Complete Guide on Professional Tax In Bihar

Overview : The state government of Bihar imposes professional tax on individuals and GST registered taxpayers carrying out certain professions, trades, calling and employment. The tax rates per se are prescribed in the “Schedule of Rates” under The Bihar Tax on Professions, Trades, Callings and Employments Act of 2011. In this article, we are going to analyse various aspects of Professional tax in Bihar online, including the process of payment, due date, tax rates, penalty of delayed or non-payment, applicability, and need for Professional Tax Registration. For further assistance and consultation, speak to us directly!

The State Governments of various Indian states, including Bihar, have the authority to impose professional tax on individual taxpayers by enacting a law to this effect. While the law itself covers all aspects of Professional tax requirements in the state, including the need and eligibility for registration, payment due date, tax rates, penalties and more, the Central Government has capped the amount of Professional Tax paid annually to Rs.2,500 only. This indicates that although the tax rates may differ from state to state, the maximum amount can never exceed the limit prescribed by the Central Government. Let’s dig a little deeper by considering Professional tax regulations in the state of Bihar.

Professional Tax Applicability in Bihar

Professional tax is classified as a direct tax which is charged or imposed by the Government of Bihar on all types of trades, professions and employment. It is to be noted that any income earned by an individual from salary or any other profession including lawyers, doctors, chartered accountants etc. are subject to professional tax in Bihar under the authority of The Bihar State Tax on Professions, Trades, Callings and Employment Act, 2011. The aforesaid act is applicable to the whole of the state of Bihar and levies PT on the following four kinds of assessments.

| Section 4 (1) of the Bihar PT is reproduced hereinbelow for ease of reference. | Taxable Persons Under Bihar PT |

|---|---|

4. Levy and charge of tax .—

|

|

Professional Tax in Bihar on Salaried Individuals

Although Professional Tax is levied on salaried individuals, section 5 of the PT Act of Bihar casts an obligation on the employer to obtain professional tax registration and collect the requisite taxes during the payment of salaries itself. Ultimately, it’s the employer that pays the deducted taxes to the government authorities on behalf of the salaried employees. Wondering what the tax rates are? The table below gives you detailed insights into the tax slabs prescribed for the purpose with their adjacent tax amounts.

| S.No | Salary Range (Annual) | PT Amount (Annual) |

|---|---|---|

| 1. | Up to ₹ 3,00,000/- | Nil |

| 2. | Between ₹ 3,00,001/- To ₹ 5,00,000/- | ₹ 1,000 |

| 3. | Between ₹ 5,00,001/- To ₹ 10,00,000/- | ₹ 2,000 |

| 4. | Above ₹ 10,00,001/- | ₹ 2,500 |

Professional Tax in Bihar on Other Category Taxpayers

The other category of taxpayers under the Bihar PT Act is every person engaged in any trade, business or self-employed profession. Professional tax is levied based on their income or turnover. A few examples may include doctors, chartered accountants, architects, or business entities like HUF, Firm, Company, Corporation, Society, and Associations. However, those earning wages on a casual basis are exempted from this list. The table below mentions the exact turnover or income slab rates on which the taxes are imposed.

| S.No | Turnover or Other Category Income | PT Amount |

|---|---|---|

| 1. | Turnover Less than ₹ 10,00,000/- (Ten Lakhs) | Nil |

| 2. | Turnover Between ₹ 10,00,001/- to ₹ 20,00,000/- | ₹ 1,000 |

| 3. | Turnover Between ₹ 20,00,001/- to ₹ 40,00,000/ | ₹ 2,000 |

| 4. | Turnover Above ₹ 40,00,001/- | ₹ 2,500 |

| 5. | Transporter – Taxi or Similar Vehicle | ₹ 1,000/- |

| 6. | Transporter – Bus or Truck | ₹ 1,500/- |

| 7. | The Companies registered under the Companies Act, 1956 or 2013 | ₹ 2,500/- |

Professional Tax Registration Bihar

Based on the category of taxpayers, professional tax registration Bihar can be obtained in two ways – PTEC & PTRC. Let’s understand the applicability and scope for each of them. In general, enrollment is required for paying professional tax imposed on self, whereas registration is required for deducting Professional tax during the course of employment. The detailed descriptions are given below.

