Company Change and Compliance

Overview : Entrepreneurs who want to build their business, attract investors, and grow their firm over time may consider forming a private limited company as their business structure. Although the registration procedure is not very difficult, many people make mistakes when dealing with the necessary post-incorporation compliances.

You can add shareholders, entice the best talent with equity, and simply raise loans thanks to private limited company registration, among other advantages. There is no free lunch, though. As soon as you incorporate, you must abide by the laws and rules of the Companies Act of 2013. In this article, many important changes related to the company and how its incorporation compliances must be fulfilled are provided.

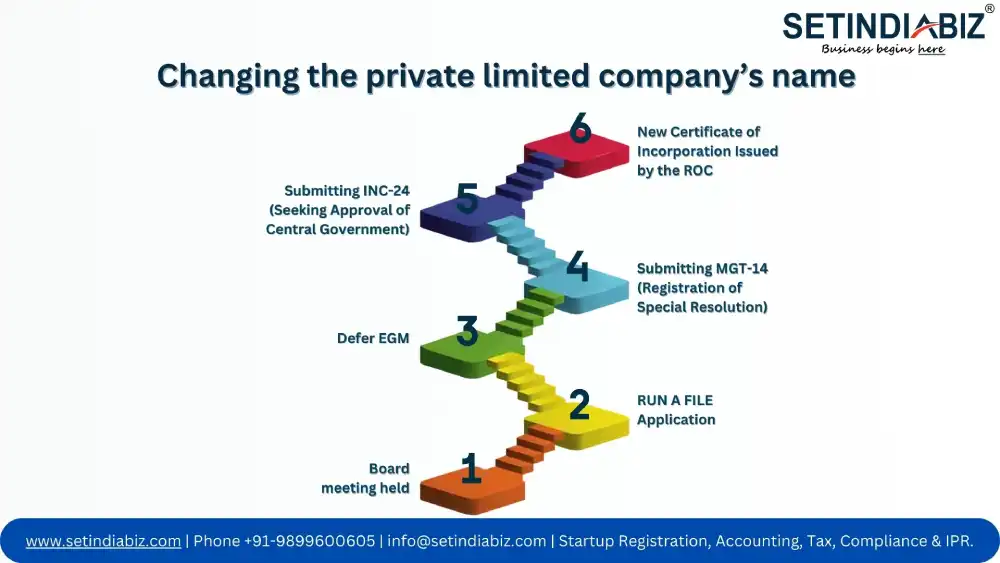

Changing the private limited company’s name

The Companies Act of 2013 establishes a clear procedure for changing a company’s name. If more than 75% of shareholders agree, the name of the company may be changed with the approval of the ROC and the Central Government.

A Step-by-Step Procedure for Changing a Company Name:

- Board meeting held: The proposed name is chosen by the board of directors, who also approve a Resolution for Name Change and give permission to file a RUN Application for name reservation for the new company name.

- RUN A FILE Application: The ROC receives a request for the Reservation of a New Name under the RUN (Reserve Unique Name) function after the board of directors has decided on the organization’s new name. A copy of the Board Resolution and, if required, the Trademark Owner’s NOC are also submitted with the RUN application. The government charges Rs. 1000 as a filing cost for the RUN application. If the new name is distinct and not the same as or confusingly similar to an already existing company, the ROC accepts it.

- Defer EGM: The next natural step is to ask the company’s shareholders for their approval after the office of the registrar of companies has approved the name. The directors must notify each shareholder of the company at least 21 days prior to the EGM date in order to call for one. The draft of the proposed resolution is to be passed as a special resolution, and an explanation must be included in the notice for the EGM.

- Submitting MGT-14 (Registration of Special Resolution): A special resolution is a decision reached with more than 75% of the vote. After being approved by the EGM, the special resolution is submitted to the ROC in Form MGT-14 within 30 days of adoption for their approval.

- Submitting INC-24 (Seeking Approval of Central Government): Along with the special resolution and a revised copy of the MOA and AOA, the application to change the company’s name is submitted in Form INC-24. A new Certificate of Incorporation is issued with the company’s new name after the ROC is satisfied.

- New Certificate of Incorporation Issued by the ROC: Following MGT-14 and INC-24’s acceptance, the ROC provides a new Certificate of Incorporation bearing the modified name. The business is required to replace the previous name with the updated name everywhere.

How can the registered office address be changed?

After a business declares its registered office by filing the INC 22, any modifications to the company’s registered office must be communicated to the ROC. If the registered office address is changing within the same city, town, or village, the change must be reported within 15 days by filing the necessary papers.

The registered office must approve a specific resolution adopted by the firm if the new registered office address is outside the boundaries of the city, town, or village. Imagine moving the company’s registered office from one ROC jurisdiction to another, then the ROC’s Regional Director needs to approve the adjustment.

What steps are included in a change in share capital procedure?

The Process Used To Change Share Capital Is As Follows:

- At least seven days before the scheduled meeting, distribute a Board notice that includes the agenda.

- In the board meeting, approve the resolution for the change in share capital.

- The approval of the shareholder’s meeting is required for the Resolution to take effect.

