Income Tax Login – Income Tax efiling Portal Login & Registration Step-by-Step Guide

Overview : Filing an ITR return can be daunting if you follow the traditional ITR registration process, as it includes a lot of paperwork, documentation, and physical submission of ITR forms to the Income Tax Department of India. The Income Tax Department’s initiative of making ITR filing paperless has resulted in an Online ITR Portal simplifying your overall ITR filing experience. File your income tax return quickly with zero paperwork by just following the online ITR Registration & Login steps.

Filing an ITR return can be daunting if you follow the traditional ITR registration process, as it includes a lot of paperwork, documentation, and physical submission of ITR forms to the Income Tax Department of India. The Income Tax Department’s initiative of making ITR filing paperless has resulted in an Online ITR Portal simplifying your overall ITR filing experience. File your income tax return quickly with zero paperwork by just following the online ITR Registration & Login steps.

In order to ease the Income Tax return filing process for the taxpayers, the IT Department takes necessary steps from time to time. In the same phase, the department has made the whole process of Income tax filing online which means now a taxpayer can file ITR without standing in the long-queues, along with following complicated paperwork and also handling required documents.

Earlier, the ITR filing process was a cumbersome task. Keeping its complexities and other associated problems into view, the Income tax department introduced its 100% paperless online ITR Filing Portal that allows taxpayers to file their ITR from the comfort of their office, home, etc. with an active internet connection.

Each taxpayer in India needs to be registered on the online Portal of the Income Tax Department. Through the online income tax portal, a taxpayer can easily file your income tax return by following some simple ITR Registration steps. With this post, you will learn about Income Tax efiling Portal Login & Registration with a step-by-step guide.

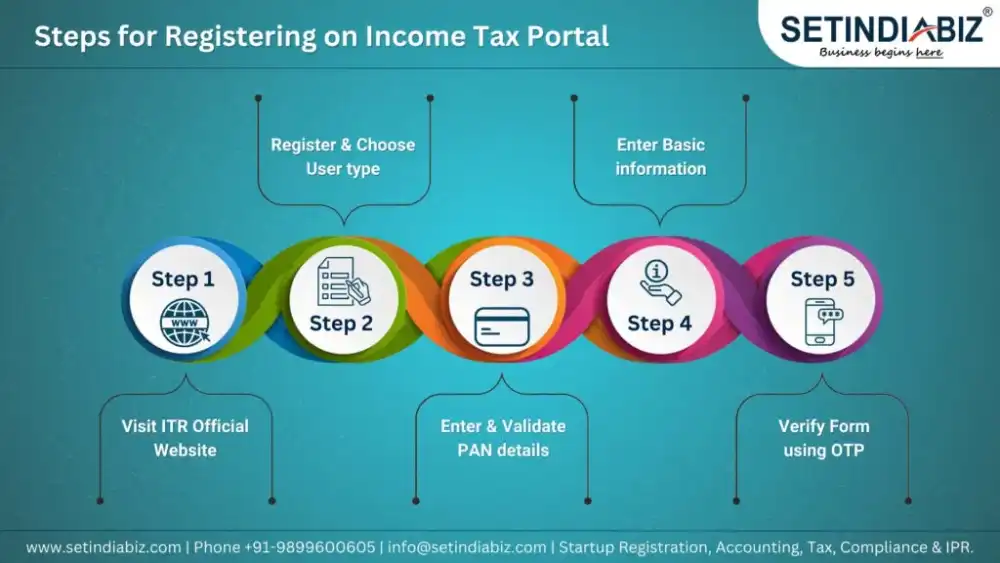

Registering on Income Tax Portal

In order to file your ITR online, you need to first register on the online portal of the Income tax department. Now the question popping up in your mind is how to do ITR Registration? If so, read the further blog carefully to learn about the nitty-gritty of ITR Registration Process. After registering properly on the online portal of the Income tax department, you can log in to your account to file your ITR.

By following the above steps for the registration process, you can register yourself on Income Tax Portal efficiently to file your ITR online within a shorter time span. The step-by-step registration process you need to follow to get yourself on the ITR portal easily;

Step 1. Visit ITR Official Website

Go to the official website of the Income Tax Department portal either by typing the URL incometax.gov.in in your browser or searching for the Income Tax Department portal. After entering the portal, click on the ‘Register’ option located on the top right corner on the homepage.

Step 2. Register & Choose User type

When you click the ‘Register’ button, you will be taken to a different page where you will be asked to choose user type from Taxpayer or Others.