1. Professional Tax Enrollment (PTEC) in Bihar

The schedule to the PT Act of Bihar provides for the tax on various kinds of professionals, traders, and other persons where the incidence of the PT falls directly on the business entity, for the purpose of payment of professional tax and furnishing of return such entities must obtain an Enrolment with the Professional Tax Department, within 7 days of applicability. The enrolment process is Online in the state of Bihar and the PT department issues a certificate known as Professional Tax Enrolment Certificate after processing of such application also known as PTEC in short.

2. Professional Tax Registration (PTRC) in Bihar

Section 5 of the Bihar PT Act, casts an obligation on employers to register themselves, collect and pay taxes on behalf of employees working under their employment. For this purpose, every employer is required to obtain a Professional Tax Registration Certificate (PTRC), the process for which is online on the State’s Commercial Tax Department’s website. The application for registration to be made within 7 from the date the employer becomes eligible to do so.

Documents Required for Professional Tax Registration Bihar

An indicative list of documents required to submit for registration of Professional tax in Bihar online is given below. You can contact our experts for any documentation assistance you need. Note that documentation is the most crucial aspect of Professional Tax Registration in Bihar. Any discrepancy and hamper the process and lead to unprecedented legal repercussions.

- Certificate of Incorporation

- Memorandum 0f Association,

- Articles of Association,

- PAN Card

- Address Proof of Company

- Bank Details of Company

- Aadhar, Address Proof and Photo of Director or Authorised Person

- List of Employees along with the details of their salaries

Step Wise Process of Professional Tax Registration Online in Bihar

Now that you’re aware of the applicability and documents for Professional Tax Registration Bihar, it’s time to uncover the process. The process is quite convenient as it is completely online and paperless. All you need to do is visit the website of the Commercial Tax Department, access the requisite form, and apply with accurate information and documents. Pay the Government fees for Professional tax registration online and complete the process in a compliant manner. Need any assistance? Our experts are here to help! Besides, the step-wise guide below will serve a definitive purpose as well.

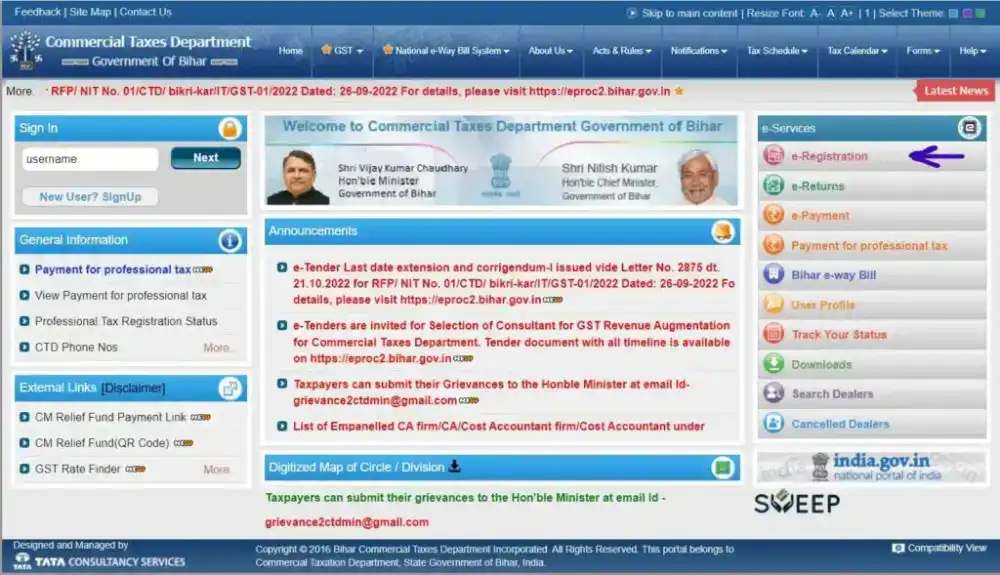

Step 1: Visit the Official Commercial Tax Website

The Applicant must visit the official website of the Commercial tax department of the Bihar government. at https://www.biharcommercialtax.gov.in/bweb/. Locate the e-Registration option on the Right Menu as indicated in the picture below.

