What Is The Procedure For Registration of GST in India?

Overview : GST Registration procedure in India can be completed on the official GST website. The taxpayer needs to register on the website first, and then file the application for GST enrollment along with the required supporting documents. Upon verifying the same, the GST departments allots a GST registration number which confirms the completion of GST registration procedure.

The GST registration procedure applies only to businesses exceeding the aggregate annual turnover limit prescribed under the scheme. For normal taxpayers, this limit extends to Rs. 40 lakhs for goods and Rs.20 lakhs for services industry. However, to bring smaller taxpayers into the GST regime, the government has introduced two new GST schemes for low income businesses, the composition and the QRMP scheme. Let’s discover the criteria for their enrolment and the stepwise process further.

GST Registration Eligibility for Normal Taxpayers

Not all businesses are eligible for the GST Registration process. Its eligibility depends on the aggregate annual turnover threshold which is the cumulative value of total outward and inward taxable supplies, tax-exempt supplies, export, and inter-state supplies. Only if a business exceeds this threshold in a financial year, it shall be eligible to undergo the GST registration process. Here are the prescribed threshold limits for GST Registration eligibility:

| Business Activity | Business in Special Category States | Businesses in Other States |

|---|---|---|

| Merchandise-Based | Rs. 20 lakhs | Rs. 40 lakhs |

| Service-Based | Rs. 10 lakhs | Rs. 20 lakhs |

However, there are certain categories of businesses that have to mandatorily take up the GST registration process, even if their turnover is below the threshold limit. Here’s a complete list of these businesses:

- E-commerce operators/ aggregators

- Businesses selling on e-commerce platforms

- Casual Taxpayers

- Business non-resident in India

- Importers & Exporters

- Taxpayers under GST Reverse Charge Mechanism

- Taxpayers registered under the older tax regime

- Businesses engaged in Inter-state supplies of goods & services

- Service Providers providing information & online databases services (OIDAR)

Besides, the eligibility for GST Registration process also depends on the type of scheme for GST enrollment, regular, composition, or QRMP.

GST Registration Eligibility for Composition & QRMP Taxpayers

The process of GST registration differs according to the scheme for which the taxpayer is getting enrolled. The Indian Government has introduced 3 major schemes under GST – the regular scheme for high-income businesses, the Composition scheme for small businesses, and the QRMP scheme for medium-sized businesses. We’ve already discussed the eligibility criteria for regular businesses. Let’s move to the composition and QRMP taxpayers now.

- GST Composition Scheme: The GST Composition scheme has been devised for smaller taxpayers with the view of easing their tax burden. Its eligibility extends to businesses with turnover up to Rs.1.5 crores. The tax rates applicable range between 1% to 6%. Additionally, GST Returns under the scheme are filed only on a quarterly basis

- GST QRMP Scheme: The GST QRMP Scheme applies to businesses having an annual turnover up to Rs.5 crore and those eligible for filing GSTR-1 and GSTR-3B returns. The tax rates applicable are the same as the regular scheme. However, taxes are paid monthly whereas the returns are filed on a quarterly basis.

Stepwise GST Registration Procedure

The GST Registration process slightly differs for regular, compositions, and QRMP schemes. However, the basics remain the same. So, to give an overview, we will discuss the GST registration process of a normal taxpayer under the regular scheme. The process broadly involves three steps – filing PART A of the application, filing PART B of the application, and Aadhaar Authentication. Let’s discuss the three steps one by one.

Filing PART A of the GST Registration Application

- Open the GST Website www.gst.gov.in on the browser.

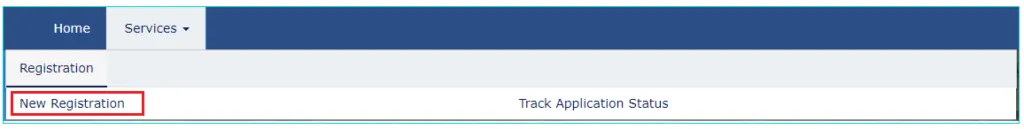

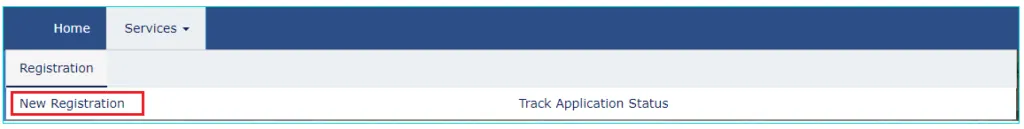

- Go to the “Services” tab on the Home Page. Go to “Registration” and then “New Registration” option to access PART A of the application.