Step 3. Enter & Validate PAN details

After choosing the user type as a ‘Taxpayer’ and entering your PAN credentials, validate it by clicking on the ‘Validate’ button.

Step 4: Enter Basic information

Fill out the registration form by providing some basic information such as Contact details, current address, Password information and also you need to choose a ‘Secret question with its Answer. Click on the submit button, after entering your details correctly.

Step 5: Verify Form using OTP

For the verification of your submitted form, you will get a 6-digit One Time Password on your phone number and email address registered with this portal. Enter this OTP to verify your submitted details. In case you are a non-resident, you will receive OTP on your registered email address.

Make sure to complete your ITR Registration process within 24 hours are the OTPs that the Income tax department sends to your mobile number or email address will expire after 24 hours after receiving them. If you fail to follow all the ITR registration steps within 24 hours, you will have to restart the process right from the beginning again.

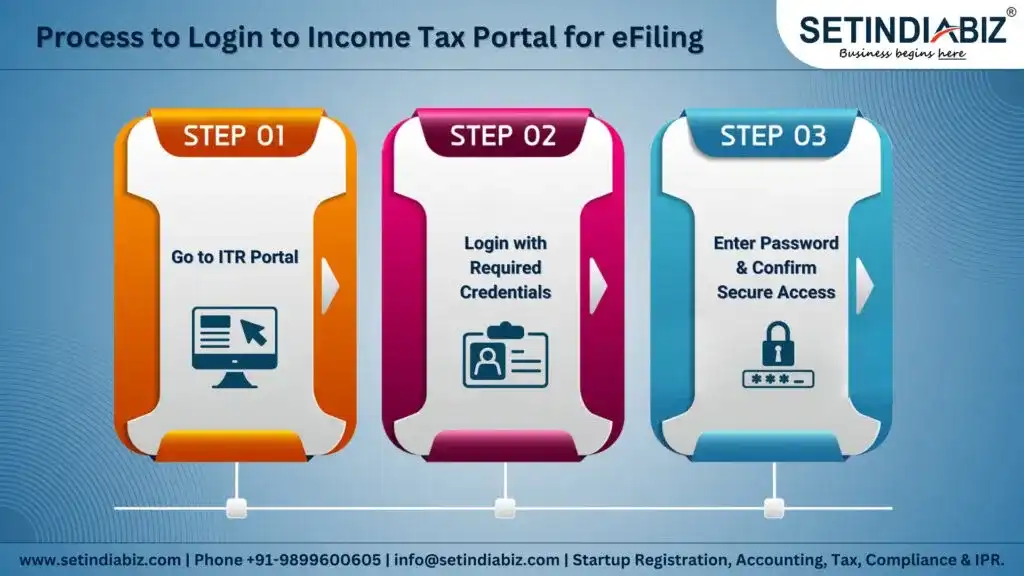

Process to Login to Income Tax Portal for eFiling

You will need to follow certain steps to successfully login to the Income tax portal for eFiling. The steps to login to the Income tax portal efiling portal are mentioned below;

Step 1: Go to ITR Portal

Go to the online Income tax portal for e-filing. On the homepage of this portal, you will see a ‘Login’ button on the top right-hand side for the registered users.

Step 2: Login with Required Credentials

On clicking on the ‘Login’ button, you will be redirected to the Login page. On this page, you are required to provide your Login Username and then click on ‘Continue’.

Step 3: Enter Password & Confirm Secure Access

Then, confirm your secure access message and enter your password. Your dashboard will be displayed on your screen.

With the help of these steps, you can securely login to the Income tax portal and file your ITR within the deadline or due date for the year. Moreover, it enables you to access a wide range of features.

Key Services of ITR e-filing Portal

By login to the income tax portal online, you will unlock access to a wide range of services; those are:

- File Income Tax Returns

- View Filed returns

- Update Profile

- Link Aadhaar

- E-verify Returns

- Access Form 26AS

- Respond to Notices/Intimations

- File Audit Reports

- Request for refund re-issue

- Complaint about your grievances online

This is how you can make the most of your income tax efiling portal login along with filing ITR!

Conclusion

Income tax return filing is a mandatory annual return that each taxpayer, business, or HUF must file before the deadline or due date. In order to file ITR online, you first need to undergo the ITR registration process to register on the ITR portal. After successfully completing your ITR registration process, log in to the ITR portal to file your ITR online and unlock several other features that will help you stay compliant with annual ITR filing requirements. Gain detailed e-filing portal Registration & Login process with this blog.

FAQ's

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.