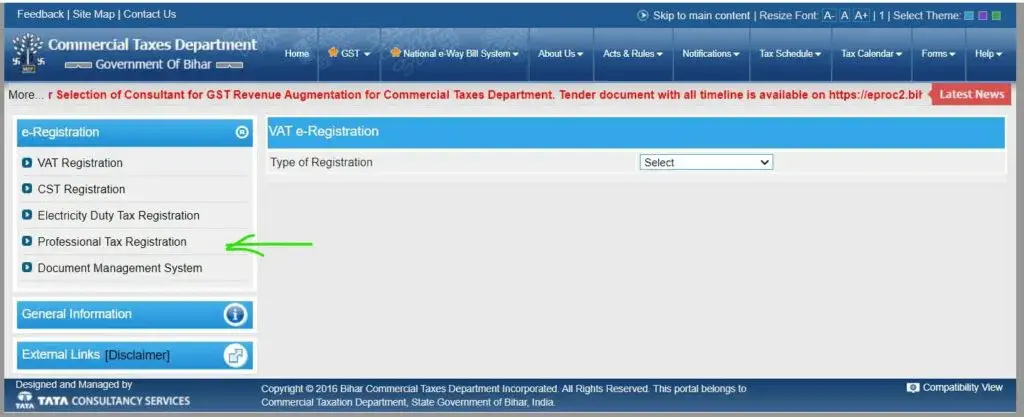

Step 2: Access the E-form for PT Registration

When you click on e-Registration page it will take you to a page where different kinds of options are provided to seek online registration under various acts of the state of Bihar. Please select the “Professional Tax Registration” from the left menu as suggested in the below image.

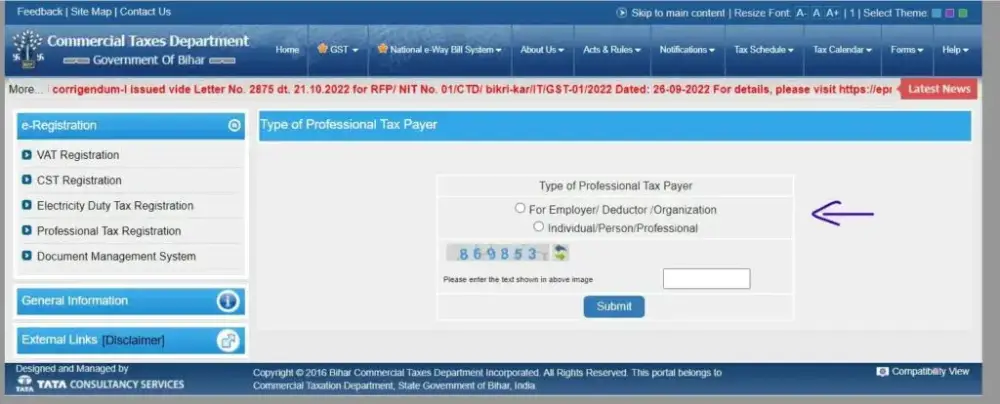

Step 3: Clarify the Type of Taxpayer

After you click on the Professional Tax Registration tab, it will take you to the next page where selection with respect to enrolment or registration is required to be made. Here is the picture of the page showing the appropriate options. As per PT Rules Registration Application as Employer/Deductor/Organisation is made in form PT-I and for Enrolment as Individual/Person/Professional the application is filed in the prescribed form PT-IA, However the applicant don’t have to worry about the form in the online mode of application.