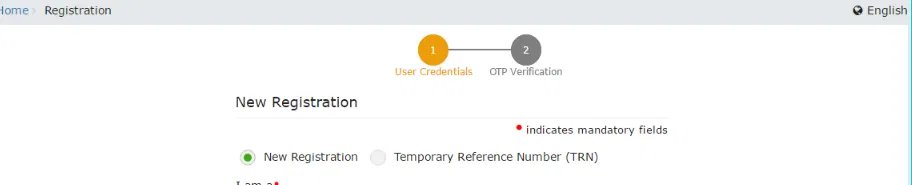

- Out of the two options that appear on the screen, choose “New Registration”.

- Start filling out the details. First, choose the category of taxpayer in the “I am” blank. A normal taxpayer under the regular GST scheme should select “taxpayer”.

- Next, select the state /UT the business belongs to. Remember GST is a destination-based tax, so the GST number allotted at the end of the registration process will be applicable to the selected state / UT only.

- Select the “District” for a detailed address.

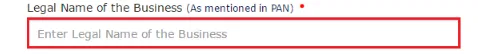

- Now, it’s time to specify the legal name of the business. This is the name with which the business gets incorporated or that’s mentioned in its PAN.

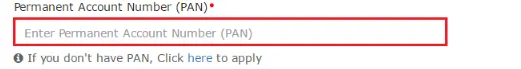

- Next, enter the correct PAN number of the business.

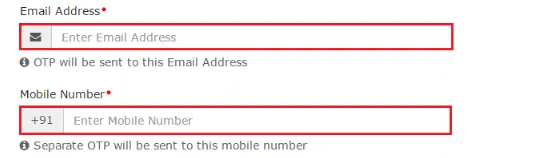

- Lastly, provide a contactable Email address, and mobile number, preferably of the primary authorised signatory. An OTP will be sent to both for verification.

- On the verification page, enter the OTPs to complete the verification process.

- A TRN or Temporary Reference Number will be generated and displayed on the screen. You can use it to login to the website and access PART B of the form.

Filing PART B of the GST Registration Application

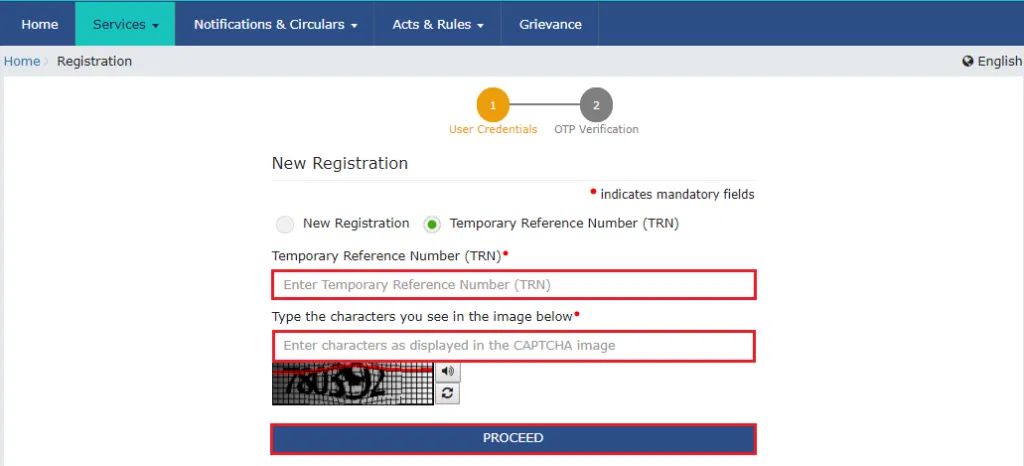

- After completing PART A of the GST Registration application, return back to the New Registration page.

- Go to the TRN option, enter the TRN, and click on Proceed to continue.

