How to Reduce NPA?

Overview : Reduce NPA (Non-Performing Assets) as we all know are those assets that are showing idle in the balance sheets of banks. Such assets are not able to contribute to the economy of the country. NPA of banks are in ever-rising mode no matter how hard government tries.

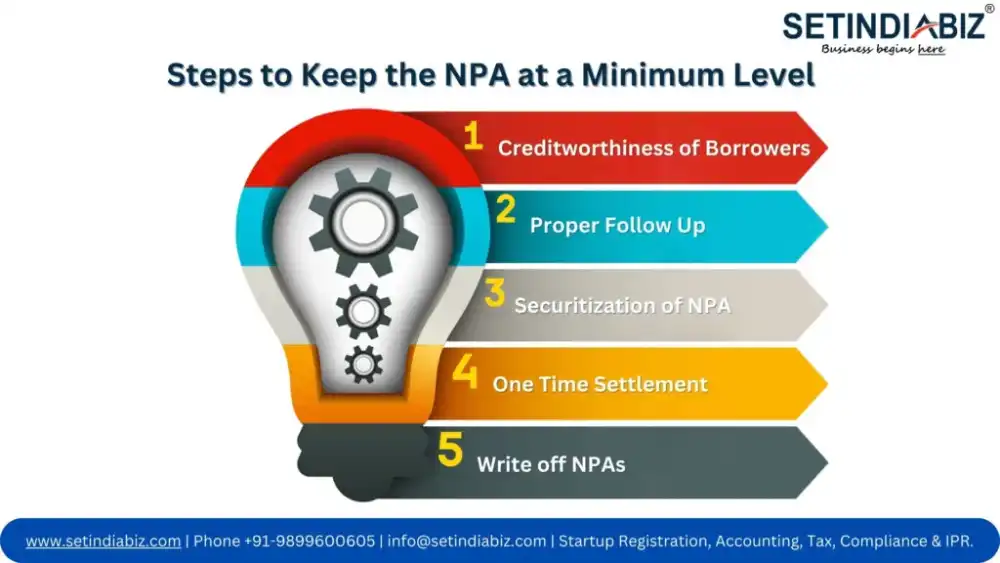

Every business has certain inherent risks, for banks inherent risk is nonrecovery of loans provided. The inherent risk can not be eliminated that can only be reduced. Bank can take the following steps to keep the NPA at a minimum level:

Steps to Keep the NPA at a Minimum Level:

Creditworthiness of Borrowers

Banks should stop giving money to unworthy people. Strict credit monitoring needs to be done by the lenders. Bank should not give loan to person who does not have any means to repay it.

Proper Follow Up

Collecting certified statement and debtors statement is not enough. There are many certified accountant who are ready to sign without verifying any single document. The external agencies are hired by the banks to follow up the credit worthiness of the borrower by checking their stock and debtors on regular interval.

Securitization of NPA

Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 also known as securitisation act, has facilitated the banks to overcome the situation of NPA. Section 13 of the said act has given option to the banks to take following steps without the intervention of the court if banks are secured creditors:

- Bank can sell the NPA to asset reconstruction companies for cash.

- Bank can appoint the manager to manage the stock on which security is created.

- Bank can take the possession of the property on which security is created.

One Time Settlement

To avoid the litigation process bank should go for the settlement scheme. Recovery camp should be organized on periodic basis as it saves the time and energy of the banks which they can use on the productive activities.

Write off NPAs

Trimming the balance sheet by writing off the NPAs is last resort with the Banks. The Tax benefits can be claimed by the banks for the same.

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.