Can Section 8 Company make profit?

Overview : Section 8 Company is a non-profit organization that is formed with purpose to serve people, not profit making. However, these companies can also make profit and use it to expand their area of services to serve a higher number of people and ensure smooth functioning of the company activities. The blog clearly elaborates what is a Section 8 Company, factors affecting the financial condition of such companies and how they can make profit for better functioning!

In the ever-changing business landscape, most of the companies are out there to make profits through their products or services they offer. However, there are such companies that don’t primarily aim to make profit, they are established for living up to the purpose of charity or serving underprivileged people, not for profit making. As per the Companies Act, businesses started for serving the deprived and disadvantaged instead of making profit can be registered under the category of Section 8, one of the company frameworks.

This piece of writing helps you develop insights into what is a Section 8 Company and whether it is one of the profit making companies in India or not!

Section 8 Company: An Introduction

As per the Companies Act, 2013 Companies that are purposed with a non-profit objective and their core purpose is to encourage arts, commerce, science, education, research, social welfare, religion, environment protection, charity and such other causes for non-profit making.

According to the Companies Act of 2013, there are three major conditions defined to grant the license of a Section 8 Company that go as below;

- The objective behind company formation should be for charitable purposes not money making.

- The profits cannot be distributed among its members.

- The income/profits generated should be utilized for promoting the objective or charity.

A Section 8 Company is required to file its annual returns with the Ministry of Corporate Affairs (MCA) and also to conduct auditing of its accounts by a Chartered Accountant. Moreover, Section 8 companies are also needed to hold Annual General Meetings and appoint directors as per the Companies Act of 2013 provisions.

Sources of Profit in Section 8 Company

Since Section 8 company is a non-profit organisation, it is not permitted to distribute profits among its members. The primary objective of a Section 8 Company is to work for the welfare of the public instead of generating profits. So, the profit potential of a Section 8 company is limited.

However, there are other ways by which a Section 8 company can generate profits, those sources include sponsorships, and fees for services. Profits obtained from these sources can be used for ensuring a smooth processing of business operations by paying organisation’s expenses and associated workers to carry out the objective of charity.

A Section 8 company should also manage its finances properly by using it responsibly. And the funds available in such companies as grants and donations must be used to promote its objectives and not for the sake of personal benefits of the members.

Apart from these factors,there are some activities/conditions that can back Section 8 Companies in making a healthy profit ensuring smooth operations of the company.

Funding: As mentioned in the above portion of the blog, funding and donations are one of the most crucial sources of income for Section 8 companies. Seeking funding and grants for the sake of carrying forward noble-cause of helping humanity can significantly enhance profit making of the company.

Investment: In order to ensure smooth operations of the company by making a constant or regular source of income, Investment is the best way to go. Section 8 companies can make a healthy profit from various types of assets, including stocks, bonds or real estate, etc. However, the return from these investments must be used to further the company’s cause.

There may be a few other ways of making profit for a Section 8 Company.

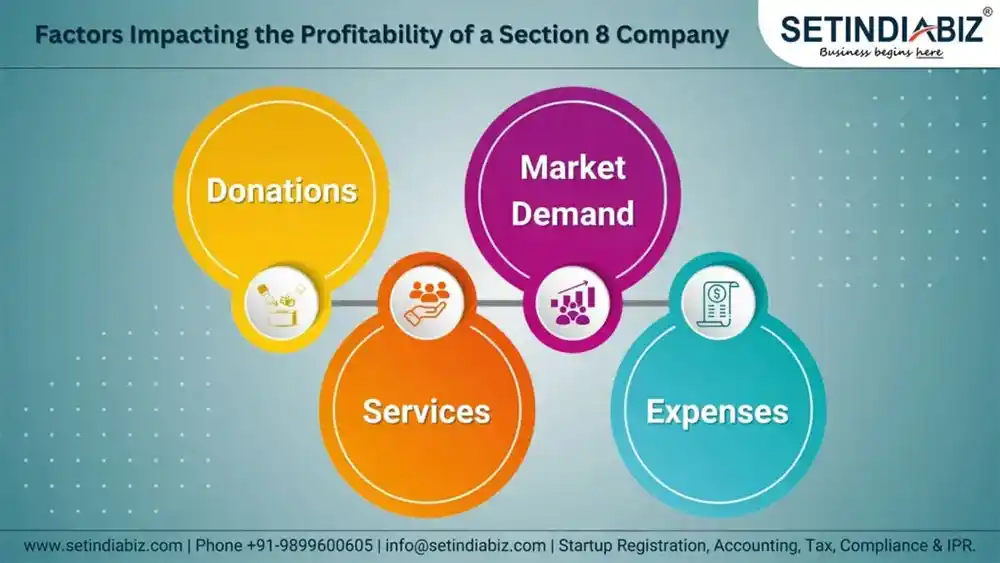

Factors Impacting the Profitability of a Section 8 Company

Being a non-profit organization, it doesn’t focus on generating profits. However, many factors can be responsible for impacting a Section 8 company income and expenses, thereby, they eventually impact Section 8 company’s overall financial stability. The factors that impact the profitability of a Section 8 Company are;

- Donations: A major part of the income or profit of a Section 8 company may come from donations and grants given by individuals, organizations and any government entities. Such grants and donations can play a crucial role in ensuring a company’s financial stability.

- Services: Section 8 Companies are often engaged in providing services to their members, clients or even the public such as conducting educational or training workshops, courses or such other classes and charge a minimum fee for such services. Such activities are also a source of income for the Section 8 Companies and thus play a crucial role in the financial status of these companies.

- Market Demand: It is one of the most important factors that can significantly impact the financial status of a Section 8 as well as any other types of companies. The demand for the services or products given by a Section 8 company can cause a great impact on its financial condition. In case of high demand for their products/services, the Section 8 Company may generate more income while decline in demand will lead to reduced income.

- Expenses: When it comes to expenses of a Section 8 company, it generally includes cost of personnel or employees, rent, utilities and other operational costs. Managing expenses of the company properly can play a crucial role in ensuring a stable income of the company.

Some additional factors may also put a great impact on the income of Section 8 companies.

Conclusion

After going through the above post, now you understand that a Section 8 company can earn profit similar to other types of companies. However, making profit or heavy income from the company is not the topmost priority of Section 8 companies. The above blog explains the sources of income of Section 8 company and whether Section 8 companies make profit or not to provide a comprehensive & clearer understanding of Section 8 company; their Sources of Income and Profit making, etc.

FAQ's

As the core objective of a Section 8 company is to work for the sake of the public’s welfare, not to solely focus on profit making. However, a Section company can raise funds through a number of sources such as donations, sponsorships, grants, fees for its services, etc. Since they are non-profitable companies in India, they can only use their funds for their goal of charity.

NGOs as well as Section 8 companies can be exempted from several taxes for their organization activities. Where NGOs can register under the Income Tax Act to avail tax exemptions for donations they receive while Section 8 companies are exempted from paying taxes on income they generate; that is subject to certain conditions.

The Section 8 companies can’t distribute dividends to its members as the funds these companies generate must be used for its core objective of charity or helping people.

For registering a Section 8 company, there is no minimum share capital requirement.

You can only close your organization registered under Section 8 company if it has not started any business activity since its incorporation or has stopped its organizational activities for over a year.

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.