How To Add a Designated Partner in LLP?

Overview : This blog is an essential guide on how to add a designated partner in LLP. We begin by explaining who a designated partner is, what are his roles, and what are the requirements to be met before his appointment. Our major focus, however, is the appointment process in general and the key compliances associated with it. So, whether you’re an entrepreneur starting an LLP business or an established LLP owner, this blog will give clear insights into its administrative and governance aspects. Read further for more information.

When it comes to Limited Liability Partnerships (LLPs), designated partners play a pivotal role in steering the daily course of operations and ensuring regulatory compliance. Unlike traditional partnership structures, where management responsibilities rest solely with the partners, LLPs appoint designated partners as separate entities to control the overall business management. These designated partners typically include individuals who are entrusted with the task of handling the day-to-day activities, meeting statutory obligations, and representing the business legally before government authorities. In this blog, let’s delve into the intricacies of who designated partners are, their appointment process, and how they participate in the governance of LLPs.

Who is a Designated Partner in LLP?

A Designated Partner in LLP is a pivotal figure entrusted with managing its internal affairs and statutory obligations. As per Section 7 of the LLP Act, 2008, every LLP must have at least two designated partners, both of whom must be individuals, with at least one being a resident in India. “Resident in India” here is an individual with a minimum stay of more than 120 days in the previous financial year. Note here that if an LLP has all its partners as body corporates or other LLPs, any two individual partners or nominees of such entities could be appointed as designated partners of the concerned LLP.

Designated partners are the backbone of an LLP’s governance, ensuring compliance with legal requirements and appropriate representation before government authorities. The appointment process of designated partners is specified in the LLP agreement. Any partner can assume this role as per the agreement, provided they meet the prescribed eligibility criteria, discussed further in the blog.

Before assuming this position, however, an individual must give his consent to act as a designated partner, and their particulars must be filed with the Registrar of Companies within thirty days of appointment. Additionally, designated partners must acquire a Designated Partner Identification Number (DPIN) from the Central Government prior to the appointment, serving as their unique identification for compliance purposes. These stringent regulations underscore the significance of designated partners in upholding the integrity and functionality of LLPs, making their role indispensable in business governance.

Who can Become a Designated Partner in LLP?

The qualifications to be appointed as a designated partner are mentioned in the LLP Act as well as the LLP Agreement. This indicates that the appointment is subject to compliance with statutory regulations as well as the discretion of partners. While the statutory regulations apply uniformly to all LLPs, the LLP Agreement provisions differ and are specific to the concerned LLP only. In the table below we have discussed the general eligibility criteria as mentioned in the LLP Act. You can refer to the specific Agreement of your LLP for further details.

| S.No. | Eligibility Criteria to Become a Designated Partner in LLP |

|---|---|

| 1. | Must be a non-minor Individual |

| 2. | Must not be an undischarged insolvent |

| 3. | Must not have been adjudicated as an undischarged insolvent in the last 5 financial years |

| 4. | Must not have defaulted on payments to creditors at any point in the last 5 financial years |

| 5. | Must not be convicted for any legal offense where punishment extends beyond 6 months of imprisonment |