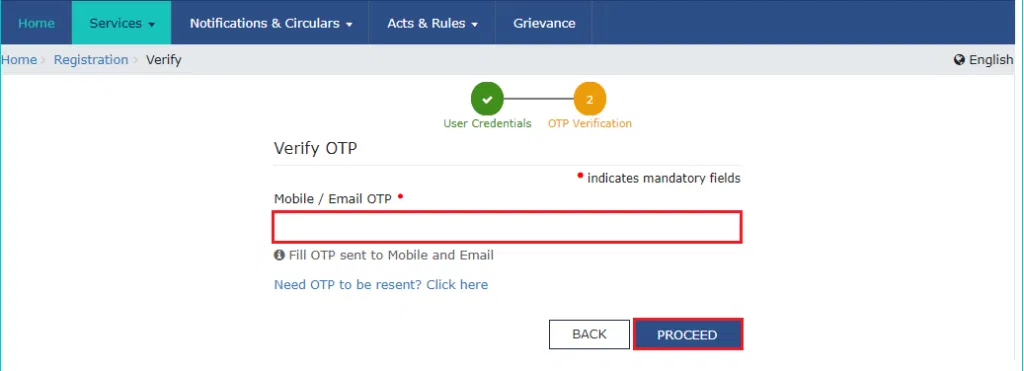

- The next step is OTP verification. For this, provide either mobile number or email address. Submit the OTP within time.

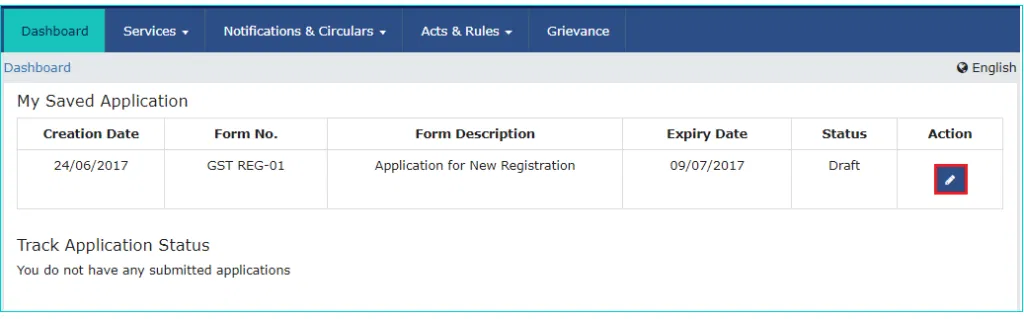

- The saved application will appear on the screen. Click on the Edit icon to continue filling in the application PART B. It must be completed within 15 days from the date of TRN generation. Here are the requisite sections:

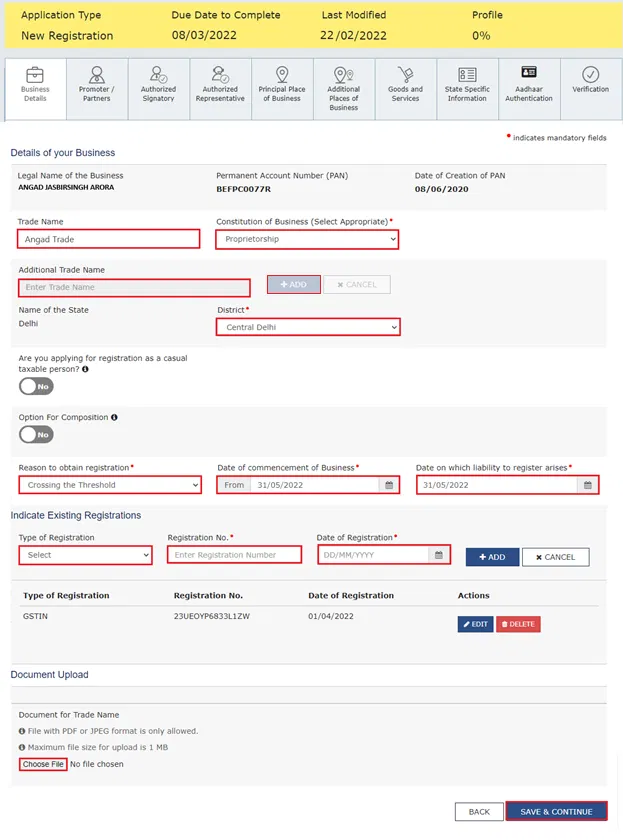

- Business Details: Trade name, business structure, district, option for composition, whether the category is that of a casual taxpayer, reason for registration, date of business commencement, and the date of GST applicability / eligibility. Upload the supporting document for the Trade name.

