Filing of BEN-2, Return of Beneficial Interest

The Companies (Significant Beneficial Owners) Rules, 2018 require every company to file a return in Form BEN-2 for all the shareholders who hold 10% or more shares in the company. This is a one time return for all existing significant business owners. Every company is mandated by the new rule to identify persons holding 10% or more beneficial interest in the company, these persons are known as SBO (Significant Business Owners). Once the identification of the SBO is done, the company shall be sending intimation to them seeking their detailed disclosure in prescribed Form BEN-1.

Every SBO/ shareholder is under to furnish the declaration within 90 days of the applicability of the rule, in case a shareholder withheld the information or send incorrect or incomplete information, the company should approach NCLT for appropriate action on the SBO. Once the declaration is received from the SBO, the company must file the BEN-2 Form within 30 days. The eform must be signed by the director, Manager, CEO or CFO or Company Secretary of the Company. It further requires to be certified by a practicing professional like CA, CS or CMA in whole time practice.

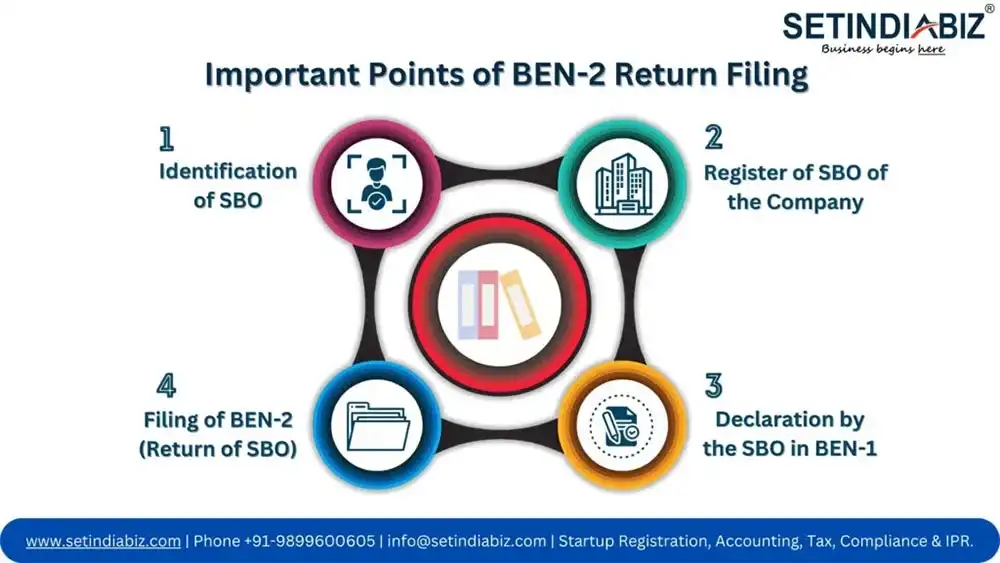

Important Points of BEN-2 Return Filing

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

The date of the BEN-2 filing depends on the availability of the form on the MCA Portal. It has been clarified by MCA that form can be filed within 30 days without any additional fee

The SBO has to furnish a very detailed declaration of investment in all kinds of business like, HUF,Proprietorship,partnershipconcerns or other any other companies, irrespective of the size and quantum of such investment. Filing of BEN-2 Return

Identification of SBO: The first step in filing the BEN-2 is to identify the Significant Business Owners of the company, as per rule every person holding 10% or more equity in the company is a Significant Business Owner (SBO)

Register of SBO of the Company: After identification of the SBO, the company must prepare and maintain a Register of Beneficial Owners holding Significant Beneficial Interest in the company in the prescribed Form No – BEN-3

Declaration by the SBO in BEN-1: The company needs to send an intimation letter (Form BEN-4) to each and every SBO seeking their information and particulars in the prescribed form BEN-1, the form is designed to capture all investments of the SBO in the company or elsewhere.

Filing of BEN-2 (Return of SBO): The last step is to file the return of Beneficial Interest in the Company in Form BEN-2 in respect of all the declarations received from the SBO

The e-form BEN-2 is the form prescribed under the rules notified on 8th February 2019, wherein a company need to file a return of significant business owners and their business interest to the ROC for following purposes

- To declare the SBO of the company under section 90

- To keep the SBO data up to date at MCA

- For declaring holding and subsidiary company relationship

FAQ's

1.What is the time limit for filing the eform BEN-2?

2. Is there any government fee payable for filing the Form BEN-2?

3.Can I file the Form BEN-2 even when I miss the deadline of 30 Days?

4.What are the documents required for filing the eform BEN-2?

5.What is the Meaning of SBO (Significance Beneficial Owner)

6.What are the companies or other entities which are exempted from filing BEN-2?

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.