| 6. | Must not be declared of unsound mind by a court of law |

| 7. | Must possess a Designated Partner Identification Number or DPIN |

| 8. | At least one of the designated partners must be an Indian Resident |

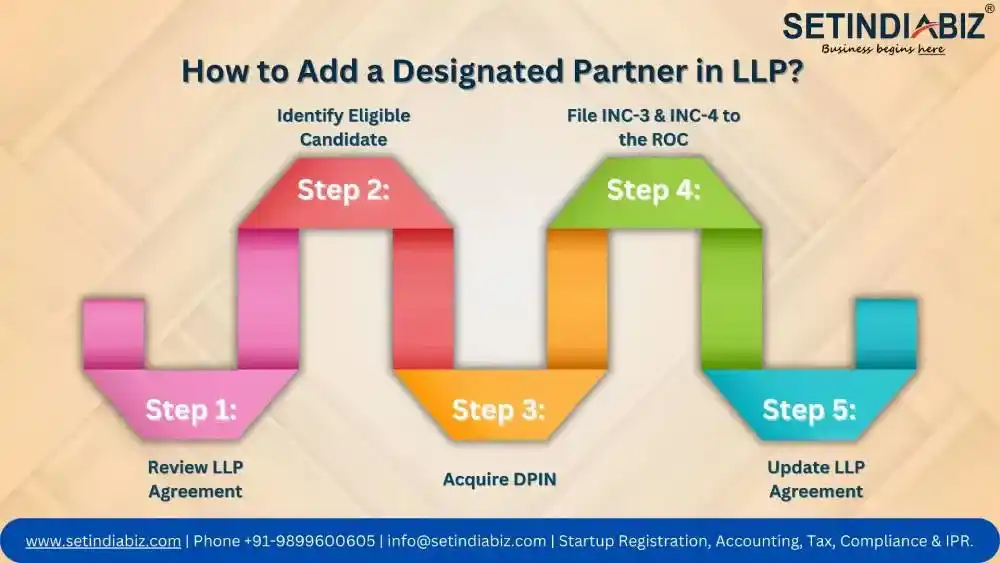

How to Add a Designated Partner in LLP?

While how many designated partners are required in LLP is mentioned in the LLP Act, the process to add a designated partner in LLP is specifically mentioned in the LLP Agreement. Section 7(2) of the Act clearly states that a partner may be appointed as a designated partner in accordance with the LLP Agreement only. The appointment is made by the other partners once the concerned partner has given his consent to act as a designated partner and has acquired a unique DPIN from the Central Government. We have explained the process of doing so further. For the rest of the process, you can refer to the LLP Agreement itself.

Step 1: Review LLP Agreement

Before proceeding with the addition of a designated partner in an LLP, it is crucial to meticulously review the LLP Agreement. This foundational document outlines the rights, responsibilities, and obligations of all partners within the LLP. Pay particular attention to any clauses or provisions related to the appointment of designated partners, as the agreement may specify requirements or procedures unique to the LLP. Additionally, ensure that the agreement aligns with the provisions of the LLP Act and any relevant regulations. By thoroughly understanding the terms outlined in the LLP Agreement, you can navigate the process to add a designated partner with clarity and confidence, while ensuring compliance with legal obligations and maintaining the integrity of the LLP’s governance structure.

Step 2: Identify Eligible Candidate

Identifying eligible candidates to serve as designated partners in an LLP involves a thorough assessment of individuals who meet the criteria outlined in the LLP Act. This includes verifying their eligibility based on residency requirements and ensuring they do not possess any disqualifications, such as being an undischarged insolvent or having a criminal record. It’s essential to conduct due diligence to confirm that the candidates possess the necessary qualifications and are willing to assume the responsibilities associated with the role. Additionally, consider the individual’s experience, expertise, and commitment to the LLP’s objectives when evaluating their suitability for the position. By carefully selecting eligible candidates, the LLP can appoint designated partners who contribute effectively to its management and uphold its reputation for integrity and compliance.

Step 3: Acquire DPIN

A Designated Partner Identification Number or DPIN is a distinct and unique identification number allotted to every individual looking forward to becoming a Designated Partner in an LLP. It is allotted by the Central Ministry of Corporate Affairs, and to obtain it, an application is to be filed by the individual who is to be appointed as the designated partner. To obtain a DPIN, an e-application form, DIR 3, available on the official website of the Ministry of Corporate Affairs is required to be filled out and submitted with the following documents of the applicant:

- PAN card

- Identity Proof

- Address Proof

You can provide any one among Aadhar Card, driver’s license, Passport, or Voter ID, as the Identity proof of the applicant. However, if the applicant is a foreign national, submitting his passport becomes mandatory. As far as the registered address proof is concerned, the applicant can provide utility bills like the electricity bill, telephone bill, water bill, or gas bill, in his name, not older than 2 months from the date on which it is being submitted. After submission of the application, it is examined thoroughly by the MCA, and upon successful verification, the DPIN is issued to the applicant. Once issued the DPIN is valid for a lifetime, subject to annual renewal. The government fee for filing DIR 3 is Rs.500 per application.

Step 4: File INC-3 & INC-4 to the ROC

No individual can act as the designated partner of an LLP unless he provides his consent to do so. The consent of the designated partner is sought in the format of a written declaration. Within 30 days of the designated partner’s appointment, his consent must be intimated to the Registrar of Companies in form INC-3. Along with INC 3, another form INC 4 is also filed to the Registrar of Companies, mentioning the details of the designated partner. These two forms are required to be filed to the ROC after the LLP appoints every single designated partner. A delay in filing these forms beyond the prescribed due date can result in a fine of Rs.100 for each day of non-filing, with no maximum limit of the penalized amount.