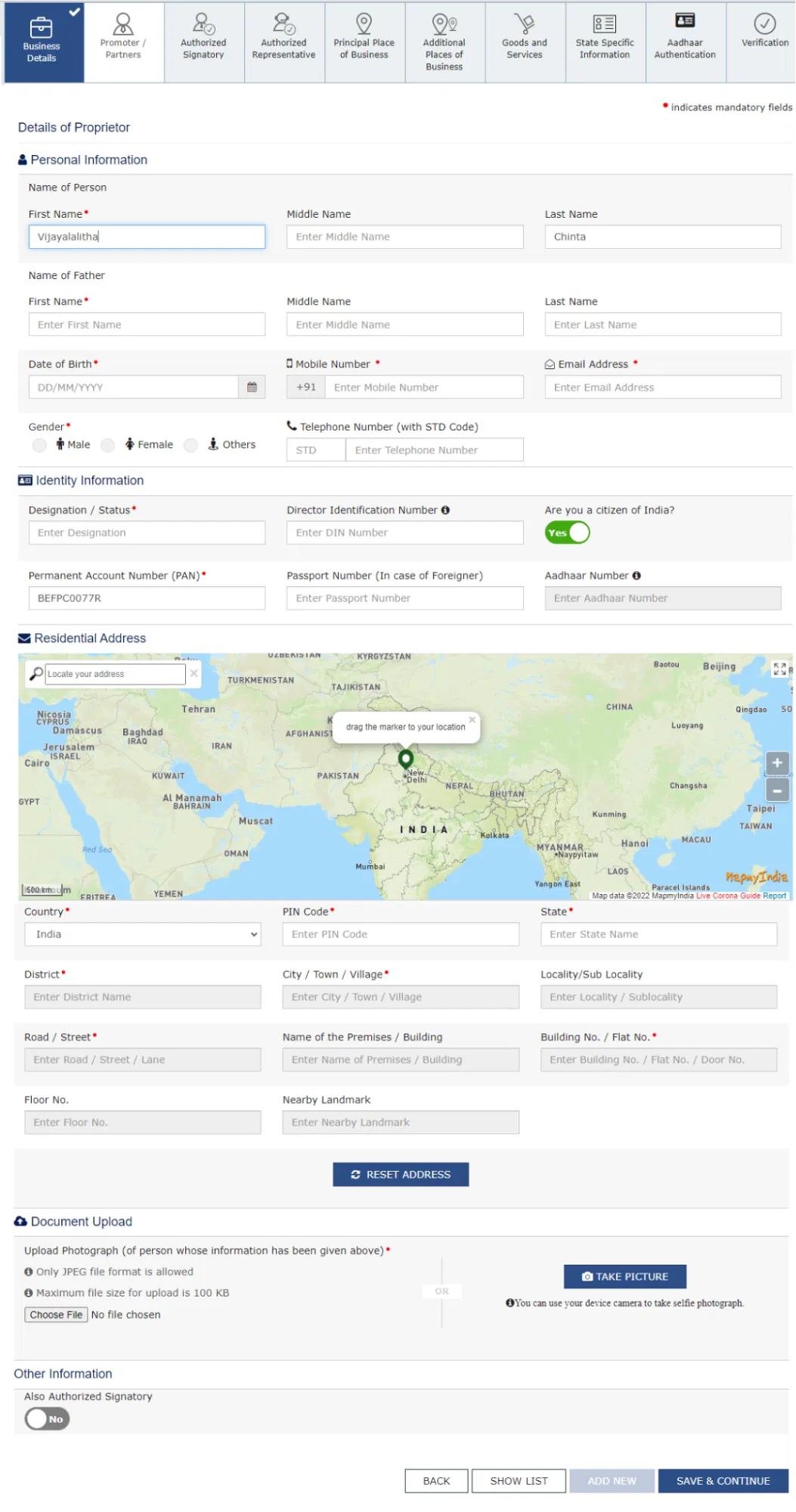

- Details of the Proprietor / Promoter: Personal information, designation/status, DIN, PAN, citizenship status, Adhar number, passport number (in case of foreigner), and full residential address. Upload photograph of the proprietor. If the proprietor is also the authorised signatory, click on the checkbox below.