Step 4: Submit the E-application and Receive Acknowledgement

Follow the onscreen instructions and submit the application for the PT Enrolment or Registration with Bihar Professional Tax Registration. After the application is submitted successfully the applicant will receive an acknowledgement for the same which may look like the picture below. You can also track the progress of the registration application on the same portal.

Step 5: Pay the Application Fee

The Government of Bihar does not collect any sort of application fee or processing fee regarding registration of professional tax in Bihar. However, at the time of PTEC or PTRC the applicable Professional Tax has to be paid.

Step 6: Receive PTEC / PTRC Certificate

On submission of the online application, the PT Department will grant the Enrolment/Registration Certificate within fifteen days from the date of application, after verification of the filled form.

Bihar Professional Tax Payment Due Date

The due date for professional tax payment in Bihar differs for different entities based on their enrollment or registration date as per their PTEC or PTRC Certificate. If a person is enrolled before the commencement of the year or prior to 31st May, then the due date is 30th June of the same year. If the entity is enrolled after 31st May, then the Bihar Professional Tax Payment Due Date will be within one month from the date of enrolment.

Penalty for Non-payment of Professional Tax in Bihar

In case the taxpayer fails to make the payment within the due date, the taxation authority can charge an amount not exceeding ₹100 for each month of delay. Further, any individual violating the provisions stated in the Bihar Professional Tax Act, will have to pay a penalty not exceeding ₹500. Further, if there is a continuous violation, the individual will have to pay not more than ₹10 for each day of such violation.

Process of Paying Professional Tax in Bihar Online

Professional Tax Payment in Bihar is a legal mandate for all entities and individuals engaged in trade, business, and profession. The process of payment is quite convenient, affordable and easy to access. The step wise guide below gives detailed insights into the same. For any assistance, consult our experts!

- Step 1 – Login into the official database or website of the Commercial Taxes Department, Government of Bihar and navigate into the home page.

- Step 2 – On the home page, select ‘e-Services’ which is featured on the rightmost corner, then select the option ‘e-Registration’. Start the registration process by providing relevant details. Once, the registration process is done. Go back to the home page again.

- Step 3 – On the home page, Select the option ‘e-Payment’ from the ‘e-Services’ column. Then, provide login ID (PAN) along with the State Code as prefix, mention the password and CAPTCHA and click on ‘Login’.

- Step 4 – After login into the account, click on the option “Professional Tax Payment” from the ‘e-Payments’ column which is featured on the leftmost side of the webpage.

- Step 5 – After clicking on the “e-payment” option, you can see a form filled with your relevant information. You can also add or modify the information as per your convenience. Next, choose the payment type, period of tax, payment form and financial year. Then check the box on the payment on Account ID and accordingly enter the tax amount payable.

- Step 6 – After entering the amount click on ‘Submit’. Now, your payment is done. A payment receipt will be generated on the page which can be downloaded for future references.

Conclusion

Professional tax regulations in Bihar mandate compliance for both salaried individuals and various other taxpayers engaged in professions or trades. With online registration and payment mechanisms in place, adherence to these regulations are made simpler. Moreover, imposition of a capped annual tax amount of Rs.2,500 by the Central Government ensures uniformity across states. Ensuring compliance with Professional tax in Bihar online is crucial for individuals and businesses alike, facilitating a smoother experience within Bihar's regulatory framework.

FAQ's

1.Does a freelancer pay professional tax in Bihar online?

2.Which authority imposes Professional Tax in Bihar?

3.Who Are Exempt from Payment of Professional Tax in Bihar?

4.Is professional tax registration mandatory for small businesses in Bihar?

5.Are pensioners required to pay professional tax in Bihar?

Author Bio

Editorial Team | in

Setindiabiz Editorial Team is a multidisciplinary collective of Chartered Accountants, Company Secretaries, and Advocates offering authoritative insights on India’s regulatory and business landscape. With decades of experience in compliance, taxation, and advisory, they empower entrepreneurs and enterprises to make informed decisions.