Appointment of Auditors: Procedure & Required Documents

Overview : The appointment of an auditor in a company is necessary under section 139 of the Companies Act 2013. An auditor’s role in a company is really crucial as he/she is responsible for ensuring financial transparency among its directors and shareholders. This blog elucidates the essential aspects related to auditor appointment in a company including time limit to appoint the first auditor, documents required, and the procedure for appointment of the first auditor.

Companies registered in India are obliged to maintain a book of accounts and get their financial statement audited each year, for which an auditor needs to be appointed. The first auditor of the company is appointed by the Board of Directors within 30 days of Incorporation, and the shareholders appoint or confirm the Statutory Auditor in the First AGM for the next five years.

Auditing the financial statements of the company is the regulatory task for the auditor, which results in the issuance of an audit report, where the auditor expresses his opinion on whether the financial statement reflects the true and fair view of the financial statement. The audit report then becomes part of the AGM documentation.

The auditor is also responsible and accountable for informing directors about the company’s financial status. If the directors are well aware of their company’s financial health, they can take timely steps to improve or even upscale their business operations. In case their implemented strategies are not yielding positive results, they can also opt to change their strategies with quick effects to avoid further losses. Let’s dive into all essential aspects of auditing and the appointment of auditors under the Companies Act.

What does an auditor mean according to the Companies Act?

The Companies Act defines an auditor as a qualified practising chartered accountant or a firm of practising chartered accountants who are appointed for the first time by the board of directors and subsequently in the AGM by the shareholders of a company to carry out the statutory functions as required under the Companies Act, 2013, to ensure financial transparency among company directors and its stakeholders.

The purpose behind appointing an auditor in a company is to protect the interests of the shareholders. The auditor is legally obliged to examine the accounts and records maintained by the directors and also make them aware of the true financial position of the company. Moreover, the auditor also needs to give his unbiased, true and fair opinions to the directors/owners/shareholders of the company, thereby helping them maintain the company’s financial condition as required.

Note : In order to qualify as an auditor under the Companies Act, an individual/firm must be a practising Chartered Accountant as per the Chartered Accountant Act, 1949. It should not be disqualified from becoming an auditor of a company as per the provisions of the Companies Act 2023. In case the auditor is a firm, all of its partners practising in India must be qualified Chartered Accountants.

Time Limit to Appoint the First Auditor

The first auditor must be appointed by a company within 30 days of its incorporation by the Board of Directors. In case the first auditor cannot be appointed by the Board of Directors, the same needs to be appointed by the shareholders within 90 days.

If the company’s first auditor is not appointed at all, it would be in violation of section 139 of the Companies Act, inviting a penalty. The filing of form ADT-1, i.e. intimation to the ROC about the appointment of an auditor, is optional in case of First Auditor appointment. However, we strongly recommend filing the ADT-1 Form.

Documents Required for Appointing the First Auditor for a Company

Before appointing a new auditor, certain documents and information must be arranged to ensure compliance with regulatory requirements. Provided below is the list of forms that one needs to file. The necessary Information for the Auditor Appointment is as follows:

- Name of the New Auditor Firm

- Address of the New Auditor Firm

- Phone Number & Email Address

- PAN Details

- Period for which the Auditor Firm is Appointed

- Details of the Resigning Auditor Firm

- Date of Appointment of New Auditor

- Digitally Signed Form ADT-1 with Signature of the Director of the company

Procedure for Appointment of the First Auditor

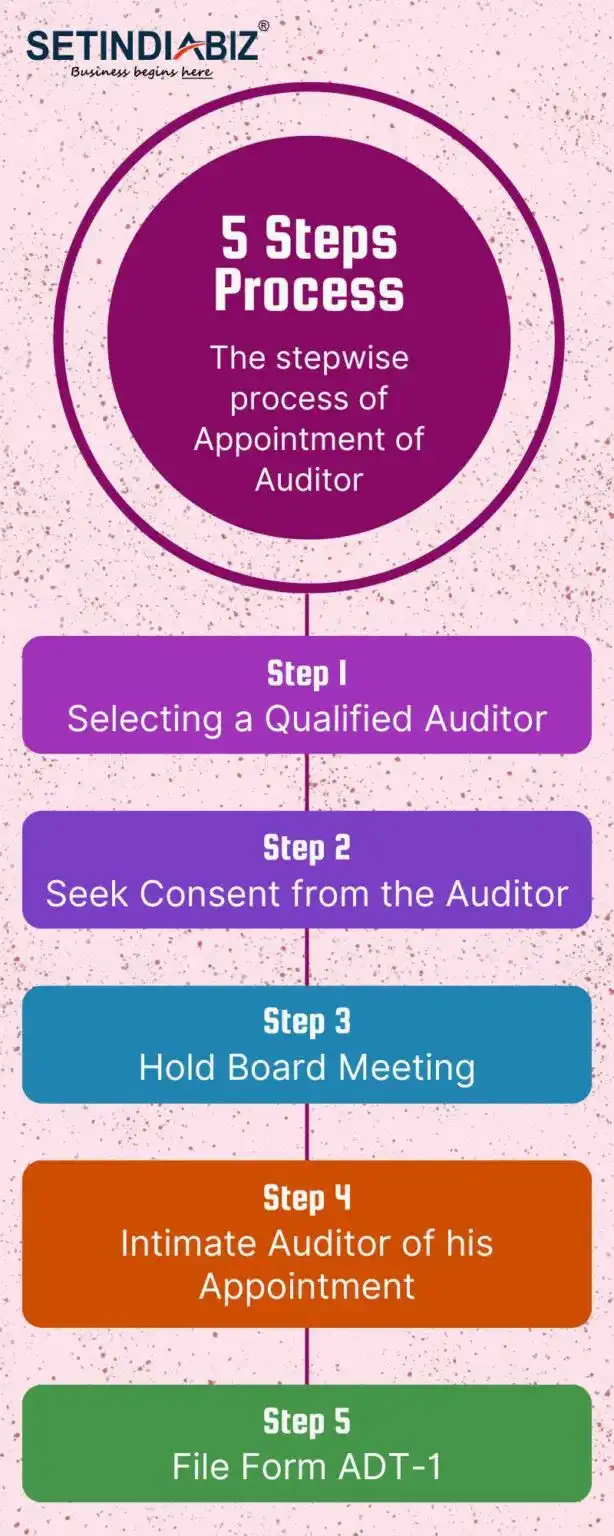

The process of appointing a company auditor involves various steps that fulfill the requirements specified under the Companies Act 2013. The stepwise process of appointing an Auditor is listed below

Step 1: Selecting a Qualified Auditor

The process of appointment of statutory auditor begins with selecting some potential candidates who are independently practicing Chartered Accountant by ICAI and eligible for statutory audit under the Companies Act, 2013. Establish a formal communication with them to serve as the statutory auditor for the company.

Step 2: Seek Consent from the Auditor

If an eligible auditor is about to become the auditor of your company, it’s important to secure the auditor’s consent in a prescribed format. This form may also include a specific declaration confirming compliance with the eligibility criteria mentioned in Section 141 of the Companies Act 2013. This step focuses on the importance of ensuring regulatory compliance during the appointment of a company’s auditor.

Step 3: Hold a Board Meeting

Convene a board meeting to formalise the appointment of the company’s first auditor. In this meeting, the remuneration of the auditor also needs to be decided, and one director is also authorised to take care of formalities pertaining to this process. Eventually, a resolution will be passed to confirm the official appointment of the auditor.

Step 4: Intimate Auditor of his Appointment

Convey the board’s decision to appoint the auditor formally by sending a letter on the company’s letterhead with the signature of the authorised director. This formal communication provides clarity and officially notifies the selected auditor about their role in the company.

Step 5: File Form ADT-1

The final step of the auditor appointment process is to file Form ADT-1 with the Registrar of Companies (ROC) within 15 days of the auditor’s appointment or 30 days from the company’s registration. This submission acts as an intimation to the ROC about the appointment of the first auditor, ensuring fulfillment of the compliance.

Legal Framework for Auditor Appointment

The Companies Act of 2013 is the governing legislation for appointing the first auditor of a company in India. According to Section 139 (6) of the Act, a company must appoint its auditor within 30 days of incorporation by passing a resolution by the Board of Directors in its first board meeting.

The auditor will hold the office until the conclusion of the first annual general (AGM). The appointment of an auditor of a company is more than a mere legal requirement, signifying the initiation of corporate financial governance that contributes to shaping the trajectory of a company’s fiscal responsibility.

Conclusion

The first auditor of a company must be appointed within 30 days of the incorporation by the Board of directors. The important aspects associated with appointment of auditor are well covered including documents requirements, process for appointing auditor in a company, etc. So, the piece of information provided would be helpful in making informed decisions on the auditor's appointment and thereby staying compliant!

FAQ's

Section 139 of the Companies Act 2013 provides that every company shall appoint an individual or firm as an auditor of the company at the first Annual General Meeting (AGM). The appointed auditor shall hold the office from the conclusion of the AGM in which he was appointed until the sixth AGM.

An Internal Auditor is appointed by the Board of Directors. The internal auditor assists in determining and improving the effectiveness of risk management, controlling and governance processes in an organisation.

Form ADT-1 is an essential form filed by companies with the Registrar of Companies (ROC) for intimation of the appointment of an auditor after the conclusion of the Annual General Meeting (AGM) under Section 139 (1) of the Companies Act of 2013. The ADT-1 Form should also be filed after the appointment of the First Auditor; however, it is not mandatory in cases where the appointment is by the auditor other than in AGM.

According to Section 139 of the Companies Act of 2013, the first Auditor of a business other than a government agency must be appointed by the board within 30 days after incorporation.

To qualify as an auditor as per the Companies Act, an individual must be a Chartered Accountant in practice or a firm of practicing CA as per the Chartered Accountant Act 1949. If the auditor is a firm, all of its partners practising in India must be qualified Chartered Accountants.

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.