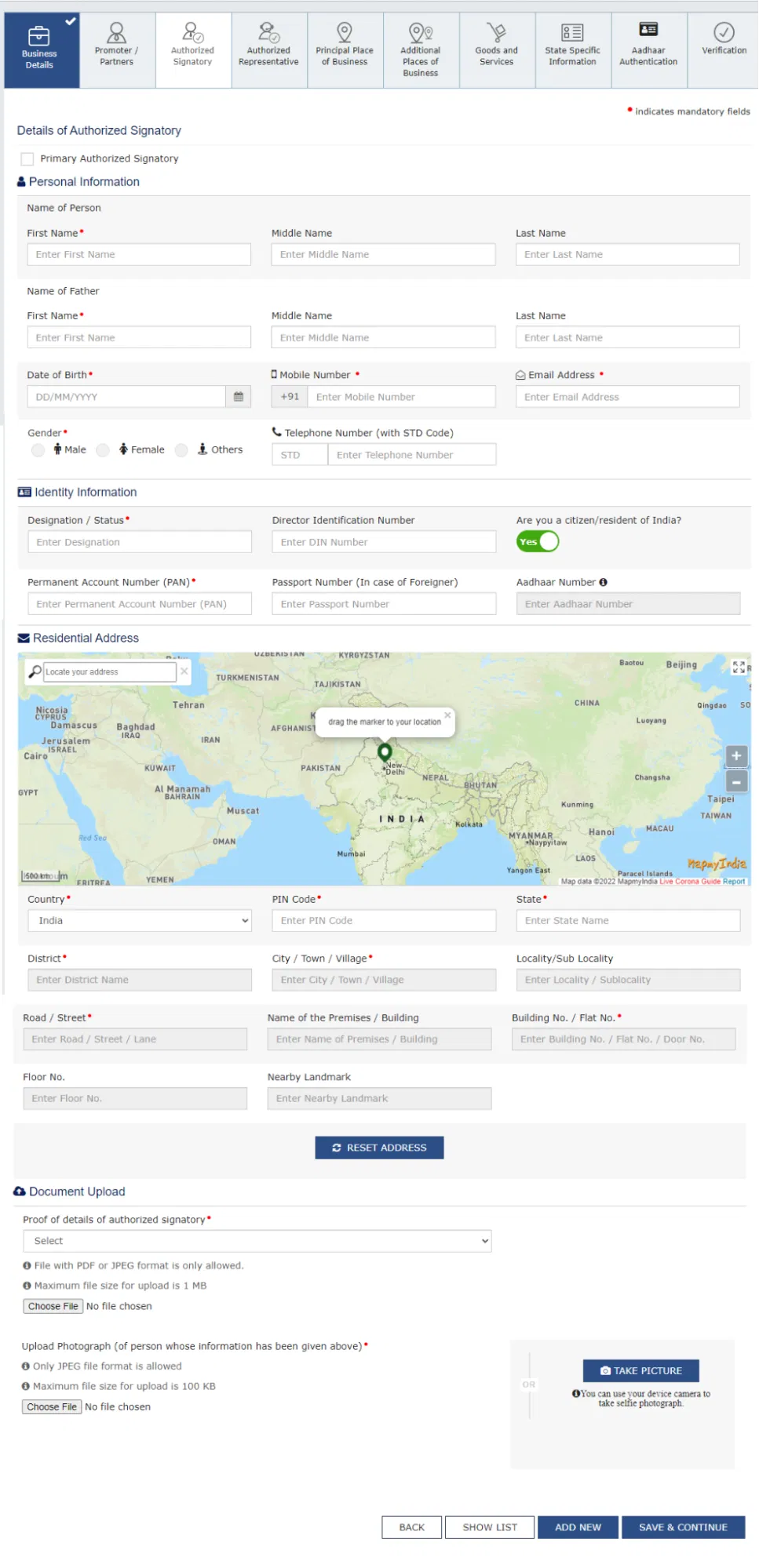

- Details of the Authorised Signatory: Personal information, designation/status, DIN, PAN, citizenship status, Adhar number, passport number (in case of foreigner), and full residential address. Upload Proof of Appointment, and photograph of the signatory.