Step 5: Update LLP Agreement

Updating the LLP Agreement is a critical step in the process to add a designated partner and ensure that the governance structure of the LLP remains aligned with the appointment. This involves amending the agreement to reflect the inclusion of the new designated partner and any associated changes to roles, responsibilities, profit-sharing arrangements, or decision-making processes. Careful consideration should be given to drafting the amendments to ensure clarity, completeness, and legal compliance. It is advisable to seek legal guidance to ensure that the amended LLP Agreement accurately reflects the intentions of all partners and adheres to the requirements of the LLP Act and any other relevant regulations. By updating the LLP Agreement appropriately, the LLP can formalize the appointment of the designated partner and maintain transparency and accountability within its governance framework.

Roles & Responsibilities of a Designated Partner

We have already discussed earlier that Designated Partners are in charge of controlling the internal management of an LLP. Besides, they also perform tasks on behalf of the LLP, like meeting statutory compliances, filing applications, and obtaining licenses and certifications in the name of the LLP. Like a Company’s director, the designated partner also acts as the agent of an LLP. We have listed a few mandatory responsibilities of designated partners below.

- A Designated Partner must sign the LLP’s statements of accounts and solvency.

- The Designated Partner should assist and cooperate with the investigating authorities in cases of an investigation by providing the necessary official documents and papers pertaining to the LLP.

- The Designated Partner is required to pay the inspector back for the conducted investigation.

- Within 60 days of the end of the fiscal year, the Designated Partner must properly file the annual returns with the Registrar; otherwise, the firm will be fined more than 10,000.

- The Designated Partner must both sign the e-forms that must be filed with the Registrar and notify the Registrar of any changes to the LLP, such as changes to the partners’ names or addresses.

Liabilities of a Designated Partner

The liabilities of a designated partner in an LLP are defined by the Limited Liability Partnership Act, which outlines their responsibilities and obligations. Designated partners are entrusted with ensuring the LLP’s compliance with the provisions of the Act, including the timely filing of documents, returns, statements, and reports as mandated by law or specified in the LLP agreement. Additionally, designated partners bear liability for penalties imposed on the LLP for any contravention of these provisions, underscoring their accountability for regulatory compliance and adherence to legal requirements. This delineation of liabilities emphasizes the significant role designated partners play in upholding the integrity and legal standing of the LLP, making it imperative for them to fulfill their duties diligently and conscientiously.

Penalties For Contravening LLP Act Provisions to Add a Designated Partner

Penalties for breaching the regulations stipulated in the LLP Act concerning the addition of a designated partner carry significant repercussions. In the event of a violation of sub-section (1) of section 7, where an LLP fails to adhere to the requirement of maintaining at least two designated partners, both the LLP itself and each of its partners face penalties. These penalties amount to ten thousand rupees initially, with an additional daily penalty of one hundred rupees for each subsequent day of continued contravention, capped at one lakh rupees for the LLP and fifty thousand rupees for each partner.

Similarly, if the LLP breaches the provisions outlined in sub-section (4) of section 7, penalties are incurred by both the LLP and each designated partner. The penalties include an initial penalty of five thousand rupees, along with a daily penalty of one hundred rupees for ongoing contravention, with maximum limits set at fifty thousand rupees for the LLP and twenty-five thousand rupees for each designated partner.

Additionally, contravening sub-section (5) of section 7 or section 9 results in penalties for both the LLP and each partner, amounting to ten thousand rupees initially, with further daily penalties for continued contravention, capped at one lakh rupees for the LLP and fifty thousand rupees for each partner. These penalties serve as deterrents, emphasizing the importance of strict adherence to the LLP Act’s provisions to avoid financial liabilities and uphold regulatory compliance.

Conclusion

Understanding the process and responsibilities associated with adding a designated partner in an LLP is essential for maintaining legal compliance and effective governance. From reviewing the LLP Agreement to identifying eligible candidates, each step plays a crucial role in ensuring the smooth incorporation and operation of the designated partner. Additionally, being mindful of the penalties for contravening the LLP Act provisions underscores the importance of diligence and adherence to regulatory requirements. By navigating these procedures diligently and with meticulous attention to detail, businesses can seamlessly add a designated partner to their LLP, thereby bolstering their management capabilities and fostering growth opportunities in a structured and compliant manner.

FAQ's

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.