporate laws has been complied with by the company. In the case of lapses, the same needs to be first rectified.

Photographs of the Registered Address

The new rule 25A require that every company shall also attach Two Photograph of the registered office of the company. The first photo of the registered office shall be taken from outside of the premises, whereas the second photo needs to be taken from within the registered office premises showing at least one director / KMP who shall be signing the e-form INC-22A.

Arrange SRN of AOC-4, MGT-7 filed for FY 2017-18

The details of filing of the financial statements under section 137 and the annual return as required under section 92 for the financial year 2017-18 are to be entered in Form No INC-22A.

OTP Confirmation

The company has to provide a unique mobile number and email id in the first section of the Form INC-22A, which shall be verified via a One Time Password (OTP) to be sent on the mobile/email as provided. The form can be further processed only after the verification of the mobile and email id both. Please note that OTP is valid for a few minutes only.

Certification of Form

After filing all the details in the Form INC-22A correctly including the details of all directors, KMP, cost accountant, company secretary, auditors, CEO, CFO, Managing Director etc. the E-Form Number INC-22A shall be digitally signed by any one director in case of the OPC and by two directors of the company. The signed form shall then be further certified by a practicing CA, CS, Cost Accountant in whole-time practice.

Filing of Form No IN-22A with ROC

Finally, the form is ready to be uploaded to the MCA-21 website, there is no government fee if the form is filed on or before 25th April 2019. However, in case of company misses the due date then the Active Form 22A can still be filed, however with government fee of Rs. 10,000/-. The form then shall be scrutinized by the government officials of MCA and if found to be correct in all aspects shall be approved.

FAQ's

1.Companies which are not required to File Form INC-22A?

2.What is the due date of filing Form INC-22A (Active Form)?

3.What is the Government Filing fee for Form 22A?

4.What is the List of documents Required to be attached with Form INC-22A?

5. What is Active Company Tagging Identities and Verification?

6. Who shall file the E-form INC-22A with Digital Signature?

7.Is it necessary to file all pending annual returns before filing the Form INC-22A?

8.What is the consequence of Late filing of the Form INC-22A?

9.What is the consequence of non-filing of Form INC-22A?

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.