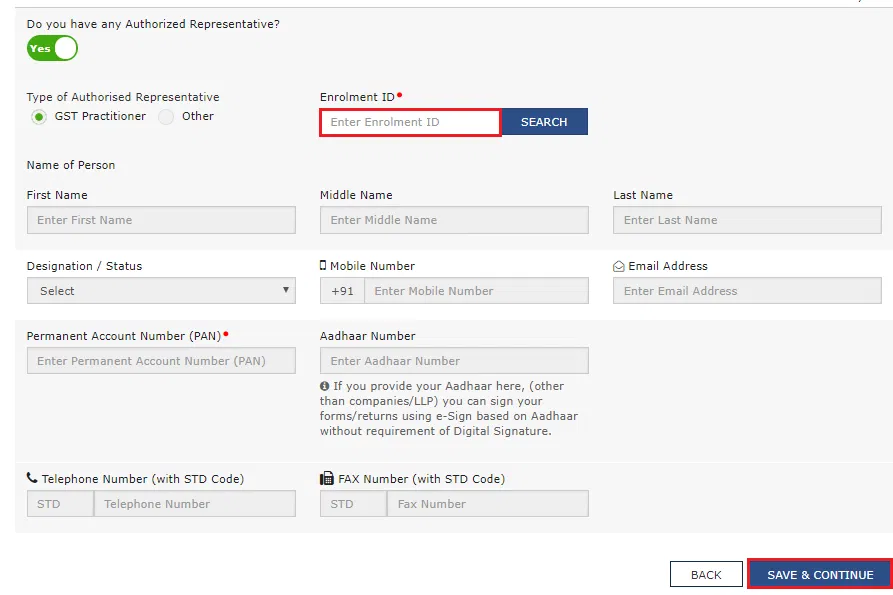

- Details of Authorised Representative: Designation, enrollment ID as a GST practitioner, personal information, PAN, Adhar, and contact details.