- Establish the date, time, and location of the shareholder’s meeting.

- The company’s shareholders may get notification of the shareholders meeting through email from the director.

- A shareholder meeting announcement should appear in the media at least 21 days before the meeting.

- Organize a shareholders’ meeting.

- With the approval of the majority of shareholders, adopt the Resolution.

- Within 30 days of the resolution’s passage, the Registrar of the Companies (RoC) is supposed to be informed about the change in share capital. The firm or its executives will be liable for paying a fine of up to 10,000 Rupees for each day the Alteration is suspended, with a maximum fine of 5 lakh Rupees, if the Registrar is not informed about the Alteration within 30 days.

- FilL the MGT-14 and SH-7 forms. The Ministry of Corporate Affairs should receive the aforementioned forms along with the appropriate fees. According to Section 117 of the 2013 Companies Act, if the Forms mentioned above are not filed with the ROC Registrar of Companies, the firm would be subject to a punishment that cannot be less than 5 lakh and cannot exceed 25 lakh. Each officer who is in default will be required to pay 1 lakh rupees, with the maximum amount being five lakhs.

How Shares of a Private Limited Company Are Transferred

The actions below must be taken in order to complete the share transfer:

- Step 1: Obtain a share transfer deed in the format required as the first step.

- Step 2: Execute the share transfer deed when the Transferor and Transferee have properly signed it.

- Step 3: Stamp the share transfer deed in accordance with the Indian Stamp Act and the State’s current Stamp Duty Notification.

- Step 4: Have a witness provide their name, address, and signature on the share transfer deed.

- Step 5: Deliver the transfer deed to the company together with the share certificate or letter of allocation.

- Step 6: The business must review the paperwork and, if accepted, issue a new share certificate in the transferee’s name.

Post-Corporation Requirements for Private Limited Companies

Here is a list of the private limited company compliances that must be completed within a certain amount of time following registration.

- Official company address register: When the firm is incorporated, the official address can be registered. A company has 15 days after incorporation to register, or else. Within 30 days after the incorporation date, the business must submit a Form INC-22 to the registrar informing them of the change. It is utilized by various authorities as official communication.

- Hold a Board of Directors meeting (BODs): Within 30 days after its incorporation, the company must schedule its first meeting with the board of directors in accordance with Section 173(1) of the Companies Act 2013. The appointment of the first auditor, the registration of the company’s address in the statutory register, and the disclosure of directors’ financial interests are all on the agenda for the meeting.

- Appoint the company’s first auditor: According to Section 139(1) of the Companies Act, the BODs must appoint the auditor within 30 days after the registered date if someone else struggles to do the same. To nominate an auditor within 90 days, an extraordinary general meeting must be called right away.

- Declare Directors’ Interests: A director’s interest in the BOD meeting must be disclosed to the company, per section 184(1) of the Companies Act of 2013. When there is a change in disclosure, it will be further discussed. Accordingly, both individually and collectively, each director achieves the company’s objective.

- Keep statutory records up to date: The following information must appear on letterheads, billheads, notice letter paper, and other official publications in accordance with the Companies Act:

- Name of the business

- The registered office’s address

- Company’s CIN (Corporate Identity Number)

- Call-in number

- Phone number

- Email address

A business must keep the required records under its registered office to avoid fines.

- Create a business bank account: The opening of a bank account within 60 days of incorporation is one of the compliance requirements for Private Limited Companies. To make it simple to record transactions, the account must be opened in the firm name.

- Make Shareholder Certificates available: Within 60 days of its incorporation, the Company must issue share certificates to shareholders. If additional shares are allocated, they become valid as of the allocation date.

- Submit INC-20A: Within 180 days of the start of the operation, directors of a company must submit an INC-20A Form to MCA after receiving an incorporation certificate. A declaration of the start of business is being made. After that, a business needs a bank account to deposit the share capital that each promoter subscribed to in the MOA (Memorandum of Association).

- Keep accurate books of accounts: Keeping accurate books of accounts is one of a private limited company’s compliance requirements. It is required to keep proper books of accounts that give an accurate and fair picture of the company’s financial situation, as per Section 128 of the Companies Act. The accrual basis of accounting shall be used in conjunction with the double-entry rule.

Private Limited Company Annual Compliance

Within 6 to 8 months at the end of each fiscal year, private limited companies must file their annual compliances. However, if your business was incorporated in January or later, the first fiscal year will be 15 months long. After the first financial year’s end, the first Annual General Meeting (AGM) is held within nine months. The AGM then occurs within six months of the conclusion of the fiscal year.

As part of company compliance, Forms AOC-4 and MGT-7 must be submitted to the Ministry of Corporate Affairs (MCA) in 30 and 60 days, respectively. Board reports and signed audit reports of the company’s financials are submitted in AOC-4. A list of shareholders and information on each Board meeting held during the year are submitted in MGT-7.

Conclusion

Because of the dynamic and fluid nature of the global market, businesses looking to grow can undoubtedly take advantage of a favorable atmosphere. In light of this, it’s critical to remain informed on the laws, regulations, and standards that affect the firm. Contact SetIndiaBiz right away for knowledgeable advice!

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.