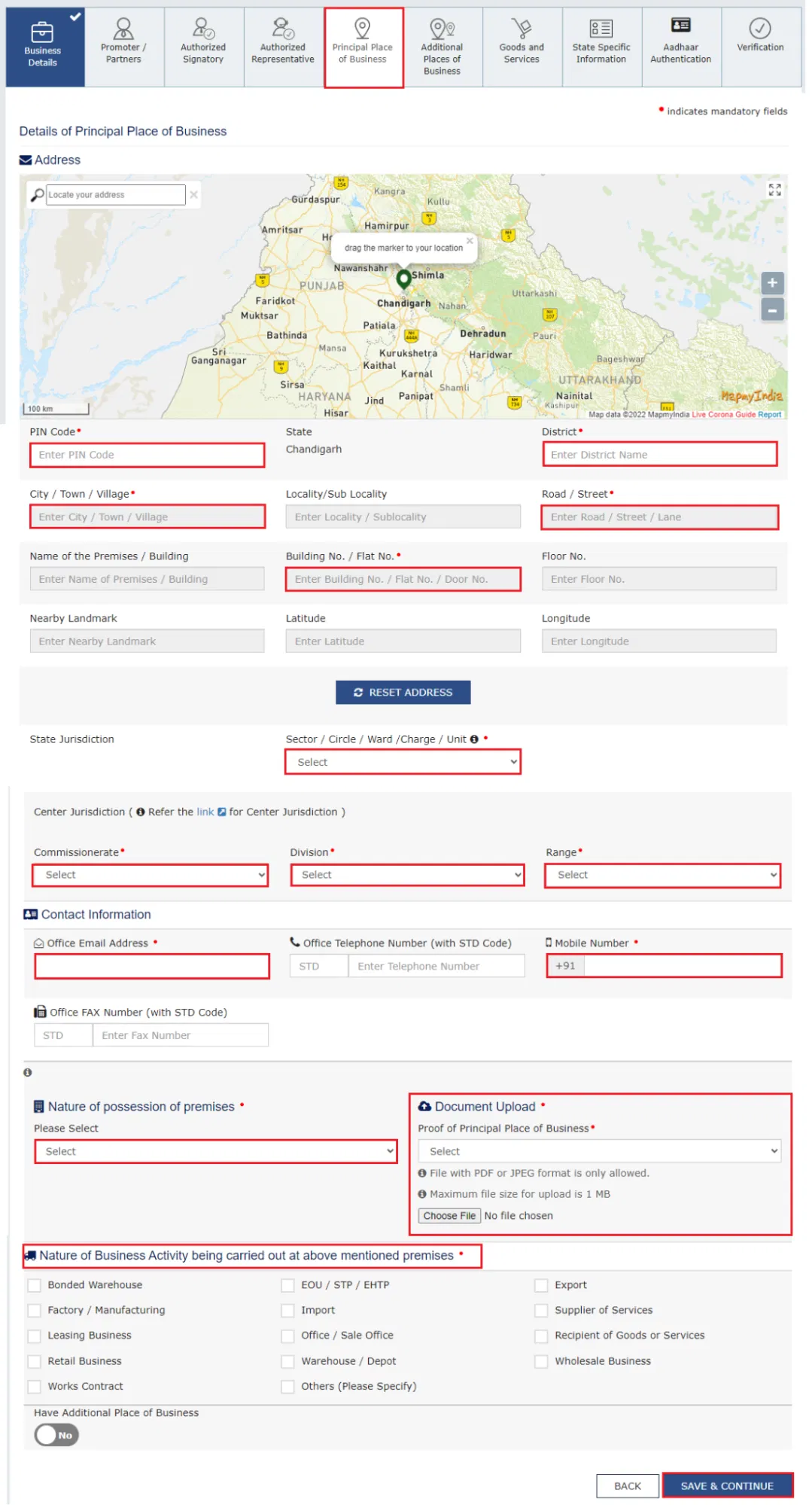

- Principal Place of Business: Full Address, Nature of Premises, and business activity details. Also, upload the Proof of Address.

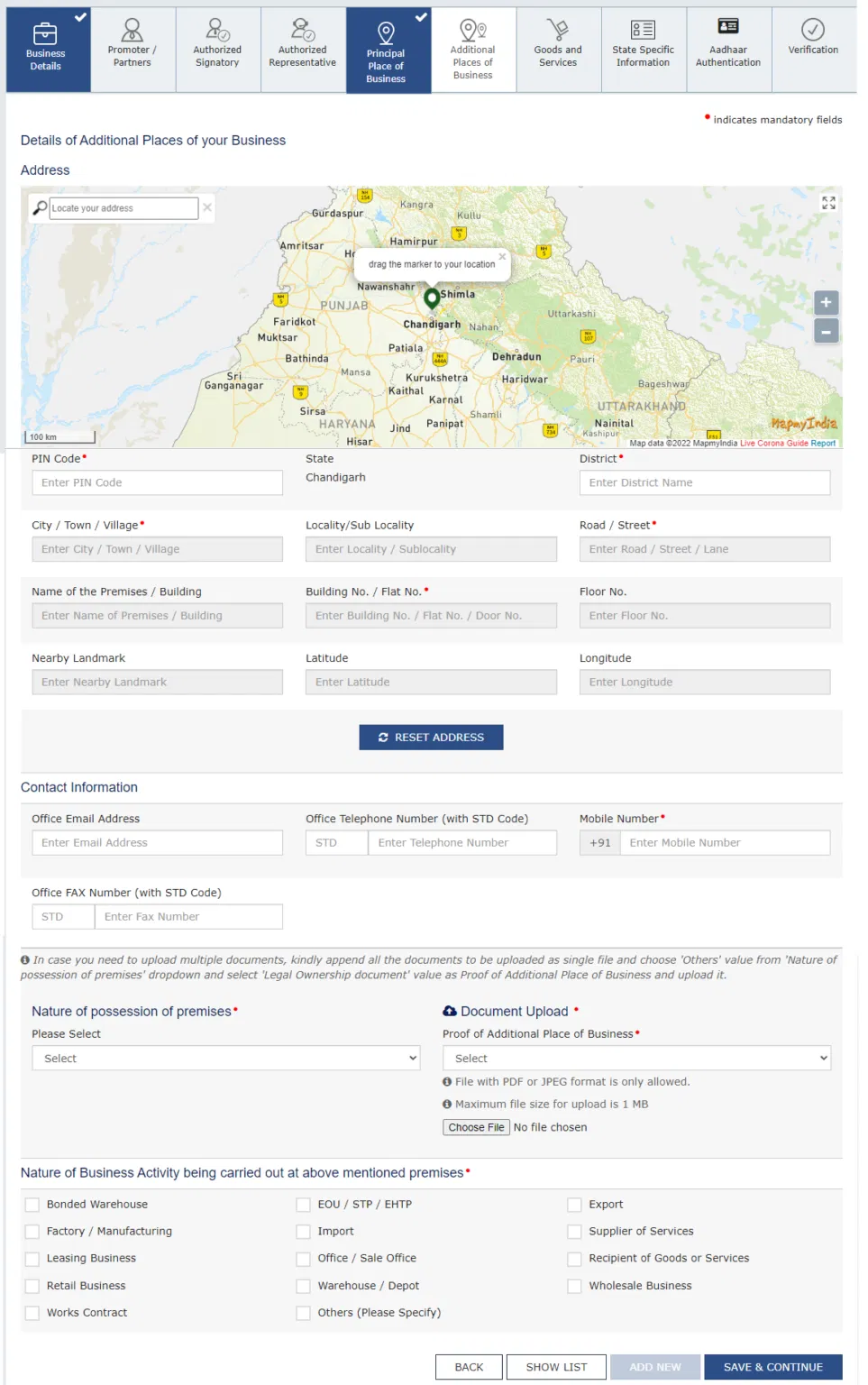

- Additional Place of Business: Provide Address details of any additional place of business apart from the principal place. Also, specify the nature of premises possession (owned / rented), and business activity. Upload the proof of address as well.

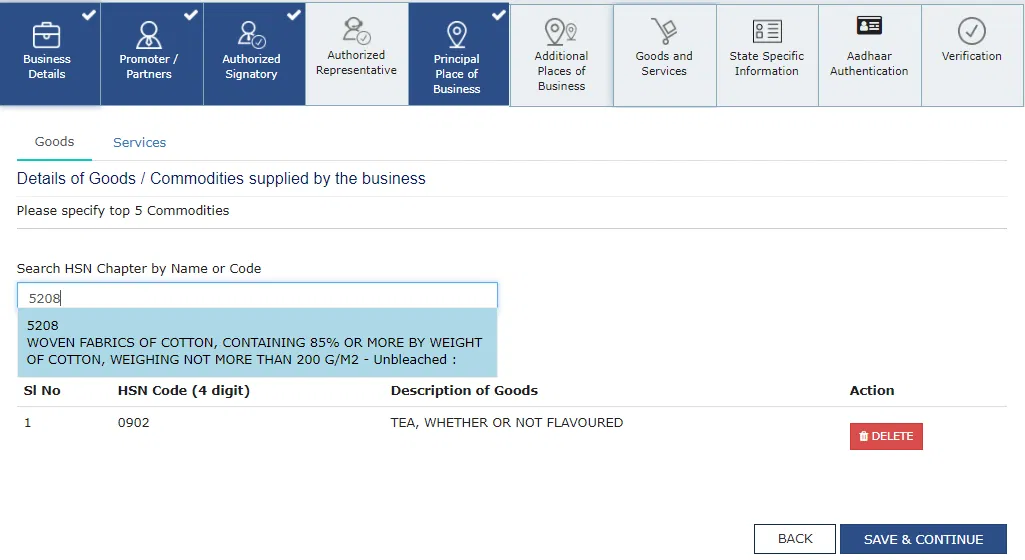

- Goods and Services: Specify the Goods and Services of the Businesses. Also, classify the goods as per HSN code, and services as per service classification code.

- Business Details: Trade name, business structure, district, option for composition, whether the category is that of a casual taxpayer, reason for registration, date of business commencement, and the date of GST applicability / eligibility. Upload the supporting document for the Trade name.

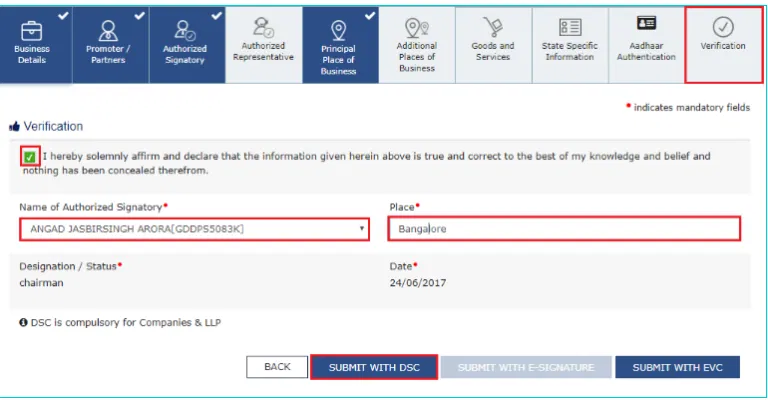

Verification By Authorised Signatory

After all the details have been filled out successfully, the next step is Verification Authorised Signatory. Here, the authorised person needs to agree to the given declaration, enter his name, place, and upload a digital signature to verify. Digital Signature must be registered on the portal, and while uploading emSigner must be running on the system with admin permissions. Also, the authorised signatory can use the option of verification with e-signature provided he possesses an Adhar number and the same has been mentioned in the application. Note that this option does not apply to companies and LLPs as verification in their cases is required through DSC.

Conclusion

The GST registration procedure has been simplified to a great extent. The application can be filed online on the GST website with a few supporting documents for evidence. Verification can easily be done through Aadhaar OTP or digital signature. The complete application can be filed within a day without any filing fee. Once enrolled, the GST registration process offers numerous benefits such as input tax credit, uniform tax rates, and elimination of double taxation.

FAQ's

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.